Northpointe Bancshares, Inc. (NYSE: NPB), the holding company for Northpointe Bank, traded at $18.22, up 0.89% in trading on January 21, 2026, following the release of its fourth-quarter 2025 financial results.

Market Capitalization

Northpointe Bancshares had a market capitalization of approximately $626 million as of January 21, 2026.

Latest Quarterly Results

For the fourth quarter of 2025, Northpointe Bancshares reported net income to common stockholders of $18.4 million, or $0.52 per diluted share. This compares with $20.1 million, or $0.57 per diluted share, in the third quarter of 2025, and $8.8 million, or $0.34 per diluted share, in the fourth quarter of 2024.

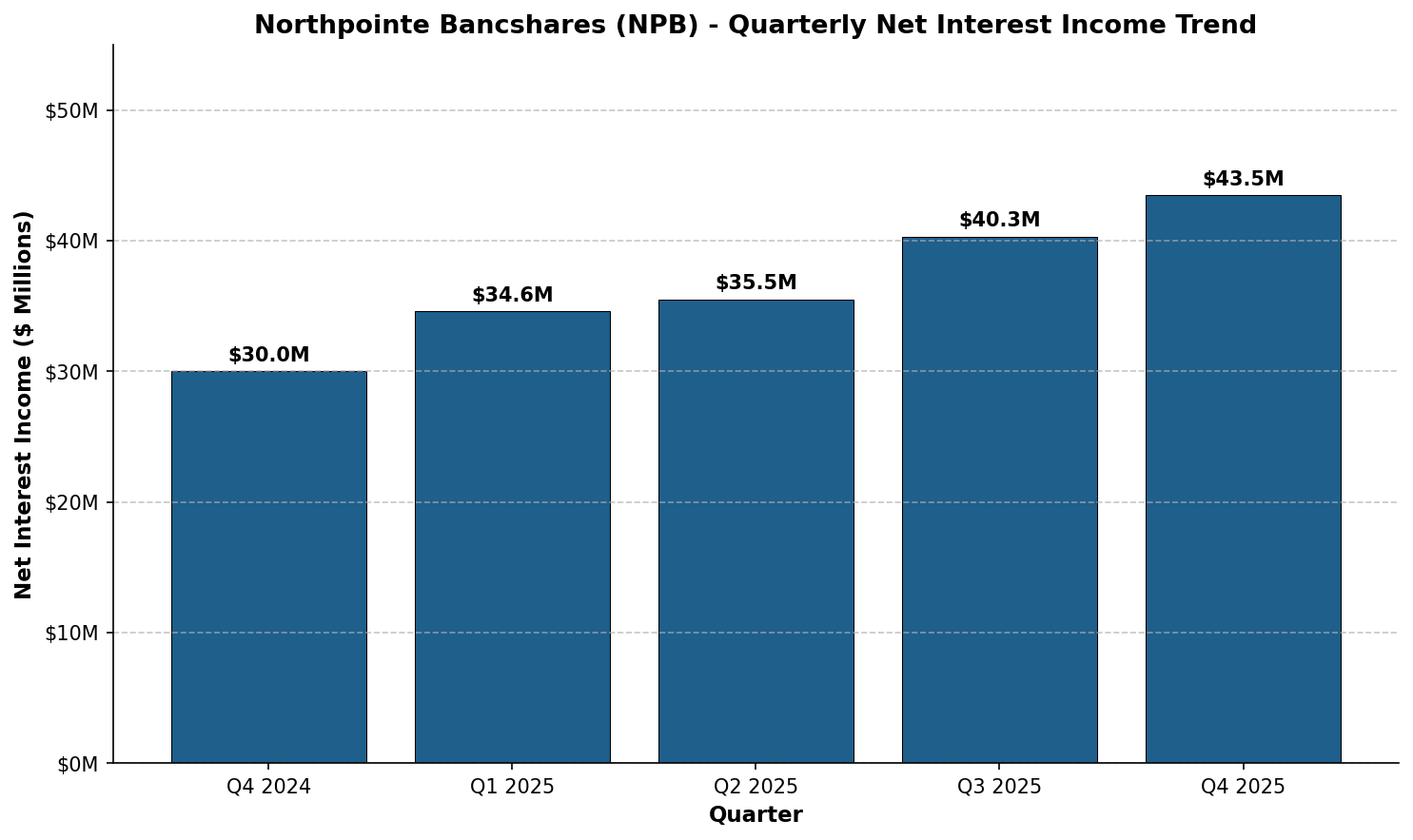

Net interest income before provision was $43.5 million for Q4 2025, an increase of $3.2 million compared to the prior quarter and $13.5 million compared to Q4 2024. Total interest income reached $106.1 million versus $82.7 million in the year-ago period. Net interest margin expanded to 2.51% from 2.27% in Q4 2024.

Segment Performance:

Mortgage Purchase Program (MPP): Period-ending balances reached $3.42 billion, an increase of $60.1 million, or 7% annualized, from the prior quarter. Total loans funded in Q4 2025 totaled $11.4 billion. Fee-adjusted yield was 7.22%.

Residential Lending: Residential mortgage originations totaled $762.0 million for the quarter. Net gain on sale of loans was $16.6 million, excluding fair value adjustments. All-in-One (AIO) loan balances increased $31.0 million, or 18% annualized.

Digital Deposit Banking: Total deposits reached $4.9 billion. The company completed an initiative to add a new digital deposit relationship during the quarter, resulting in a $234.2 million increase in savings and money market deposits.

Specialized Mortgage Servicing: Unpaid principal balance of loans serviced for others reached $4.9 billion. Loan servicing fees totaled $2.2 million for the quarter.

CHART — FINANCIAL TRENDS

Chart 1: Operating Performance

Chart 2: Market Performance

Full-Year Results Context

For full-year 2025, Northpointe Bancshares reported net income to common stockholders of $71.6 million, or $2.11 per diluted share, compared with $47.2 million, or $1.83 per diluted share, for 2024. Full-year net interest income before provision was $150.7 million, up $36.5 million from $114.2 million in 2024. Total assets increased to $7.02 billion from $5.22 billion at year-end 2024, representing growth of 34%.

