Balancing the Books

After announcing one of British politics’ biggest ever increases in taxation with her first Budget a year ago, Rachel Reeves would have hoped for a smoother ride this year. However, the OBR’s latest growth forecasts and weaker productivity assessment left the Chancellor with another fiscal black hole to fill. The result is another Budget that is, while framed as a strategy for boosting the economy, most notable for further tax hikes.

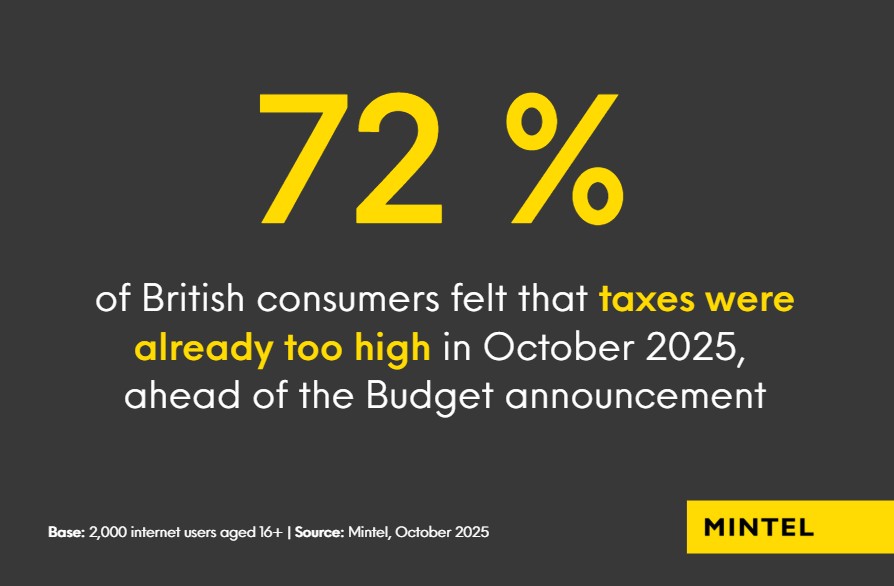

With only 24% of consumers feeling supported by the government and 72% saying taxes were already too high in October (Mintel client access only), tension was high in the lead-up to this Budget. The Chancellor faced the challenge of plugging a fiscal gap amid weaker-than-expected productivity and growth forecasts. The result: an additional £26 billion in taxes by the end of the decade.

However, this Budget was not the wholesale raid on household finances many feared. Indeed, some announcements, including a minimum wage uplift and the removal of the two-child limit on child benefit, will boost more vulnerable consumers. Elsewhere, though, changes to tax on dividends, savings and property, and to council tax, EVs, ISAs and pensions will be felt by higher earners, in particular. More broadly, additional costs for businesses are expected to have inflationary effects across a range of categories.

An Income Tax Reprieve, But Fiscal Drag Will Harm the Consumer Recovery

Workers were spared an increase in income tax rates, but a further three-year freeze on tax bands means more people will be drawn into higher tax brackets as wages rise. While this process, known as fiscal drag, doesn’t reduce workers’ take home pay, it reduces the benefits of wage rises. This will slow the growth in household spending power, and in turn, household spending.

