Protein consumption in the US has reached new heights, driven by its strong associations with health, fitness, and overall lifestyle needs. Consumers see protein as essential not only for athletic performance, but also for maintaining energy, satiety, and supporting healthy ageing.

This article will take you through the key protein trends, consumer behaviors, and technological advancements reshaping protein consumption in the United States. Keep reading for actionable insights into the evolving landscape of protein market trends and the protein industry’s future trajectory.

How Big is the US Protein Market?

The US protein market encompasses a range of products from traditional animal-based proteins to plant-based alternatives. This dynamic market is valued at $114.4 billion as of 2024 and is projected to grow at an annual rate of 1.9% until 2028. This steady expansion reflects increasing consumer interest in high-protein diets, coupled with the industry’s adaptation to shifting demands for health, sustainability, and convenience.

How much protein do Americans consume?

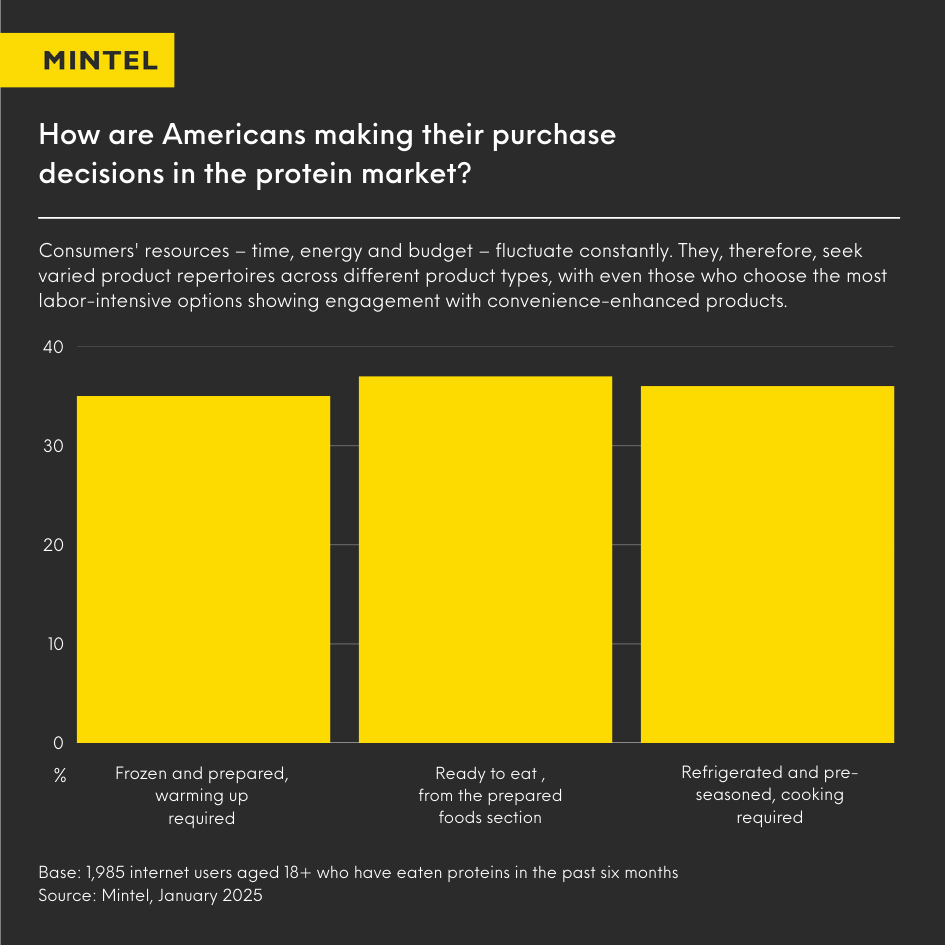

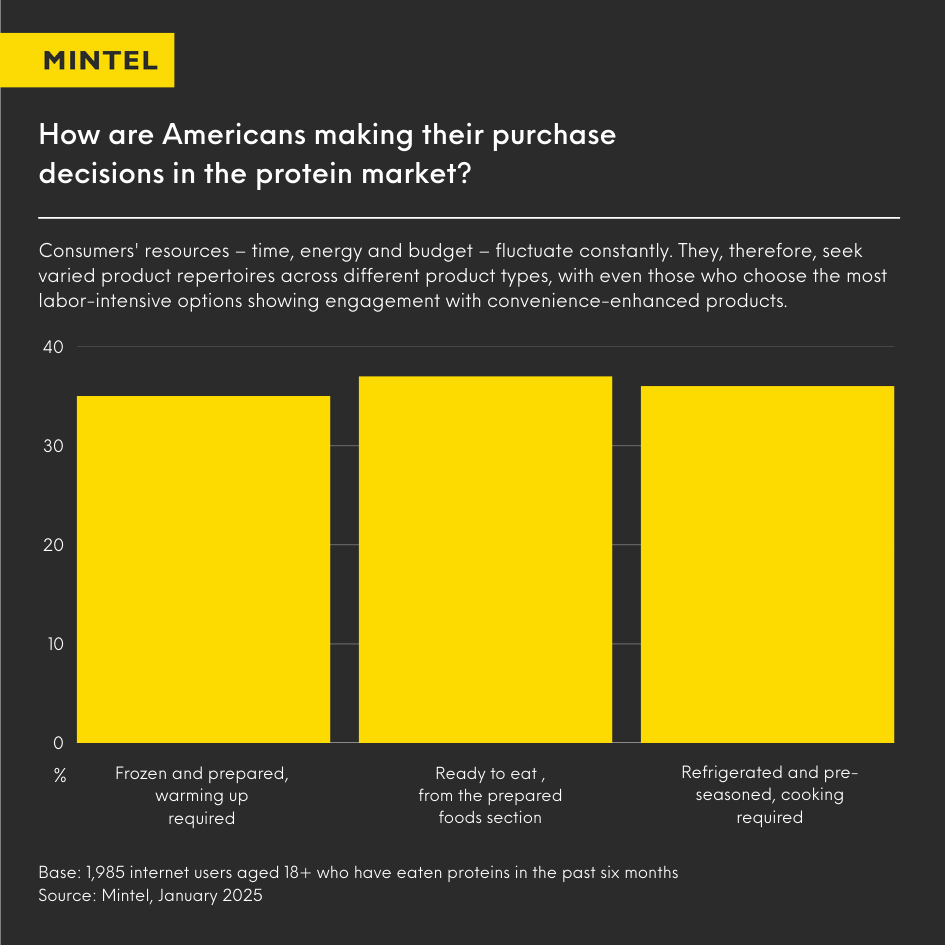

US-Americans consume protein in various forms, from traditional staples like meat and fish to innovative plant-based alternatives. Most consumers engage with various protein formats, ranging from raw or frozen to ready-to-eat and prepared options that cater to modern demands for convenience.

Notably, about 90% of individuals consume animal-based proteins regularly, while over 40% include plant-based proteins in their diet. This segmentation hints at opportunities for brands and retailers to diversify and grow their share in the coming years, driven by animal-alternative protein trends.

