While many companies face tariff-related headwinds, certain stocks stand poised to weather—or even benefit from—the storm.

The potential winners in a tariff-heavy environment will be companies with domestic supply chains, pricing power, and essential products.

Looking for actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to InvestingPro’s AI-selected stock winners.

As President Donald Trump’s sweeping tariff measures take effect Wednesday, investors are scrambling to reposition portfolios for what could be a prolonged period of trade tensions. Indeed, the market reaction to Trump’s tariffs has been severe, with major indices experiencing substantial declines.

Source: Investing.com

As global markets brace for the impact of Trump’s tariff policies, certain companies are positioned not just to weather the storm but potentially thrive in this changing trade landscape. Let’s examine five stocks that could benefit from the shifting economic environment.

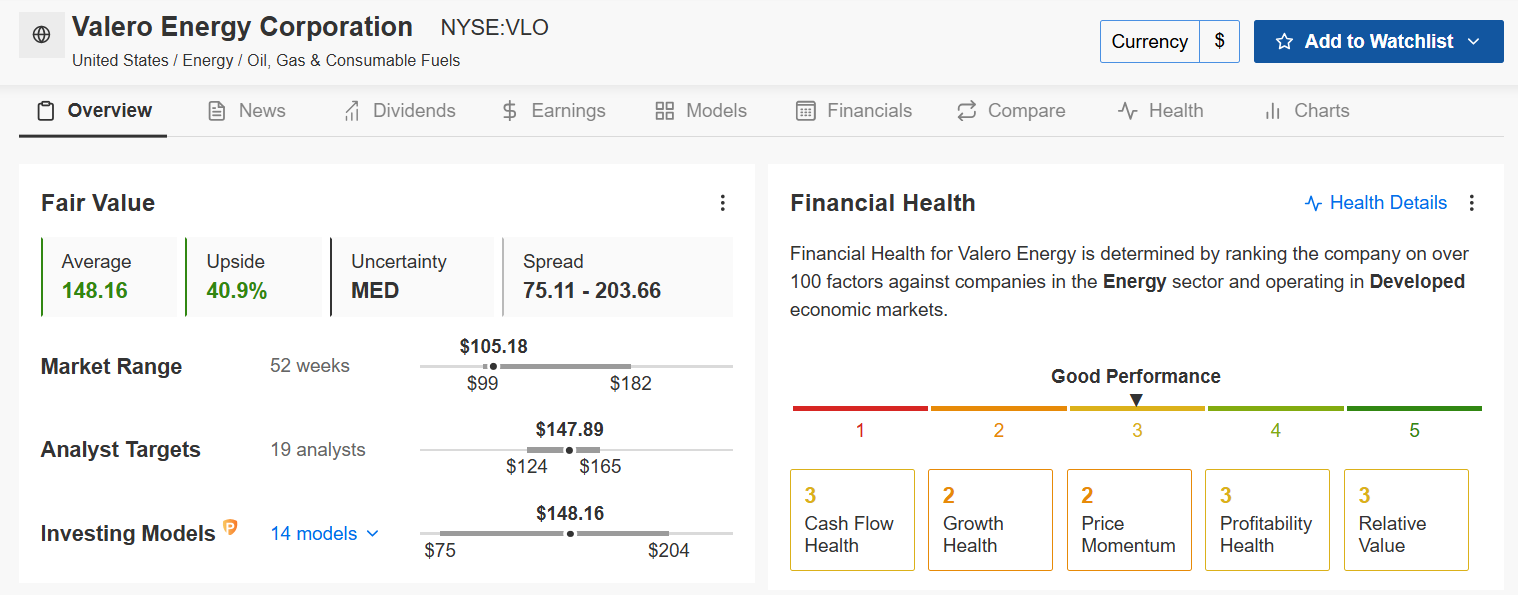

1. Valero Energy

Fair Value: $148.16 (+40.9% upside potential)

Financial Health: GOOD (Score: 2.74)

P/E Ratio: 12.3x

Dividend Yield: 4.30%

Valero Energy (NYSE:) is a leading refiner and marketer of transportation fuels and petrochemical products. Headquartered in San Antonio, Texas, Valero operates 15 refineries across the United States, Canada, and the United Kingdom, with a combined throughput capacity of approximately 3.2 million barrels per day.

