Their strategic roles in AI infrastructure and innovation make them attractive picks, especially given their current valuations.

As the AI trade continues to evolve, these undervalued stocks could deliver outsized returns for patient investors.

Looking for more actionable trade ideas? Subscribe now and save 45% off InvestingPro!

While mega-cap AI players like Nvidia (NASDAQ:) and Microsoft (NASDAQ:) dominate headlines, Super Micro Computer (NASDAQ:), Kyndryl (NYSE:), and Qorvo (NASDAQ:) are quietly building foundational technologies that power the AI revolution. Their roles in AI infrastructure, enterprise IT, and edge computing make them essential to the AI trade, yet their stocks remain undervalued relative to their growth potential.

For investors looking to diversify their AI portfolios and capitalize on underappreciated opportunities, these three stocks offer a compelling mix of growth, value, and upside potential.

1. SuperMicro Computer: The AI Infrastructure Powerhouse

Current Price: $41.15

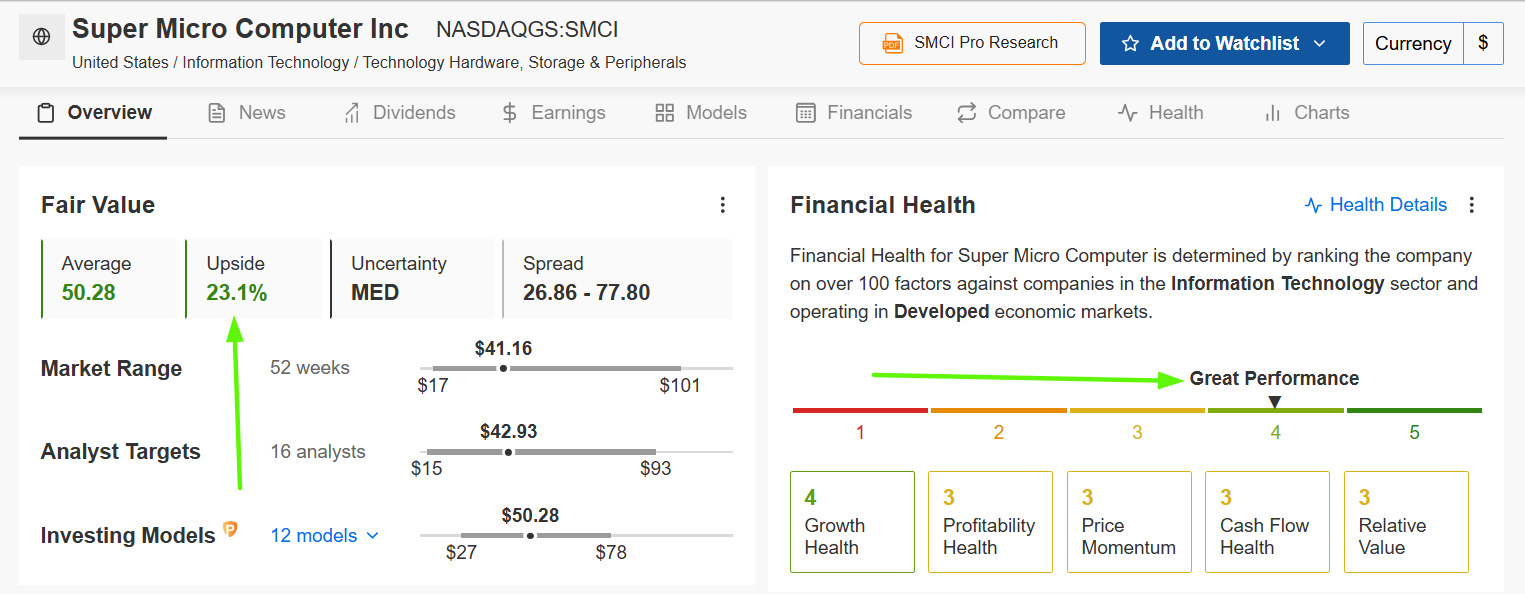

Fair Value Price Target: $50.28 (+23.1% Upside)

Market Cap: $24.5 Billion

SuperMicro has emerged as a critical hardware provider in the AI infrastructure landscape, yet trades at valuations significantly below many of its AI-related peers. The company’s partnerships with tech giants such as Nvidia, Meta (NASDAQ:), and Amazon (NASDAQ:), along with its involvement in high-profile AI projects like Elon Musk’s xAI, position it at the heart of the AI infrastructure boom.

