• Fed FOMC meeting, Powell news conference, and trade war developments will be in focus this week.

• Palantir is expected to report strong earnings and guidance, making it an appealing stock to buy.

• Ford faces a challenging landscape amid geopolitical and macro headwinds, suggesting a more cautious approach.

• Looking for more actionable trade ideas? Subscribe here for 50% off InvestingPro!

The stock market ended sharply higher on Friday, with the major averages notching their second straight week of gains amid a strong jobs report and potential easing of trade tensions between the U.S. and China.

The jumped 3% for the week, the rose 2.9%, while the tech-heavy rallied 3.4%.

Source: Investing.com

With Friday’s surge, the S&P 500 has now recovered its losses since April 2, when President Donald Trump announced his ‘Liberation Day’ tariffs.

More volatility could be in store this week as the latest meeting of the Federal Open Market Committee is set for Tuesday-Wednesday. The U.S. central bank is widely expected to leave interest rates unchanged, but Fed Chair Jerome Powell could offer hints about when rate cuts might start when he speaks in the post-meeting press conference.

Source: Investing.com

Elsewhere, the busy earnings season continues with reports due from notable companies such as, Advanced Micro Devices (NASDAQ:), Super Micro Computer (NASDAQ:), ARM Holdings (LON:), Palantir (NASDAQ:), Coinbase (NASDAQ:), Shopify (NASDAQ:), Walt Disney (NYSE:), Novo Nordisk (NYSE:), Uber (NYSE:), Ford Motor (NYSE:), DoorDash (NASDAQ:), AppLovin (NASDAQ:), and DraftKings (NASDAQ:).

Regardless of which direction the market goes, below I highlight one stock likely to be in demand and another which could see fresh downside. Remember though, my timeframe is just for the week ahead, Monday, May 5 – Friday, May 9.