Business & Operations Update

In December 2025, the company completed a private placement of $70.0 million in aggregate principal amount of fixed-to-floating rate subordinated notes. The proceeds were used to redeem the company’s remaining non-cumulative perpetual Series A preferred stock.

The company continued to expand its digital deposit platform, completing a new digital deposit relationship during Q4 2025. The wholesale funding ratio improved to 64.60% from 67.58% in the prior quarter.

Total regulatory capital ratios remained in excess of minimum requirements. At December 31, 2025, Northpointe Bank’s Total Capital to Risk-Weighted Assets ratio was 11.35%, Tier 1 Capital to Risk-Weighted Assets was 11.21%, and Tier 1 Capital to Average Assets was 9.50%.

M&A and Strategic Moves

Northpointe Bancshares completed its initial public offering on the NYSE in February 2025. During its first year as a public company, total assets grew from $5.2 billion to over $7 billion.

The company expanded its loan participation program in Q4 2025, with MPP balances participated to other institutions increasing to $457.0 million from $37.5 million in the prior quarter.

Equity Analyst Commentary

Institutional coverage indicates an average 12-month target of $19.08, based on assessments by equity research analysts covering the company. The stock reached a 52-week high of $18.86 in September 2025.

Guidance and Outlook

For 2026, management provided guidance including: net interest margin of 2.45%-2.55%; saleable mortgage originations of $2.2-$2.4 billion with all-in margins of 2.75%-3.25%; provision for credit losses of $3-$4 million; and non-interest expense of $138-$142 million.

The Board of Directors declared a quarterly cash dividend of $0.025 per share, payable on February 3, 2026 to shareholders of record as of January 15, 2026.

Performance Summary

Northpointe Bancshares shares traded up 0.89% following Q4 2025 results. Net income to common stockholders was $18.4 million for the quarter. Return on average equity was 14.82%. The Mortgage Purchase Program contributed $11.4 billion in funded loans. Net interest margin expanded to 2.51%. Total assets surpassed $7 billion. The company maintains capital ratios in excess of regulatory minimums.

Advertisement