With gold at $3,800 per ounce, miners are generating record cash flows, yet their valuations lag behind the metal’s price, creating a buying opportunity.

Here are the 5 best gold mining stocks to consider for your portfolio right now.

Looking for actionable trade ideas? Subscribe now to unlock access to InvestingPro’s AI-selected stock winners!

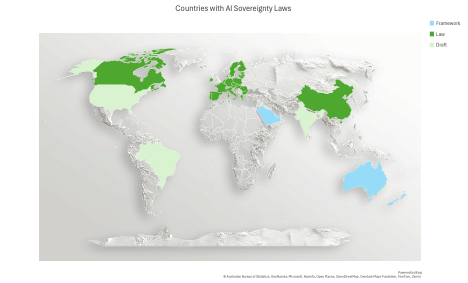

As continues its impressive rally toward historic highs, driven by , concerns, geopolitical uncertainty, and central bank diversification away from the , stocks of companies mining the yellow metal present compelling investment opportunities.

The VanEck Gold Miners ETF (NYSE:) has surged a whopping 125% year-to-date, outpacing the broader market, yet many gold mining stocks remain undervalued.

Source: Investing.com

This discrepancy offers significant upside potential for investors seeking leveraged exposure to the gold rally. Below, we highlight the top five gold mining stocks to consider for your portfolio, based on their strong fundamentals, production growth, low costs, and analyst endorsements.