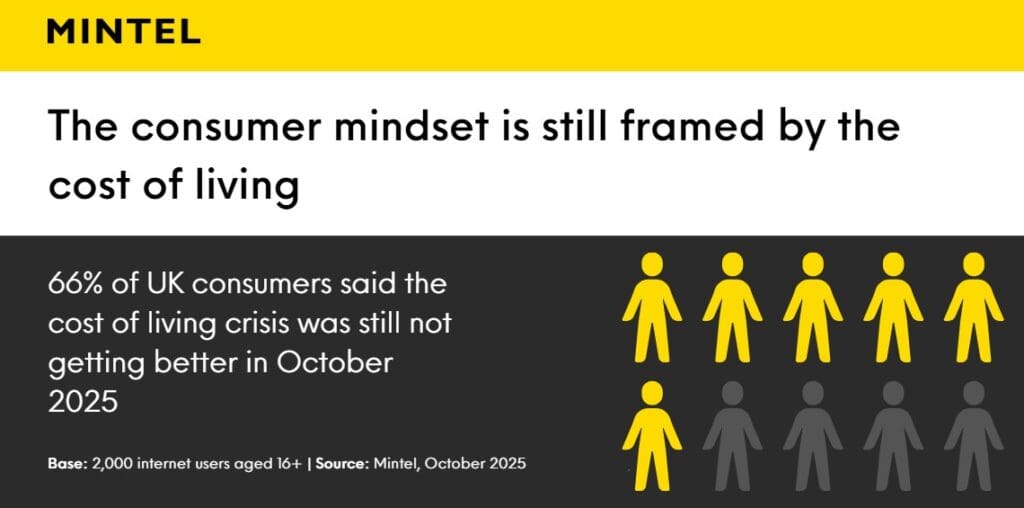

One of the biggest stories came away from Parliament, as the OBR accidentally leaked its Economic and Fiscal Outlook early. Within this, weaker GDP growth and higher inflation than previously forecast. Cost pressures remain the defining issue for many Brits, with two-thirds saying the cost of living crisis was still not getting better in October 2025. This has fostered a cautious consumer mindset that this Budget will not dispel.

A Greater Burden on the Wealthiest Taxpayers

The biggest increase in personal taxation from this Budget lands on Britain’s wealthiest households. The Chancellor has increased tax on earnings from property, dividends and savings by 2%, introduced a £2,500 council tax surcharge on properties worth over £2 million (rising to £7,500 for properties valued at over £5 million), and placed a £2,000 cap on National Insurance exemption for salary sacrifice pension contributions.

Wealth taxes will never be popular among those they are targeted at, and could have a dampening effect on confidence. For now, though, it’s important to note that the vast majority of higher-earning households report comfortable finances and will continue to do so. In October, 47% of households earning £75,000 or more reported healthy finances, with another 36% saying they were getting by OK.

The Cost of Living Recovery Gets Ever Longer, But Opportunities Remain

While the lowest earners receive an above-inflation bump in pay, and the most well-off find themselves with new and increased tax costs, the picture for those in the middle is broadly more of the same.

For three years now, we’ve seen a stop-start recovery from the height of the cost of living crisis. British consumers have a well-developed toolkit of budget-stretching behaviours, that they will continue to use.

Value remains the primary focus across consumer categories. This isn’t to say people are unwilling to spend, but with consumers scrutinising every expense, brands need to fight competitors from across different categories to secure every sale.

For many businesses, the Budget brings increased employee costs and higher tax bills, making price competition particularly challenging. This needs to remain the focus, though, alongside value-add messages that accentuate both the material and emotional benefits of products and services in what is still a challenging consumer environment.

Food and Drink: “Brands have an opportunity to help consumers persevere”

Kiti Soininen | Director, Food and Drink

Helping consumers to persevere, not just to be resilient, is a critical theme for companies in 2026, as identified in Mintel’s 2026 Global Food & Drink Predictions. As the slow squeeze on household finances is expected to continue, that call to action becomes more pertinent still. Amid these continued pressures, expect consumers’ now ingrained savvy spending habits to endure, with own-label’s competitive prices winning favour and the onus firmly on brands to justify their value.

To connect with shoppers amid these tensions, look to budget-friendly solutions that they can feel good about. Think tinned beans not as the economy choice, but as a flavoursome nutritional powerhouse, that’s also good for the planet, and can be the hero of the meal and thus worth paying more for.

Retail: “Not the present retail wished for”

Nick Carroll | Principal Strategist, Retail

The retail sector faces a mixed bag. While the introduction of lower business rates tiers may encourage SME investment on UK high streets, the lack of exemption from the highest rates band for supermarkets and large non-food stores is a blow. Larger retailers will bear a greater burden, potentially leading to higher prices for shoppers and even store closures.

