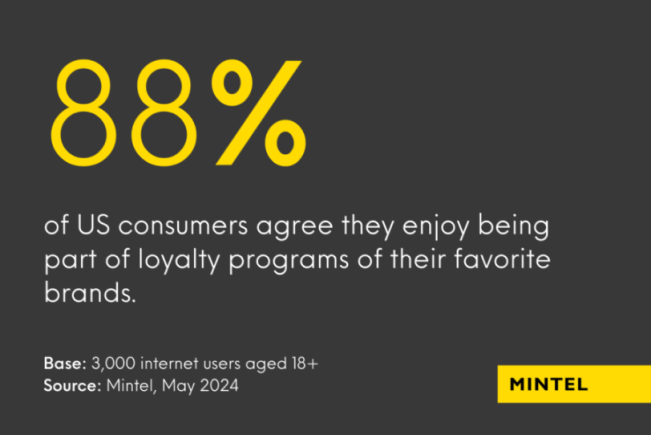

Discover how economic uncertainty is reshaping consumer behavior and why loyalty program strategies are becoming critical for building long-term brand connections. Our latest thought piece from Mintel Consulting explores how brands can adapt their strategies with value-driven rewards, personalization, and emotional engagement to stay ahead in challenging times.

Download this free analysis below to start redefining your approach to customer loyalty today!

Download free strategy insights

A Loyalty Program That Feels Out of Touch is Worse Than No Loyalty Program at All

Before we launch into a discussion about loyalty programs and rewards, I would like to tell a story about how we got here. One that I’m sure many of you can relate to…

It all started with an email that landed in the dark corner of my inbox. The subject line read, “Your February Rewards Are Here!” Intrigued, I clicked through, thinking it might hold something of value. After all, loyalty programs are meant to reward us for our continued support, right?

I’ve been a loyal customer of this brand for nearly ten years, spending thousands annually on their products and services. When that email came in, I figured, with budgets tightening, it was worth taking a look. I clicked through to my rewards page, curious about what I might find. To my surprise, I had reached the top tier of their loyalty program, the crème de la crème of their membership. Intrigued, I eagerly scrolled down to see what rewards were waiting for me.

And that’s when the disappointment hit.

Sweepstakes entries. So many sweepstakes entries. More than half of my “rewards” consisted of the chance to win something.

50% off accessories at a company store I don’t have access to… because I’m not a customer of that specific product.

Preferred seating at an event 1,500 miles away. This is something that, realistically, I’d never use.

Does this brand know me at all? Does it know any of its customers? After a decade of loyalty and significant spending, I wasn’t expecting a free car or even a free month of service, but something of actual value should not have been out of the question.

A well-designed loyalty program should:

Make customers feel appreciatedThey should feel seen and valued, not just like a number in your database.

Deepen the brand relationshipRewards should reinforce why they love your brand, not make them question their loyalty.

Reduce the temptation to switchIf your rewards don’t matter, they become meaningless, making it easier for customers to explore competitors.

My experience with this brand was disappointing and unthoughtful; I didn’t feel appreciated or known. I wasn’t sure how this brought me closer to the brand, and it didn’t stop me from exploring other companies’ offerings.

The takeaway is simple: A loyalty program that feels out of touch is worse than no loyalty program at all. If your rewards don’t resonate, don’t engage, and don’t reinforce why customers should keep choosing you, then you’re not rewarding loyalty—you’re undermining it.

To get a full analysis behind these numbers, download your free copy today and transform your loyalty strategy!

Download free strategy insights

Four Strategic Priorities for Brands During Periods of Wavering Consumer Confidence

When economic headwinds start to blow, brands often look to tighten budgets and pull back on extra initiatives. But for loyalty, this is exactly the time to lean in and invest. Mintel’s Andrew Davidson recommends brands “lead with value” to navigate the turbulent times ahead. The recent tariffs, have not only created unpredictability in the market, but they are also impacting consumer behaviors. While some may be cautious and tightening their budgets, others may be rushing out to buy big-ticket items before prices are impacted.

In uncertain times, your loyalty program strategy is one of the most powerful tools you have to retain customers, drive value, and strengthen relationships. The key is knowing where to focus your energy and what customers actually want right now.

Below, we’ll explore four high-impact strategies that brands should prioritize to ensure their loyalty programs remain relevant, engaging, and cost-effective, no matter what the economy throws their way.

Value-driven loyalty: Moving beyond points

When budgets are tight, customers don’t want vague promises of future rewards, they want clear, immediate value. Traditional points-based systems still have a place, but brands need to go further. Value-driven loyalty is about offering benefits that feel meaningful right now, not six months down the road.

Start by rethinking your earn and burn structure. Consider offering cashback, dollar-off discounts, or even subscription-based perks (like free shipping or member-only pricing) that create a sense of exclusivity and long-term savings. Brands like Amazon (with Prime) and Panera (with their Sip Club) have proven that customers will gladly commit to a recurring fee when the value exchange is crystal clear.