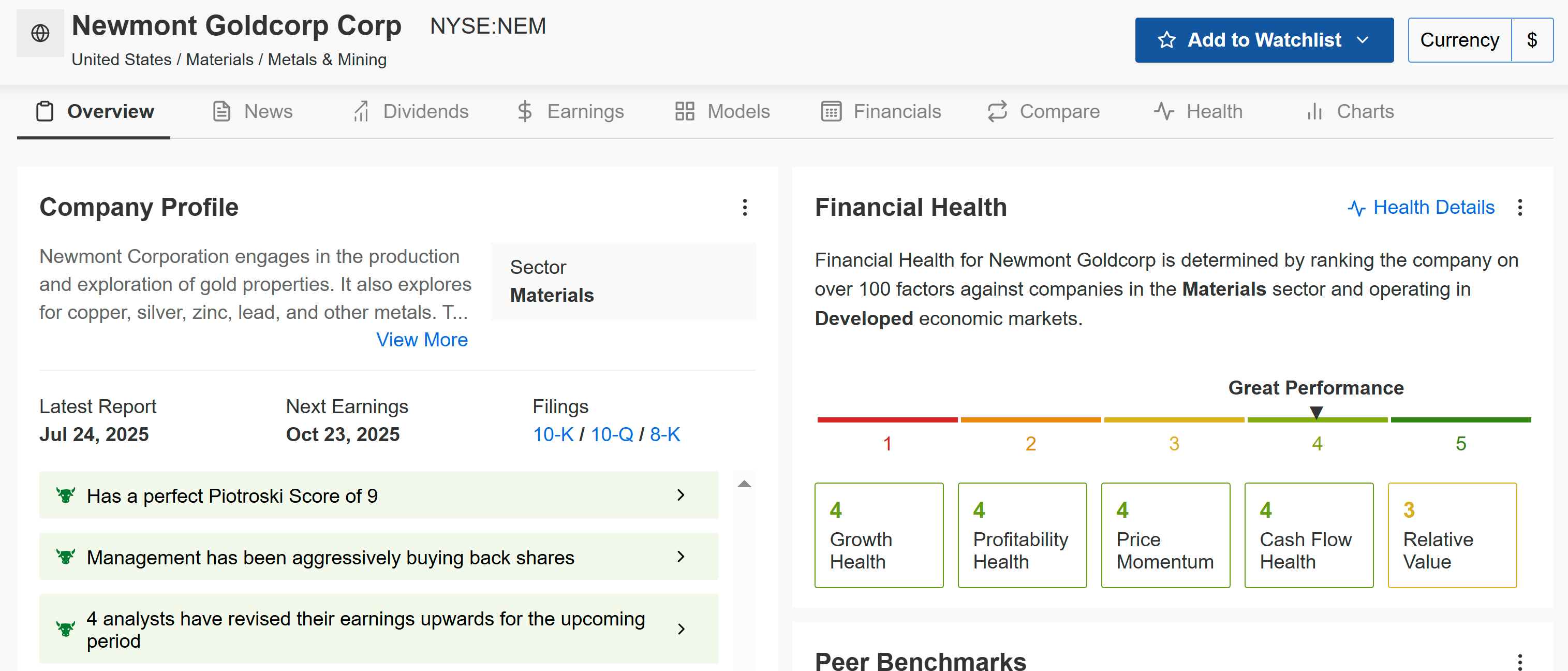

1. Newmont Corporation – The Blue-Chip Gold Standard

Market Cap: $92.6 billion

Year-to-Date Return: +126.5%

Forward P/E: 13.5x

As the world’s largest gold producer and the only gold miner included in the , Newmont Goldcorp (NYSE:) is the undisputed blue-chip of the sector. The company is known for its strong balance sheet, low-cost production, and commitment to shareholder returns.

Analysts, including those at JPMorgan, see Newmont as undervalued, with its stock up 126.5% year-to-date. With gold prices expected to hold above $3,800, Newmont’s scale, diversified assets, and strong cash flow position it for significant upside. UBS projects a 20-30% stock price increase over the next 12 months.

Source: InvestingPro

In addition, Newmont offers a dividend yield of 1.3%. For investors seeking a core, lower-risk holding in the gold space, Newmont is the foundational choice.

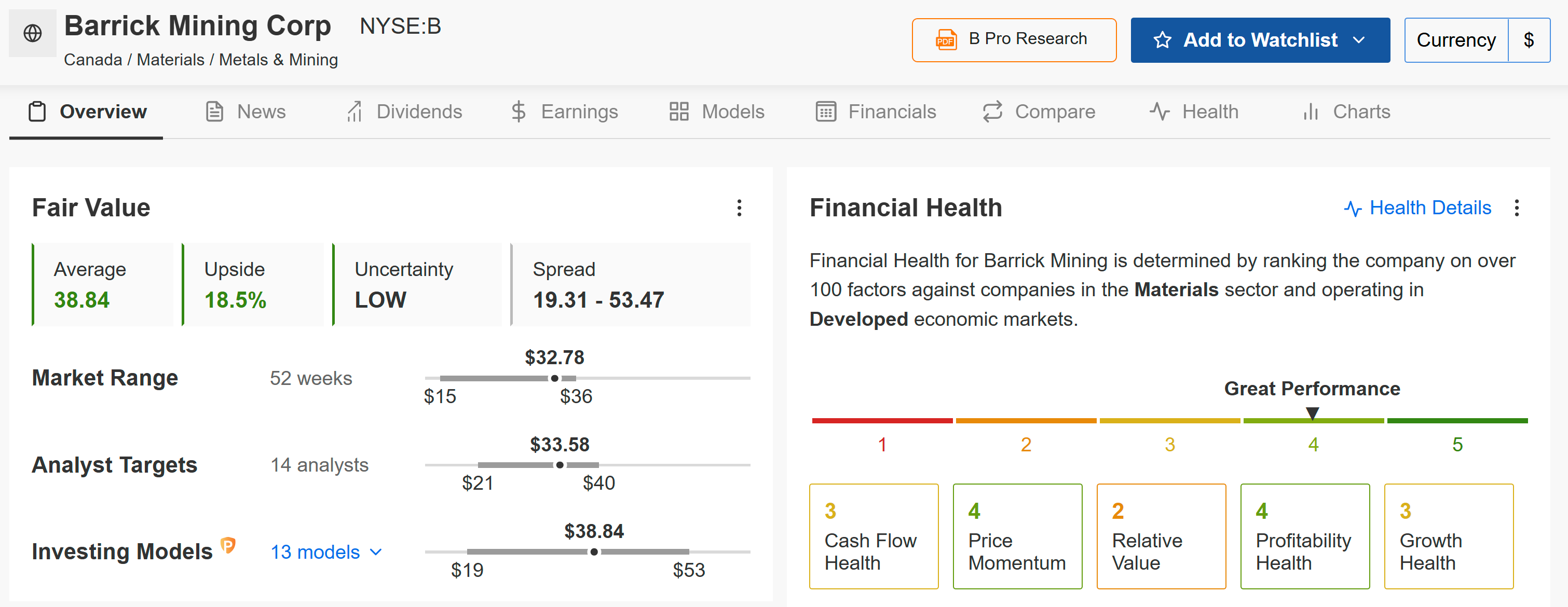

2. Barrick Mining – The Global Growth Story

Market Cap: $55.9 billion

Year-to-Date Return: +111.4%

Forward P/E: 12.7x

If Newmont is the king, Barrick Mining (NYSE:) is the powerful and disciplined challenger. The company has undergone a remarkable transformation, focusing relentlessly on a portfolio of “Tier One” assets—mines capable of producing over 500,000 ounces of gold annually for at least ten years at a low cost.

