RBA cut fully priced, focus shifts to guidance

Hawkish tone could lift AUD, weigh on equities

AUD/USD testing key 200DMA with bullish signals

ASX 200 momentum remains strong, 8400 key resistance

A sharp decline in US Treasury yields, reversing earlier gains, helped spark a recovery in risk appetite on Wall Street, delivering strong tailwinds for cyclical assets like the and .

With a 25 basis point rate cut from the Reserve Bank of Australia (RBA) fully priced for later today, whether those gains are sustained, extended or unwound may hinge on the guidance the bank offers on the rate outlook. On that front, a hawkish tone relative to market pricing looks the more likely outcome.

RBA Forecasts Key for AUD, ASX

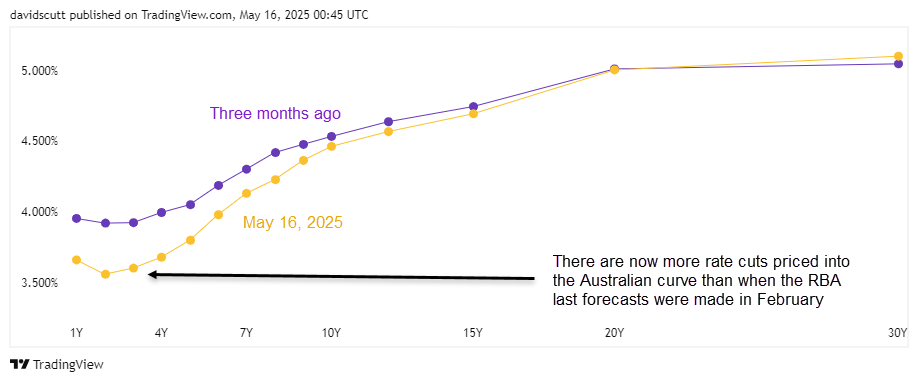

As seen in the Bloomberg graphic below, which shows implied probabilities from AUD swaps markets, a 25bp cut is about as close to locked in as it gets without being fully priced. With 97.7% probability assigned and no major shocks expected, market reaction will likely centre on the tone of the RBA’s policy statement and updated forecasts.

Source: Bloomberg

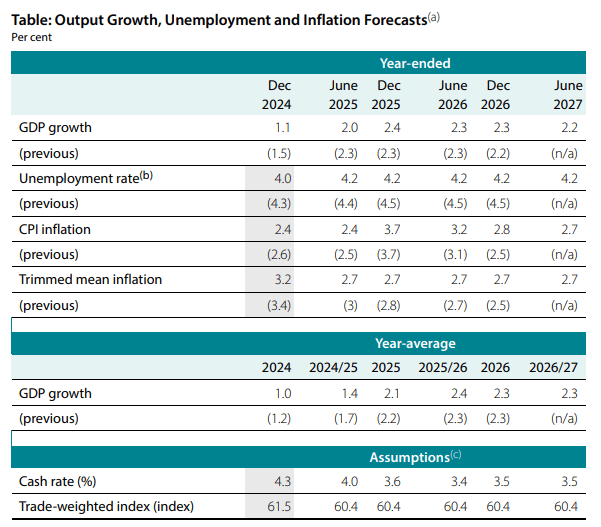

The RBA’s last set of forecasts, released in February, is shown below. For , the bank’s 2% year-ended growth call for June 2025 may be revised slightly lower following soft household consumption in Q1. With the holding steady at 4.1% last month, there’s likely little need for near-term tweaks to labour market forecasts.

Source: RBA

Given the RBA’s dual mandate of full employment and low and stable inflation, the greatest interest may come from its updated trimmed mean inflation profile. Back in February, when the easing cycle began, the bank’s inflation forecasts didn’t show a return to the midpoint of the 2–3% target band, warning that too many cuts were priced for it to hit its mandate.

Source: TradingView

Fast forward to today, and even more easing is priced in than when those forecasts were made, suggesting that rather than being revised lower, the bank’s inflation projections may stay unchanged—or even edge higher. Yes, uncertainty remains high and prices have dropped further than expected, but don’t be surprised if the RBA pushes back on current pricing, which sees two additional cuts beyond today.

If that materialises, it could lift the Australian dollar while taking some heat out of the ASX 200.

