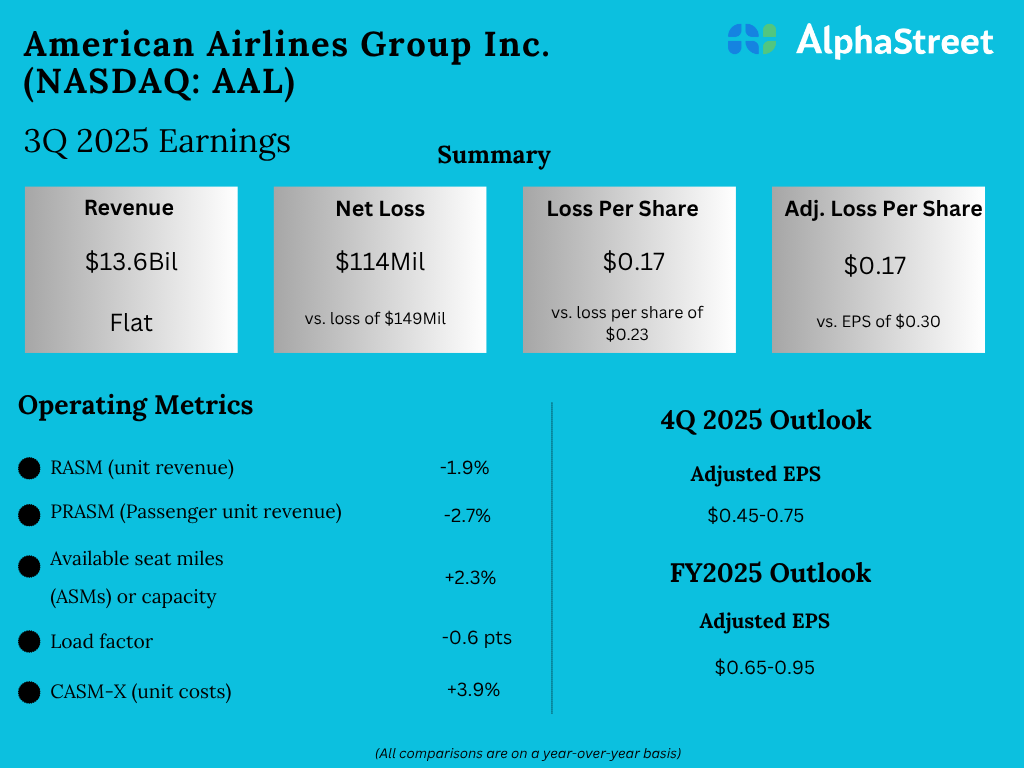

DXY struggles to hold 100 level; technical signals suggest risk of further downward move.

Fed policy direction remains unclear amid stagflation concerns and conflicting economic signals.

Looking for actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to InvestingPro’s AI-selected stock winners.

The continues to be under pressure due to President Donald Trump’s protectionist trade policies, especially his aggressive rhetoric and frequently changing stance on tariffs. Trump’s announcement that there will be no exceptions to tariffs on electronic products creates uncertainty in global markets and continues to undermine investor confidence.

The dollar started the new week at 100 after dropping to 99 last week. But early trades showed another decline, and it moved back toward the 99 level.

This means the dollar is now at its lowest level in three years. The dollar’s losses are especially noticeable against the and the . The exchange rate also started testing the 1.14 level, showing that the dollar is losing its image as a safe investment.

Looking at macroeconomic data, the decline in both headline and core and data released in the US signaled a temporary weakening in inflationary pressures. This has increased expectations for an cut by . While the markets are pricing a 25 basis point rate cut in May at 20% probability, this rate rises to 80% in June.

Markets expect a total rate cut of 80 basis points in the US this year, which could keep the dollar under pressure.

However, the European Central Bank (ECB) is also expected to cut by 25 basis points at its meeting on Thursday. This may limit the euro’s gains against the dollar. The ECB is now focusing more on supporting growth than fighting inflation, showing a dovish approach. This could slow down the euro’s rise in the short term and help the dollar find some balance.

Trade War Undermines Dollar’s Safe-Haven Status

US President Trump’s mixed messages on tariffs—being tough one day and pulling back the next—are hurting investor trust in US economic policy. This loss of confidence is causing short-term market swings and even raising doubts about the dollar’s role as the world’s main reserve currency.

The recent tax exemption debate on electronic products is another sign of the ongoing uncertainty. President Trump said there would be no exemptions, which conflicted with earlier reports that some tech products might be spared. These contradictions make it hard for the market to understand or follow his policies.

At the same time, Trump’s unclear trade stance with China and his aggressive trade moves are putting pressure on the US economy’s growth outlook. If inflation rises while growth slows, it could lead to stagflation—a risky situation with both inflation and weak growth.

This makes it very hard to set the right course for monetary policy. The Fed needs to cut interest rates to support the economy, but it might also need to raise rates if inflation picks up. These opposite needs could leave monetary policy tools stretched thin.

Still, some members of the Federal Reserve are trying to calm markets, saying the bank has other tools beyond interest rates to manage the economy.

Falling Inflation Provides Temporary Relief

The decline in CPI and PPI data released last week led to further pressure on the dollar. The decline in headline and core inflation on an annual basis has eased the pressure on the Fed, at least for now. This led to the repricing of interest rate cut expectations and paved the way for the to fall below the 100 level. However, market professionals are not sure whether this decline is permanent. Because a “stagflation” scenario, in which growth will slow down due to the impact of trade wars and this slowdown may simultaneously increase inflation, is being increasingly pronounced.

This week, markets will focus on the US , Eurozone and ECB interest decision. In the Eurozone, headline inflation is expected to fall to 2.2% and remain stable at 2.4%. Over the weekend, US and European markets will be open for 4 days due to the Easter holiday, which may increase volatility.

Technical Outlook on DXY

From a technical perspective, the Dollar Index (DXY) dropped sharply after losing support in the 103–104 range earlier this month. It quickly fell to the key psychological level of 100, which may continue to act as an important short-term support.

On the daily chart, both the short-term moving averages and the Stochastic RSI are still showing bearish signals. The dollar’s recovery attempts at 100 are weakening, suggesting that if the index fails to hold above this level in the coming days, the downward move could continue toward the Fibonacci expansion zone between 94 and 97.

If Federal Reserve Chair Powell makes hawkish comments on interest rates this week, it could help support the dollar, triggering buying interest and possibly pushing the DXY back above 100. In such a scenario, we might see a move up to the 101.5–102 range. Additionally, any signals from the European Central Bank (ECB) could also influence short-term dollar movements.

However, the current environment still points to a downward trend for the dollar in the near term. The direction will largely depend on how Trump handles tariff issues, the progress of US-China trade talks, and the Fed’s communication.

Looking at the latest developments, pressure on the dollar is likely to continue in the short term. For a lasting recovery, a pause in the trade war and greater political stability in the US will be necessary.

****

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and instantly unlock access to several market-beating features, including:

ProPicks AI: AI-selected stock winners with proven track record.

InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.