On the economic data front, we have PMI and inflation figures in the US, Europe, the UK, and the Asia Pacific.

We also have key events like Japan’s CPI, China’s lending rate, and the UK’s spring statement.

Week in Review: Markets in Flux as Federal Reserve and the BoE Keep Rates on Hold

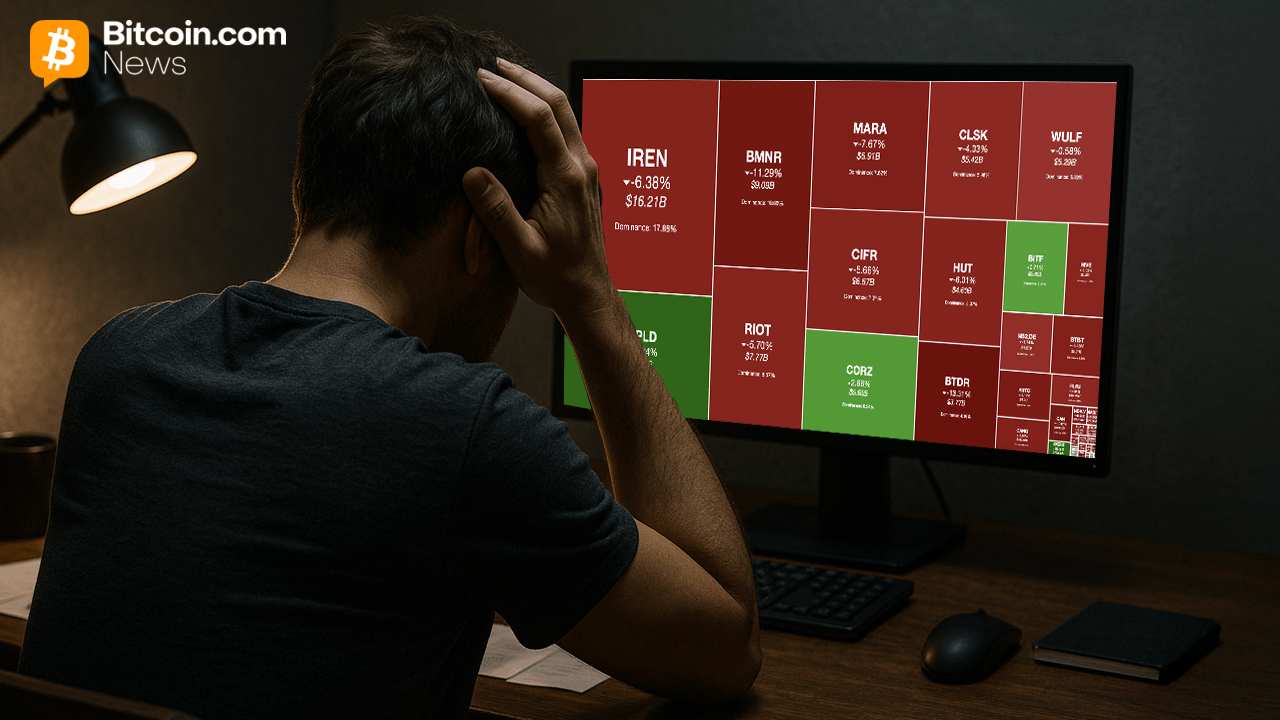

Markets have struggled once more this week as an attempt at a rebound in risk assets was met with selling pressure.

The and the are both on course to end the week in the green, but selling pressure remains in play.

Investors withdrew a large amount of money from global equity funds in the week leading up to March 19, due to ongoing concerns about the impact of U.S. President Donald Trump’s tough trade policies on the global economy.

There was a tiny bit of optimism post the FOMC meeting, however, this faded rather quickly with sellers returning en masse.

According to LSEG Lipper data, they sold a net $29.7 billion worth of global equity funds during the week, marking the biggest weekly outflow since December 18.

