The stock market soared on Friday, with the blue-chip Dow hitting a record closing high, after Federal Reserve Chair Jerome Powell pointed to a possible rate cut at the central bank’s next policy meeting in his remarks at the Jackson Hole Symposium.

The “shifting balance of risks may warrant adjusting our policy stance,” Powell said, taking note of recent softness in the labor market.

Source: Investing.com

Despite Friday’s rally, Wall Street’s main indexes closed mixed for the week. The rose 1.5%, the gained 0.3%, while the tech-heavy shed 0.6%. The small-cap jumped 3.3%.

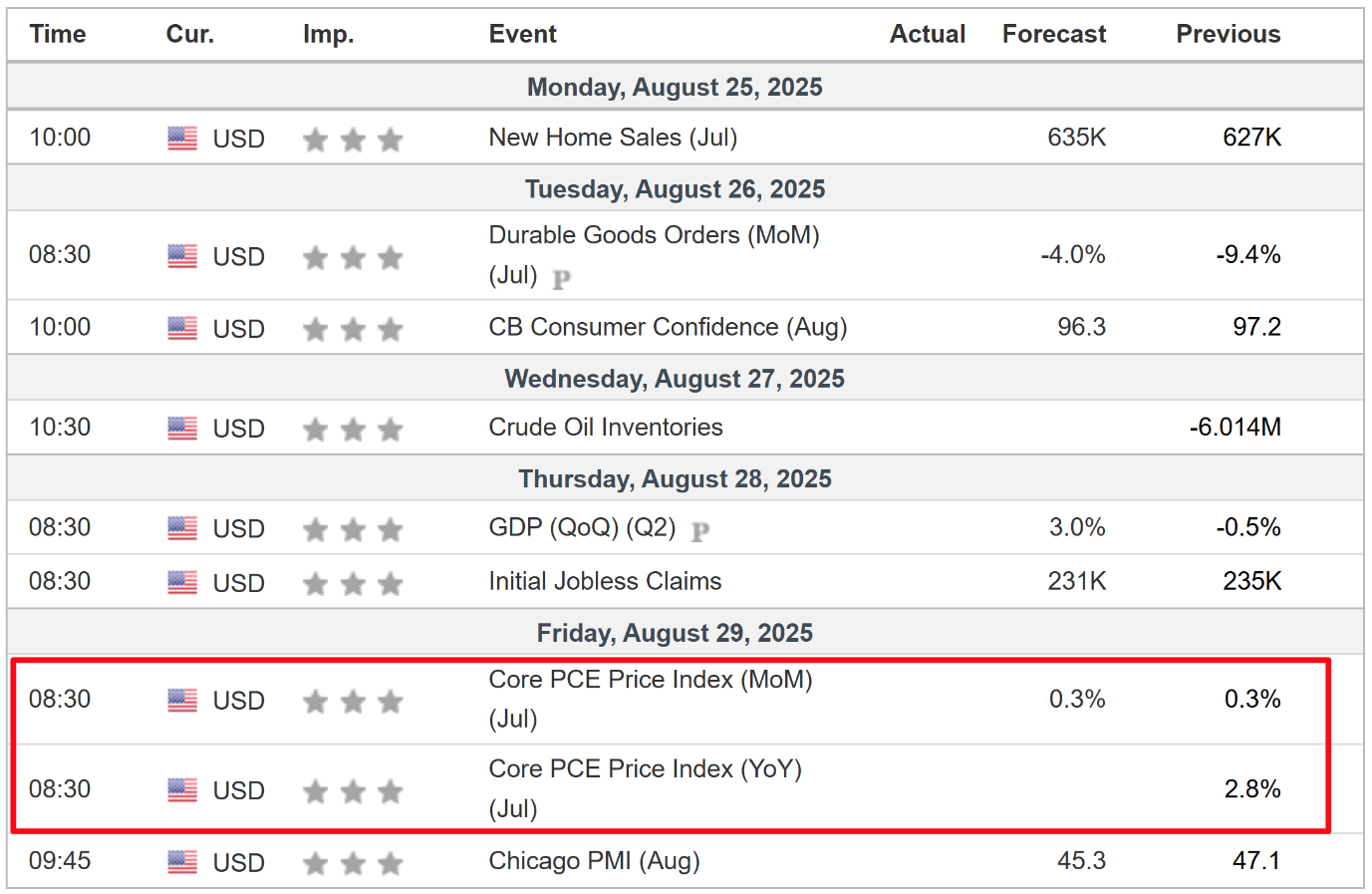

More volatility could be in store in the week ahead as investors assess the outlook for the economy, inflation, interest rates and corporate earnings amid ongoing trade tensions.