Source: Investing.com

SMCI has been a volatile yet high-performing AI stock, surging 2,100% over five years due to insatiable demand for AI servers. Despite a 66% drop from its peak since joining the S&P 500 in March 2024—driven by accounting concerns and a potential delisting risk—the stock has shown resilience, gaining 35% year-to-date.

Trading at just 14 times forward-earnings estimates, Supermicro is notably cheaper than peers like Nvidia (25.5 times earnings), despite its projected revenue growth of 62% year-over-year to $23.5-$25 billion in fiscal 2025.

Recent challenges, including a DOJ investigation and auditor resignations (Deloitte in 2023, EY in 2024), have weighed on the stock, but an independent committee cleared allegations of misconduct, and the company is working to resolve delayed financial filings.

Source: InvestingPro

With a Fair Value of $50.28, SMCI stock presents a sizable upside potential of +23.1% from its current price of $41.15. The company’s ‘GREAT’ financial health score from InvestingPro (overall: 3.03) stands out, especially with impressive revenue growth over the last twelve months.

For investors willing to stomach short-term volatility, Supermicro’s low valuation and dominant position in AI servers make it a standout undervalued opportunity.

2. Kyndryl: The Enterprise AI Enabler

Current Price: $39.44

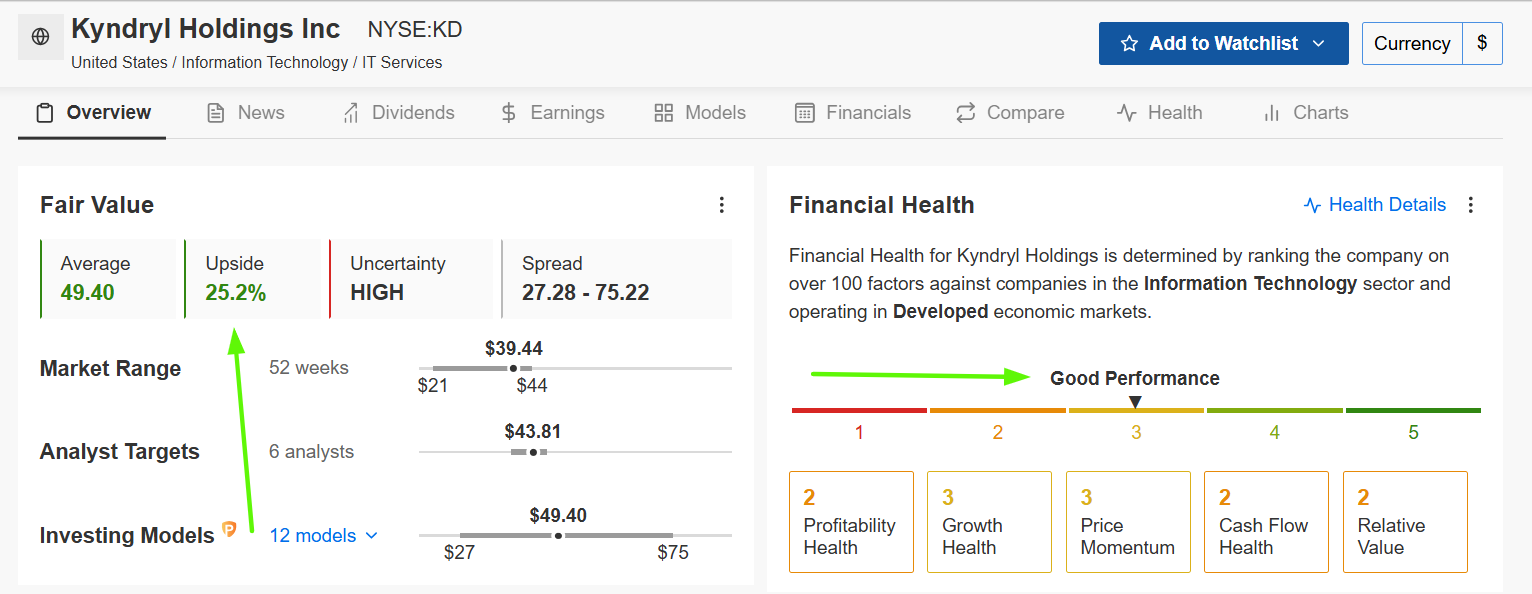

Fair Value Price Target: $49.40 (+25.2% Upside)

Market Cap: $9.1 Billion

Kyndryl, spun off from IBM (NYSE:) in 2021, is sometimes overlooked, but its numbers tell a quietly compelling story. By managing data architectures and facilitating cloud migrations to hyperscalers like Amazon, Google (NASDAQ:), and Microsoft, Kyndryl enables businesses to leverage AI effectively.

