looks fantastic! The fabulous short-term buy and sell zones chart for gold.

We bought the approach to the $2956 horizontal support and resistance (HSR) zone yesterday, and the market is surging higher today.

The key to buying these zones is to play the odds without “calling a low”. The good news is that odds are very high that gold bounces nicely higher from here.

Note the washed-out position of the 14,7,7 series Stochastics oscillator. It’s deeply oversold, and rallies have usually occurred from key oscillator positioning like this in the past.

Investors need to be able to buy more than one zone, like the big commercial traders do.

In a nutshell, no soldier goes into a major war expecting to win it with just one battle. Gold market investors need to think less like stock market price chasers do, and more like gridline warriors.

On that note, the next big buy zone for gold is the $2835-$2800 zone. If this rally fails and there’s another dip, gold probably trades in this second horizontal support zone, and pros (current and prospective) must be buyers if that occurs.

Governments are modern-day pirates. President Donnie’s obsession with shooting tariff tax cannon balls is becoming more of a concern to his billionaire backers each day but…

If a billionaire worth $20billion loses $10billion in a wipeout of the US stock market and economy, they still have vastly more purchasing power than they’ll ever need.

In contrast, the average US citizen has a lot of debt and lives almost paycheck to paycheck. Their tiny savings are mostly in the form of mortgaged homes and 401k stock market plans. They can’t handle much more inflation… but it’s coming:

If a product is made in Vietnam by workers that are paid a $100/week pittance by a US corporation, there will be a massive spike in the cost of that product if its “onshored” to America, where workers would balk at working for a wage like their Vietnamese counterparts get paid. Prices will rise for waylaid consumers, and corporate earnings will fall… for the companies lucky enough not to be completely destroyed by the tariffs.

In the big picture, American government pirates are living an empire transition fantasy, one where a tiny population of 150million fiat-oriented US workers lord over the rest of the world… and their government keeps the world in line with tariff tax cannons.

The problem for the pirates is that most citizens in the East (and a few savvy ones in the West!) are focused on supreme money gold rather than failed money fiat.

This chart is basically a picture of a fiat-obsessed man with a water pistol standing at the bottom of Niagara Falls… and the man imagines he can shoot more water up the falls than the golden falls pour onto him. Does that sound sane?

The US government is fighting another unwinnable war, like fiat money itself is fighting an unwinnable war against gold.

Short-term traders should think about switching their goal… from getting more fiat to getting more gold. That’s because the big trend for fiat is down, down, and down. Even with the best short-term tactics, the mission to get more fiat by constantly buying and selling gold is vastly more onerous than the opposite mission, which is to buy and sell fiat… to get more gold!

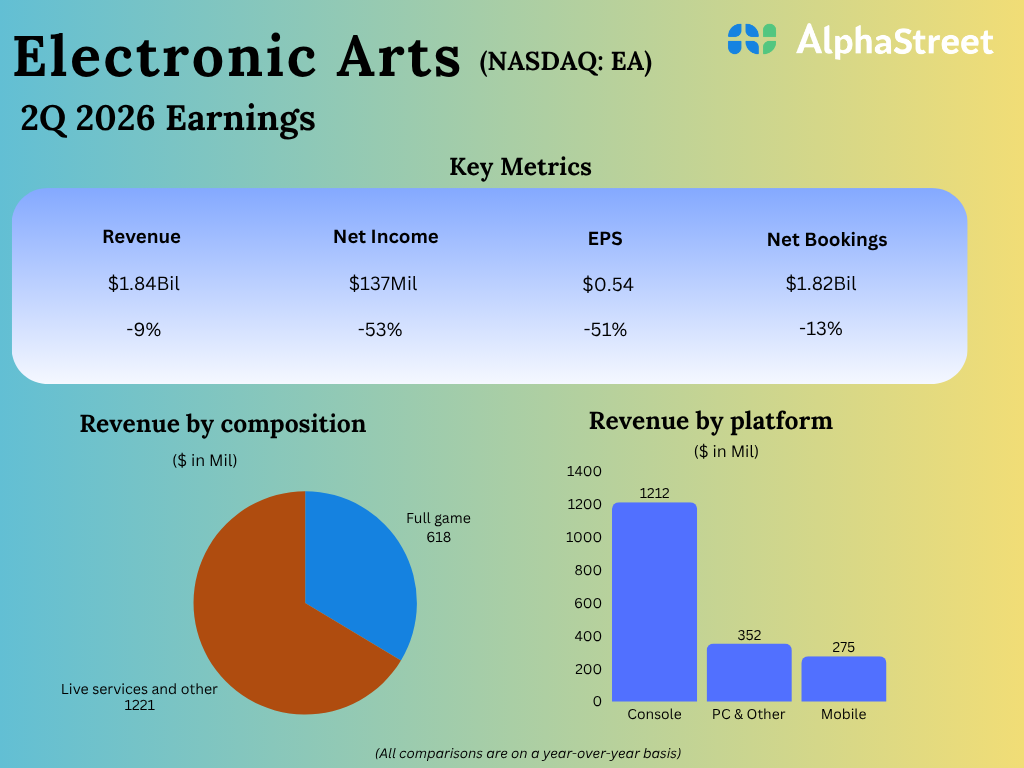

A look at the stock market. The US stock market is clearly due for a bounce, and that’s good news for silver and the miners, which often surge as the Dow does too.

As the US government pirates press on with their stagflationary tariff taxing madness, a massive divergence/decoupling event likely lies ahead… for gold and the stock market.

This US stock market rally probably only forms the right shoulder of a H&S top, and while US rates can drop in the short-term due to the market mayhem… they will begin to rise as the inflation from the tariffs appears.

A super-sized mix of the market meltdowns of 1929 and 1966 appears to be on the history-rhymes horizon. The only question is: Are gold bugs prepared?

The weekly GDX (NYSE:) chart. There was a textbook pullback after the breakout and a huge rally straight to $60 is one realistic scenario from here.

Here’s another scenario for the weekly chart, where a rally also begins now, lasts perhaps until June or July, and from there a more typical handle on the cup pattern forms… with that handle formation lasting until about October… and then there’s a rally not just to $60, but to $100 and more!

Gamblers can be aggressive gold stock buyers here, but more conservative investors may wish to wait until September/October, which is also often when a seasonal low for the metals occurs. I’m expecting a massive stagflation-oriented US stock market crash at that time as well, with gold stocks faring much better than the stock market… and then the miners should begin a major surge that should last well into the year 2026!