• Tesla, Alphabet earnings, and more Trump tariff news will be in focus this week.

• Philip Morris stands out as a buy, driven by its strong smoke-free product growth and a promising earnings report.

• Boeing faces significant headwinds from the U.S./China trade war and operational challenges, making it a stock to sell.

• Looking for actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to InvestingPro’s AI-selected stock winners.

The stock market ended mixed in choppy trading on Thursday, with the major averages finishing the holiday-shortened week lower as tariffs continued to worry investors. Wall Street stayed closed on Friday for the Good Friday holiday.

The declined 2.7%, the fell 1.5%, while the tech-heavy slumped 2.6%.

Source: Investing.com

More volatility could be in store in the week ahead as investors continue to assess the outlook for the economy, interest rates and corporate earnings amid President Trump’s trade war.

The first quarter earnings season shifts into high gear, with reports expected from Tesla (NASDAQ:) and Google-parent Alphabet (NASDAQ:) – two of the so-called Magnificent Seven megacap companies.

Other high-profile companies on the agenda include Intel (NASDAQ:), IBM (NYSE:), Boeing (NYSE:), GE Aerospace (NYSE:), AT&T (NYSE:), Verizon (NYSE:), T-Mobile (NASDAQ:), Comcast (NASDAQ:), Lockheed Martin (NYSE:), RTX (NYSE:), Northrop Grumman (NYSE:), American Airlines (NASDAQ:), Southwest Airlines (NYSE:), Procter & Gamble (NYSE:), Philip Morris (NYSE:), Pepsico (NASDAQ:), Chipotle Mexican Grill (NYSE:), and Merck (NYSE:).

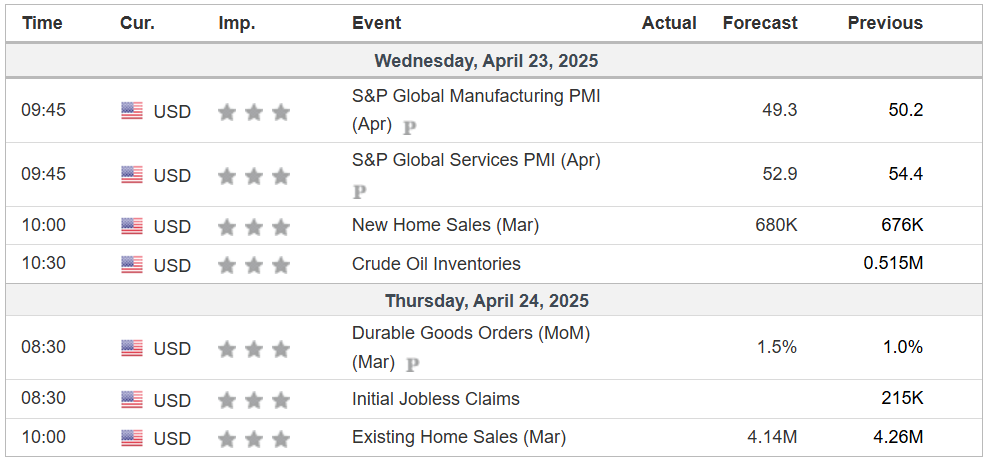

Meanwhile, in a data-light week, most of the focus will fall on jobless claims, durable goods, and new home sales figures.

Source: Investing.com

Regardless of which direction the market goes, below I highlight one stock likely to be in demand and another which could see fresh downside. Remember though, my timeframe is just for the week ahead, Monday, April 21 – Friday, April 25.

Stock To Buy: Philip Morris

Philip Morris, the tobacco giant, is poised for a strong earnings beat when it delivers its first quarter update before the market opens on Wednesday at 6:55AM ET. According to the options market, traders are pricing in a swing of about 6% in either direction for PM stock following the print.

It should be noted that Philip Morris has consistently beaten earnings expectations, surpassing consensus estimates in each of the last four quarters. The company’s strategic pivot towards smoke-free alternatives, notably the Zyn nicotine pouch and IQOS heated tobacco products, has been instrumental in driving growth.

Source: InvestingPro

Analysts forecast adjusted earnings per share (EPS) of $1.61, marking a 7.3% increase year-over-year, with revenues projected at approximately $9.14 billion, up 4% from the prior year.

This optimism is largely fueled by the company’s strategic shift towards smoke-free products, particularly the Zyn nicotine pouch, which has gained popularity and is seen as a key driver for revenue growth through the end of the decade. IQOS, its heated tobacco device, also continues to perform well, with shipment growth expected to remain in double digits.

The company’s smoke-free transformation is a long-term growth driver, with over $14 billion invested in developing these products since 2008.

Given its strong fundamentals, I believe that Philip Morris will reaffirm its full-year 2025 adjusted EPS forecast of $7.04 to $7.17, indicating strong confidence in sustained growth.

