Markets have recently been shaken by China restricting exports of rare earths and Trump responding with new tariffs. Trump’s more positive comments have eased some concerns, but investors are keeping a close eye on upcoming talks between the US and China.

In Japan, the political scene has changed, with Sanae Takaichi, who favors lower government spending, becoming the leader of the ruling party. At the same time, the Bank of Japan’s signals suggest interest rates are unlikely to rise soon. These factors put pressure on the , which could push the USD/JPY pair back into an upward trend.

US Moving Without Macroeconomic Data

The ongoing US government shutdown is affecting financial markets in two ways. First, it delays the budget process, leaving uncertainty about how it will be resolved. Second, key economic data are not being released because the statistics bureau is closed.

As a result, we do not have updated information on the labor market, and this week’s inflation figures are in doubt. This is especially important with the at the end of the month. The market expects a 25-basis-point rate cut with almost full certainty, though there is a small chance the Fed might pause without the latest data. That scenario is unlikely, but it cannot be completely ruled out.

If normal government operations resume and labor market data are released before the Fed meeting, the market will use that data as the benchmark for expectations.

In Japan, both the government and the Bank of Japan have sent dovish signals. Governor Ueda highlighted uncertainties around U.S. tariffs and wage trends, reducing expectations for an interest rate hike this year. On top of that, the rise of Sanae Takaichi, a supporter of Abenomics, as the new leader of the ruling party adds to yen weakness, which could push the USD/JPY pair back into an upward trend.

USD/JPY Technical Analysis

The recent surge in USD/JPY allowed it to break past resistance around 151 yen per dollar. This clears the way for the uptrend to continue, with the next target near this year’s high at 158 yen per dollar.

The previous resistance has now turned into key support, where buyers are holding the line for now. If sellers manage to push through, the correction could reach around 150 yen per dollar, but the overall uptrend is still expected to continue.

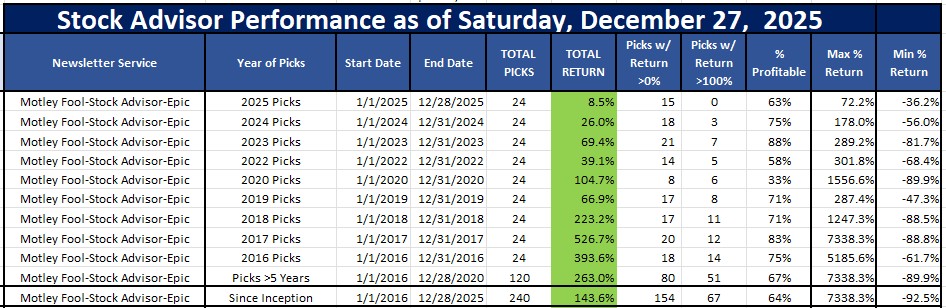

****InvestingPro provides a comprehensive suite of tools designed to help investors make informed decisions in any market environment. These include:

AI-managed stock market strategies re-evaluated monthly.

10 years of historical financial data for thousands of global stocks.

A database of investor, billionaire, and hedge fund positions.

And many other tools that help tens of thousands of investors outperform the market every day!

Not a Pro member yet? Check out our plans here and get up to 50% off with the Flash Sale.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.