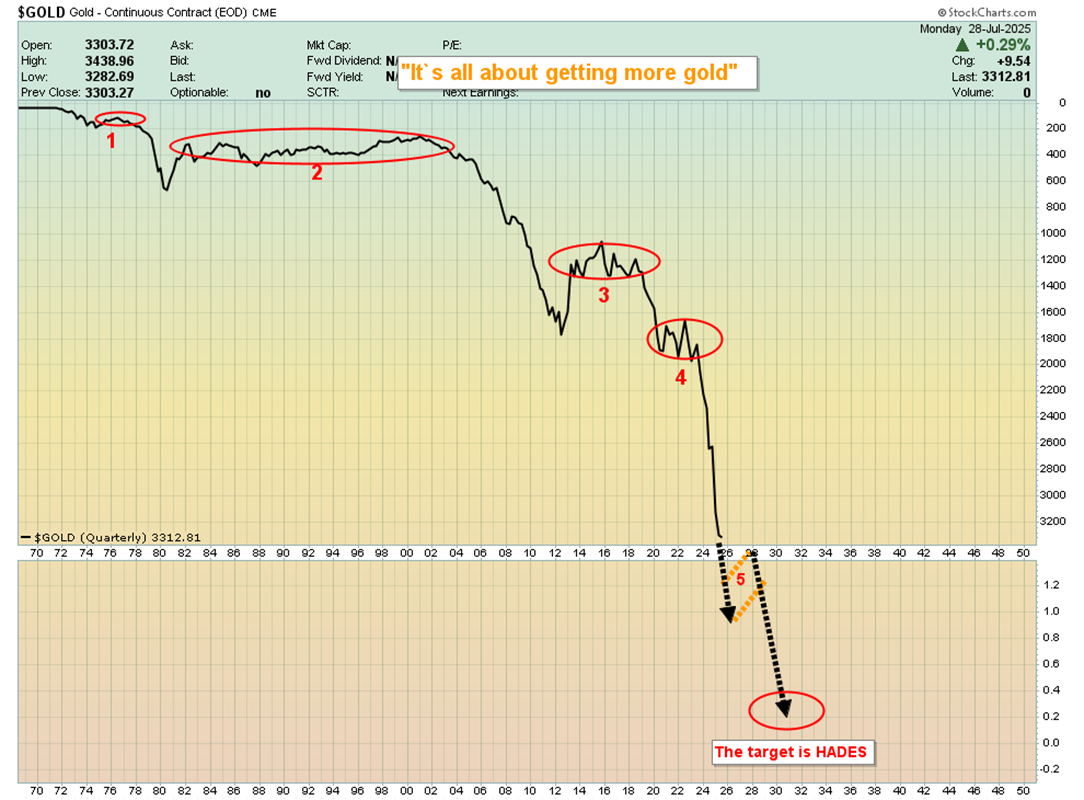

In time, the bulk of price discovery will be centred in Asia, but that’s a long-term transition.

The American fear trade still plays a big role in gold pricing, and this week features the employment report, US , a meet, the report, the government , and a big tariff tax announcement.

It’s probably the biggest reports/events week of the year, and the action begins early Wednesday morning with the ADP report!

Should rates be cut, given the swoon in private sector employment? A persuasive case can be made to do that.

The QQQ Nasdaq ETF (NASDAQ:) chart. The Fed is going to be reluctant to cut rates with the stock market soaring.

Basis the Shiller/CAPE ratio, the SP500 is now the second most overvalued in history.

Given the near-insane amount of institutional speculation in the market, a case can be made that rates should be hiked rather than cut.

To add to the chaos, the government is demanding cuts while adding inflationary tariff taxes. How will the Fed act tomorrow… and what does it mean for gold?

