Shares of Hormel Foods Corporation (NYSE: HRL) plunged 13% on Thursday after the company delivered mixed results for the third quarter of 2025 and cut its earnings guidance for the full year. The branded foods provider expects to see continued top line growth while pressures on profit are anticipated to persist for the remainder of the year.

Mixed results

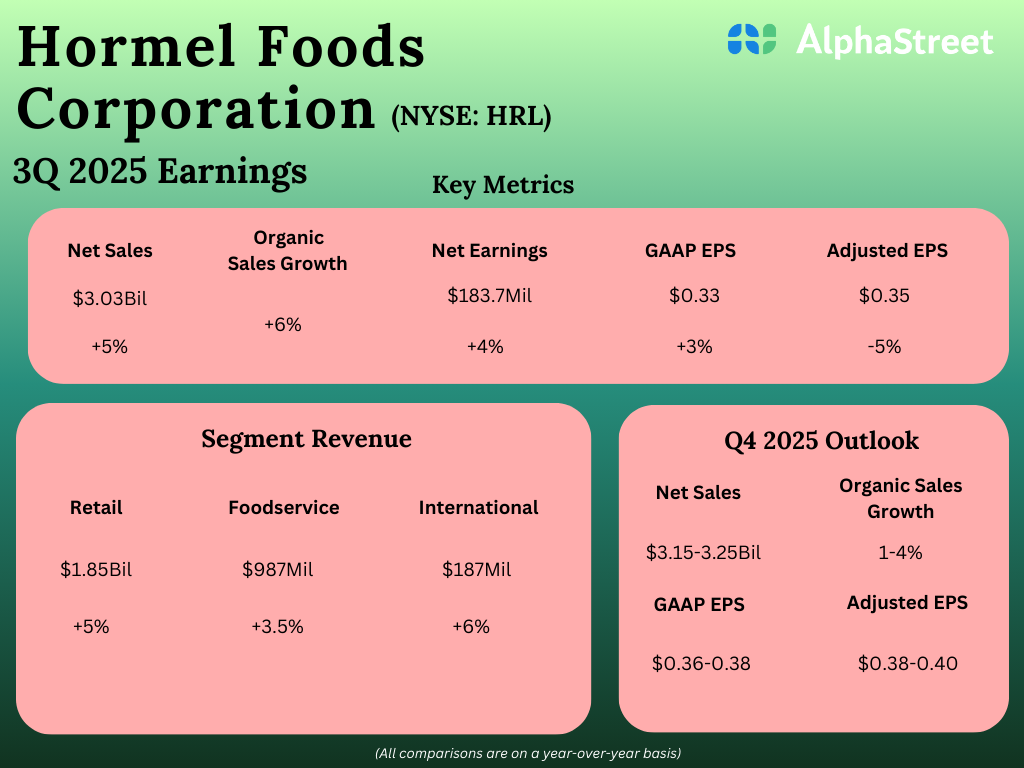

Hormel’s net sales increased nearly 5% year-over-year to $3.03 billion in Q3 2025, beating estimates of $2.98 billion. Organic sales rose 6%. While GAAP earnings per share grew 3% to $0.33, adjusted EPS fell 5% YoY to $0.35, missing projections of $0.41.

Segment sales growth

Hormel saw sales growth across all its segments in the third quarter. The Retail segment saw sales and volume both increase by 5% YoY, helped by gains in turkey, Planters snack nuts, and SPAM. The company also saw strong performance from Wholly guacamole, Hormel Black Label bacon, Hormel chili, and Gatherings party trays.

In the Foodservice segment, sales were up 3% while volume was down 4%. The foodservice industry is facing headwinds from soft traffic, commodity inflation, and shifts in consumer behavior. These factors have impacted the company’s business as well.

However, on an organic basis, sales grew 7% and volumes increased 2%, helped by gains from the customized solutions business, Planters snack nuts, Jennie-O turkey, Hormel pepperoni, Hormel Fire Braised meats and Café H globally inspired proteins. Hormel premium pepperoni saw volume growth of over 20% in Q3.

In the International segment, sales were up 6% and volume was up 8%, helped by growth in the China market and robust exports of SPAM luncheon meat.

Guidance cut

Hormel expects to see top line growth, even in a dynamic consumer environment, helped by its strong portfolio. However, profits are expected to remain pressured, namely by commodity inflation, with a recovery anticipated only next year.

For the fourth quarter of 2025, net sales are expected to range between $3.15-3.25 billion while organic sales growth is expected to be 1-4%. GAAP EPS is projected to be $0.36-0.38 while adjusted EPS is estimated to be $0.38-0.40.

Hormel revised its outlook for fiscal year 2025. It now expects net sales to be $12.1-12.2 billion versus the previous expectation of $12.0-12.2 billion. Organic sales is expected to grow 2-3%. GAAP EPS is now expected to be $1.33-1.35 versus the prior range of $1.49-1.59. Adjusted EPS is now expected to be $1.43-1.45 versus the earlier range of $1.58-1.68.