In the lead‑up to Christmas, beauty retailers in London pulled out all the stops to capture consumer attention, create memorable experiences and maximise spending in the Golden Quarter, the crucial final three months of the year.

Mintel BPC analysts Georgia and Shiyan hit the streets to witness these activations first-hand and share their insights below.

Beyond traditional Christmas decorations and gift sets, retailers tapped into key retail execution and emerging beauty trends to differentiate and encourage shoppers to spend more time in-store.

Social Media Steps into the Store

Beauty retailers brought the buzz of online beauty cultures into physical spaces, helping visualise social trends in real life through in-store brand activation and guide consumers to trending products.

K-Beauty became a staple for beauty consumers in 2025, with many learning about beauty products and trends via social media. Christmas 2025 marked many K-Beauty retailers’ first festive period and gave gift-buyers the opportunity to access cult favourites easily. K-Beauty retailers PureSeoul and SkinCupid tapped into multiple trends including personalisation, gamification and charms. Makeup brand Glow launched a playful bear plushie keychain, available at PureSeoul, designed to be attached to bags.

Meanwhile, SkinCupid brought ‘FragranceTok’ to life with a large eye-catching display of fruits and botanicals illustrating the fragrance notes in Add’ct’s line of fragrances. The visually striking display makes buying fragrance approachable and fun, removing some of the jargon often used by content creators.

Trending-on-social Christmas gifts were front and centre at Boots and Space NK, where curated gift sets and bold merchandising made it easy for shoppers to pick up products that reflect online beauty conversations. This ‘social-first’ merchandising bridges the gap between digital inspiration and real-world purchase, as one in five of UK BPC in-store buyers have purchased products from a ‘trending on social media’ display in a shop, driving impulse buys and shareable content.

In-Store Execution that Simplified Discovery

With the sheet volume of beauty products, beauty aisles can be difficult to navigate, supported by and 68% of UK adults saying that the amount of beauty/grooming products available is overwhelming. Retailers are overcoming this with guidance and a focus on curation.

At Liberty, the Fragrance Lounge organises scents by olfactory family rather than brand, making exploration intuitive and educational. Visitors can also book private, one-on-one consultations with a Fragrance Concierge, elevating fragrance shopping into a more relevant offer given that a significant 71% of UK adults who have bought beauty gifts in the past year think retailers should offer more in-store advice.

PureSeoul’s Discovery Zone simplified the shopping journey. By highlighting the newest K-Beauty brands, the retailer guides consumers through a crowded landscape and encourages experimentation. This curated approach turns complexity into excitement by empowering consumers to explore brands that they are likely to be unfamiliar with, having only recently launched in the UK.

Retail Experiences that Go Beyond Shopping

Experiential retail remained a core pillar to elevate the shopping experience and build a brand’s in-store presence, with many brands layering interactivity, gamification and wellness into retail spaces during the festive season.

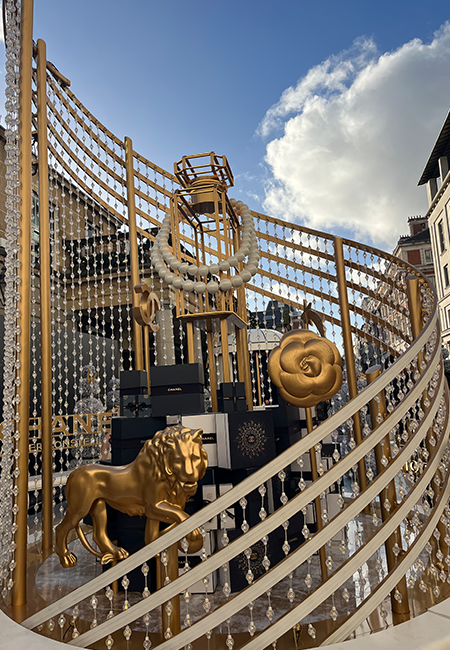

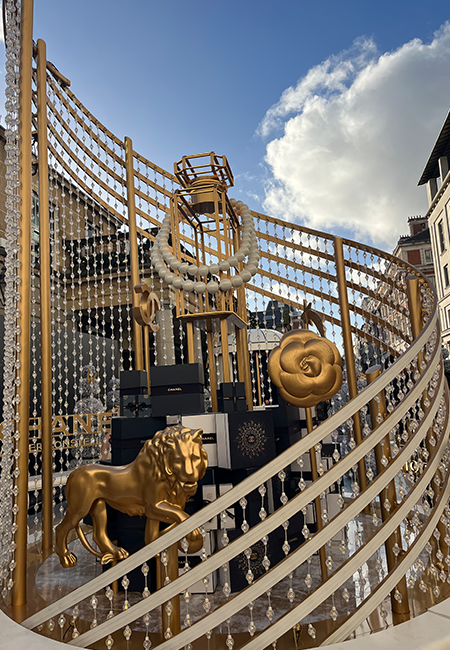

Chanel’s Winter Constellation Pop-Up dazzled Covent Garden with a celestial light installation celebrating the iconic No5 bottle. Shoppers were able to scan QR codes to reveal ‘falling stars’ digital interactivity moments. Staff carried adorned Chanel No5 bags, which added a theatrical touch to spark conversation and interest among visitors.

