The US and China eased trade tensions by agreeing on a preliminary plan to carry out the consensus reached in Geneva, according to negotiators. While full details of the deal aren’t yet available, US officials said they are confident that issues related to rare earth minerals and magnets will be resolved under this plan.

After two days of tough talks in London, U.S. Commerce Secretary Howard Lutnick said the new framework deal adds substance to the agreement made in Geneva last month to reduce the steep tariffs between the U.S. and China.

The Geneva deal had stalled because China kept limiting exports of critical minerals, leading the Trump administration to impose its own export controls on items like semiconductor design software and aircraft.

Lutnick said the London agreement will ease restrictions on China’s rare earth minerals and magnets, as well as some U.S. export controls, in a “balanced way.” However, he didn’t share specific details after the talks ended late at night in London.

China’s Vice Commerce Minister Li Chenggang said they had agreed on a basic trade framework, which will now be presented to leaders in both the U.S. and China.

Market reaction has been relatively positive, but the lack of details remains somewhat concerning. This is evident by the moves we are seeing in which remain elevated this morning, making a move toward $3350.

It is a sign that a deal was expected, but the details will be more important, and until we have clarity on that front, markets may remain in a form of limbo.

Source: LSEG

In China, signs of easing restrictions appeared as several rare earth magnet companies, like JL MAG Rare-Earth, Innuovo Technology, and Beijing Zhong Ke San Huan, announced they had received export licenses.

China dominates the rare earth magnet market, essential for electric vehicle motors. Its decision in April to stop exporting many critical minerals and magnets disrupted global supply chains.

In response, the U.S. stopped exporting semiconductor design software, chemicals, and aviation equipment in May, canceling previously issued export licenses.

Asian Market Wrap

Asian stocks saw small gains, with mainland China standing out. A regional stock index rose by 0.3%, while Hong Kong climbed 1% and mainland China gained 0.9%, leading the region.

The European Open

European stocks stayed mostly flat on Wednesday. The index was nearly unchanged at 553.88 points by 0806 GMT.

In Europe, industrial metal miners rose 0.6%, and personal and household goods also saw gains.

British homebuilders like Bellway (LON:) and Vistry went up as finance minister Rachel Reeves prepared to announce plans for over £2 trillion in public spending to boost the UK economy.

Retailers were the biggest losers, dropping 1.3%, with Zara’s owner, Inditex (BME:), falling 5% after missing sales expectations. Inditex was the worst-performing stock on the index.

On the FX front, the strengthened slightly, causing the to dip 0.08% to 1.1416 and holding steady at 145.05 .

China’s onshore stayed mostly unchanged at 7.1867/dollar, while the was at 7.1875, both near two-week lows.

The , which tracks it against six other currencies, rose 0.17% to 99.129.

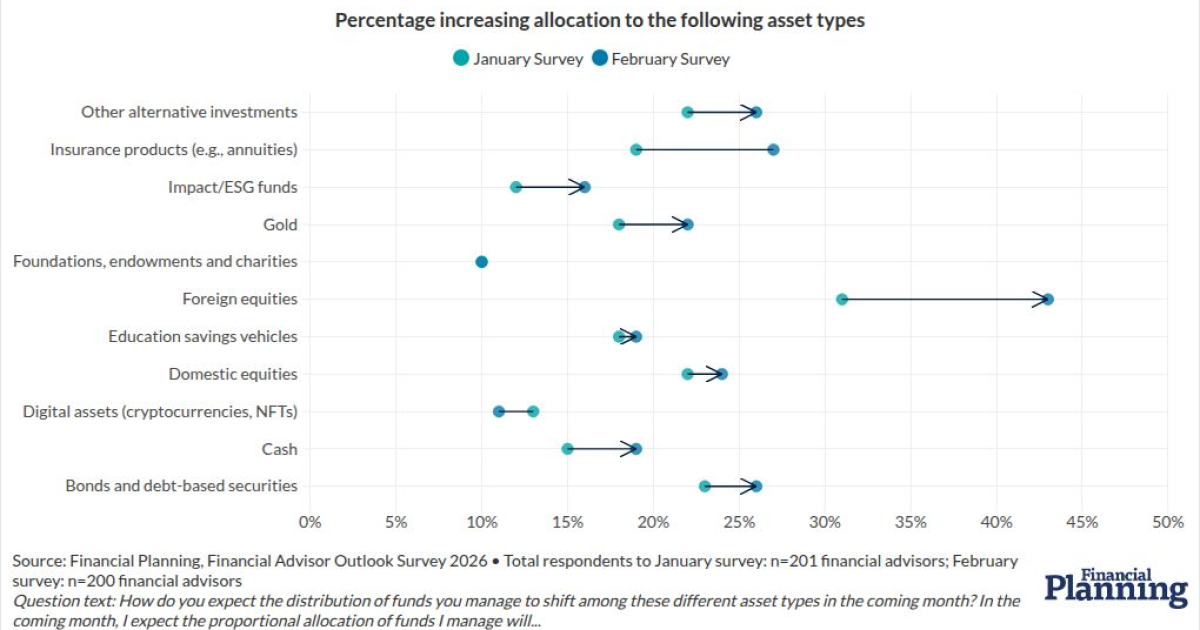

Power Currency Balance

Source: OANDA Labs

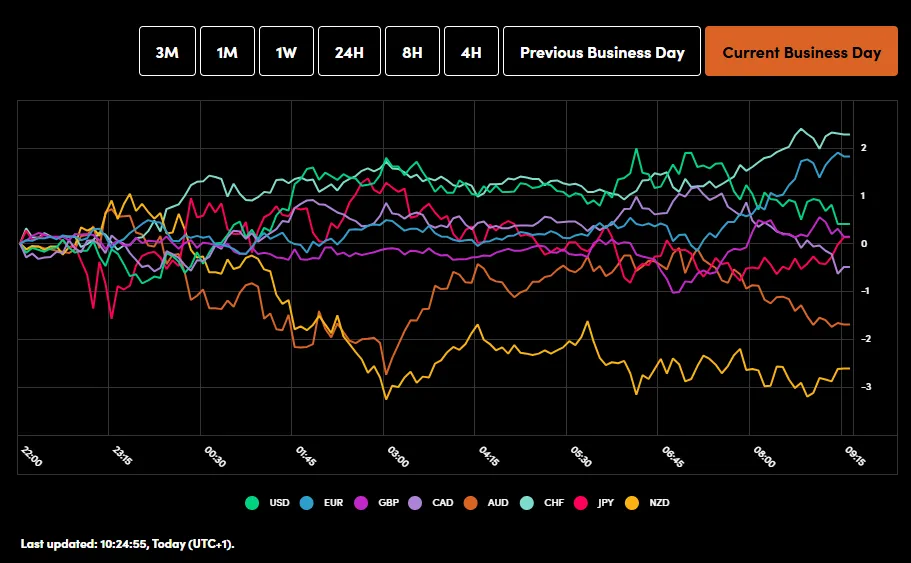

Chart of the Day – DAX Index

From a technical standpoint, the is back at 24000 support with the daily range still holding firm.

The lack of commitment is being seen across markets, and given the DAX v-shape recovery is understandable at present.

The wee bit of optimism from the US-China preliminary deal will likely keep the DAX supported and limit any downside moves.

Immediate support at 24000, 23900, 23600.

Immediate resistance rests at 24200 and 24500, respectively.

DAX Daily Chart, June 11. 2025

Source: TradingView.com

Original Post