As Trump’s tariffs impact global trade flows, Valero’s heavy U.S. footprint makes it less vulnerable to import tariffs, as most of its is sourced domestically or from tariff-exempt regions. Its refining capacity also benefits from potential disruptions to foreign competitors, positioning it as a domestic energy winner in a protectionist climate.

Source: InvestingPro

With a “GOOD” Financial Health score of 2.74 and trading at just 12.3x earnings, Valero appears significantly undervalued with a Fair Value estimate of $148.16—suggesting 40.9% upside potential. The company’s 4.3% dividend yield offers compelling value for defensive investors seeking both income and potential appreciation during trade disruptions.

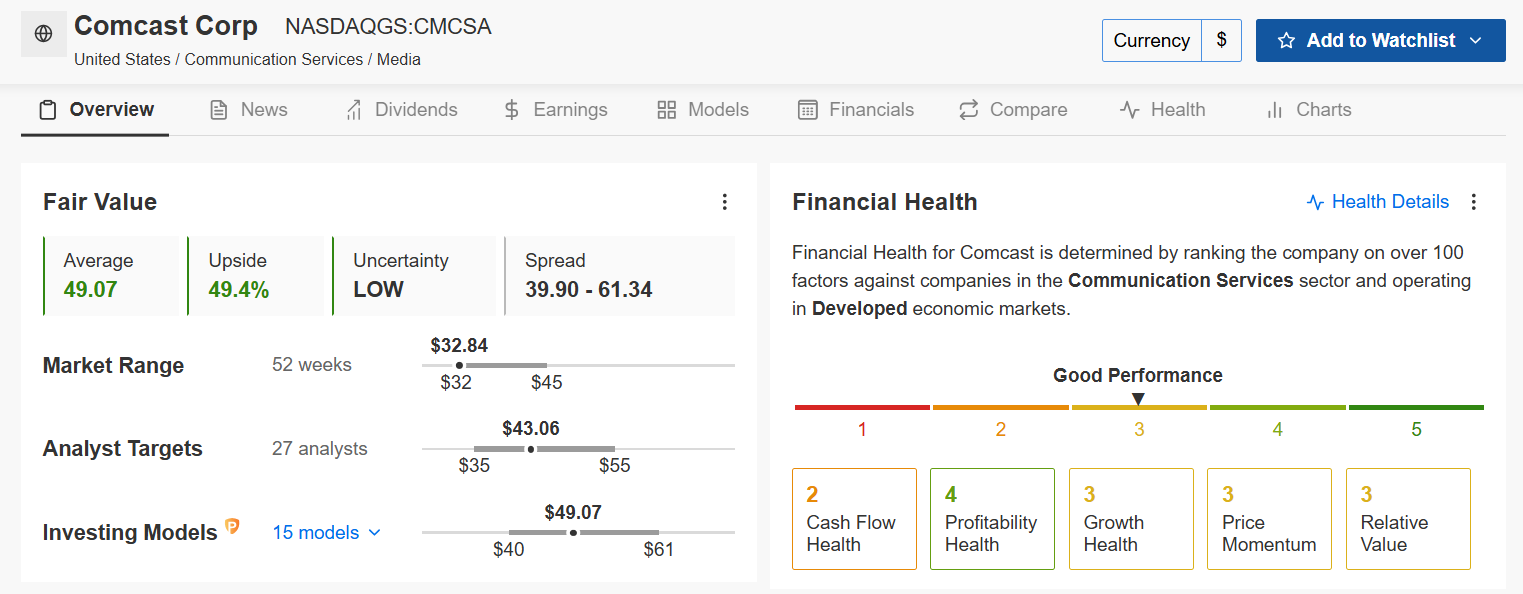

2. Comcast

Fair Value: $49.07 (+49.4% upside potential)

Financial Health: GOOD (Score: 2.77)

P/E Ratio: 7.9x

Dividend Yield: 4.02%

Comcast (NASDAQ:) is a global media and technology company primarily known for its cable television, broadband internet, and advertising services. With a stronghold in the U.S. media landscape, Comcast operates through its various segments, including NBCUniversal and Sky.

As a primarily domestic service provider, Comcast’s core operations are less exposed to international trade tensions, shielding them from the direct impact of trade wars. Additionally, Comcast’s essential services nature provides defensive characteristics similar to Verizon (NYSE:) and AT&T Inc (NYSE:), which have seen share price increases as investors seek stability.

