Structural shortages still support the long-term case, despite short-term pullbacks.

Meanwhile, the dollar index tests range highs, but momentum remains uncertain.

Looking for actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to InvestingPro’s AI-selected stock winners.

After prices moved above the $50 per ounce threshold, the scenario of breaking out to new historical highs became increasingly likely. However, it must be acknowledged that the magnitude of the rally and the speed with which the demand side has achieved this are surprising—even despite favorable macroeconomic and fundamental conditions. New peaks, currently located around the $54 per ounce area, failed to hold, and we are now observing a corrective phase. Still, an equally dynamic rebound does not alter the baseline scenario, which points to continued upward movement, primarily due to ongoing structural shortages of the commodity in global markets. Other factors such as the tariff war, the Fed’s policies, and the US government shutdown are expected to play an important role, at least in the short term.

Over 8% Correction in Silver

Although silver has seen a strong correction of over 8% over the past week, the overall outlook remains bullish. It should be considered, above all, that following such a sharp upward wave, this kind of pullback is usually not an attempt to reverse direction but more likely a case of profit-taking and a search for new accumulation at lower price levels. In the short term, the catalysts for the correction include reports that an agreement between Republicans and Democrats is nearing, as well as Donald Trump’s optimism about a new deal with China (though in the latter case, the optimism may be unfounded). If, in fact, the most positive scenario from the sellers’ point of view materializes, then a further decline toward the $44 per ounce level cannot be ruled out.

Nevertheless, this should be good news for market bulls, as it could offer an attractive opportunity to buy at more favorable prices while adhering to the long-term scenario of a fundamental shortage of the commodity amid steadily rising demand.

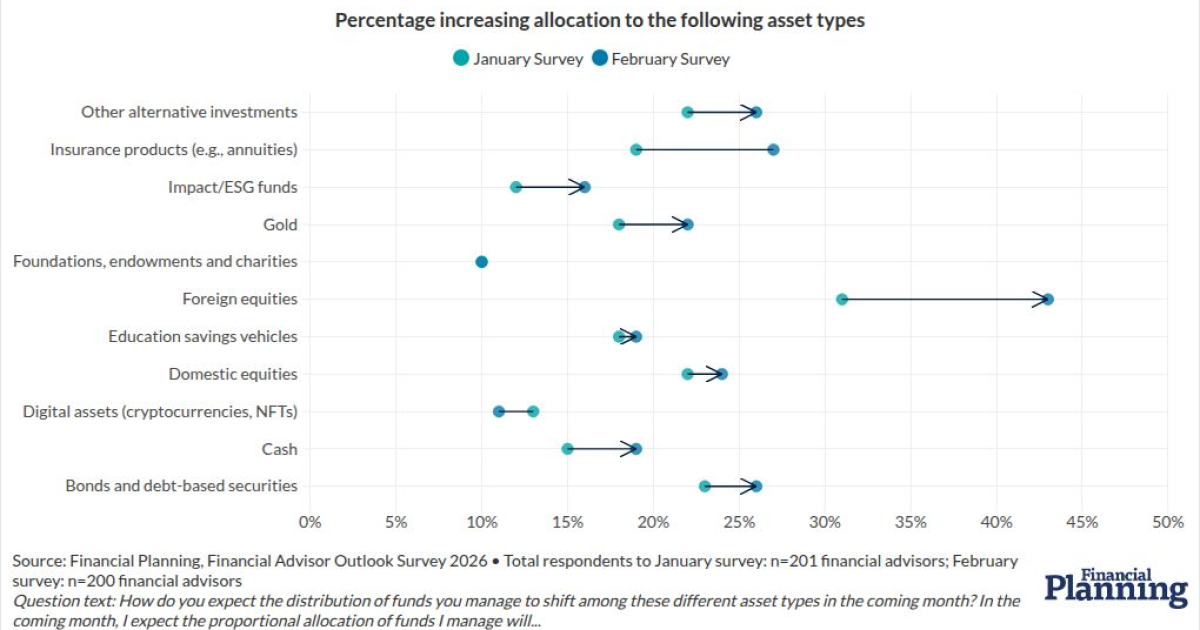

Dollar Index Will Struggle to Climb Out of Consolidation?

For more than a month, the has been moving upward, bouncing off the lower boundary of the multi-month sideways trend defined in the 96–100 point range. Currently, the main objective for buyers is to challenge the upper limit of this range, with the intent to push even higher.

Figure 1 Technical analysis of the US Dollar Index

If the demand side succeeds in this effort, then market focus could shift to 103 points, with a possible intermediate stop at 101.50. The 96-point level, which has consistently held, remains the primary support.

Possible Ranges for Corrective Movement on Silver

Looking at the long-term technical outlook for silver, the current rebound still appears to have room for expansion. In percentage terms, this may resemble the formation of a new impulse; however, a potential drop toward the $44 per ounce area—where the nearest support and the 23.6% Fibonacci retracement converge—can still be classified as a correction within the context of the recent gains.

Figure 2 Technical analysis of silver

Problems with trend continuation and a potential reversal could be signaled if the price drops below a key level marked in part by the next internal retracement at 38.2%. It will be important to monitor the momentum of the declines and updates from the key areas referenced in today’s analysis.

Problems with trend continuation and a potential reversal could be signaled if the price drops below a key level marked in part by the next internal retracement at 38.2%. It will be important to monitor the momentum of the declines and updates from the key areas referenced in today’s analysis.

****InvestingPro provides a comprehensive suite of tools designed to help investors make informed decisions in any market environment. These include:

AI-managed stock market strategies re-evaluated monthly.

10 years of historical financial data for thousands of global stocks.

A database of investor, billionaire, and hedge fund positions.

And many other tools that help tens of thousands of investors outperform the market every day!

Not a Pro member yet? Check out our plans here.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.