Amid this backdrop, companies with business models insulated from tariff-related costs stand out.

For investors seeking stability and upside in a tariff-heavy landscape, these two names represent compelling opportunities.

Looking for more actionable trade ideas? Subscribe now to unlock access to InvestingPro’s AI-selected stock winners and save up to 50%!

As President Donald Trump’s aggressive trade policies reshape the global economic landscape, investors face heightened uncertainty. Sweeping tariffs on imports from major trading partners like China, Canada, Mexico, Japan and South Korea have sparked fears of inflation, supply chain disruptions, and potential economic slowdown.

Amid this challenging backdrop, certain companies are better positioned to weather the storm due to their business models, which are less exposed to tariff-related costs. Netflix (NASDAQ:) and Uber (NYSE:) stand out as two such stocks, offering resilience and growth potential.

Here’s why these companies stand strong and what makes them compelling buys in the current landscape.

1. Netflix

Netflix is positioned to thrive as President Trump amps up trade tariffs, thanks to its digital-first business model and growing global subscriber base, which remains largely unaffected by import duties or supply chain disruptions. Unlike hardware or manufacturing-driven peers, Netflix’s costs are largely tied to content production and licensing, not goods crossing borders.

This insulates the streaming company from the cost increases that tariffs impose on imported products or raw materials.

Year-to-date, Netflix’s stock has performed impressively, gaining approximately 43% in 2025, reflecting investor confidence in its growth trajectory and ability to navigate challenging economic conditions. NFLX stock closed at $1,275.31 last night, just below its all-time high.

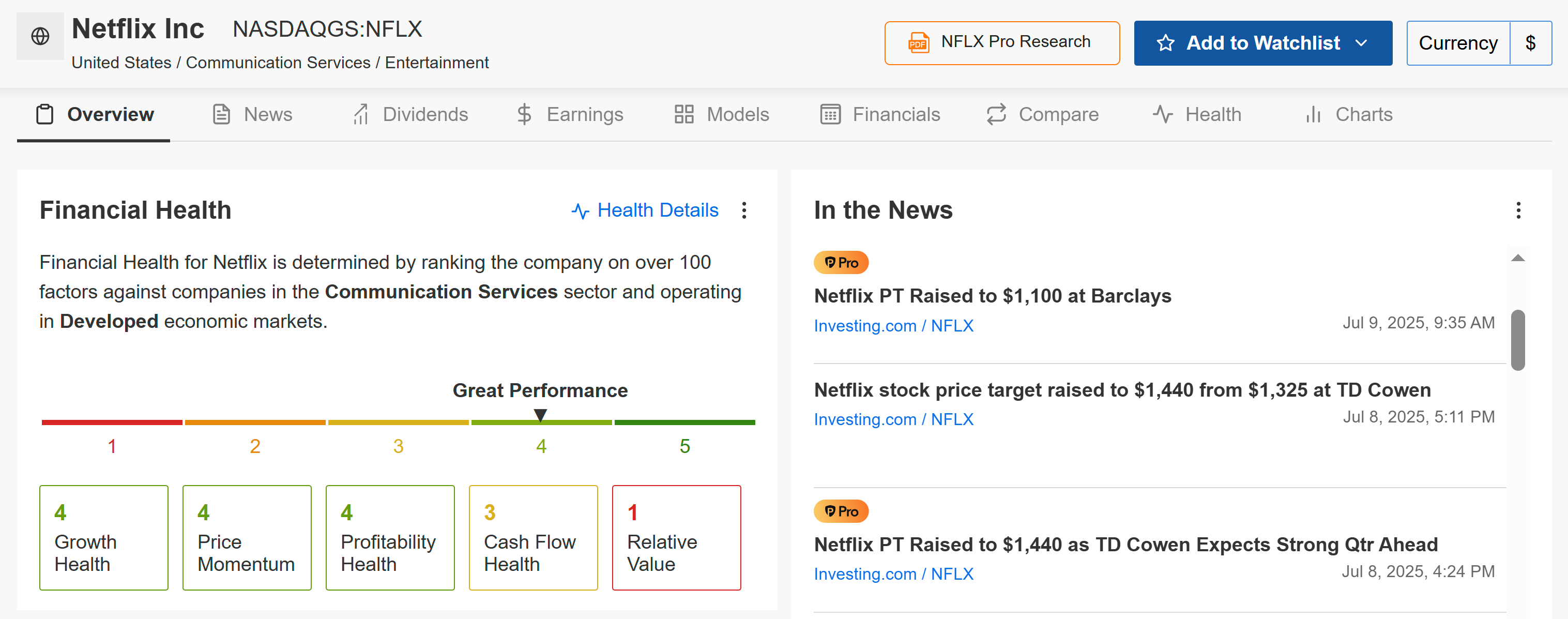

Source: Investing.com

Analysts see more to come, with a “monster” content slate for the second half of 2025 likely to boost both engagement and subscriber growth. TD Cowen just raised its price target to $1,440, citing strong member growth and pricing power even after January’s price hike.