Source: InvestingPro

With a “GOOD” Financial Health score of 2.77 and trading at a modest 7.9x earnings, Comcast appears significantly undervalued against its Fair Value estimate of $49.07—suggesting 49.4% upside potential. The company’s 4.02% dividend yield and strong cash flow generation capabilities provide stability during economic turbulence.

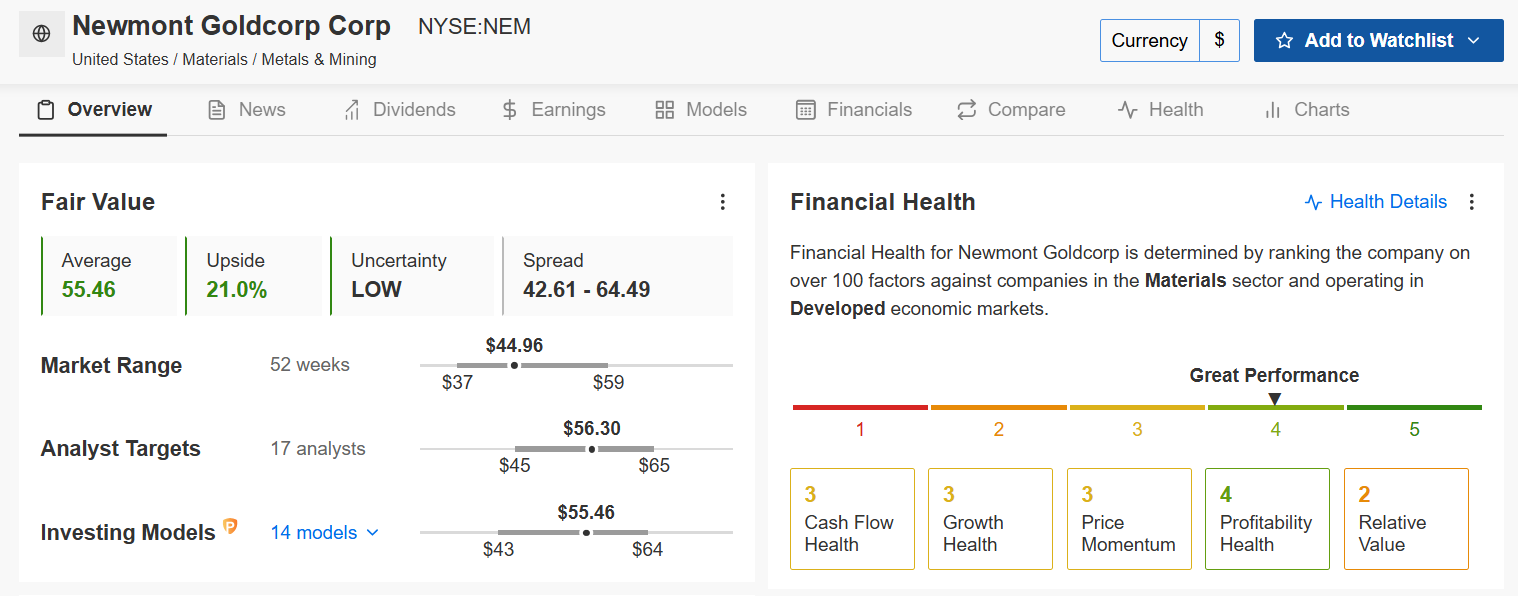

3. Newmont Gold

Fair Value: $55.46 (+23.4% upside potential)

Financial Health: GREAT (Score: 3.21)

P/E Ratio: 15.7x

Dividend Yield: 2.22%

Newmont (NYSE:) is the world’s largest mining company, extracting gold, , silver, and other metals from mines across North America, South America, Australia, and Africa. It produces over 6 million ounces of gold annually, thriving on the metal’s status as a safe-haven asset.

prices often surge during economic uncertainty, and Trump’s tariffs could fuel such conditions by stoking inflation and trade disputes. Newmont stands to benefit as investors flock to gold, especially with its strong U.S. operations reducing tariff exposure. Its scale and profitability make it a reliable pick if global trade wars intensify.

Source: InvestingPro

With a “GREAT” Financial Health score of 3.21 and a Fair Value estimate of $55.46, indicating 23.4% upside potential, Newmont provides both defensive characteristics and growth potential. The company’s 2.22% dividend yield adds an income component unusual among gold miners, making it particularly attractive during uncertain economic periods.

