holds above 1.14, and the US–China trade talks are in focus. looks to US-China trade talks after Chinese data

EUR/USD Holds Above 1.14, US–China Trade Talks in Focus

USD rose after the US NFP on Friday

EUR supported as ECB nears the end of its cutting cycle

EUR/USD holds above 1.14

EUR/USD is rising, recovering from Friday’s selloff, trading above the 1.14 level.

The is under renewed pressure in cautious trade as US-China trade talks take place. The USD is falling, giving back gains from Friday following the , which showed that the US jobs market slowed but by less than expected. Payrolls rose by 139k, vs. 130k expected, compared to 147k in the previous month.

Today, attention is being paid to the US-China trade talks scheduled in London. US Treasury Secretary Bessent and two other Trump administration officials are set to discuss with Chinese counterparts after talks that were said to have been scheduled a couple of weeks earlier. Any signs of progress could give the US dollar a boost.

The EUR is rising amid expectations that the ECB is nearing the end of its rate-cutting cycle. The ECB cut rates by 25 basis points last week, and ECB President Christine Lagarde noted the central bank was nearing the end of the cycle.

Looking ahead, the eurozone economic calendar is relatively quiet this week. Today, the Eurozone Sentix investor confidence could influence investors.

EUR/USD Forecast – Technical Analysis

EUR/USD recovered from the 1.1065 low, rising to a peak of 1.15 last week, before easing lower to current levels at 1.1425. The uptrend remains intact, although momentum has slowed.

Buyers will need to rise above 1.15 to extend the bullish run towards 1.1475.

Sellers will need to take our minor support at 1.14. Below, 1.1280 support comes into play.

Oil Looks to US-China Trade Talks After Weaker Chinese Data

Oil prices were lower at the start of Monday but held onto most of last week’s gains as the market watched US-China trade talks in London. A deal could provide some height towards an improving global economic outlook and be fueled and armed.

The prospect of a US-China trade deal helped lift oil prices last week. Three of Donald Trump’s top aides are set to meet with Chinese counterparts to restart trade talks after they stalled a few weeks earlier. An additional call between Trump and President Xi Jinping at the end of last week helped WTI gain 6% across the week, its first weekly gain in three weeks.

Oil prices are also helped by the US jobs report, which showed the unemployment rate held steady at 4.2% in May and payrolls fell by more than expected.

Meanwhile, Chinese export growth slowed in the three months to May as U.S. trade tariffs slowed shipments. Factory gate deflation worsened to a level not seen in two years. The data shows that China’s crude oil imports declined in May to the lowest daily rate in four months, due to widespread maintenance plans in both state-owned and independent refiners.

Expectations are rising that OPEC+ could also accelerate supply hikes in August and September, which could raise the downside risk for oil prices. The new faster pace of APEC plus production increases appears to be here to stay.

Meanwhile, ongoing wildfires have disrupted production in Canada, supporting the price along with robust US fuel demand in the driving season.

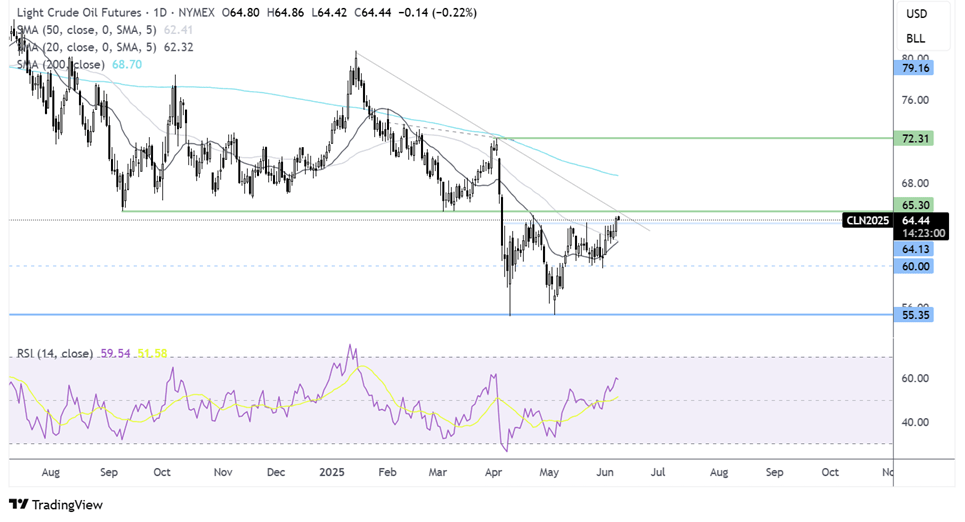

Oil Forecast – Technical Analysis

Oil has extended its recovery from the 55.30 low, rising above the 50 SMA towards the 65.00 and the multi-month falling trendline resistance.

Buyers supported by momentum will look to extend the recovery above 65 to expose the 200 SMA at 68.75.

Failure to rise above the 65 resistance zone could see the price retest resistance at 64, and below here, 60.00 comes into play. A break below 60 creates a lower low, changing the chart’s structure.

Original Post