On the economic calendar, most important will be Friday’s core PCE price index, which is the Fed’s favorite inflation gauge. That will be accompanied by the latest consumer confidence reading, as well as fresh housing data.

Source: Investing.com

Elsewhere, in corporate earnings, Nvidia (NASDAQ:)’s results will be the key update of the week as the reporting season draws to a close. Other notable names include CrowdStrike (NASDAQ:), Snowflake (NYSE:), Okta (NASDAQ:), Dell (NYSE:), HP (NYSE:), Best Buy (NYSE:), Dollar General (NYSE:), Kohl’s (NYSE:), Burlington Stores (NYSE:), Ulta Beauty (NASDAQ:), Dick’s Sporting Goods (NYSE:), Gap (NYSE:), Abercrombie & Fitch (NYSE:), Alibaba (NYSE:), and Li Auto (NASDAQ:).

Regardless of which direction the market goes, below I highlight one stock likely to be in demand and another which could see fresh downside. Remember though, my timeframe is just for the week ahead, Monday, August 25 – Friday, August 29.

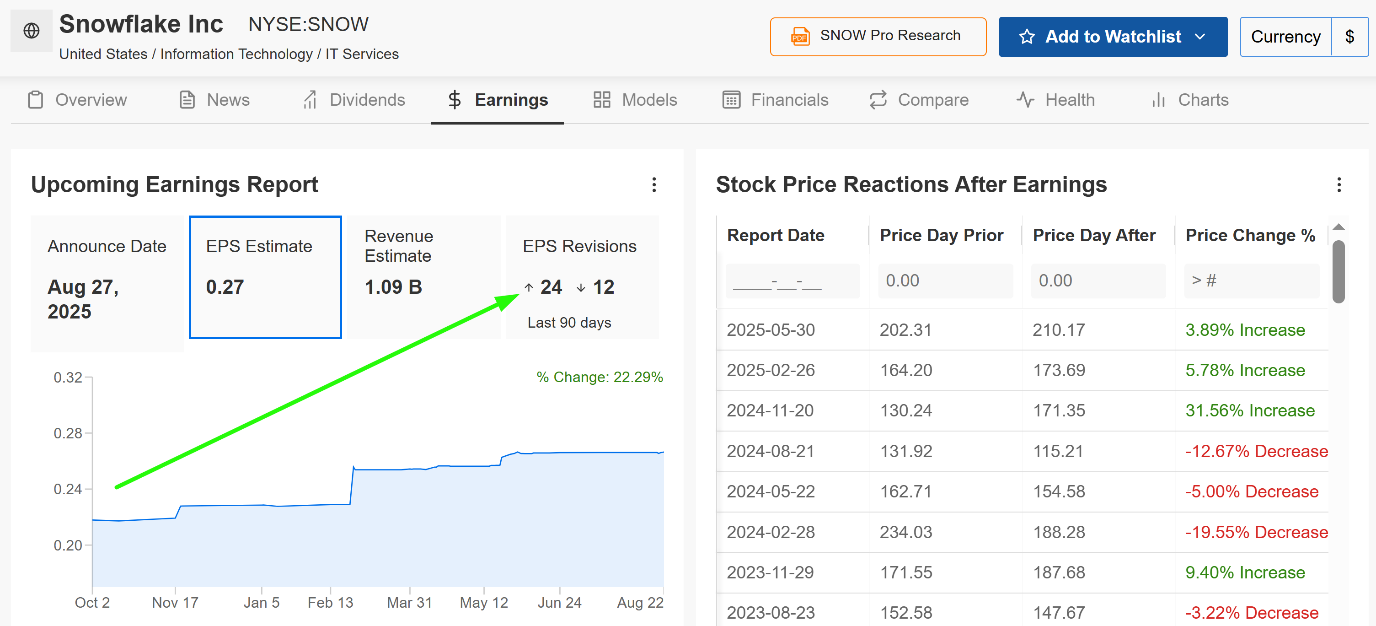

Stock To Buy: Snowflake

Snowflake is positioned for a potential positive catalyst when it releases its Q2 earnings report on Wednesday at 4:05PM ET. Analysts expect the AI data cloud company to demonstrate solid profit and sales growth, driven by continued customer acquisition and revenue expansion, as organizations seek scalable and flexible data solutions.