Jefferies calls Barrick a “catch-up” play, with a price target of $40-$44, suggesting 25-37% upside. The company’s strong balance sheet and diversified portfolio make it a resilient choice in volatile markets. At current gold prices, Barrick’s profitability is poised to accelerate into Q4 2025.

Source: InvestingPro

Barrick offers a dividend yield of 1.8%, supported by its strong cash flow generation. The company’s low all-in sustaining costs (AISC) and strong free cash flow position it well to capitalize on higher gold prices.

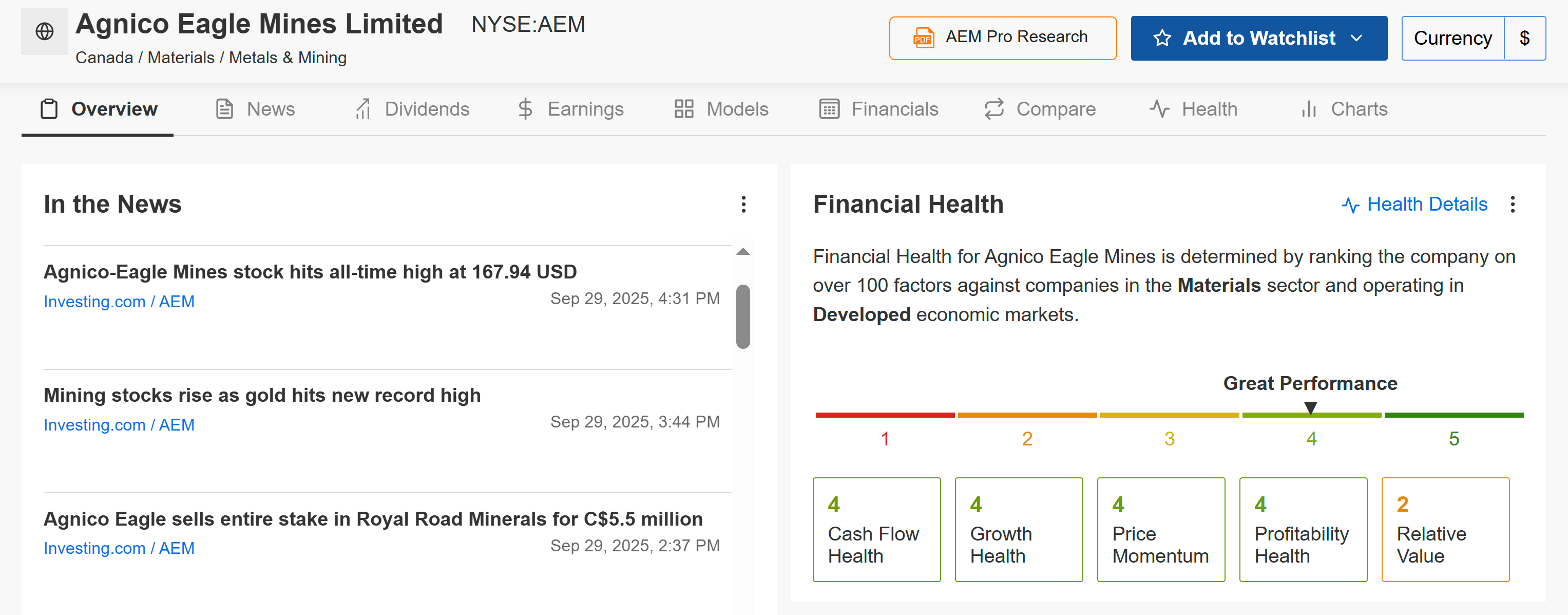

3. Agnico Eagle Mines – The North American Powerhouse

Market Cap: $84.6 billion

Year-to-Date Return: +115.5%

Forward P/E: 20.2x

Agnico Eagle Mines (NYSE:), a Canadian gold mining giant, operates low-cost mines in stable jurisdictions like Canada, Finland, and Mexico, producing 3.4 million ounces in 2024. For investors who prioritize quality management and a low-risk geopolitical footprint, Agnico Eagle is a premier choice that consistently delivers value.