Source: Investing.com

Kyndryl’s stock has climbed 14% in 2025, reflecting its growing role in enterprise AI implementation as organizations move from AI experimentation to full-scale deployment.

Despite its strategic positioning at the intersection of enterprise IT and artificial intelligence, Kyndryl trades at remarkably modest valuations. With a forward P/E ratio below 15 and a price-to-sales ratio under 0.4, the market appears to be valuing Kyndryl as a legacy IT services provider rather than recognizing its emerging role in enterprise AI transformation.

The company’s generative AI services have driven significant revenue, with $1.2 billion generated from hyperscaler-related customers in fiscal 2025, surpassing its $1 billion target.

Source: InvestingPro

Trading substantially below its Fair Value target of $49.40, KD stock offers a +25.2% upside potential, highlighting its undervaluation and growth potential. As per InvestingPro, the IT infrastructure services provider has an above-average Financial Health score of 2.6 out of 5.0 and a “Strong Buy” analyst consensus.

Investors seeking exposure to enterprise AI adoption, with a focus on long-term growth, may find Kyndryl’s current price attractive, especially as it expands its hyperscaler-driven revenue.

3. Qorvo: The Connectivity Backbone for AI

Current Price: $76.41

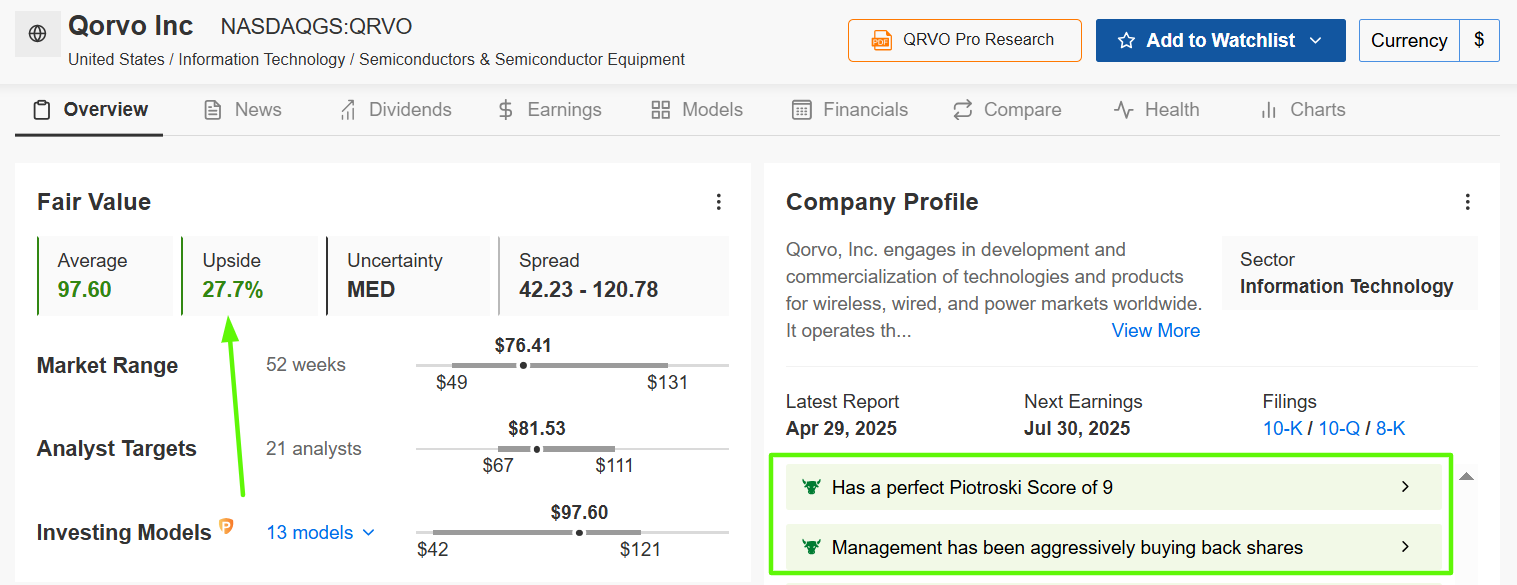

Fair Value Price Target: $97.60 (+27.7% Upside)

Market Cap: $7.1 Billion

Qorvo, a semiconductor company, specializes in radio frequency (RF) solutions like power amplifiers, filters, and front-end modules that enable high-speed, low-latency connectivity for 5G, IoT, and AI-driven devices. While not a direct AI hardware provider, Qorvo’s RF components are critical for the connectivity infrastructure supporting AI ecosystems, such as edge AI devices and IoT systems that feed real-time data into AI models.

