Shares of Take-Two Interactive Software, Inc. (NASDAQ: TTWO) fell 8% on Friday. The company delivered strong results for the second quarter of 2026 and raised its full-year outlook but a delay in the release of Grand Theft Auto VI hurt the stock. Here’s a look at the quarterly performance:

Q2 numbers

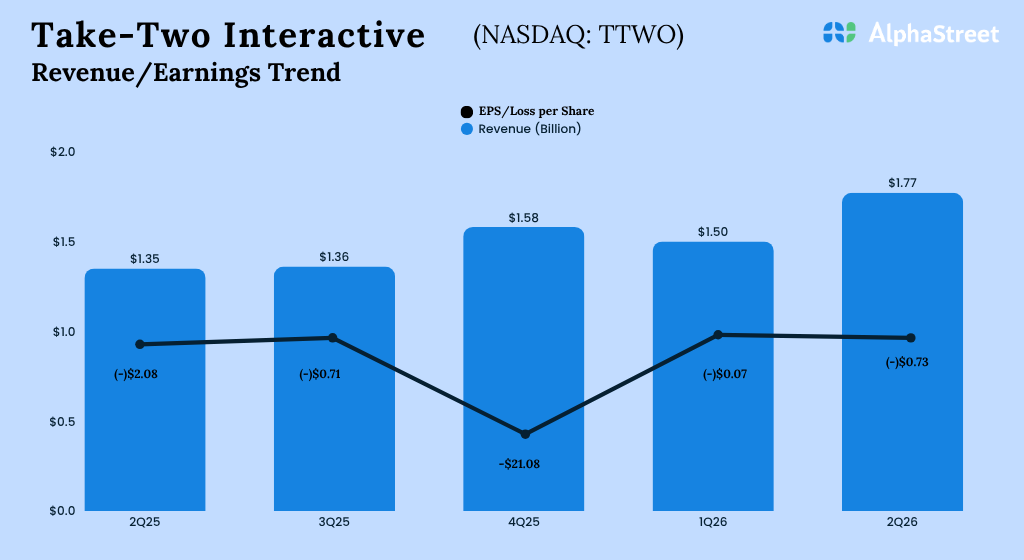

Take-Two’s net revenue increased 31% to $1.77 billion in the second quarter of 2026 compared to the same period a year ago. Net loss amounted to $0.73 per share compared to a loss of $2.08 per share last year.

Business performance

In Q2, TTWO’s net bookings grew 33% year-over-year to $1.96 billion, coming way ahead of the company’s expectations. The largest contributions to bookings came from core franchises like NBA 2K, Grand Theft Auto, and Red Dead Redemption, as well as mobile titles like Toon Blast, Toy Blast, Match Factory!, Empires & Puzzles, Words With Friends and Color Block Jam. New releases such as Borderlands 4 and Mafia: The Old Country also contributed significantly to bookings growth.

Net bookings from recurrent consumer spending grew 20% in Q2 and accounted for 73% of total bookings. During the quarter, 2K launched three major titles, including NBA 2K26, which has been performing exceptionally well, especially in terms of in-game spending. Grand Theft Auto Online is also seeing high levels of engagement.

The mobile business continues to deliver strong results, with Toon Blast and Match Factory growing 26% and 20%, respectively. Color Block Jam continues to perform well with strong engagement. Zynga continues to work on improving its portfolio with new features and innovation in live services.

TTWO announced that Rockstar Games will now release Grand Theft Auto VI on November 19, 2026.

Outlook

Take-Two raised its guidance for fiscal year 2026 based on its strong performance in the second quarter and higher expectations for many of its core franchises in the latter half of the year. The company now expects net bookings to range between $6.40-6.50 billion, representing a YoY growth of 14% at the midpoint. Net revenue is now expected to be $6.38-6.48 billion for the year.

For the third quarter of 2026, net bookings are expected to be $1.55-1.60 billion, and net revenue is expected to be $1.57-1.62 billion.