Source: Investing.com

Shares of Philip Morris have been on a tear, hitting a series of record highs in recent sessions, and the strong technical signals across multiple timeframes suggest continued upward momentum.

PM closed at $163.21 on Friday, earning the tobacco company a valuation of $254 billion. The stock is up 35.6% year-to-date in 2025, ranking it towards the top of the S&P 500 index.

It is worth mentioning that InvestingPro’s AI-powered models rate Philip Morris with a ‘GOOD’ Financial Health Score of 3.1 out of 5.0, with particularly strong metrics in profit (4.22) and price momentum (4.52).

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Subscribe now and position your portfolio one step ahead of everyone else!

Stock to Sell: Boeing

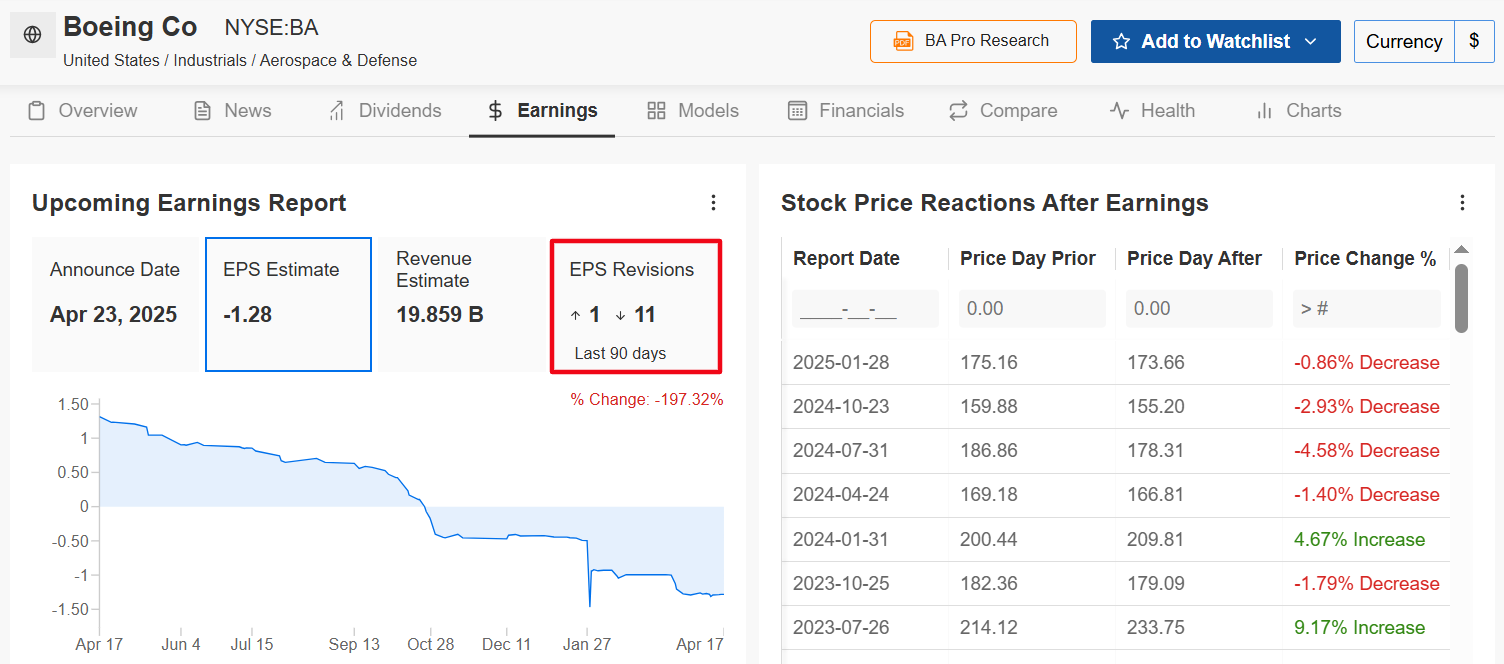

In contrast, Boeing finds itself in a precarious position as it gets set to release its first quarter earnings report on Wednesday at 7:00AM ET. As one of the largest U.S. exporters and a key player in the aerospace industry, Boeing is facing significant headwinds from the U.S.-China trade war.

Recent reports that China has ordered its airlines not to take further deliveries of Boeing’s jets add another layer of complexity to the company’s challenges. This move is a significant blow considering China represents a crucial market for the company.

As could be expected, an InvestingPro survey of analyst earnings revisions point to mounting pessimism ahead of the print, with 11 of the 12 analysts covering Boeing revising their EPS estimates downward in the past 90 days.

Source: InvestingPro

Wall Street sees Boeing losing -$1.28 per share for the quarter, compared to a loss of -$1.13 in the same quarter last year. Meanwhile, revenue is expected to rise 19.8% year-over-year to $19.8 billion.