Sources: LSEG Datastream

The this week saw the return of a phrase many market participants have come to ridicule, and that is ‘transitory’. This was the answer by Fed Chair Jerome when quizzed on the potential of tariffs to lead to increased inflationary pressure.

This will be a key consideration as to how markets may perform this year as it will likely determine the amount of rate cuts the Central Bank is able to deliver. Looking at the Feds updated projections and it does not paint an attractive picture.

On the FX front, the has finally rallied, breaking above a key level at 104.00. The recovery in the USD has led to declines in and . The Yen was unable to maintain its recent gains thanks to the stronger Dollar, however is only up around 0.23% for the week.

continued its rise this week, with a fresh YTD high around the $3050/oz mark. Friday did see a slight pullback which could be down to the stronger US Dollar and potential profit taking.

prices continued to rebound this week but remain confined within a tight range. Thursday looked to have set the stage for further gains after new sanctions on Iran. Friday, however, saw Oil falter on a stronger US Dollar after running into a key resistance level.

The Week Ahead: PMI and Inflation Data in Focus

Asia Pacific Markets

The main focus this week in the Asia Pacific region will be data from Japan and the medium term lending rate from China.

Japan’s Tokyo CPI and are in focus this week. On Monday, flash PMI data will be out, followed by Tokyo’s CPI on Thursday. Tokyo’s prices may drop slightly due to energy subsidies and stable fresh food costs, but core prices (excluding fresh food and energy) are expected to stay at 1.9%. For PMIs, services might improve due to strong wage growth, while manufacturing could decline because of US tariffs.

China is set to update its medium-term lending facility rate on Monday, with the one-year rate expected to stay at 2.0%. On Thursday, we’ll get the first industrial profits data for 2025. The key focus will be whether profits can grow again, despite tough comparisons to last year’s numbers.

Europe + UK + US

In developed markets, the , and will all release PMI data which markets will be keeping a close watch on given concerns about global growth. We also have the Feds preferred inflation gauge due on Friday as markets get a look at February’s PCE numbers.

In the UK markets will be paying attention to the spring statement by Chancellor Rachel Reeves set for March 26. The focus will be on addressing rising debt interest costs and tight public finances. Chancellor Rachel Reeves is expected to announce spending cuts, particularly in welfare and departmental budgets, to recover the £10bn fiscal headroom lost due to higher borrowing costs. However, these cuts may only provide temporary relief, as further tax hikes are likely in the autumn.

The government is hoping that economic reforms, like changes to planning rules and closer ties with the EU, will help boost growth. However, these changes are unlikely to show quick results. With few choices left, the Treasury has tough decisions ahead, as it tries to balance spending cuts with political and economic challenges.

The U.S. will release and . Confidence has been dropping as people worry about job and benefit cuts from government spending reductions. Concerns over tariffs raising prices and falling stock markets are also fueling fears about the economy.

Fed Chair Powell has downplayed weak sentiment, noting it hasn’t been a reliable indicator of spending growth. February’s personal spending data will be key after January showed declines. A rebound is expected (+0.7% nominal, +0.4% volume), but overall spending may weaken further, potentially paving the way for a potential Federal Reserve rate cut in September.

Chart of the Week – US Dollar Index (DXY)

This week’s focus is back on the as it looks to consolidate recent gains and push on.

The DXY has pushed above the key resistance level at 104.00, with a weekly candle close above likely to embolden bulls.

The 14-period RSI has finally left oversold territory, hinting at a shift in momentum as well.

Immediate resistance rests some distance away at the psychological 105.00 which is also where the 200-day MA currently rests. This highlights how important that 105.00 handles may prove to be when the DXY makes its way to the level.

A break above 105.00 brings resistance at 105.63 and 106.13 into focus.

Support, meanwhile, rests at 103.65 and 103.17, respectively.

US Dollar Index (DXY) Daily Chart – March 21, 2025

Source:TradingView.Com

Key Levels to Consider:

Support

Resistance

Read More:

Original Post