Market participants predict a sizable swing in SNOW stock after the update drops, as per the options market, with a possible implied move of +/-11.5% in either direction.

Sentiment has been notably positive heading into the print. According to InvestingPro data, earnings estimates have been revised upward 24 times, compared to 12 downward revisions. TD Cowen, KeyBanc, and UBS have all reiterated bullish stances ahead of earnings, expecting Snowflake to beat or at least meet guidance.

Source: InvestingPro

Consensus calls for Snowflake to post adjusted earnings per share of $0.27, climbing 42.1% from EPS of $0.19 in the year-ago period. Revenue is seen rising 25.6% to $1.09 billion, reflecting the company’s ability to capture market share in a high-growth industry.

Snowflake has been capitalizing on the global transition to cloud-based data analytics, garnering increasing demand for its platform that empowers businesses to manage and analyze vast amounts of data seamlessly. The integration of artificial intelligence and machine-learning capabilities into its platform positions it at the epicentre of the AI boom.

Given these dynamics, Snowflake’s management is likely to provide strong sales guidance for the current quarter as it benefits from the robust upward trend in AI adoption rates, customer retention, and strategic growth initiatives, such as collaborations with Microsoft (NASDAQ:), ServiceNow (NYSE:), and Amazon’s AWS.

Source: Investing.com

SNOW stock ended Friday’s session at $196.81. Technical analysis paints a bullish short-term picture: SNOW’s 1-hour signals are overwhelmingly “strong buy” on indicators and “buy” on moving averages. RSI sits at 40.4 (not oversold), and volatility is high but manageable for a tech name—33.1% (90-day).

Additionally, InvestingPro’s AI-powered models rate Snowflake with a “FAIR” Financial Health Score of 2.44, reflecting its strong growth metrics and efficient operations.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Subscribe now for 50% off and position your portfolio one step ahead of everyone else!

