Andrew Fox | The Image Bank | Getty Images

“Dead” investors often beat the living — at least, when it comes to investment returns.

A “dead” investor refers to an inactive trader who adopts a “buy and hold” investment strategy. This often leads to better returns than active trading, which generally incurs higher costs and taxes and stems from impulsive, emotional decision-making, experts said.

Doing nothing, it turns out, generally yields better results for the average investor than taking a more active role in one’s portfolio, according to investment experts.

The “biggest threat” to investor returns is human behavior, not government policy or company actions, said Brad Klontz, a certified financial planner and financial psychologist.

“It’s them selling [investments] when they’re in a panic state, and conversely, buying when they’re all excited,” said Klontz, the managing principal of YMW Advisors in Boulder, Colorado, and a member of CNBC’s Advisor Council.

“We are our own worst enemy, and it’s why dead investors outperform the living,” he said.

Why returns fall short

Dead investors continue to “own” their stocks through ups and downs.

Historically, stocks have always recovered after a downturn — and have gone on to reach new heights every single time, Klontz said.

Data shows how detrimental bad habits can be relative to the buy-and-hold investor.

The average stock investor’s return lagged the S&P 500 stock index by 5.5 percentage points in 2023, according to DALBAR, which conducts an annual investor behavior study. (The average investor earned about 21% while the S&P 500 returned 26%, DALBAR said.)

The theme plays out over longer time horizons, too.

The average U.S. mutual fund and exchange-traded fund investor earned 6.3% per year during the decade from 2014 to 2023, according to Morningstar. However, the average fund had a 7.3% total return over that period, it found.

That gap is “significant,” wrote Jeffrey Ptak, managing director for Morningstar Research Services.

It means investors lost out on about 15% of the returns their funds generated over 10 years, he wrote. That gap is consistent with returns from earlier periods, he said.

“If you buy high and sell low, your return will lag the buy-and-hold return,” Ptak wrote. “That’s why your return fell short.”

Wired to run with the herd

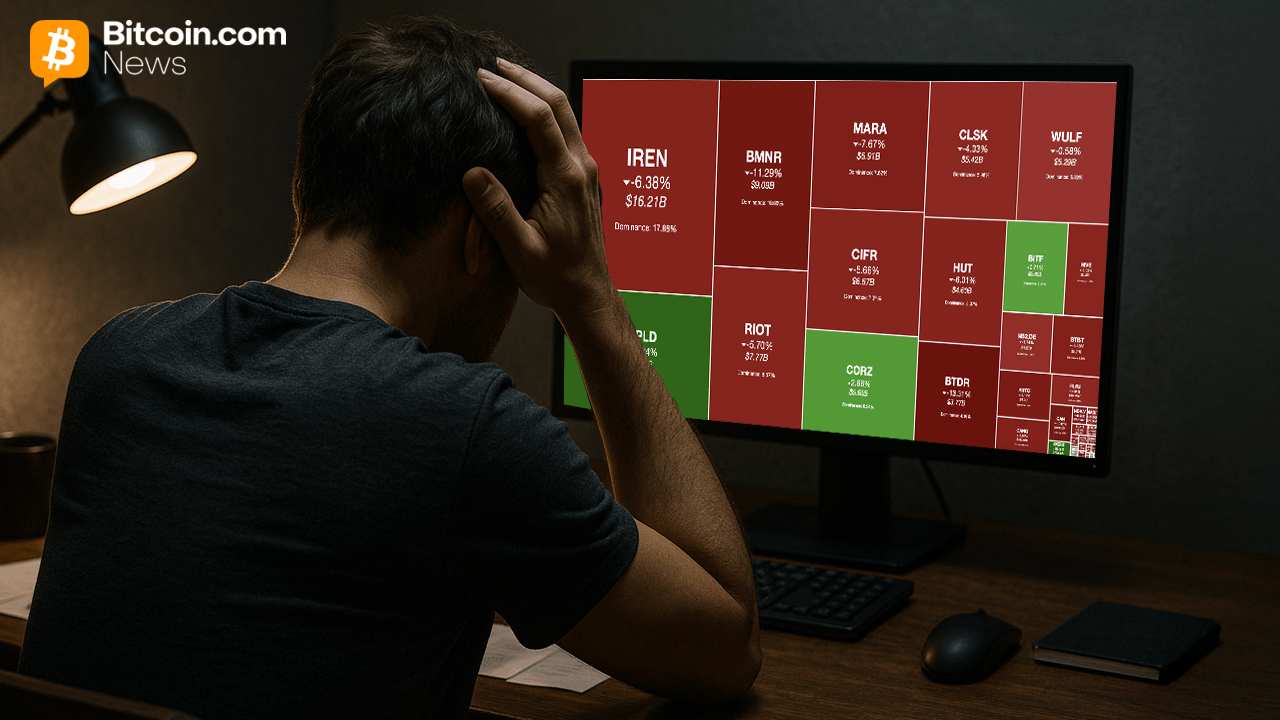

Emotional impulses to sell during downturns or buy into certain categories when they’re peaking (think meme stocks, crypto or gold) make sense when considering human evolution, experts said.

“We’re wired to actually run with the herd,” Klontz said. “Our approach to investing is actually psychologically the absolute wrong way to invest, but we’re wired to do it that way.”

Market moves can also trigger a fight-or-flight response, said Barry Ritholtz, the chairman and chief investment officer of Ritholtz Wealth Management.

More from Personal Finance:Investors will be ‘miles ahead’ if they avoid these 3 thingsStock volatility poses an ‘opportunity’How investors can ready their portfolios for a recession

“We evolved to survive and adapt on the savanna, and our intuition … wants us to make an immediate emotional response,” Ritholtz said. “That immediate response never has a good outcome in the financial markets.”

These behavioral mistakes can add up to major losses, experts say.

Consider a $10,000 investment in the S&P 500 from 2005 through 2024.

A buy-and-hold investor would have had almost $72,000 at the end of those 20 years, for a 10.4% average annual return, according to J.P. Morgan Asset Management. Meanwhile, missing the 10 best days in the market during that period would have more than halved the total, to $33,000, it found. So, by missing the best 20 days, an investor would have just $20,000.

Buy-and-hold doesn’t mean ‘do nothing’

Of course, investors shouldn’t actually do nothing.

Financial advisors often recommend basic steps like reviewing one’s asset allocation (ensuring it aligns with investment horizon and goals) and periodically rebalancing to maintain that mix of stocks and bonds.

There are funds that can automate these tasks for investors, like balanced funds and target-date funds.

These “all-in-one” funds are widely diversified and take care of “mundane” tasks like rebalancing, Ptak wrote. They require less transacting on investors’ part — and limiting transactions is a general key to success, he said.

“Less is more,” Ptak wrote.

(Experts do offer some caution: Be careful about holding such funds in non-retirement accounts for tax reasons.)

Routine also helps, according to Ptak. That means automating saving and investing to the extent possible, he wrote. Contributing to a 401(k) plan is a good example, he said, since workers make contributions each payroll period without thinking about it.