The delayed removal of the customs duty exemption for overseas orders under £135 (the “de minimis” rule) will bring relief for international brands, particularly extreme value players, and disappointment for domestic retailers already grappling with cost increases. Some shoppers will welcome a lack of action here, with value high on the list of consumer priorities. However, for a domestic sector facing another round of cost pressures, keeping the exemption in place for now will sting.

Beauty and Personal Care: “K Beauty’s success is a sign of the times”

Sam Dover | Director, Beauty, Personal Care and Household Care

UK consumers’ value-driven mindset led to the success story of 2025, the rise of K Beauty. Consumers have traded down and extended their routines, drawn to the promise of efficacy at an accessible price point, the well-designed packaging and sensorial textures provided by these brands. The success of the category has boosted both value and volume sales in facial skincare.

With the underlying demand drivers that propelled K Beauty set to persist, and with shoppers always looking for newness, this will open doors for more international brands to make headway in the UK BPC market, with India, in particular, one to watch.

Travel, Leisure, and Gambling: “Gambling sector dealt a heavy blow”

Paul Davies | Senior Director, Travel, Leisure and Trends

The online gambling market has been hit by a significant tax rise, with remote gambling duty increasing from 21% to 40% from April 2026, and general betting duty (for online sports betting) moving from 15% to 25% from April 2027. However, there is some relief for physical stores, with machine games duty remaining at 20%. Prior to the announcement, leading UK gambling companies told Mintel that a significant increase in Machine Games Duty (MGD) could cut profits in half, and put the brakes on future investments in UK high street locations.

Now that the industry has avoided that scenario, we are likely to see more casinos, bingo halls, and even betting shops roll out ‘softer’ branding concepts to improve public perceptions and take advantage of lower tax rates (compared to online).

Meanwhile, the introduction of a tourist tax, allowing mayors to levy a nightly charge on hotel and holiday rentals, adds another cost for domestic and overseas visitors. The levy is unlikely to have such a big impact that it proves to be the decisive factor in consumers’ choice of holiday destination, but it’s another added cost in a domestic market that has already seen prices rocket over recent years.

Foodservice: “Business rates provide relief for small venues, but pressure on large operators”

Trish Caddy | Associate Principal, Foodservice

The OBR’s Economic and Fiscal Outlook, published alongside today’s budget, shows that hospitality was hit hardest by last year’s NIC hike, experiencing the greatest number of job losses. The number of employees in hospitality fell by 2.5% in the year to October 2025, compared to a 0.6% fall across all sectors. Today’s reform in business rates and the boost to small pubs, cafes and restaurants goes a little way to smoothing this impact, offering these smaller businesses a competitive advantage over large operators.

The new “milkshake tax” arrives as consumers move towards healthier, lower-sugar options, creating an opportunity for operators to reformulate and highlight responsible sourcing. This leans into trends we already see in the market. Already, 53% view out-of-home beverages as healthier than supermarket RTDs, while two-thirds seek venues with strong environmental credentials. Those who adapt quickly stand to retain loyalty and win market share.

Mintel’s Conclusion

In the end, the 2025 Budget was less disruptive than many feared, and we shouldn’t expect wholesale changes in consumer behaviour. For brands, the task now is to absorb what it means for their businesses, and to acknowledge that the key consumer trends we’ve seen over a number of years now are set to remain. Catering to these trends, including demand for low prices and affordable luxury, offering mood boosts during an uncertain time, remains key to success.

How Mintel Can Help Your Business Adapt

At Mintel, we provide in-depth analysis of consumer behaviour and emerging trends across multiple industries worldwide.

Our experts help businesses understand changes in demand, respond to shifting consumer preferences, and identify growth opportunities.

Connect with us to get data-backed recommendations and build strategies that position your brand for continued success in an evolving landscape.

Contact an expert today!