Broadcom, Inc. (NASDAQ: AVGO) has carved a niche for itself in the AI race by offering custom-built AI chips for specific workloads. Having invested heavily in its AI portfolio, the semiconductor giant has positioned itself to capitalize on the growing demand for AI infrastructure. The tech firm is back in the spotlight this week as it prepares to release its Q3 earnings, with analysts forecasting strong revenue and earnings growth.

Broadcom (AVGO) shares recently hit a fresh high, climbing over 30% year-to-date to close at $300.25, well above their 52-week average. Despite the rally, analysts see further upside, driven by surging AI semiconductor revenue and VMware’s evolving into an AI-native infrastructure provider.

Estimates

Broadcom is expected to publish its third-quarter 2025 earnings on Thursday, September 4, at 4:15 pm ET. As per Wall Street analysts’ consensus estimates, adjusted earnings are expected to increase to $1.66 per share from $1.24 per share in Q3 2024. The forecast for third-quarter revenue is $15.82 billion, which represents a 21% year-over-year growth. The Broadcom leadership is looking for consolidated revenue of around $15.8 billion for the July quarter, up 21%.

Earlier, the management exuded optimism that Broadcom’s current trajectory of growth will continue in the third quarter, with AI semiconductor revenue growing an estimated 60% YoY to $5.1 billion. It expects the momentum in enterprise networking and broadband to sustain in Q3, while server storage, wireless, and industrial are expected to be almost flat. Infrastructure software revenue is expected to grow 16% YoY to around $6.7 billion in the July quarter.

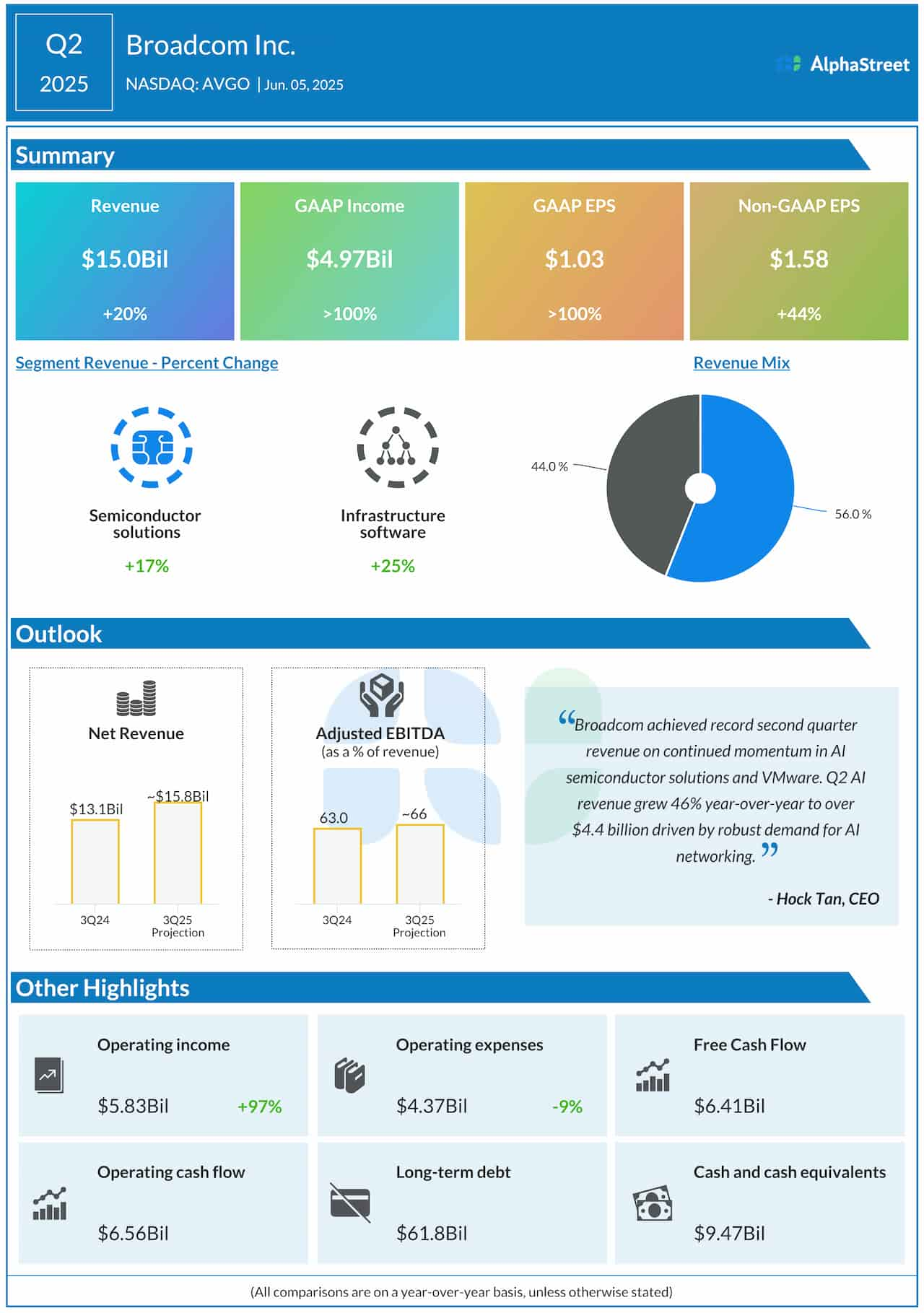

Strong Q2

In the second quarter of fiscal 2025, Broadcom’s revenues rose to $15.0 billion from $12.49 billion in the corresponding quarter a year earlier, exceeding estimates. The top-line growth translated into an increase in second-quarter adjusted earnings to $1.58 per share from $1.1 per share in the prior-year period. On an unadjusted basis, net income was $4.97 billion or $1.03 per share in Q2, vs. $2.12 billion or $0.44 per share in Q2 2024. The company has a strong history of outperforming Wall Street’s expectations – quarterly earnings consistently beat estimates over the past five years.

From Broadcom’s Q2 2025 Earnings Call:

“Customers are increasingly turning to VMware Cloud Foundation (VCF) to create a modernized private cloud on-prem, which will enable them to repatriate workloads from public clouds while being able to run modern container-based applications and AI applications. Of our 10,000 largest customers, over 87% have now adopted VCF. The momentum from strong VCF sales over the past eighteen months, since the acquisition of VMware, has created annual recurring revenue, or otherwise known as ARR, growth of double digits in core infrastructure software.”

AI Prowess

The management sees AI revenue growth extending into FY2026 amid stable demand for both training and inference workloads. New product cycles, including Tomahawk 6, are expected to drive demand growth. Broadcom differentiates itself from others by co-designing and manufacturing Application-Specific Integrated Circuits with hyperscalers, while competitors like AMD and NVIDIA dominate the general-purpose GPU market.

After recovering from the April lows, the value of Broadcom’s stock has nearly doubled, closing slightly above $300 in the latest session. AVGO traded up 3% on Thursday afternoon.