With zero debt and $2.3 billion in liquidity, Agnico is well-positioned for organic growth and exploration. Its disciplined cost management and high-grade deposits make it a favorite among analysts, with the stock catching upgrades at UBS and Jefferies recently.

Source: InvestingPro

Additionally, Agnico Eagle offers a dividend yield of about 1%, making it attractive for income-focused investors.

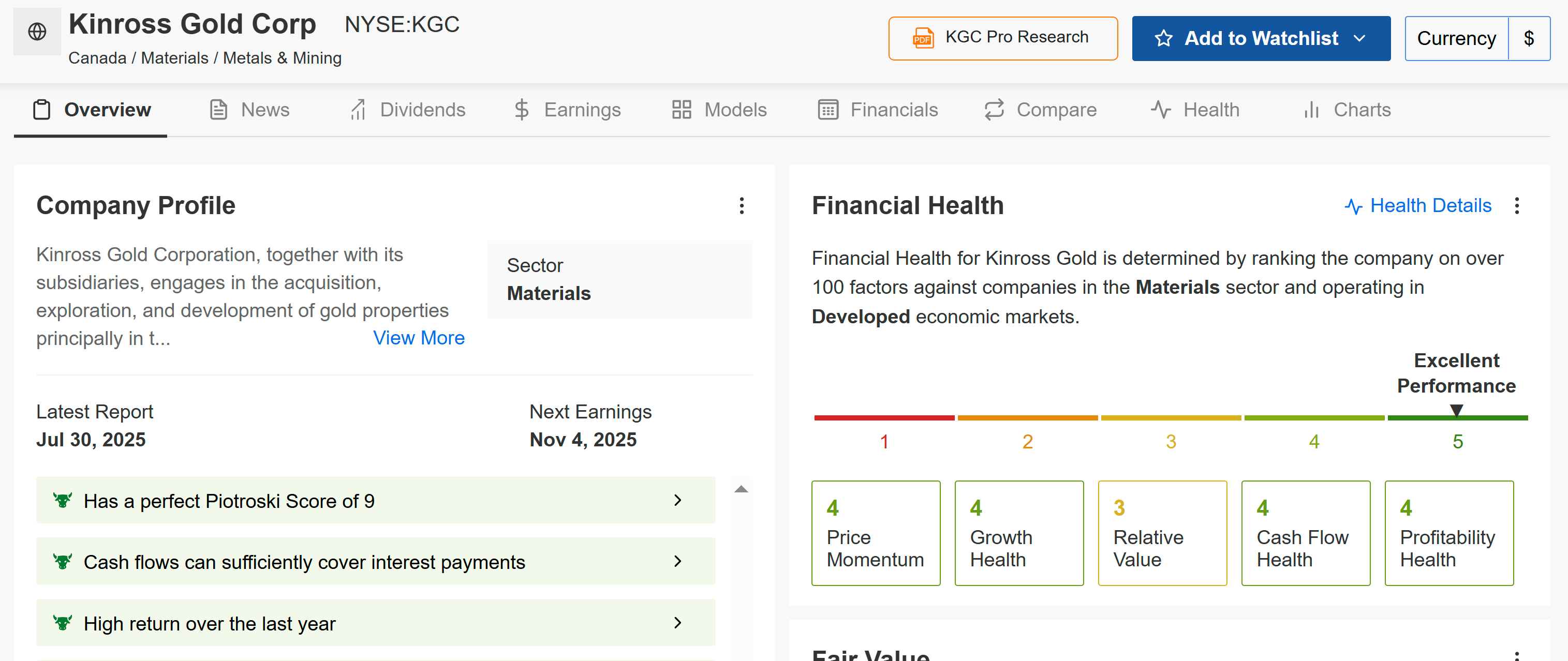

4. Kinross Gold – The Value Play with Upside

Market Cap: $30.3 billion

Year-to-Date Return: +168%

Forward P/E: 14.1x

Kinross Gold (NYSE:), a mid-tier producer, delivered a standout year with 21% revenue growth and doubled net earnings, producing 2 million ounces at an all-in sustaining cost (AISC) of $1,300 per ounce.