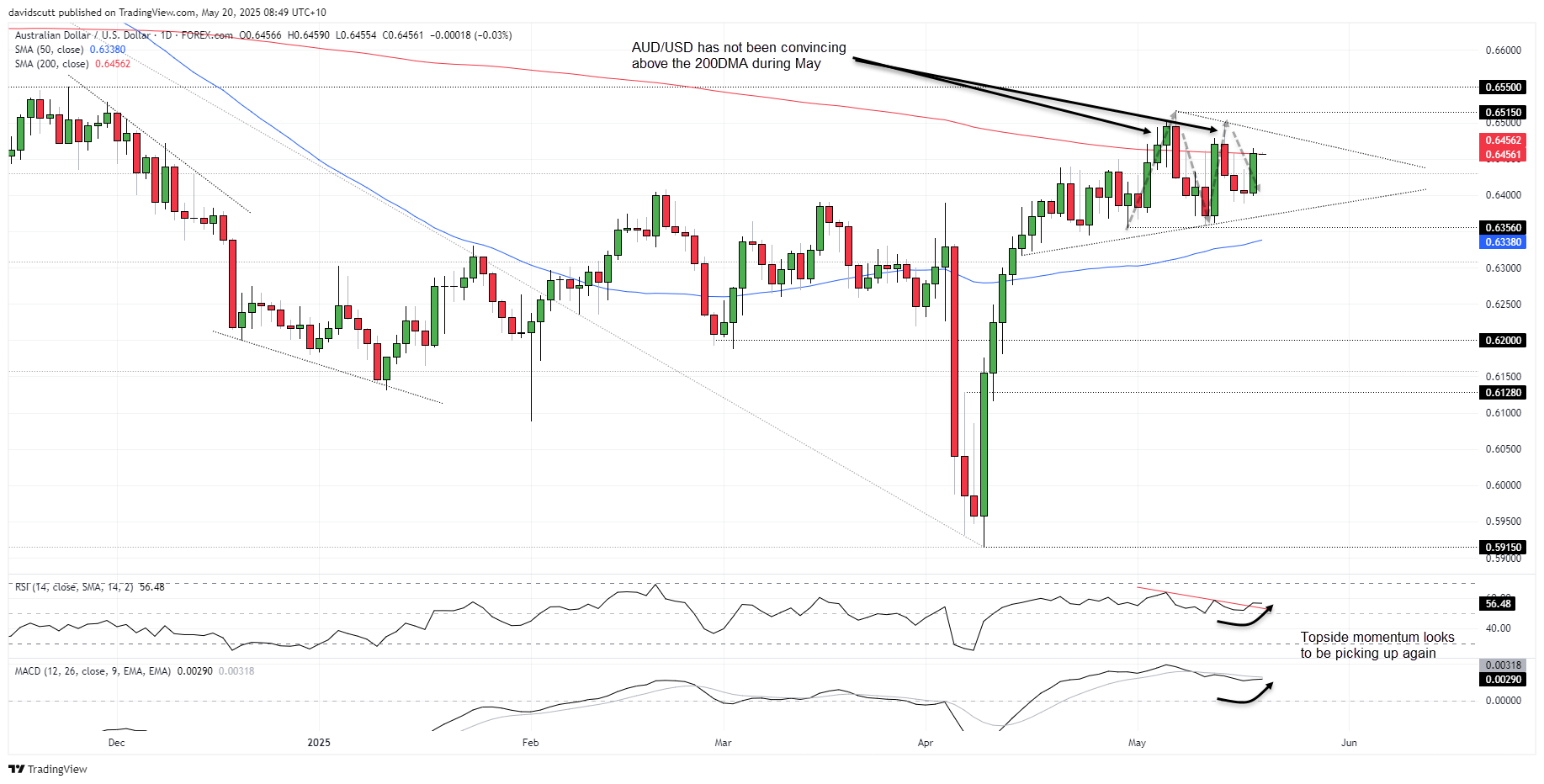

AUD/USD Battle at 200DMA Resumes

Source: TradingView

AUD/USD finds itself testing the key 200DMA early in the Asian session, a level it’s failed to break convincingly above in May. While Monday’s three-candle morning star pattern hints at upside, the signal is weaker given the lack of a sustained downtrend beforehand.

Still, with RSI (14) and MACD indicators turning higher, this test of the 200DMA may have more legs. Zooming out, AUD/USD also appears to be forming a bull pennant—a continuation pattern that warns of an eventual resumption of the prior bullish trend

Above the 200DMA, resistance sits between .6500 and .6515, with .6550 the next level of note if cleared. Below, watch for support to emerge under .6400 and at .6356, the latter a level that held repeatedly earlier this month. The 50DMA is another key downside level to monitor.

