As fears of an AI bubble intensify, smart investors are rotating into steadier, non-tech opportunities with reliable cash flows and attractive valuations. For those looking to diversify away from the froth, here are three such stocks to consider.

1. Coca-Cola

Year-To-Date Performance: +15%

Market Cap: $308 Billion

Coca-Cola (NYSE:) remains the ultimate consumer moat, trading at just 23x forward earnings—below its 10-year average (27x)—with a reliable 2.89% dividend yield ($2.04 annual payout) backed by 55 consecutive years of payout increases.

Source: Investing.com

Coca-Cola’s recent financial performance demonstrates remarkable consistency and growth acceleration across key metrics that validate the company’s strategic transformation. Q3 2025 organic revenue rose 7%, fuelled by 7% volume growth in emerging markets and 5% price/mix gains in developed ones, with EPS beating estimates by 4%.

With zero exposure to AI capex cycles and over $10 billion annually in cash flow supporting buybacks and dividends, KO provides a reliable income stream, making it a perfect anchor for a portfolio seeking sanity beyond the AI frenzy.

Coca-Cola leads with a Financial Health Overall Score of 2.80 (“GOOD”), underpinned by a robust 4.15 Profit Score and solid momentum. The average analyst price target sits at $79.13—11% above today—while the highest target reaches $85.00.