Source: Investing.com

Qorvo has underperformed the broader market over the past year, weighed down by cyclical challenges in the semiconductor sector. Unlike pure AI plays like Supermicro, Qorvo’s indirect exposure to AI through 5G and IoT connectivity has garnered less investor enthusiasm.

From a valuation perspective, Qorvo appears significantly undervalued relative to its AI potential. Trading at approximately 14x forward earnings and 2.5x sales, the stock reflects limited recognition of its growing role in the edge AI ecosystem.

Qorvo’s undervaluation makes it a safer bet for conservative investors looking to capitalize on the long-term growth of 5G and IoT. Its steady demand from diverse industries and potential to benefit from AI-driven connectivity growth make it an overlooked gem.

Source: InvestingPro

Trading at $76.41, QRVO is still well below its Fair Value of $97.60, with an upside potential of +27.7%. Qorvo’s perfect Piotroski Score of 9 signals robust financial strength, and with activist investor Starboard Value on board, operational improvements could unlock major value.

If you’re seeking an overlooked AI chip play with activist tailwinds, Qorvo’s risk/reward profile looks unusually attractive.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now for 45% off and instantly unlock access to several market-beating features, including:

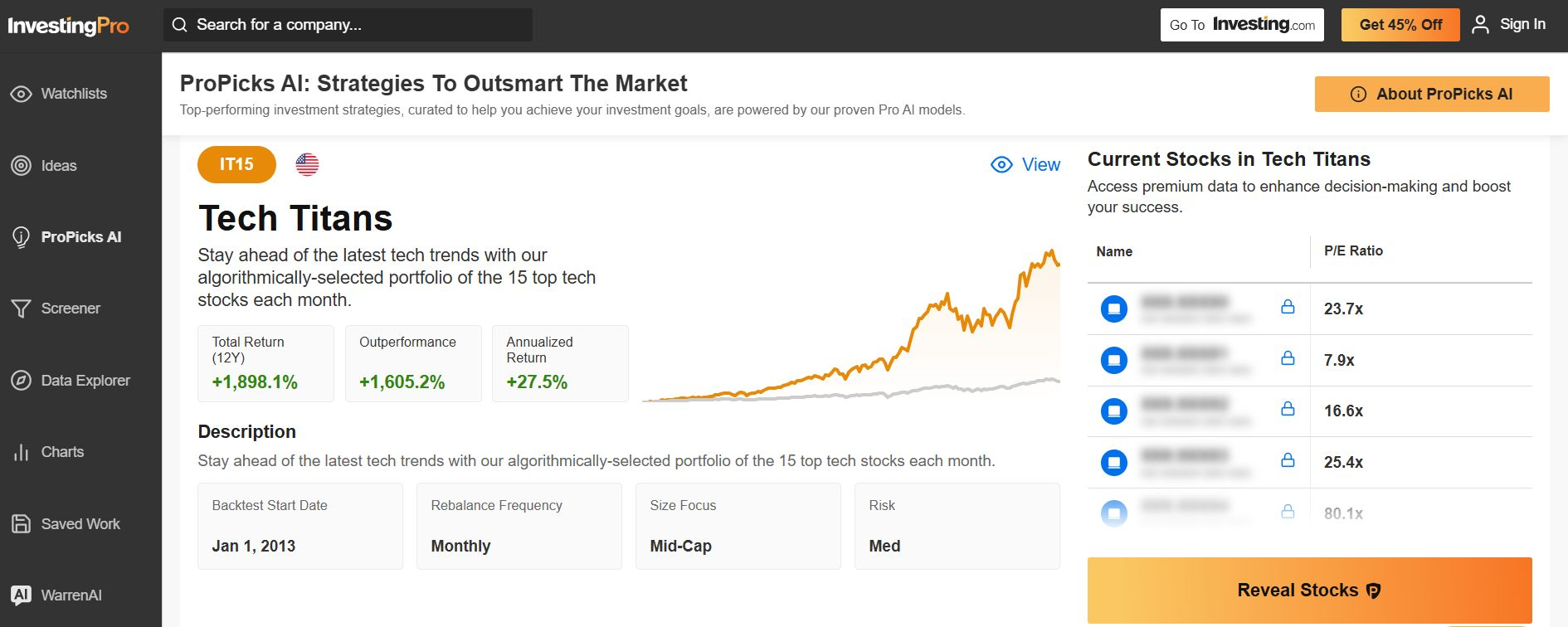

ProPicks AI: AI-selected stock winners with proven track record.

InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Invesco Top QQQ ETF (QBIG), and Invesco S&P 500 Equal Weight ETF (RSP).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.