Boeing continues to grapple with production delays, quality control problems, and ongoing legal challenges related to its 737 MAX aircraft, which have damaged its reputation. Moreover, the ongoing cash burn remains a critical concern for investors, a stark reminder of the financial strain the company is under.

The company has not booked an annual profit since 2018, losing $35.7 billion over the past six years.

Keeping that in mind, Boeing CEO Kelly Ortberg is likely to strike a cautious tone regarding the company’s fiscal 2025 outlook. Market participants predict a sizable swing in BA stock after the print drops, according to the options market, with a possible implied move of 6.5% in either direction.

Source: Investing.com

BA stock ended Friday’s session at $161.90, valuing the aerospace giant at $121.8 billion. Shares, which are trading below their key moving averages, are down 8.5% in 2025, reflecting investor concerns over the company’s operational and geopolitical headwinds.

Be aware that Boeing’s financial health has deteriorated to a ‘WEAK’ overall score of 1.33, with particularly concerning metrics in cash flow (1.05) and growth (1.14).

Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and instantly unlock access to several market-beating features, including:

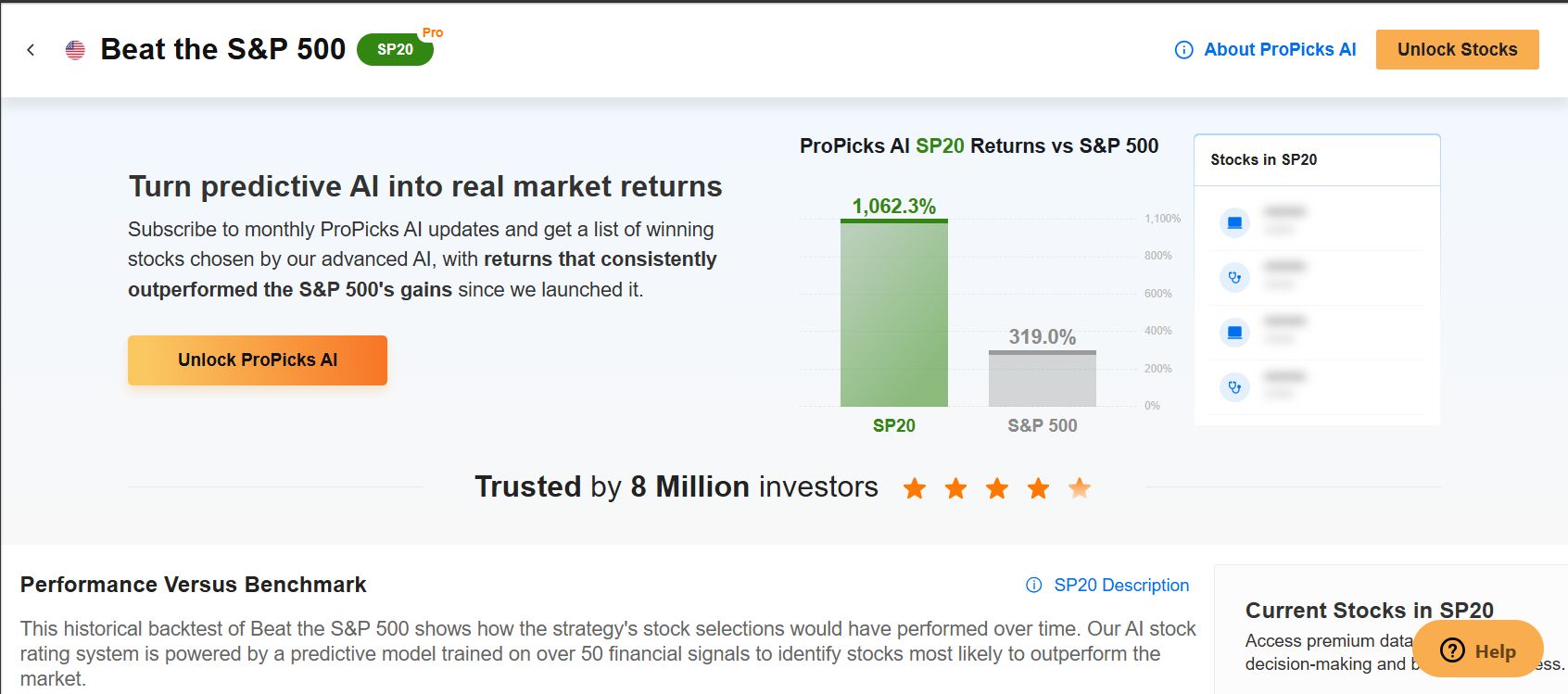

• ProPicks AI: AI-selected stock winners with proven track record.

• InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

• Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

• Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am short on the S&P 500 and via the ProShares Short S&P 500 ETF (SH) and ProShares Short QQQ ETF (PSQ).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.