rose after the rate decision, rises as Trump weighs up involvement in the Middle East

The US dollar has been rising on safe-haven demand as President Trump continues to weigh up the US involvement in the Israel-Iran conflict, which is entering its seventh day. Reports suggest the US could potentially start targeting Iran’s nuclear facilities as soon as this weekend. Any sense of this happening could add to USD safe-haven demand.

Attention turned to the Bank of England’s interest rate decision earlier today, where the central bank kept rates on hold at 4.25%, as widely expected. With inflation still running above the BoE’s 2% target—currently at 3.4%—the decision reflects lingering concerns despite some signs of cooling in the labour market and service sector inflation. While the rate hold came as no surprise, the Bank adopted a slightly more dovish tone, which could weigh on the pound. Markets continue to price in two rate cuts by year-end.

Yesterday, the Federal Reserve left unchanged for a fourth consecutive meeting. While the central bank lowered the growth forecast to 1.4% this year and lifted inflation to 3%, the dot plots remained unchanged, with two 25 basis point rate cuts expected this year.

GBP/USD Forecast – Technical Analysis

GBP/USD has fallen away from the 1.3630 high reached last week, dropping below 1.3450 support and out of the multi-month rising channel. The price is testing the 50 SMA around 1.34.

Sellers supported by the RSI below 50 will look to extend losses towards 1.33 and 1.32.

Should the 50 support hold, buyers will need to retake 1.3450 and a rise above 1.36 could set the price on track for gains towards 1.3750.

Oil Rises as Trump Weighs Up Involvement in the Middle East

The Israel–Iran conflict enters its 7th day

Trump considers direct involvement, possibly this weekend

Oil consolidates around 75.00

Oil prices are rising as the Israeli-Iran conflict escalates, fuelling fears of broader conflict in the Middle East, which could disrupt oil supplies.

As the conflict entered its seventh day, Israel attacked Iranian nuclear sites. The US is reportedly weighing up options as to whether to join attacks on Iran’s nuclear facilities. These worries are lifting the risk premium on oil.

Should the US enter the conflict, this could raise the chances of Iran blocking the Strait of Hormuz, a key waterway and chokepoint for around a fifth of oil supplies.

The markets remain jittery, awaiting firmer signs that could influence supply and stability.

Separately, the Federal Reserve US interest rates remained unchanged on Wednesday. Policy makers lowered growth forecasts and lifted inflation forecasts, but still pencilled in two rate cuts this year. Federal Reserve Chair Jerome Powell said that the Fed would remain data-dependent and that he expects accelerated consumer inflation from Trump’s tariffs.

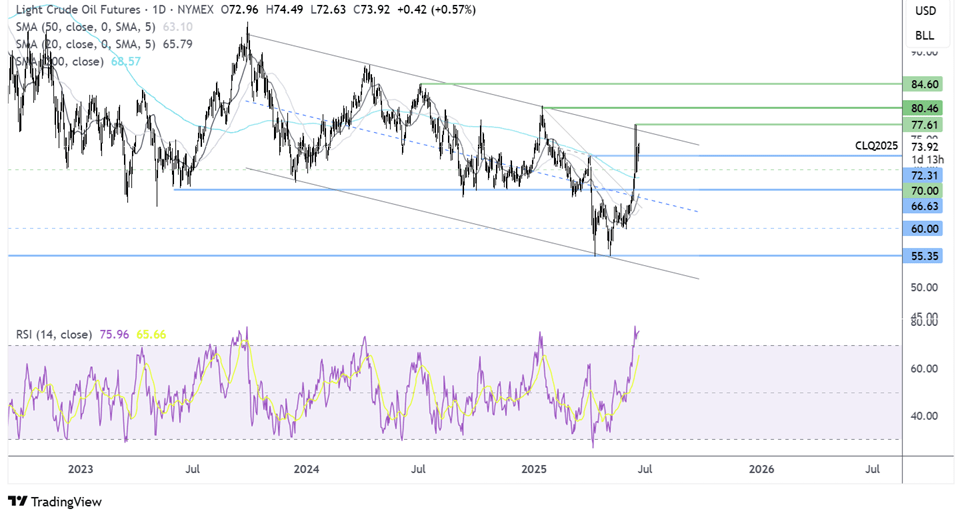

Oil Forecast – Technical Analysis

The oil price extended its recovery from 55.30, the April low, rising above the 200 SMA to a five-month peak of 77.60. While the price has eased back from this peak, it holds above 72.30, the April high and consolidates around 75.00.

Buyers could be building momentum for another break higher. A rise above 77.60, the June high and the upper band of the falling channel, is needed to create a higher high and bring 80.00 and 84.00 the July 2024 level into focus.

Support is at 72.30, the April high. A break below here negates the near-term uptrend, bringing 70.00. From here, the 200 SMA is exposed at 68.50.

Original Post