The US dollar’s weakness, linked to inflation data and interest rate expectations, supports silver’s rise.

As the gold/silver ratio peaks, silver targets $34 and $35.50 per ounce, driven by growing demand.

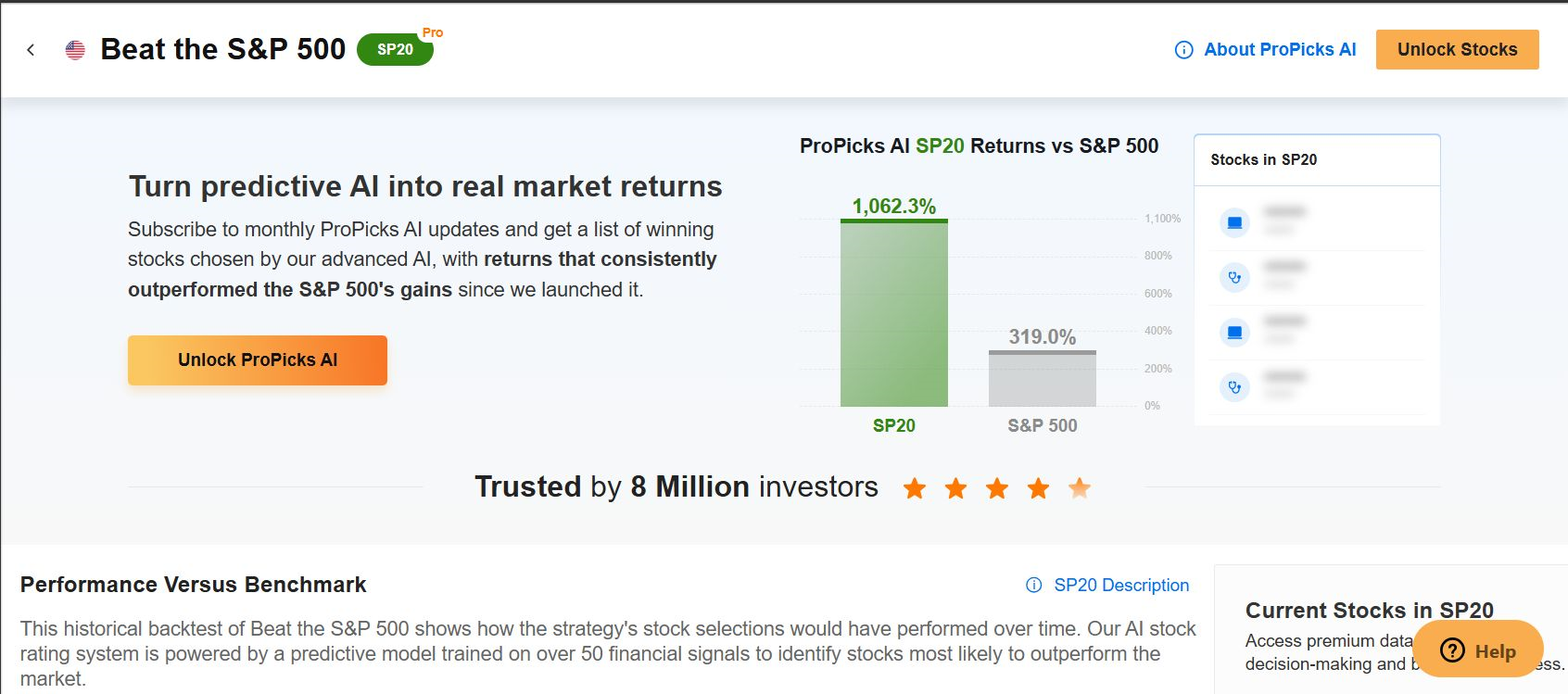

Looking for actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to InvestingPro’s AI-selected stock winners.

, which is used a lot in industries (especially in renewable energy), dropped sharply at the start of the month due to rising tensions in the US trade war with other countries. The main reason for the drop was growing worry about a slowdown in the global economy, especially in the US, where people are starting to talk about a possible recession later this year.

However, silver prices are now bouncing back. This is because some tariffs have been delayed or made less strict—especially for electronics. Prices have already recovered more than half of their earlier losses. If the stays under pressure and there are no new surprises in trade policy, silver could fully recover and continue to rise.

US Dollar Remains Key to Silver Price

The latest inflation data from the US shows that the is getting closer to the target. This, along with expectations of interest rate cuts happening sooner than expected, is keeping pressure on the US dollar. You can clearly see this in the , which measures the dollar’s value against a group of other major currencies.

Right now, the technical setup for the dollar is very interesting. The index is testing long-term lows around the 99-point level.

If sellers push the dollar index below this key level, it could open the door for further declines, with the next major target near 95 points—its lowest level since early 2022. This matters a lot for silver since a weaker dollar usually supports higher prices for metals and other commodities.

However, because of slow market activity during the holiday period and fewer major economic updates expected, there is also a good chance the dollar will hold this support level and bounce back above 100 points, at least in the short term.

Gold/Silver Ratio Breaks 100 Mark

The gold/silver ratio index reflects the price relationship between and silver. At the start of the month, following the announcement of new tariffs, there was a clear upward trend. This shows that gold remains the main asset seen as a safe haven, while silver, being part of many industrial sectors, is less favored in times of economic uncertainty.

Currently, we are seeing a consolidation, with the lower boundary around the price level just below 100 points. If the trend moves lower, the next technical target is likely around 93 points.

This scenario could unfold if the upward momentum in silver continues at its current pace. Looking at silver prices, we observe a continued upward trend, which is likely to reverse the earlier downward movement.

The next targets for silver on the demand side are the supply zone at $34 per ounce, followed by a slightly higher peak at $35.50 per ounce.

****

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and instantly unlock access to several market-beating features, including:

ProPicks AI: AI-selected stock winners with proven track record.

InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.