After a quiet start to May in the tariff war, President Donald Trump is making moves again. He plans to raise tariffs on imports from the European Union and wants to double the current tariffs on and . On top of that, China is accused of not following the Geneva agreement, which puts the future of those deals at risk.

Meanwhile, on Sunday, Ukraine’s Security Service launched large drone attacks on Russian strategic aviation as part of Operation Spiderweb. These events, especially the tariff actions, have weakened the U.S. dollar, which is reflected in Monday’s gains for the main currency pair, .

Will ECB Drop Rates Below 2%?

This week, the key macroeconomic event is the upcoming . Most market participants expect the ECB to cut rates by 25 basis points, lowering the benchmark to 2.15%.

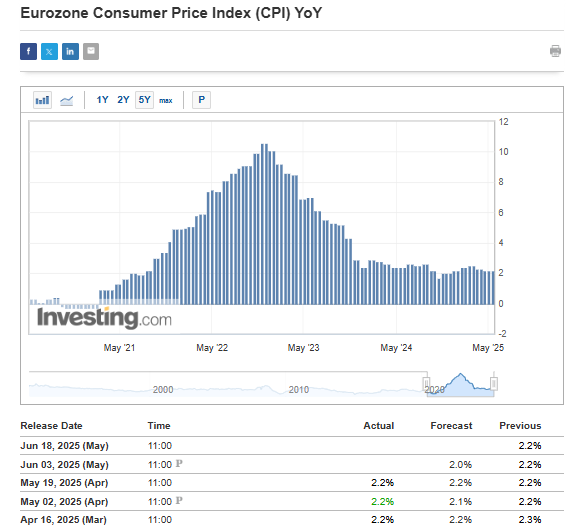

This rate cut is already priced in, but the key question is whether the ECB will continue easing monetary policy. This morning’s showed that eurozone inflation slipped below the 2% target, adding pressure for further rate cuts.

If inflation stays below 2%, it could slow the euro’s recent gains against the . The next inflation data will be crucial, with a sustained move below 2% supporting this scenario.

US Labor Market Data Next

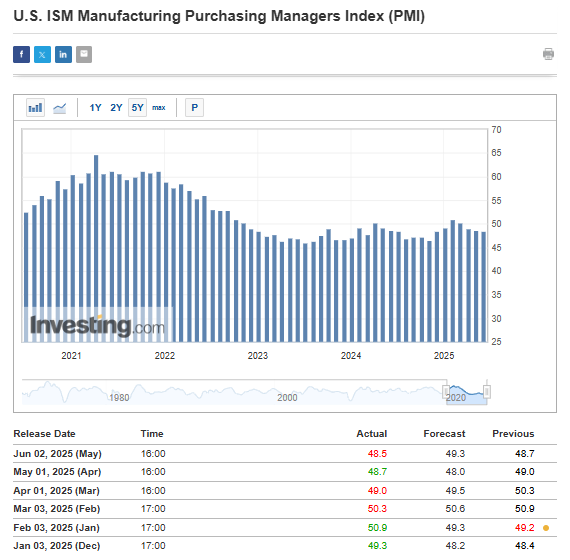

This week started with US industrial data, which came in weaker than market expectations for the .

These readings continue a negative trend that started in early February, pushing the ISM manufacturing index back below the 50-point mark. This ongoing decline is adding downward pressure on the US dollar in both the short and medium term.

As usual, the data will be released this Friday. Early forecasts suggest little change is expected, unless there are unexpected surprises.

EUR/USD Technical Analaysis

The recent surge in demand for the major currency pair pushed it to its highest level in over a month, with the possibility of further gains. However, after the latest data from the eurozone, the pair is now pulling back toward the support level around 1.1380.

If supply supports a further rebound, investors will likely watch the area where the upward trend line meets the 1.1320 level. The main target for buyers remains the recent high around 1.1580.

***

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and instantly unlock access to several market-beating features, including:

ProPicks AI: AI-selected stock winners with a proven track record.

InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters and criteria.

Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk rests with the investor. We also do not provide any investment advisory services.