3 companies particularly well-positioned in this environment are Nucor, Weyerhaeuser, and ONEOK.

Each company, with its unique set of services and solid track record, deserve consideration in your portfolio.

Looking for actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to InvestingPro’s AI-selected stock winners.

With President Donald Trump’s ‘Liberation Day’ set for Wednesday, his administration is gearing up to unleash a wave of tariffs aimed at bolstering American industries and reducing dependence on foreign imports.

This trade war strategy, rooted in Trump’s “America First” philosophy, promises to reshape markets by imposing reciprocal tariffs and targeted duties on goods like , , and energy imports.

While this shift may spark volatility, it also creates opportunities for companies with strong domestic footprints. Three standout stocks—Nucor (NYSE:), Weyerhaeuser (NYSE:), and ONEOK (NYSE:)—are well-positioned to thrive amid these policies.

Here’s why they’re worth considering as smart buys in today’s environment.

1. Nucor

Year-To-Date Performance: +2.5%

Market Cap: $27.6 Billion

Nucor is the largest steel producer in the U.S., operating over 25 scrap-based steel mills nationwide. The company manufactures a diverse range of steel products, including sheet steel, plate steel, structural steel, and bar steel used in construction, automotive manufacturing, and infrastructure projects.

NUE stock currently trades at $119.66, earning the Charlotte, North Carolina-based steel products company a valuation of $27.6 billion. Shares are up 2.5% year-to-date.

Source: Investing.com

Trump’s tariffs on imported steel—potentially matching or exceeding duties imposed by other nations—are designed to shield domestic producers like Nucor from cheap foreign competition. With reduced pressure from imports, Nucor could see increased demand and higher prices for its steel, especially as industries reliant on steel prioritize U.S. suppliers.

Trump’s first-term steel tariffs already demonstrated this effect, boosting Nucor’s market position, and ‘Liberation Day’ promises a similar lift.

Financially, Nucor shows solid fundamentals despite recent industry headwinds. The company maintains a P/E ratio of 13.7x, significantly below many industrial peers, suggesting potential undervaluation.

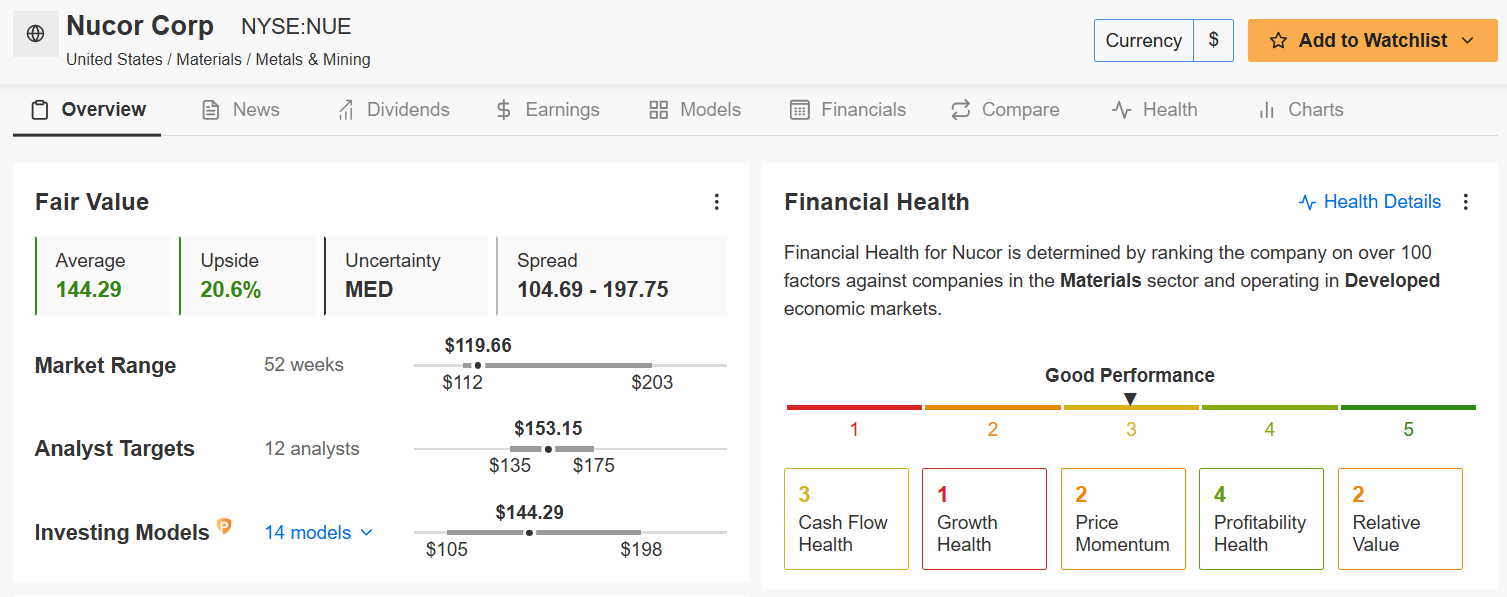

Source: InvestingPro

The InvestingPro Fair Value price target sits at $144.29, representing a substantial 20.6% upside from current levels. With a healthy 1.9% dividend yield and impressive 9.6% shareholder yield, Nucor offers both growth potential and income.