Analysts project 9-10% EPS growth in 2026, driven by its low-cost operations and efficient asset base. Trading at a forward cash flow multiple of 1.8x, Kinross is one of the most attractively priced miners in the sector. Its focus on high-margin mines in the Americas and West Africa, and Russia supports consistent cash flow generation, making it a compelling value play.

Source: InvestingPro

With a relatively low debt level and solid cash flow generation, Kinross is positioned well to weather volatile market conditions and capitalize on rising gold prices.

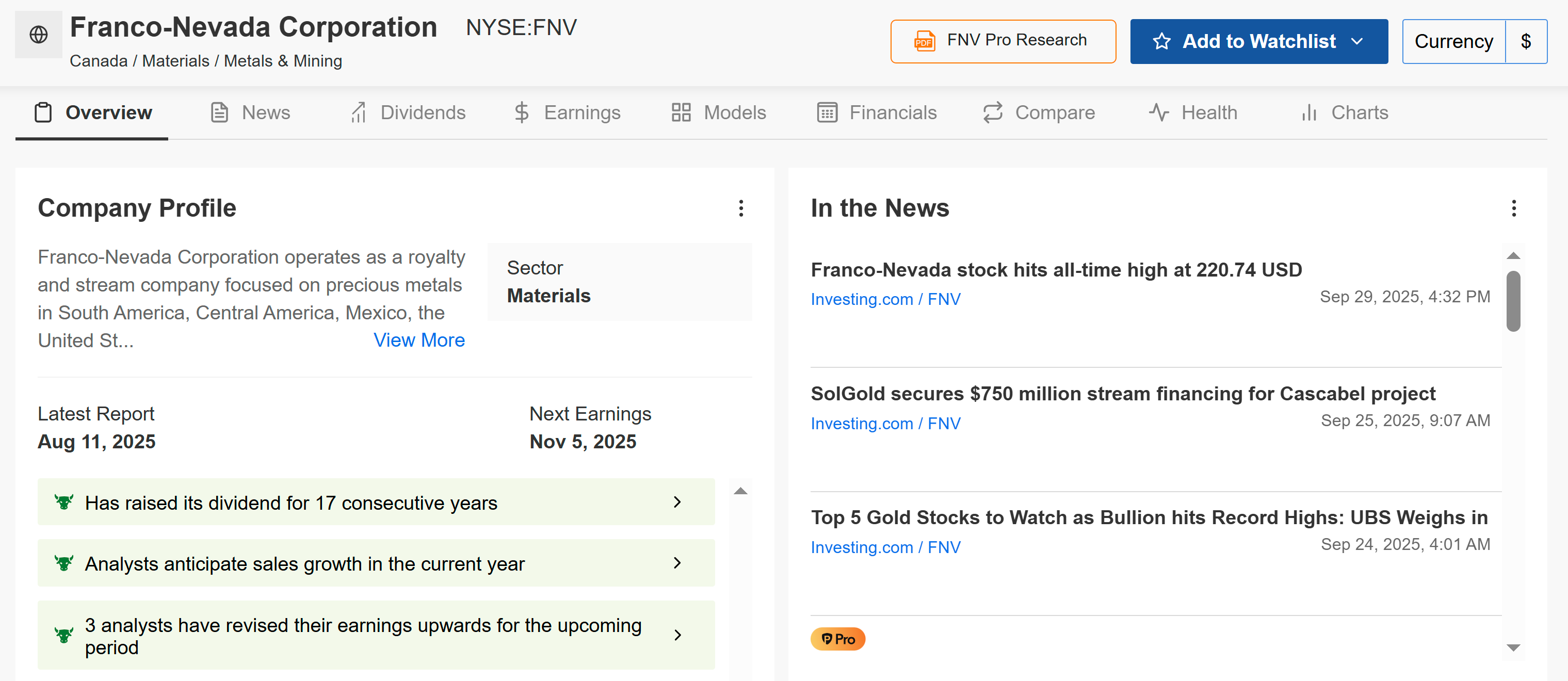

5. Franco-Nevada Corporation – The Premium Royalty Play

Market Cap: $43 billion

Year-to-Date Return: +89.6%

Forward P/E: 37.5x

Unlike traditional mining companies, Franco-Nevada (NYSE:) operates as a royalty and streaming company. Instead of digging for gold, it provides upfront capital to miners in exchange for a percentage of the mine’s future revenue (a royalty) or the right to purchase a portion of its future production at a deeply discounted, fixed price (a stream).