What Trends Are Taking Over The US Protein Market?

To stay relevant, brands should watch out for the following consumer protein trends:

1. Clean labels and transparent ingredients are gaining traction in the US protein market

Consumers increasingly associate all-natural claims with healthiness, leading to a surge in demand for products with minimal processing and clearer ingredient transparency. This trend is supported by our finding that nearly half of consumers believe all-natural proteins are inherently healthier. Certifications and storytelling about sourcing and production further bolster brand perception and can foster trust and customer loyalty.

2. Functional positioning is key to protein bar market trends

High-protein claims dominate ingredient information given on product packaging, resonating with consumers seeking energy, muscle recovery, and satiety benefits. Protein products targeting keto enthusiasts or fitness-focused individuals continue to expand.

Categories like high-protein snacks, bars, and beverages are thriving as consumers look for convenient ways to meet their dietary goals, with functional positioning particularly appealing to younger, active demographics.

3. New protein trends show that convenience and value are the future

Convenience remains a major driver for innovation in the protein market. Pre-seasoned products, ready-to-eat snacks, and easy-to-prepare meal kits have become essential in busy households. Over 60% of consumers maintain their value-added protein consumption, however, almost 30% report decreasing it. Those decreasing their intake express concern about products being too processed, despite valuing the time saved in meal preparation.