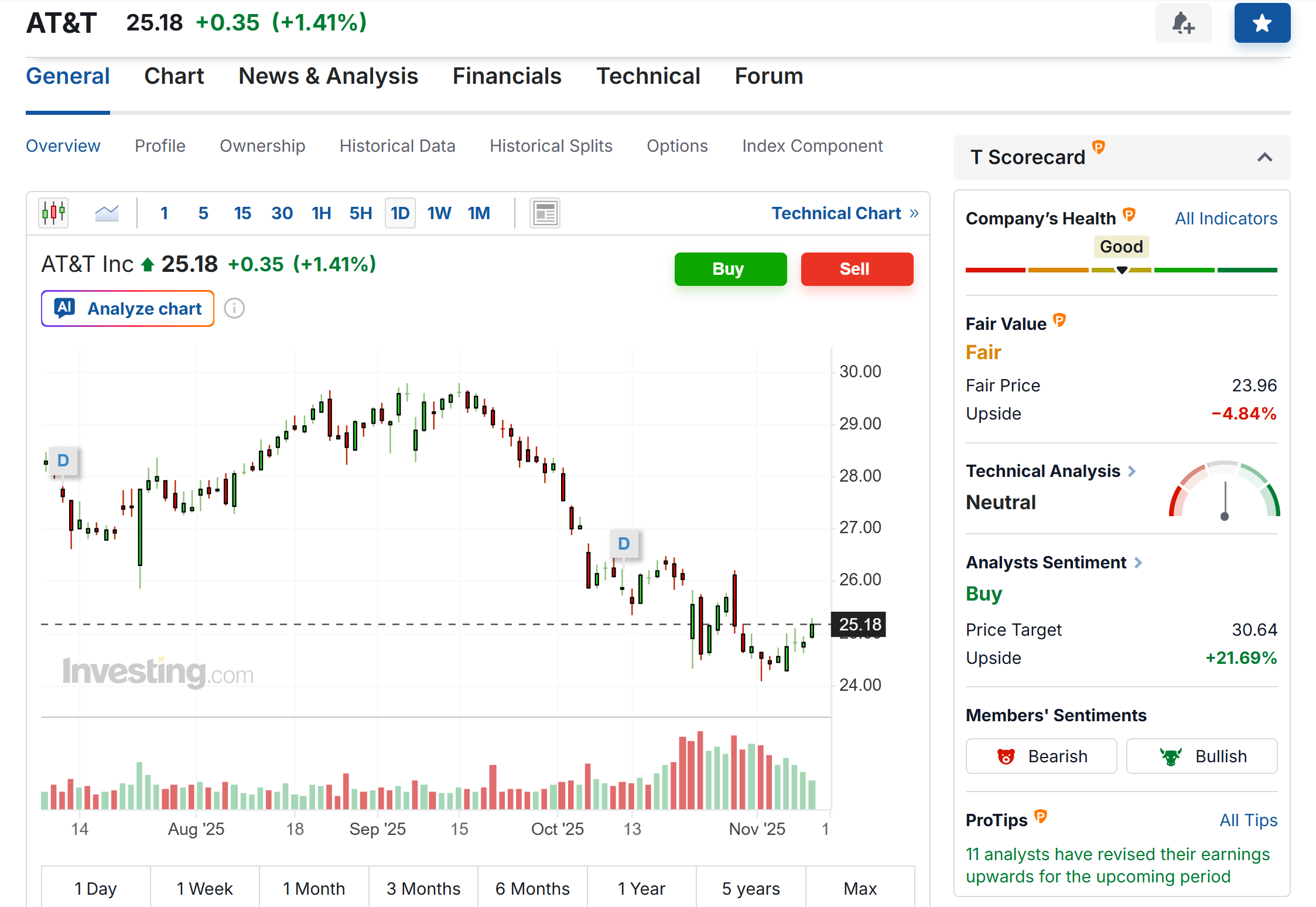

2. AT&T

Year-To-Date Performance: +10.6%

Market Cap: $178.5 Billion

AT&T (NYSE:), meanwhile, is the 5G cash flow king, yielding a generous 4.4%, the highest among large-cap telcos. Free cash flow surged to $4.8 billion in Q3 2025—up 18% year-over-year—enabling $10 billion in debt reduction this year alone, while broadband net adds hit +300,000, the best in a decade.

Yet, the market continues to assign it a rock-bottom valuation, trading at a forward price-to-earnings ratio of 8.2x that is a fraction of the S&P 500 average.

Source: Investing.com

While not as glamorous as an AI chip designer, AT&T’s recent operational improvements reflect management’s successful execution of strategic focus initiatives. This disciplined strategy is already generating massive and improving free cash flow, providing solid momentum for its balance sheet.

The company’s wireless segment continues demonstrating pricing power and customer retention strength while 5G network investments position AT&T for future monetization opportunities in enterprise and consumer markets.

AT&T boasts a Financial Health Overall Score of 2.82 (“GOOD”), with strength in Value (3.20) and Profit (3.38) but a more modest Growth score. The mean analyst target is $30.64, a full 21% above the current price of $25.26, suggesting the market may be undervaluing the telecom giant.