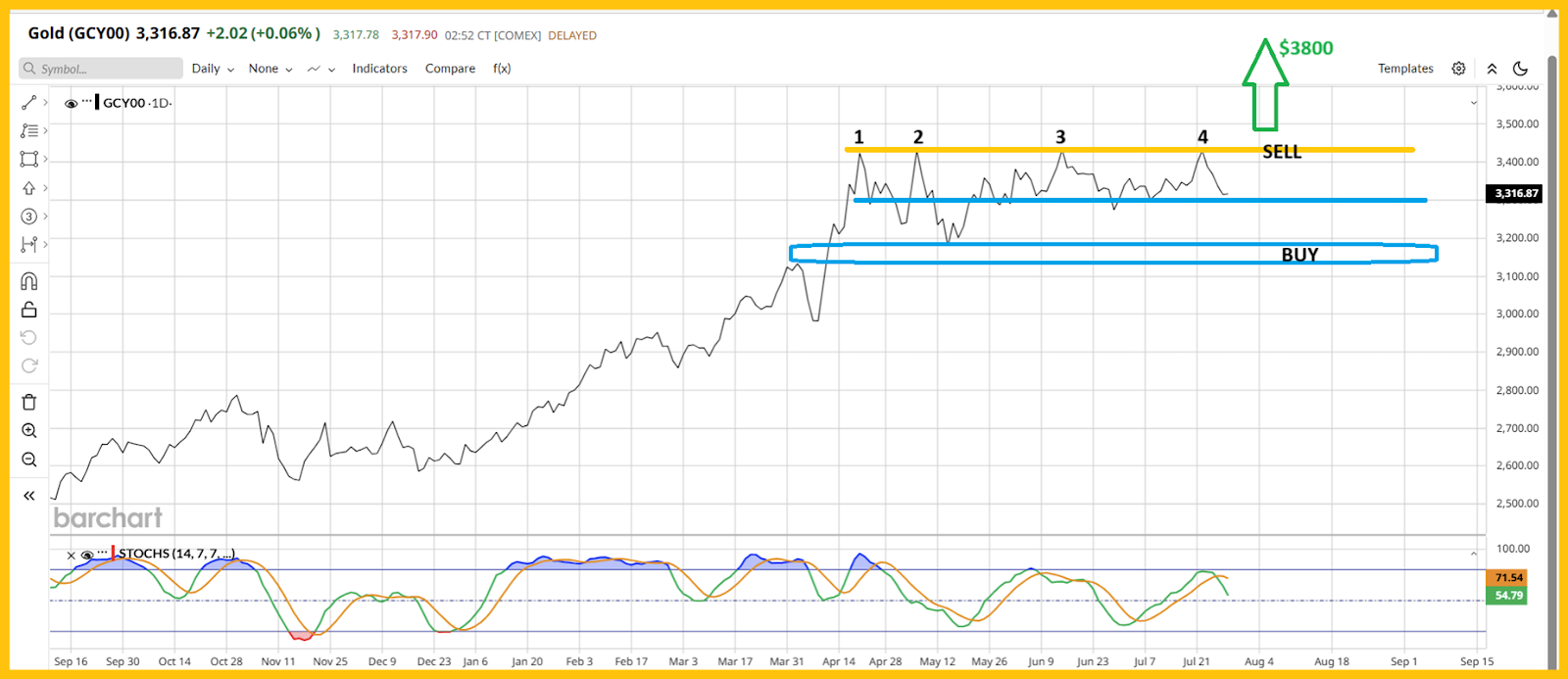

If the Fed cuts and/or Jay provides dovish commentary, gold could rally and break above the key $3440 zone.

If there is no cut and no dovish talk, there could be a bit more softness in the price.

If gold were to trade at $3170-$3130 and then rally from there to the $3800 target zone, investors who bought gold, silver, and miners into the dip would be handsomely rewarded.

The $3300 area is also a buy zone, but it is best suited for gamblers and “nibblers”.

The weekly chart. The $3800 target zone is the same as for the daily chart, and the inverse H&S pattern on the Stochastics oscillator (14,5,5 series) is “bullishly intriguing”.

Gold isn’t a stock, let alone a “whipping boy” that investors buy to make “big fiat profits”. It’s the world’s greatest currency. In a nutshell, it’s an end, not a means.

In the big supreme currency picture, it doesn’t matter whether gold will bottom around $3170 or whether yesterday’s low marks the end of the consolidation.