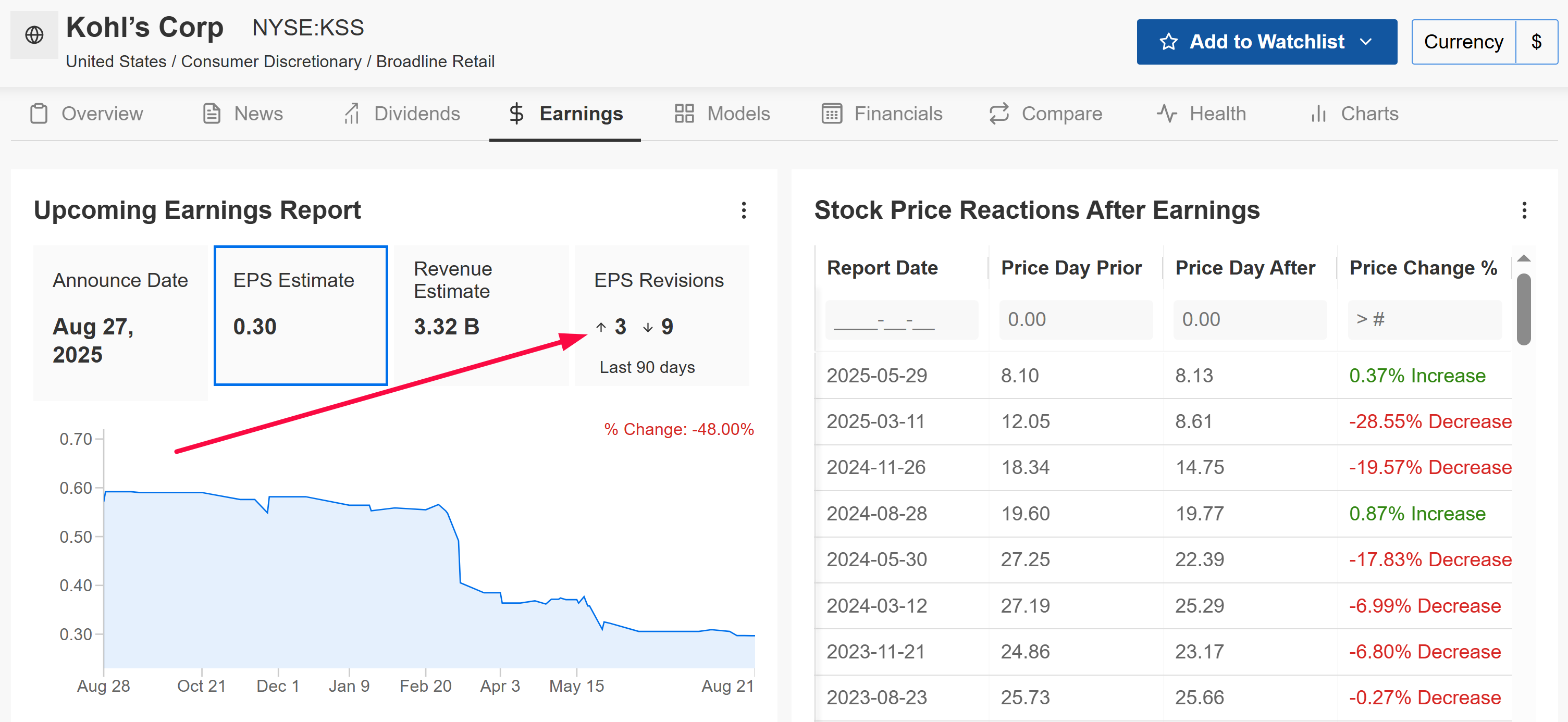

Stock to Sell: Kohl’s

Kohl’s, on the other hand, is a stock to avoid this week as it faces a challenging retail landscape. The mid-tier department store is facing a formidable set of headwinds that are likely to result in a downbeat earnings report and a cautious outlook.

The company, which operates over 1,100 stores across the U.S., is scheduled to release its second quarter earnings before the U.S. market opens on Wednesday at 7:00AM ET. With implied volatility pointing to a +/-15.1% stock move post-earnings, the risk of a miss looms large.

Analyst sentiment has deteriorated significantly ahead of the report, with InvestingPro data showing nine out of the 12 analysts covering Kohl’s reducing their profit estimates.

Source: InvestingPro

Wall Street sees Kohl’s reporting earnings of $0.30 per share, tumbling 49.1% from a year earlier, while revenue is anticipated to decline by 5.7% to $3.3 billion. These figures reflect ongoing difficulties in a sector battered by shifting consumer preferences and economic pressures.

The brick-and-mortar retailer is grappling with operational inefficiencies and weakening consumer demand, particularly for discretionary items like the apparel, home goods, and accessories that are the bread and butter of Kohl’s’ business.

This dynamic places Kohl’s in a precarious position in the retail landscape—the “murky middle.” It lacks the rock-bottom prices of a value leader like Walmart (NYSE:) and doesn’t have the brand cachet of more premium retailers. Adding to these woes is intense competition from all sides, including online giants like Amazon (NASDAQ:), off-price retailers like TJX Companies (NYSE:), and fast-fashion players.

Given these challenges, Kohl’s faces a very tough path ahead, with little near-term relief expected from its upcoming earnings report.

Source: Investing.com

KSS stock closed at $13.89 on Friday. Shares have underperformed the S&P 500 in the year-to-date, reflecting mounting investor concerns about Kohl’s long-term prospects as it struggles to adapt to the evolving retail landscape.

It should be noted that Kohl’s has an InvestingPro Financial Health Score of 2.16, tagged as ‘FAIR’, highlighting the company’s difficulty in attracting customers and driving sales.

Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and save 50% on all Pro plans amid the summer sale and instantly unlock access to several market-beating features, including:

ProPicks AI: AI-selected stock winners with proven track record.

InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the via the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Invesco Top QQQ ETF (QBIG), Invesco S&P 500 Equal Weight ETF (RSP), and VanEck Vectors Semiconductor ETF (SMH).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.