This structure offers superior margins and growth flexibility while maintaining exposure to gold price movements. As bullion prices rise, the company captures upside through existing royalties while avoiding the cost inflation and operational challenges facing traditional miners.

Source: InvestingPro

Furthermore, Franco-Nevada offers a history of consistent dividend growth, raising its annual payout for 17 consecutive years.

Bottom Line

These five gold mining stocks represent the best opportunities to capitalize on the current precious metals bull market while managing operational risks through diversification and quality focus.

Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and instantly unlock access to several market-beating features, including:

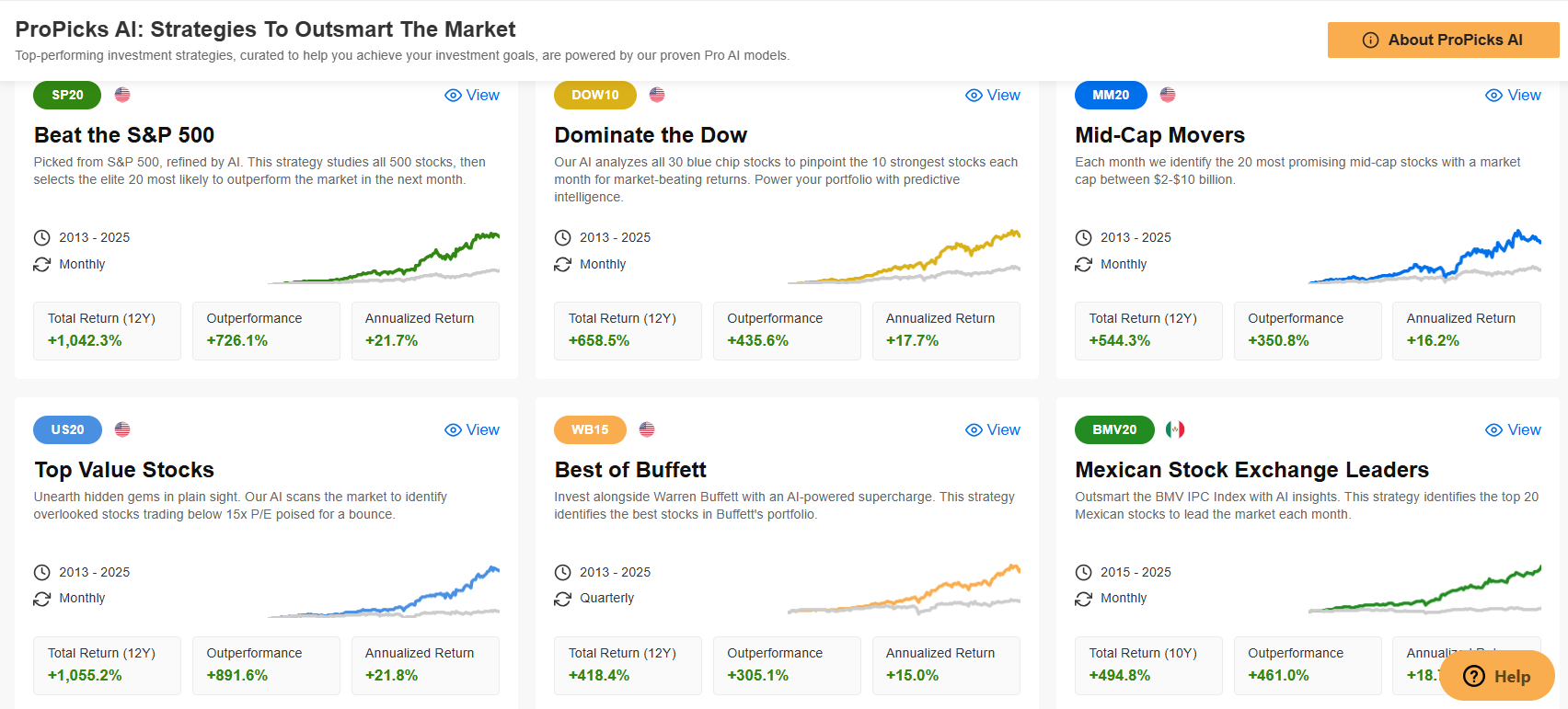

ProPicks AI: AI-selected stock winners with a proven track record.

InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500 and the Nasdaq 100 via the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Invesco Top QQQ ETF (QBIG), and Invesco S&P 500 Equal Weight ETF (RSP).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.