2. Weyerhaeuser

Year-To-Date Performance: +3.5%

Market Cap: $21.1 Billion

Weyerhaeuser, one of the world’s largest private owners of timberlands, is the biggest softwood lumber manufacturer in the United States, ranking first in the industry for lumber production capacity. It is also one of the largest manufacturers of wood products in North America.

WY shares ended at $29.14 on Tuesday, valuing the Seattle, Washington-based timber real estate investment trust at $21.1 billion. Shares are up 3.5% in 2025.

Source: Investing.com

Trump’s proposed tariffs on imported lumber, particularly from Canada, aim to curb foreign supply and boost domestic producers. Weyerhaeuser, with its vast U.S. timber resources, is primed to capitalize as builders turn to American lumber to avoid tariff-driven cost hikes.

This shift could drive up demand and prices for Weyerhaeuser’s products, especially if construction activity holds steady or grows under Trump’s economic policies.

Weyerhaeuser’s financial performance has been challenged recently, with revenue declining 7.2% to $7.12 billion in FY2024. However, analysts project 5.7% growth in 2025 as housing construction potentially accelerates under new policies.

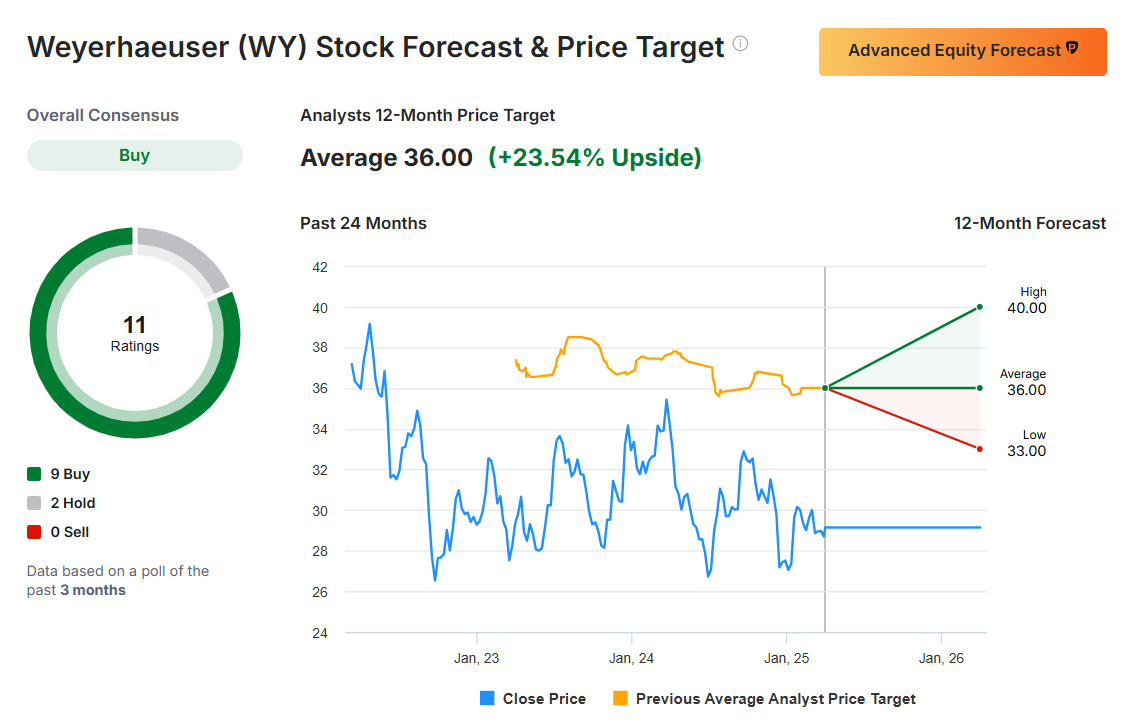

Source: Investing.com

Analysts see significant upside potential, with a mean price target of $36.00 representing a 23.5% premium to current trading levels. The lumber giant’s 2.88% dividend yield provides meaningful income while investors wait for the recovery to materialize.