Flexibility is another crucial lever. Let customers earn and redeem in ways that match their lifestyle. Whether that’s combining discounts with points, redeeming rewards at checkout, or choosing from a personalized catalog of options. In a challenging economy, flexibility signals empathy, and customers notice.

Ultimately, value-driven loyalty marketing program makes people feel like sticking with your brand is a smart choice, not just a convenient one.

Hyper-personalization through data and AI

In a sea of sameness, personalization is how your brand stands out. And in a data-rich world, there’s no excuse for one-size-fits-all loyalty program experiences. Customers expect relevance. They expect to be seen. And thanks to advances in AI and machine learning, brands can now deliver hyper-personalized offers, content, and rewards at scale.

The best personalization goes beyond simply including a name in an email. It leverages real-time behavioral data, purchase history, engagement patterns, and preference signals to tailor every touchpoint. Imagine sending a customer a reward for something they buy regularly, right before they typically buy it. Or offering early access to a product in their favorite category. That’s how you turn data into delight.

Importantly, hyper-personalization also improves operational efficiency. Instead of mass sending irrelevant offers that drive no ROI, you’re investing in the customers most likely to respond, maximizing value per interaction. It’s smarter marketing, especially when budgets are under pressure.

Personalization doesn’t just drive conversions, it builds emotional equity. Customers who feel understood are far more likely to stay loyal, even when price or convenience are on the line.

Want to continue building customer loyalty in the future? Download our full analysis and start refining your strategy today!

Download free strategy insights

Strengthening emotional and experiential loyalty

In a transactional world, emotional loyalty is your ultimate competitive advantage. When price sensitivity is high and switching is easy, customers stay with brands they feel connected to, not just those offering the lowest price.

This is where emotional and experiential loyalty programs shine. Brands need to think beyond the points and discounts and offer experiences that make their customers feel like insiders. This could include exclusive community benefits, early access to products, or VIP-only events (virtual or in-person). Even small touches, like celebrating milestones or birthdays, can leave a lasting impression that keeps customers coming back.

Cause-based loyalty is another powerful tactic, especially in today’s values-driven consumer landscape. Allow customers to donate points to nonprofits, support local initiatives, or see how their loyalty contributes to shared impact goals. Brands like TOMS, Patagonia, and Bombas have built entire ecosystems around this ethos.

Don’t overlook the power of gamification and social engagement to liven up loyalty programs. Customers love interactive challenges, leaderboards, and rewards for completing non-purchase activities like writing reviews or sharing on social media. These touchpoints drive repeat engagement and help solidify the brand relationship in a way that feels fun, not forced.

The bottom line is: when customers feel emotionally invested, they don’t just stick around, they advocate, refer, and forgive. That’s priceless in uncertain times.

Using partnerships to expand relevance and reduce costs

In today’s fragmented landscape, no brand has to go it alone. Strategic partnerships are a powerful way to extend your loyalty offering, increase perceived value, and reduce costs, especially when budgets are tight.

Think of co-branded rewards, cross-promotions, or shared loyalty program ecosystems where customers can earn and redeem across multiple brands. For example, a fitness app might partner with a healthy meal delivery service, or a travel brand could team up with a luggage company. These collaborations add freshness and variety to your loyalty program without requiring you to develop everything in-house.

Partnerships can also help you reach new audiences and drive acquisition. When two complementary brands align, they unlock access to each other’s loyal customer base, essentially sharing the cost of engagement while boosting relevance.

The key is choosing partners that align with your brand values and target audience. Done well, these alliances feel natural and additive, not like a forced marketing play.

In an economy where brands need to do more with less, partnerships are one of the smartest ways to expand your impact without expanding your spend.

Final Thoughts: Loyalty That Last Through Uncertainty

These four strategies, value-driven loyalty, hyper-personalization, emotional and experiential engagement, and smart partnerships, aren’t just best practices. They’re survival strategies in a volatile market. When customers are being cautious with their time and money, brands that make loyalty easy, personal, and meaningful will win.

Loyalty isn’t a line item: it’s a relationship. And the brands that invest in that relationship now will build deeper trust, stronger engagement, and long-term growth that outlasts any downturn.

Let uncertainty be your opportunity to rethink, realign, and rebuild loyalty in smarter, more human ways. Your customers—and your bottom line—will thank you for it.

Build Brand Loyalty with Mintel Consulting

Mintel Consulting is uniquely positioned to provide brands with a comprehensive assessment of the consumer’s opinions as well as the marketing and positioning of competing brands. Together, this will position brands to make data-driven decisions on how best to craft or adjust their strategies.

To get a taste of how Mintel Consulting can enhance your customer loyalty strategy, download our comprehensive consumer insight thought piece for detailed analysis and actionable insights to help your brand deliver real value and foster lasting loyalty.

Download free strategy insights