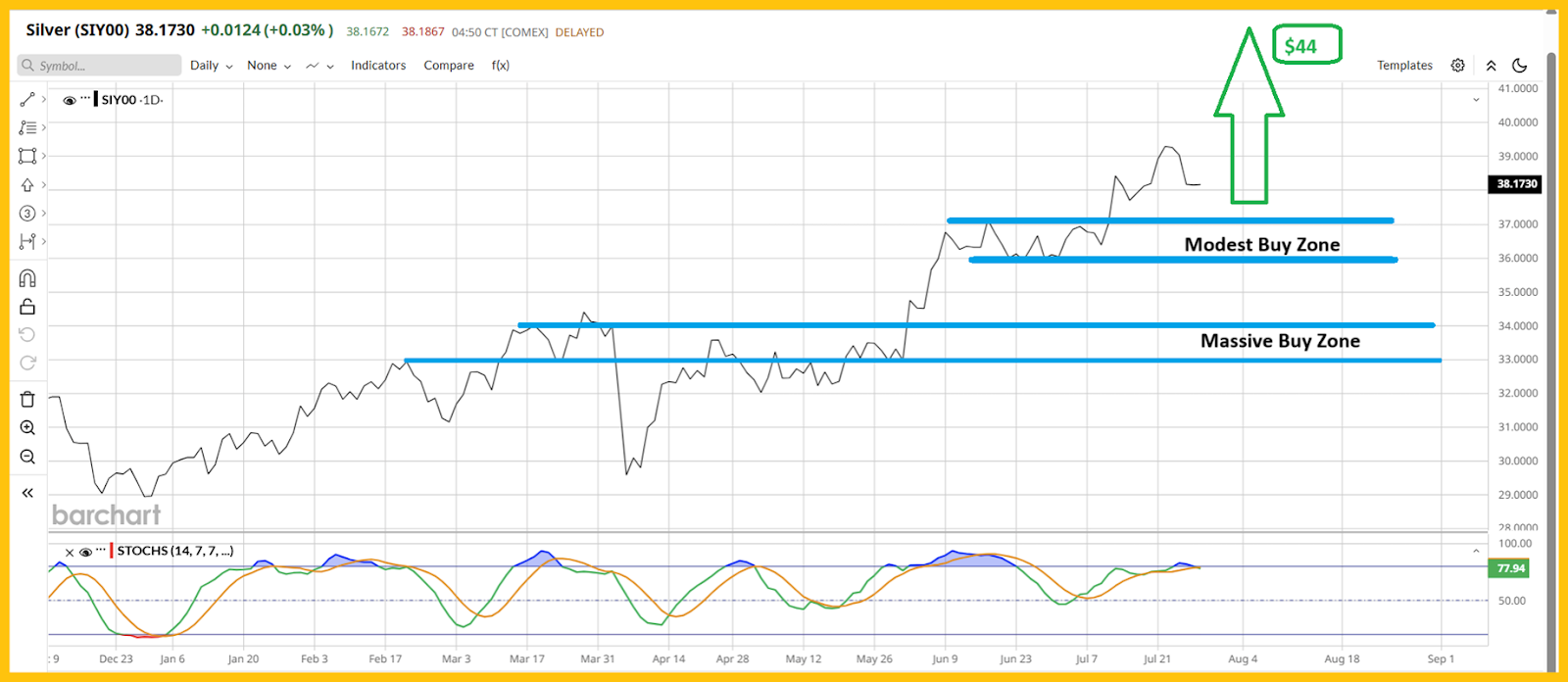

Investors need to focus on getting more gold and excitingly, silver and mining stocks are two of the best ways to do that. A look at silver. Silver seems “eager” to surge towards $44. This week’s slew of reports may give investors a final chance to get in at $37 or even $36… before the big rally begins.

The enticing chart. The current rally is a bit extended; note the positioning of Stochastics and RSI.

Many high-quality CDNX stocks are already ten baggers and twenty baggers… in just the past few months! A rest is well-deserved and healthy.

Having said that, any pullback in the CDNX from here is arguably the greatest buying opportunity for gold and silver stocks since the early 1970s… and perhaps in the entire history of markets.

The GDX (NYSE:) daily chart. While the action over the past few weeks can be viewed as frustrating… there’s no technical damage to the chart.

In fact, there’s some decent bull flag action now in play. GDX is starting to act as it should… as a mechanism to leverage the price action of gold!

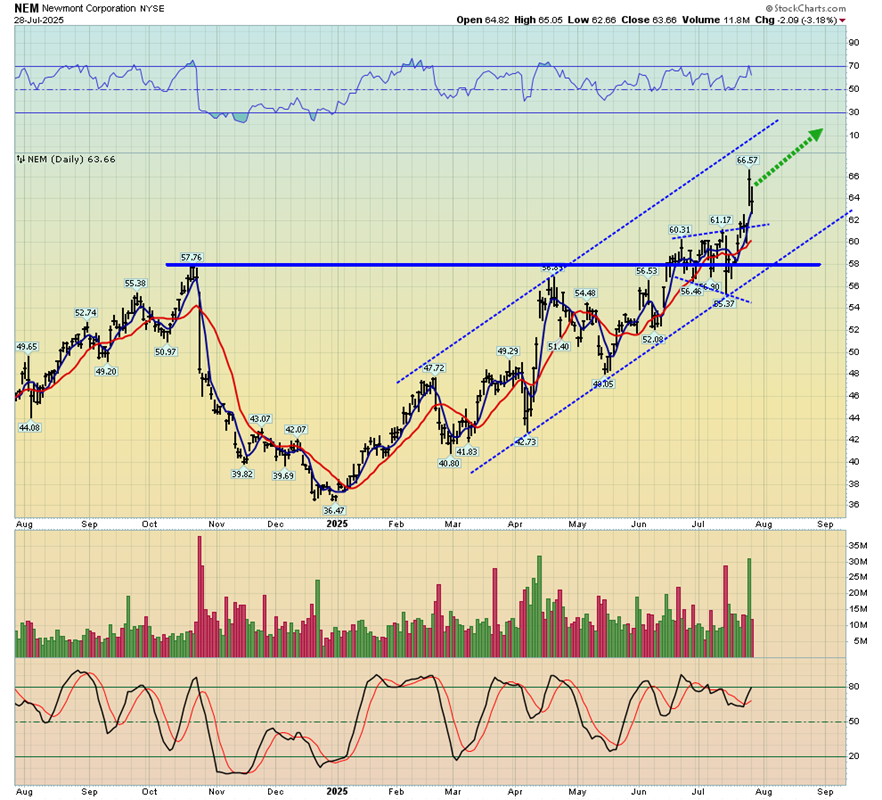

The weekly “leader of the pack” Newmont chart. A massive inverse H&S pattern breakout is in play. The target of the pattern is at least $90.

A look at the daily chart. In time, I expect most intermediate and senior producers will look as good as Newmont does now. A gold price of $3000+ turns most of these companies into cash cows and at $3800 gold, investors can expect to see the , XAU, and GDX soar together… to glorious all-time highs!