3. ONEOK

Year-To-Date Performance: -0.9%

Market Cap: $59.5 Billion

ONEOK operates as a leading midstream service provider in the and natural gas liquids (NGLs) sector, with extensive pipeline networks and processing facilities primarily in the Mid-Continent, Permian Basin, and Rocky Mountain regions.

OKE is currently at $99.48, earning the Tulsa, Oklahoma-based midstream operator a market value of $59.5 billion. The shares are just about flat since the start of the year.

Source: Investing.com

Trump’s emphasis on energy independence, coupled with tariffs on imported oil (like the 25% duty on Venezuelan crude), is set to supercharge domestic energy production. As U.S. and output rises, ONEOK’s infrastructure will be in high demand to move these resources efficiently.

The company’s focus on natural gas and NGLs also aligns with Trump’s push to dominate energy markets, ensuring steady growth in its midstream services.

Unlike many energy companies, ONEOK has demonstrated impressive growth, with revenue increasing 22.7% to $21.70 billion in FY2024. Analysts project continued strength, with 21.5% growth expected in 2025. The company’s P/E ratio of 19x represents a reasonable valuation given this growth trajectory.

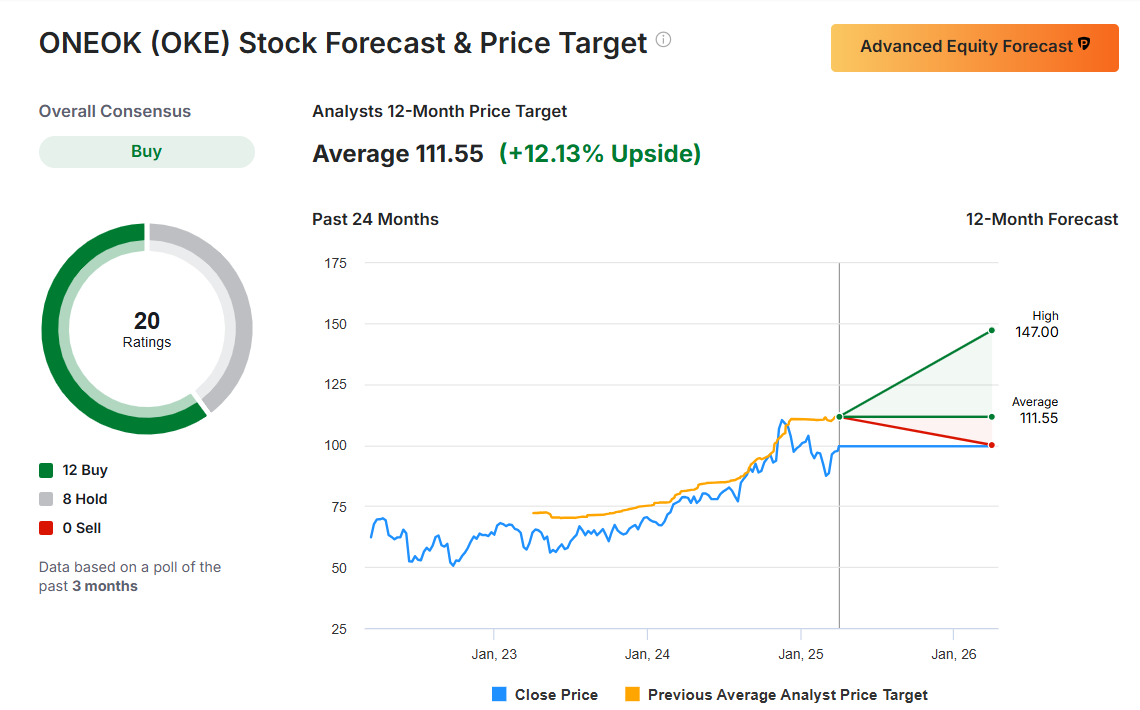

Source: InvestingPro

With a mean analyst price target of $111.55 suggesting roughly 12% upside and a generous 4.1% dividend yield, ONEOK offers an attractive combination of growth, income, and inflation protection. The company’s strong return on equity of 18.1% demonstrates management’s ability to deploy capital effectively.

Conclusion

As Trump’s trade war unfolds, the stocks of Nucor, Weyerhaeuser, and ONEOK represent companies that are strategically positioned to capitalize on the changing dynamics of international trade.

Each company, with its unique products and services, is set to benefit from policies aimed at supporting domestic industries and enhancing U.S. competitiveness on the global stage.

For investors looking to navigate the current trade environment, these stocks offer promising opportunities for growth and stability amidst the broader uncertainties of the market.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and instantly unlock access to several market-beating features, including:

ProPicks AI: AI-selected stock winners with proven track record.

InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Invesco S&P 500 Equal Weight ETF (RSP).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.