US and India lead global silver markets with growing demand from investors.

Silver eyes $50 mark with Federal Reserve policy and tariffs key to reaching highs.

Looking for actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to InvestingPro’s AI-selected stock winners.

After the holiday slowdown, demand in the metals market, including silver, has surged. Silver has risen above $40 per ounce, reaching its highest level in over a decade. This increase is driven by similar factors to those affecting gold, as discussed in yesterday’s analysis.

Additionally, industrial demand for silver is rising, especially from the electric vehicles and renewable energy sectors. Supply remains limited since only about 30% of silver is directly mined. In the short term, investors will watch the , which is expected to cut interest rates by 0.25% this month, with a possibility of a more significant decrease.

Shifting Dynamics in the Global Silver Market

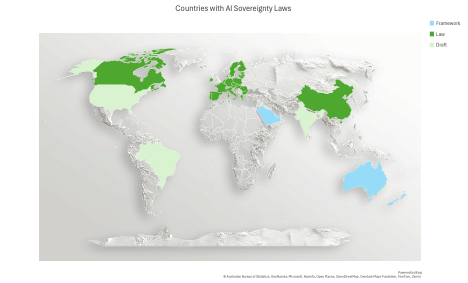

As economic and monetary factors support further increases in silver prices, it’s important to consider where the main centers of demand for silver are located. Silver is increasingly being seen as a hedging asset, similar to gold, which could lead to more demand from institutional investors like mutual funds, pension funds, and central banks.

If this trend continues, it could support a long-term rise in silver prices, similar to that of gold.

The US is currently the largest market for silver trading, with pension funds being a significant source of demand. Close behind is India, which is expected to become the largest market soon, as last year’s record demand in ounces supports this expectation. Germany and Australia follow, with bullion coins and bars being the most popular investment choices in these countries.

Silver’s March Toward Record Levels

A clear rise above $40 per ounce for silver has sparked speculation about reaching historical highs around $50 per ounce. Achieving this may be challenging this year, but it’s not out of the question. Two important factors are the Federal Reserve’s monetary policy and US government tariffs. If the Fed eases policy and the government tightens tariffs, this could support reaching these price levels. Technically, the next target on this path is the 2011 high of $44 per ounce.

In the short term, a local price correction might occur, offering an opportunity to buy at a better price before potentially continuing the uptrend. The optimal support area for this scenario is around the recently broken peaks near $40 per ounce, which is also slightly reinforced by the uptrend line below it.

If we see a descent below the indicated line, then the next target for supply should be the several times tested support of $37 per ounce.

****

InvestingPro provides a comprehensive suite of tools designed to help investors make informed decisions in any market environment. These include:

AI-managed stock market strategies re-evaluated monthly.

10 years of historical financial data for thousands of global stocks.

A database of investor, billionaire, and hedge fund positions.

And many other tools that help tens of thousands of investors outperform the market every day!

Not a Pro member yet? Check out our plans here.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.