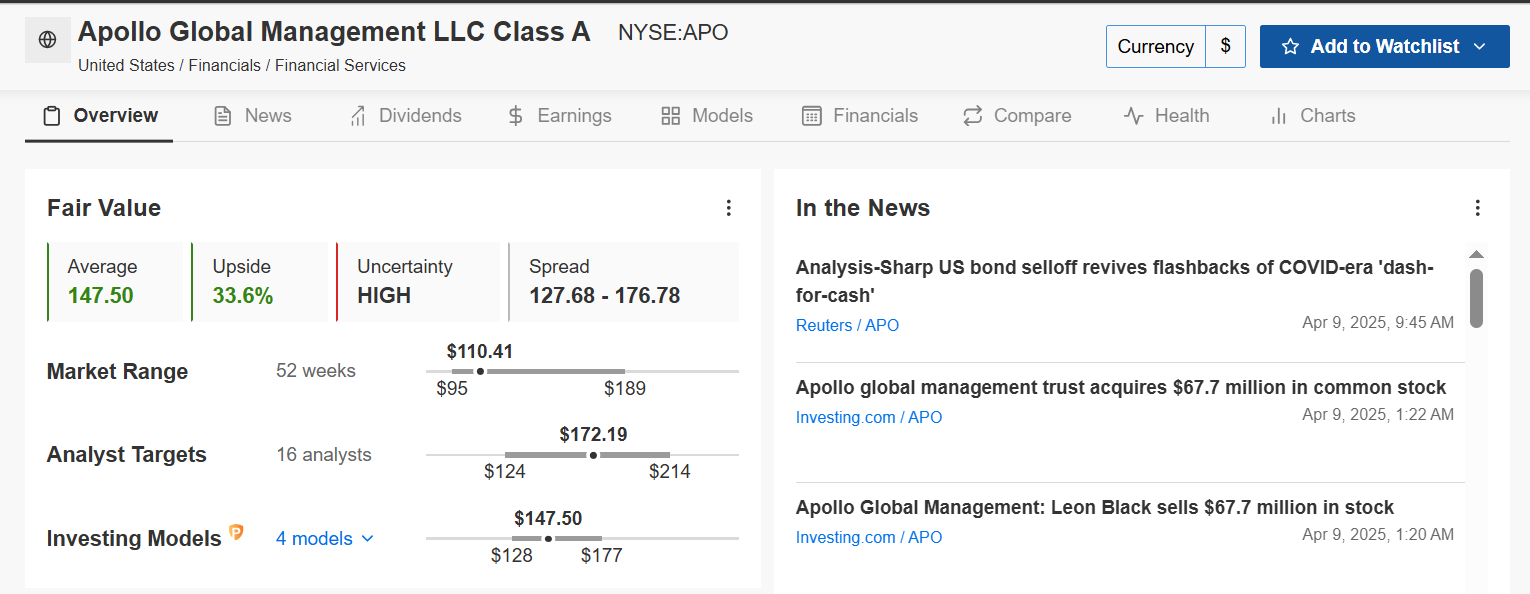

4. Apollo Global Management

Fair Value: $147.50 (+33.6% upside potential)

Financial Health: UNAVAILABLE

P/E Ratio: 14.8x

Dividend Yield: 1.68%

Apollo Global Management (NYSE:) is a major alternative asset manager, overseeing investments in private equity, credit, and real assets, with a focus on distressed debt, infrastructure, and corporate turnarounds. Launched in 1990 by Leon Black, Apollo has grown into a $600 billion-plus asset management titan.

With a diverse portfolio and a focus on opportunistic investments, Apollo is well-positioned to navigate the complexities of a trade war. The company’s expertise in identifying and capitalizing on market dislocations could prove to be a strength as Trump’s tariffs reshape global trade and investment flows.

Source: InvestingPro

Trading at 14.8x earnings with a Fair Value estimate of $147.50 suggesting 33.6% upside potential, Apollo offers compelling value. While its Financial Health score is unavailable, the company’s strong track record in navigating complex market environments makes it worth consideration as trade tensions escalate.