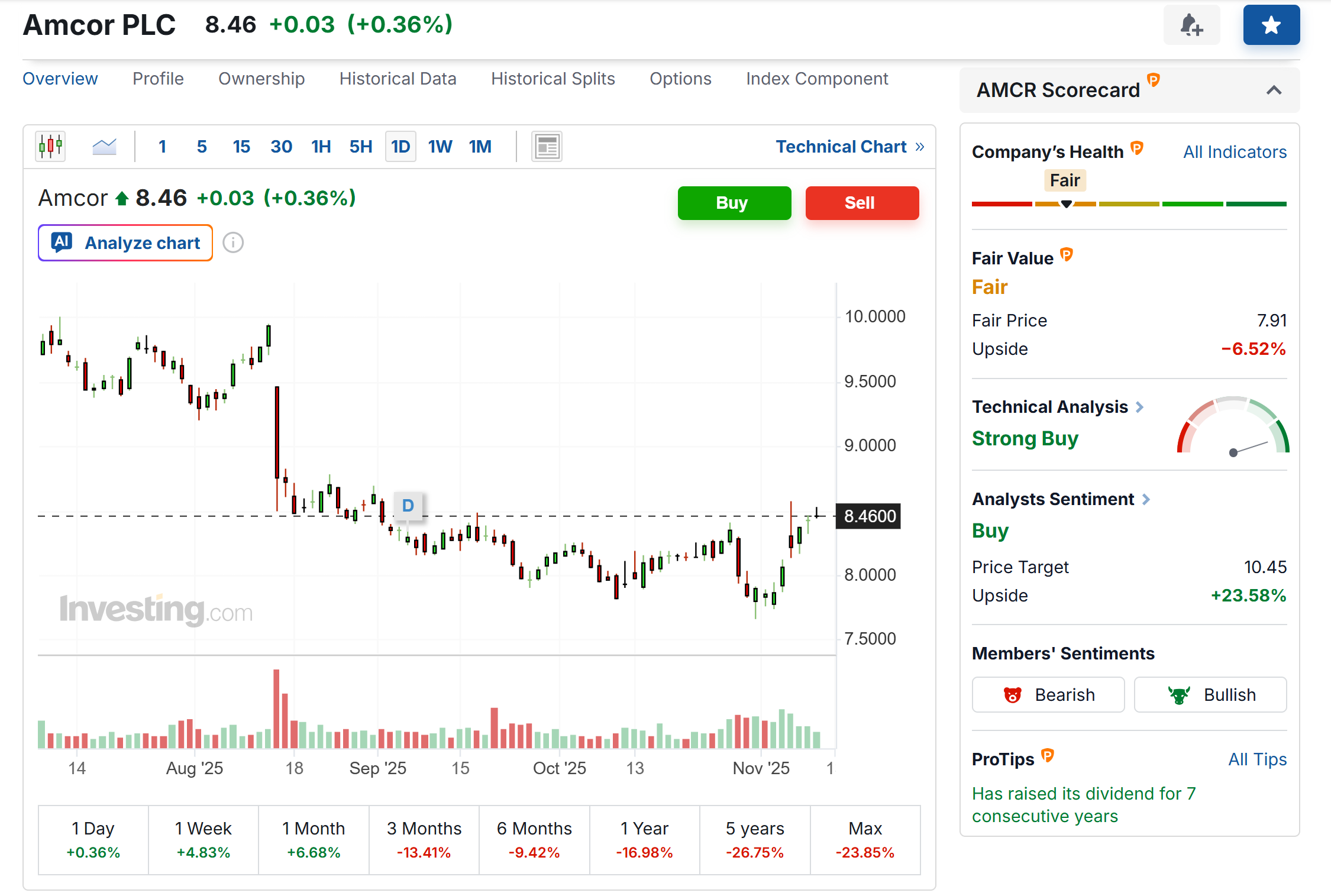

3. Amcor

Year-To-Date Performance: -10.1%

Market Cap: $19.5 Billion

Rounding out the trio is Amcor (NYSE:), the quiet packaging powerhouse that nobody talks about—yet everyone relies on. As the global leader in consumer packaging, Amcor supplies rigid plastics and flexible films to giants like Nestlé, PepsiCo (NASDAQ:), Pfizer (NYSE:), and Unilever, ensuring steady demand that grows regardless of AI hype cycles.

Source: Investing.com

At 26x forward earnings, with a 6.1% dividend yield and $1.2 billion in annual share repurchases, Amcor combines attractive valuation with investment-grade balance sheet strength. The company raised its FY2025 adjusted EPS guidance to $0.78–$0.82, reflecting 8% year-over-year growth, driven by 6% volume gains in healthcare that offset softer staples.

Amcor trails with a Financial Health Overall Score of 2.37 (“FAIR”), reflecting a more mixed profile—lower growth and cash flow, but steady profits. Its analyst upside is the most bullish: the average target is $10.45 (versus an $8.46 price), with a high target of $12.00.

That’s a potential 23% gain, making Amcor stand out for value-focused investors seeking a turnaround or recovery play.

Conclusion

In an investment climate marked by growing AI hype and bubble concerns, seeking out stable, non-AI stocks can provide a crucial counterbalance to portfolios. Coca-Cola, AT&T, and Amcor stand out as resilient options, combining solid earnings momentum with reasonable valuations.

These companies offer dependable growth potential and consistent dividends, making them attractive opportunities for those looking to diversify and stabilize their investments away from the AI sector’s uncertainty.

Below are the key ways an InvestingPro subscription can enhance your stock market investing performance:

ProPicks AI: AI-managed stock picks every month, with several picks that have already taken off in November and in the long term.

Warren AI: Investing.com’s AI tool provides real-time market insights, advanced chart analysis, and personalized trading data to help traders make quick, data-driven decisions.

Fair Value: This feature aggregates 17 institutional-grade valuation models to cut through the noise and show you which stocks are overhyped, undervalued, or fairly priced.

1,200+ Financial Metrics at Your Fingertips: From debt ratios and profitability to analyst earnings revisions, you’ll have everything professional investors use to analyze stocks in one clean dashboard.

Institutional-Grade News & Market Insights: Stay ahead of market moves with exclusive headlines and data-driven analysis.

A Distraction-Free Research Experience: No pop-ups. No clutter. No ads. Just streamlined tools built for smart decision-making.

Not a Pro member yet?

Already an InvestingPro user? Then jump straight to the list of picks here.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF, and the Invesco QQQ Trust ETF. I am also long on the Technology Select Sector SPDR ETF.

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.