The gamification trend was at play in multiple stores, including Benefit, SkinCupid and The Body Shop. Claw machines, playable with a spend threshold, encouraged store visitors to spend more, created memorable experiences and social-ready photo opportunities. Making use of nostalgia-inspired games, such as Chess, Tamagotchi, along with a playable Operation-style game in store, Benefit’s extended its gaming theme across in-store displays, social media content and gift sets.

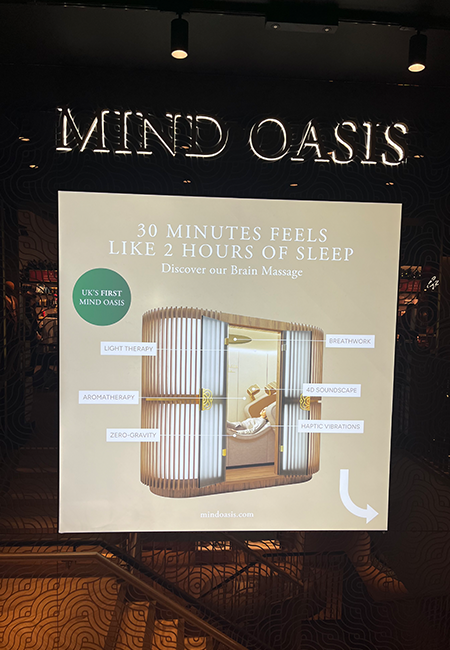

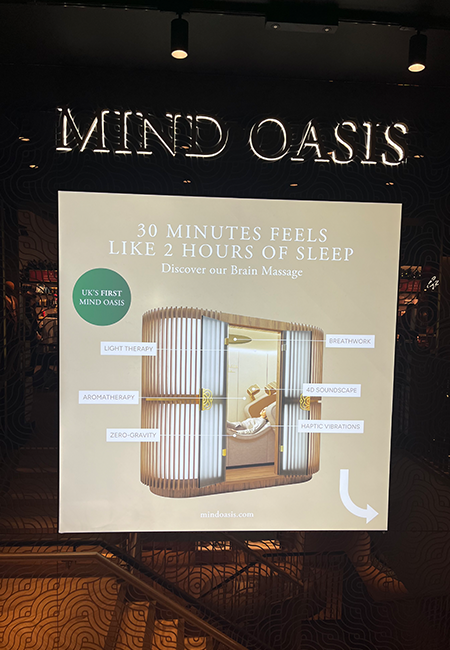

Rituals welcomed Oxford Street shoppers to take a break from the busy shopping season with its Mind Oasis. Opening just ahead of Christmas 2025, the space features treatments such as a Brain Massage, claiming to deliver the feeling of 2 hours of sleep in 30 minutes and a Hydro Massage for easing physical stress, an activation that blends wellness with retail in a compelling way.

What Christmas 2025 Revealed About Beauty Retail

The 2025 festive season reinforced that beauty retail is no longer just about selling products; it’s about creating moments. From social media inspired merchandising to gamified engagement opportunities and curated discovery, these strategies show how physical spaces can remain relevant and exciting.

With six in ten of UK BPC buyers say browsing products in a shop is a fun/enjoyable way to spend their time, retailers that deliver personalisation, entertainment and ease will receive both attention and loyalty in 2026 and beyond.

Looking ahead, retailers will continue to create memorable experiences for shoppers. Differentiation will come from giving consumers a respite from algorithms and A.I. Stores that train their staff to become experts, capable of delivering guided and curated experiences that forego digital tools in favour of human connection will win over consumers.

In-store, gamification will go beyond seasonal activations to become part of everyday shopping. ‘Play zones’ that encourage experimentation, customisation and interaction in a fun, low-pressure environment will transform shopping from a chore to an enjoyable experience. This directly aligns with Mintel’s 2026 Global BPC Prediction Sensorial Synergy, which emphasises the distinction between “buying” (a necessity) and “shopping” (a leisure activity). When retail feels playful and immersive, it elevates shopping into a form of entertainment, encouraging longer visits and higher engagement.

Interested in receiving more market insights and fresh perspectives from our analysts, delivered directly to your inbox? Subscribe to our free newsletter Spotlight.

Or contact us directly for tailored-to-you insights.

Subscribe to Spotlight

Contact us