An upcoming catalyst that could drive its stock price higher is the release of its Q2 earnings report on July 17, where analysts expect continued subscriber growth, particularly in international markets, and improved profitability from recent price hikes and ad-tier adoption.

Source: InvestingPro

As per InvestingPro, Netflix earns a 3.18 Financial Health Score—firmly in the ‘GREAT’ category—reflecting robust profitability, strong cash flows, and outstanding financial discipline. InvestingPro also highlights that the streaming giant boasts a perfect Piotroski Score of 9, signaling exceptional fundamentals.

2. Uber

Similar to Netflix, Uber’s asset-light platform-driven business model is inherently insulated from global trade disruptions caused by tariffs due to its hyper-local, service-based nature. The ride-hailing and delivery services company connects local drivers with local riders, and local restaurants with local eaters.

Its “product” – a ride or a meal delivery – is created and consumed within a single geographic market, making it entirely unaffected by cross-border duties on goods.

Uber shares have delivered an impressive 61.6% return year-to-date, riding strong growth in both its Mobility and Delivery units and expanding partnerships in autonomous vehicles. UBER closed Tuesday’s session at $97.48, its highest level on record.

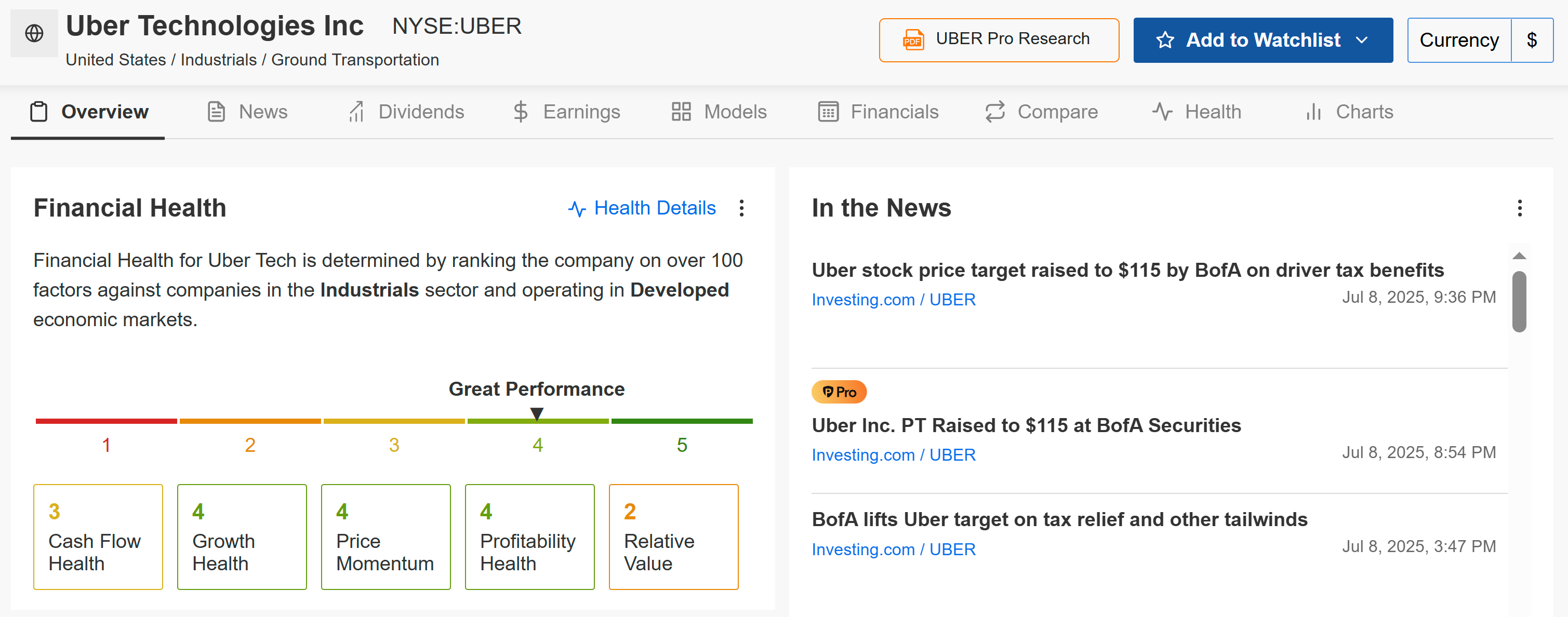

Source: Investing.com

Uber’s advancements in autonomous driving, through partnerships like Waymo, could lower operational costs and boost margins. Expansion into international markets less affected by U.S. tariffs and the continued growth of Uber Eats, driven by demand for convenience, are key catalysts.