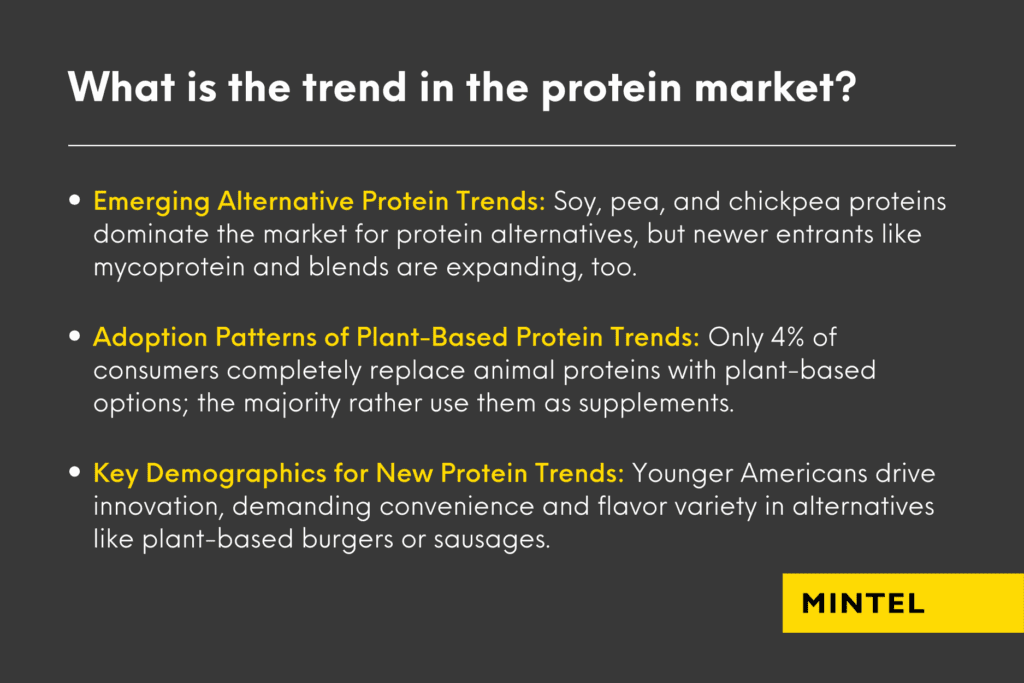

4. Plant-based protein trends are on the rise, but continue to be scrutinized

While plant-based options show strong growth, driven by health and sustainability concerns, this segment faces scrutiny from perceptions of over-processing. Consumers demand clarity on nutrition and protein completeness. Generational divides are also apparent, with younger consumers displaying higher adoption rates compared to Baby Boomers, who remain largely skeptical.

The balance lies in delivering both taste, through flavor innovation, and nutrition, by ensuring alternative proteins meet health criteria.

5. Consumer protein trends focus on quality

Across the board, US-Americans are paying closer attention to protein quality. Complete proteins (those containing all essential amino acids) are taking precedence, with animal proteins continuing to dominate due to their established reputation for digestibility and availability. Plant-based proteins, however, are catching up, aided by innovations like combinations of grains and legumes to achieve completeness.

6. Technology is driving innovation in the protein market

From lab-grown meat to precision fermentation, technology plays a crucial role in meeting future protein demands sustainably. Tools like AI are optimizing ingredient formulations for enhanced taste and nutrition, while cell-cultivated meats offer revolutionary solutions with reduced environmental impact.

US Protein Consumption by Product Segments

Protein consumption in the US vary across different product segments (animal-based, plant-based alternatives, and functional products) as consumer preferences are changing and influenced by factors, such as sustainability or health concerns. Dive into the different product segments below.

Animal-based proteins continue to dominate the market

Animal-based proteins remain dietary cornerstones for most Americans, with red meat sales projected to reach $76.9 billion in 2025 despite health and environmental scrutiny.

The key purchase drivers in the meat and fish segments are quality and price, with over 50% of buyers making purchase decisions based on those factors. Innovations around convenience, such as pre-cooked, pre-seasoned, and individually portioned meats, can address buyers’ cooking fatigue. These products also help younger consumers, less skilled in the kitchen, confidently prepare protein-potent meals.

Plant-based protein trends and alternatives are challenging meat producers

Saturated fat, cholesterol concerns, and ethical reasons (sustainability) are driving some consumers away from traditional protein sources like meat and fish. The plant-based protein market, valued at $1.225 billion in 2024, faces a slowing trajectory but remains an area of innovation due to sustainability goals and dietary variety.

The rise of functional protein products

Functional formats such as protein bars, ready-to-drink (RTD) shakes, and supplements are flourishing, driven by their convenience and multifunctionality. RTDs and bars are lifestyle-friendly, aligning with on-the-go consumption trends, as snacking is on track to take over traditional mealtimes.

Sustainability and Protein Supply Chain Issues Force Brands to Rethink Their Protein Market Strategy

Meat and dairy production face mounting sustainability pressures, with environmental concerns prompting exploration into regenerative agriculture and carbon footprint labelling. Conversely, plant-based proteins position themselves as environmentally friendly alternatives but must also surmount scrutiny over processing.

Local sourcing, transparent communication about production processes, and a balance between health messaging and environmental benefits are key strategies to address sustainability challenges.

While consumer intentions around sustainability are rising, behavioral shifts remain incremental. Brands must find innovative ways to communicate environmental benefits without alienating audiences focused on taste and convenience.

What’s Next in the US Protein Market

The future of the protein market will hinge on the industry’s ability to balance health-consciousness, convenience, sustainability, and innovation.

Whether tapping into emerging new protein trends like plant-based alternatives or refining traditional animal proteins for modern sensibilities, brands must anticipate and adapt to shifting consumer values.

To stay ahead of the curve, tune in to the latest market trends and innovations by subscribing to our Spotlight newsletter below.

Subscribe to Spotlight

Or, explore Mintel Store for all our US food market research.