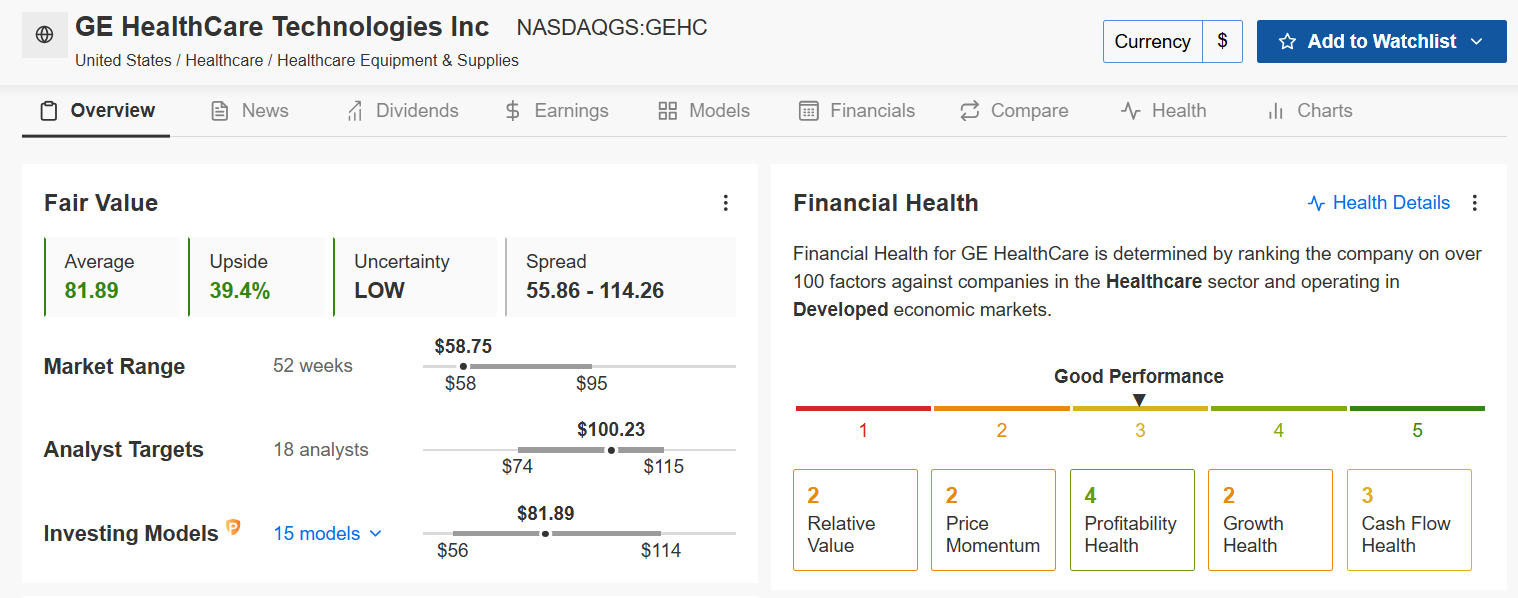

5. GE Healthcare Technologies

Fair Value: $81.89 (+39.4% upside potential)

Financial Health: GOOD (Score: 2.78)

P/E Ratio: 19.7x

Dividend Yield: 0.2%

GE HealthCare Technologies (NASDAQ:) provides medical imaging, diagnostics, and healthcare IT solutions, including MRI machines, ultrasound systems, and patient monitoring tools, serving hospitals and clinics worldwide. Spun off from General Electric (NYSE:) in 2023, GE Healthcare generates billions in revenue, with a strong U.S. base complemented by global operations.

While tariffs could raise costs for imported components, GE Healthcare’s domestic manufacturing presence mitigates much of that risk. Healthcare remains a non-cyclical sector, insulated from trade war fallout, and demand for its critical equipment persists regardless of economic turbulence. Its growth potential and defensive nature make it a standout as tariffs kick in.

Source: InvestingPro

With a “GOOD” Financial Health score of 2.78 and trading at 19.7x earnings, the company appears undervalued compared to its Fair Value estimate of $81.89—suggesting 39.4% upside potential.

Conclusion

These five companies share several characteristics that make them compelling considerations as tariffs take effect: domestic revenue focus, strong financial positions, attractive valuations, and business models that could benefit from—or at least withstand—trade disruptions.

While no investment is without risk, particularly during periods of economic uncertainty, these stocks offer interesting opportunities for investors looking to position portfolios defensively while maintaining upside potential.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and instantly unlock access to several market-beating features, including:

ProPicks AI: AI-selected stock winners with proven track record.

InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am short on the S&P 500 and Nasdaq 100 via the ProShares Short S&P 500 ETF (SH) and ProShares Short QQQ ETF (PSQ).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.