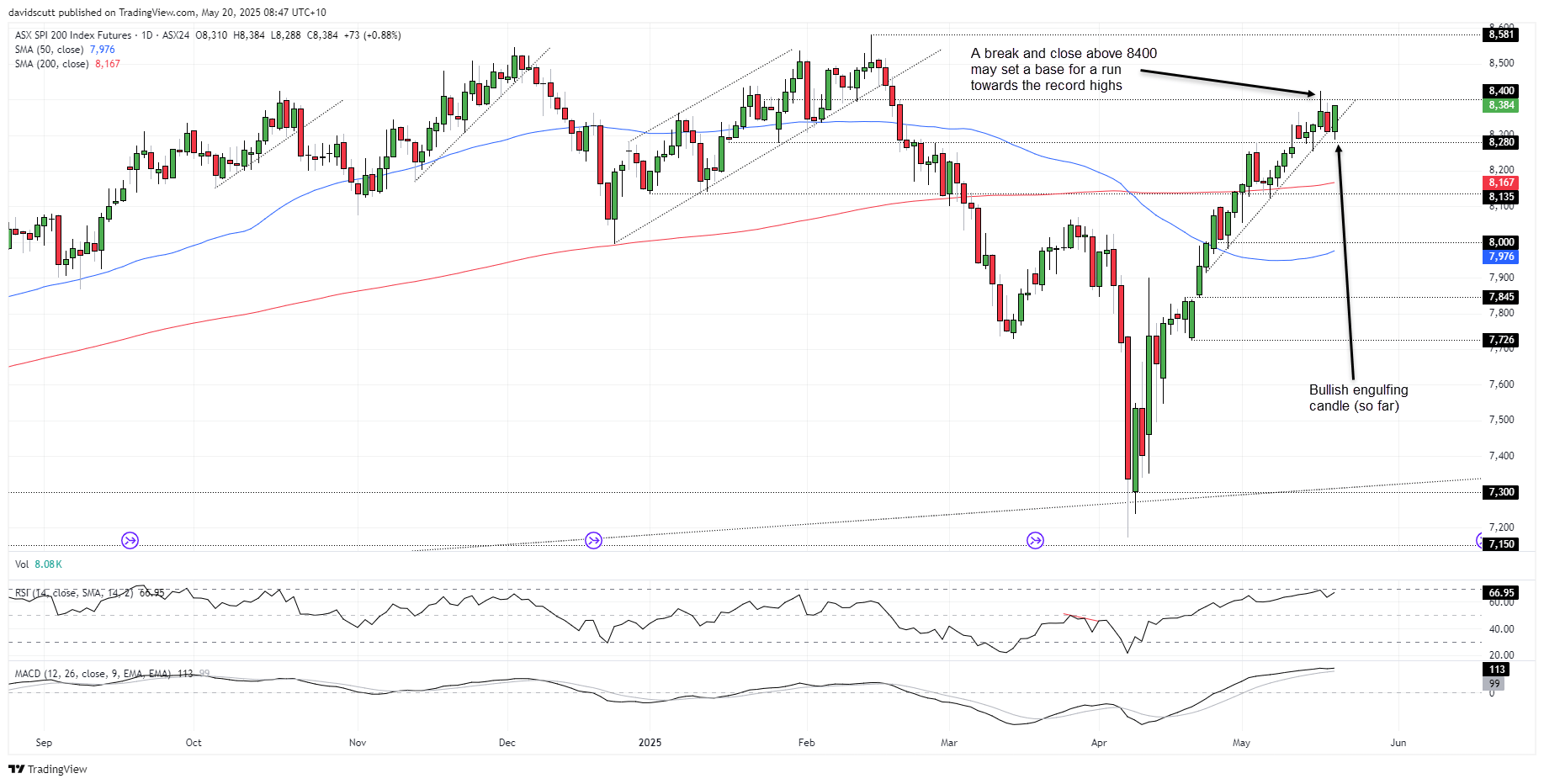

ASX 200 SPI Futures Deliver Bullish Signal

Source: TradingView

The rally in off the April lows remains relentless, with another downside break of uptrend support failing in the overnight session, producing a bullish engulfing candle that warns of further upside if sustained during Tuesday’s day session.

8400 is the key near-term resistance, having capped the index last week. A sustained break above could invite more bulls to chase a retest of the former record highs at 8581. On the downside, 8280 remains critical support. A break and close below would increase the risk of a return to the 200DMA.

Given the price action and momentum backdrop, dip buying may continue to be more rewarding than fading the broader rally.

Original Post