In This Article

For years, the “growth at all costs” mentality has driven rental investors to scoop up as many properties as possible, often working toward a unit goal.

But in 2025, the tide is turning, and landlord expectations for 2025 have shifted relative to their sentiments in Q4 2024. Instead of actively acquiring new properties, more landlords are focusing on maintaining and improving the rentals they already manage.

If you’re a rookie or experienced investor, this shift is actually good news. There are strategies that you can apply right now to strengthen your portfolio, even if you don’t feel ready (or able) to buy your next property.

Wouldn’t you rather have fewer properties to maintain, but still the same cash flow? This is where dollars are left on the table by not stabilizing and maximizing the value you already have in properties.

Fewer Acquisitions, More Focus on Existing Portfolios

Between November 2024 and June 2025, the landlord outlook changed notably. The percentage of landlords planning to buy new properties dropped from 67% to 53%. Those reporting no plans to change their portfolio climbed from 32% to over 43%.

So, what does this mean? It signals a strategic pivot: Rather than chasing expansion, landlords are turning their attention to optimization.

For rookies, this is a reminder that you don’t need dozens of units to succeed. Even a small portfolio can perform like a big one if you keep it running efficiently.

What’s Stopping Landlords From Buying More?

When asked about the biggest obstacles to adding new properties, landlords pointed to two major challenges (July 2025 survey, 1,756 respondents):

Property prices (55%): The single biggest barrier, with more than half of respondents saying high acquisition costs are holding them back.

Interest rates (23%): Nearly a quarter of landlords say elevated financing costs are the reason they’re pressing pause.

In short, even motivated investors are finding that current conditions make acquisitions more complex and less attractive than in the past.

This signals an opportunity. While many investors step back and sit on the sidelines, you can strengthen your operations so you’re prepared to act when deals return.

Oftentimes, investors scale too fast and forget about asset management in their business model. This is your chance to implement such a strategy.

Asset management involves monitoring and enhancing the performance of your existing properties. Too often, landlords think growth means more doors, but without strong asset management, every new property adds more complexity, not more profit.

Asset management means tracking income and expenses closely, spotting ways to increase revenue, cutting unnecessary costs, and making sure each unit is operating at its full potential. Rookies especially tend to neglect this step, focusing on acquisitions instead of optimization.

But in today’s market, sharpening your asset management skills can be just as powerful as adding another property to your portfolio. One example is getting quotes on your insurance premium for your properties. Set a reminder to alert you ahead of time when your policy is set to expire. Shop your policy to get the best rate. This is one way to keep cash in your pocket.

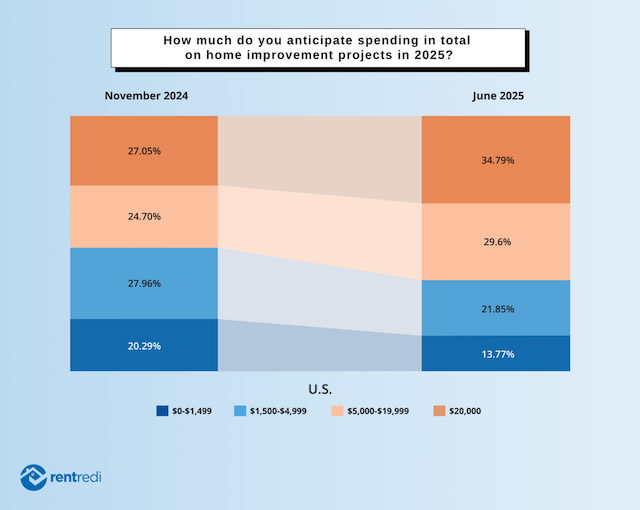

A “Renovate and Optimize” Mindset

With acquisitions slowed, many landlords are finding better returns by reinvesting in the properties they already own, such as:

Renovations that increase rental value

Efficiency upgrades that cut costs

Smarter and stronger systems are becoming the go-to strategies for improving cash flow and tenant satisfaction.

Investing in rental properties involves more than just increasing rent—it focuses on building long-term stability, enhancing tenant satisfaction, and fostering resilience through smarter property management. This means prioritizing elements you can control, like technology that helps you stay organized.

For example, if you have a turnover at a property, it may be time to use your capital to rip out the carpets and put in luxury vinyl plank, or upgrade the appliances. These are just two things that can increase the rent you charge for your property.

Regional Differences Stand Out

The RentRedi/BiggerPockets survey highlights notable regional variations as it relates to investment intentions:

Western U.S.: Landlords with no plans to change their portfolios jumped 14 points, from 39% to 53%.

Northeast U.S.: This area continues to show the strongest appetite for acquisitions, with 57% of landlords planning to buy more property in 2025, outpacing the national average.

These differences underscore the importance of tailoring investment strategy to local market dynamics. What feels impossible in one region may still be a strong play in another.

For investors considering long-distance investing, this regional data is also a reminder that you don’t need to be locked into your local market. If deals aren’t penciling out where you live, you can look elsewhere.

And if you opt for modern property management software, managing your rentals from hundreds (or even thousands) of miles away is easier than ever. Platforms like RentRedi centralize communication and streamline rent collection and electronic signing of documents, like your lease agreements, while keeping maintenance requests organized so you don’t need to be physically on-site. This opens the door to opportunities in more affordable or higher-growth regions without sacrificing oversight or peace of mind.

You might also like

The Role of Technology in a Shifting Market

When landlords were asked what they wanted to accomplish by leveraging tools and resources in their rental business, their answers highlighted a clear set of priorities.

For more than one-third of respondents, the top goal was increasing revenue. About 30% said their focus was on saving time and effort, followed by decreasing costs and increasing property value.

Efficient property management is becoming even more essential as landlords look to maximize returns without adding doors. This is where tools like RentRedi come in. By automating rent collection, tenant communication, and maintenance tracking, landlords can focus more energy on smart strategy, successful growth, or simply enjoying life outside managing rentals.

By automating rent collection, tenant communication, and maintenance tracking, landlords free up hours each week. These hours can be reinvested into strategy, growth, or simply enjoying life outside of managing rentals.

Final Thoughts

The real estate landscape in 2025 is shifting towards strategic opportunities to enhance cash flow. Landlords are focusing on portfolio optimization rather than rapid acquisition.

Obstacles like property prices and interest rates are real, but they’re also prompting landlords to get sharper with systems and strategies. This should be encouraging. You don’t need to compete with large investors buying dozens of units. Instead, you can win by focusing on what you already own by managing it smarter and leveraging tools that keep you organized and scalable.

Whether renovating, repositioning, or strategically acquiring properties, one thing is clear: success now relies on smarter management, improved tools, and adaptability. The investors who succeed won’t just be those with the most properties; they will be the ones managing their rentals most effectively.