Earnings on August 5 will be closely watched, especially as analysts expect continued double-digit profit and revenue growth as well as improving margins thanks to the company’s strategic growth initiatives.

Source: InvestingPro

Uber commands an even stronger 3.59 financial health score, also rated as ‘GREAT’, underpinned by powerful growth, momentum, and improving profitability. ProTips for Uber include multiple upward earnings revisions, consistent profitability across recent periods, and strong stock price performance over the last month, quarter, and year, making it a compelling buy amid the current market backdrop.

Bottom Line

In a potentially turbulent global trade landscape, both Netflix and Uber offer compelling reasons for investment. Their fundamental business models are naturally protected from the direct impacts of tariffs, while their strong market positions and clear growth catalysts suggest they are well-equipped to continue thriving, making them attractive additions to portfolios looking for resilience and growth in uncertain times.

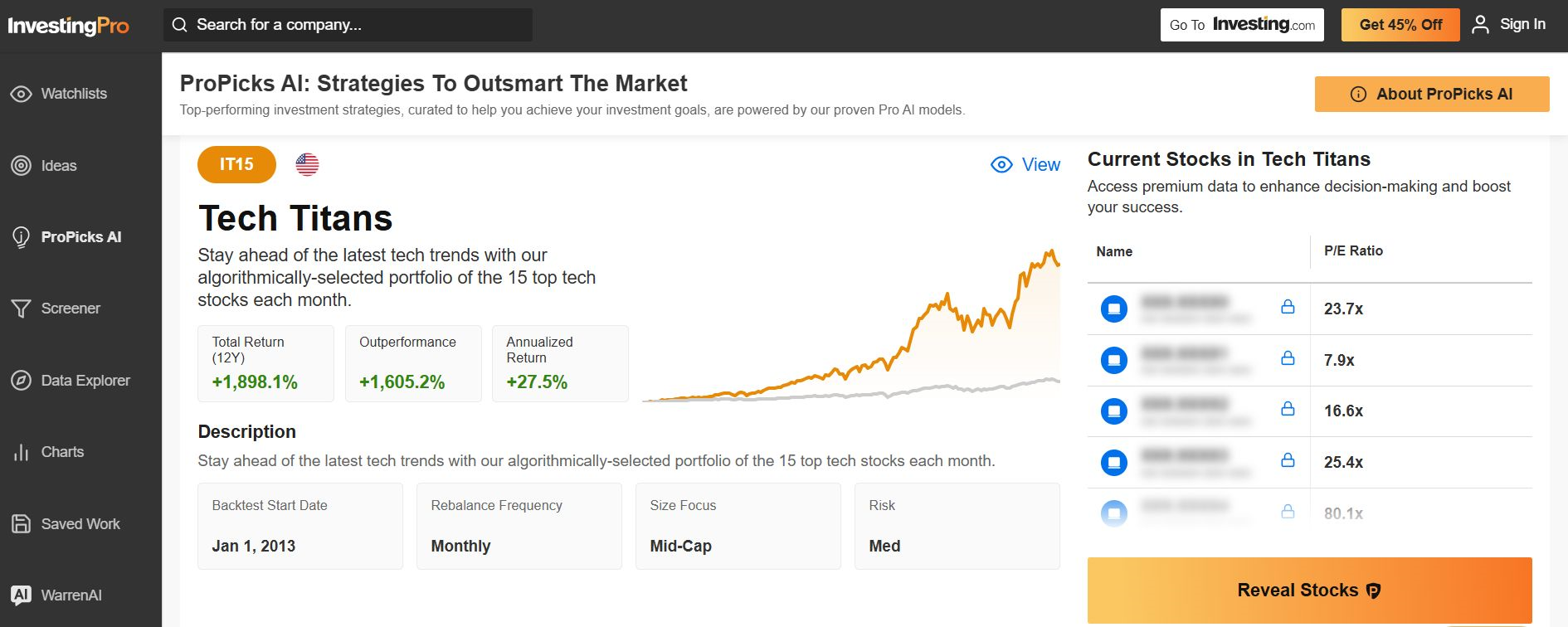

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now for up to 50% off and instantly unlock access to several market-beating features, including:

ProPicks AI: AI-selected stock winners with proven track record.

InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Invesco Top QQQ ETF (QBIG), and Invesco S&P 500 Equal Weight ETF (RSP).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.