Stock To Buy: Palantir

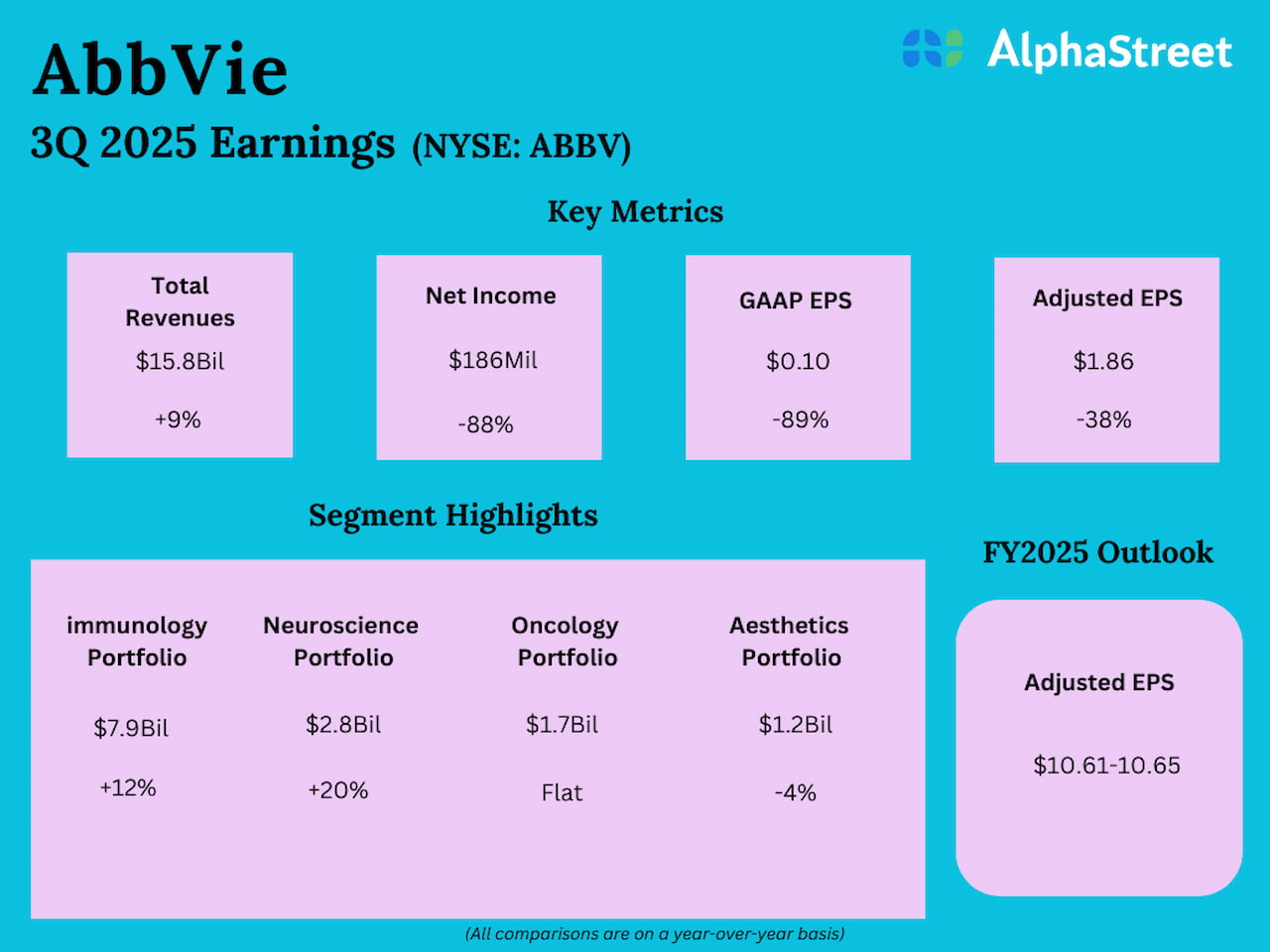

Palantir is scheduled to report its Q1 2025 earnings after the market closes on Monday at 4:05PM ET, with expectations set for potentially robust results and strong forward-looking guidance. A call with CEO Alex Karp is planned for 5:00PM ET.

The data analytics and AI software company is capitalizing on a favorable shift in U.S. government and military spending, prioritizing software and AI solutions over traditional hardware and equipment. Additionally, Palantir is well-positioned to secure lucrative contracts from European defense agencies ramping up their budgets.

Source: InvestingPro

Wall Street expects Palantir to earn $0.13 per share, representing a 62% year-over-year increase. Revenue is projected to rise 36% to $862.2 million, amid booming demand for its AI-powered software solutions, particularly within U.S. government agencies and the defense sector.

This would mark Palantir’s seventh consecutive quarter of accelerating revenue growth, building on the momentum that drove a 24% stock gap-up following its February earnings report.

Looking ahead, Palantir appears strategically positioned at the intersection of two powerful trends: increased government technology spending and the AI revolution. With federal spending on AI surging across North America and Europe, the company remains in the sweet spot to ride this wave.

Source: Investing.com

Market participants predict a sizable post-earnings swing in PLTR stock, with a possible implied move of 16% in either direction according to the options market. Shares – which have staged an astonishing rally off the April 7 low of $66.12 – closed at $124.28 on Friday (just below the mid-February all-time high of $125.41).

Despite concerns about its valuation, the technical picture for Palantir is exceptionally strong, with “strong buy” signals across all timeframes from 5-minute charts to monthly analyses.

With an RSI of 72.38, the stock is in overbought territory—typically a cautionary sign, but in the context of pre-earnings momentum and strong fundamentals, this suggests powerful buying pressure.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Subscribe now and position your portfolio one step ahead of everyone else!

Stock to Sell: Ford

In contrast, Ford faces a turbulent road ahead as it prepares to release its Q1 earnings report on Monday evening at 4:05PM ET. Analysts expect lackluster results, but the bigger concern lies in the broader outlook.

As could be expected, an InvestingPro survey of analyst earnings revisions points to mounting pessimism ahead of the print, with all five of the analysts covering Ford revising their EPS estimates downward in the past 90 days.

With President Donald Trump’s proposed tariffs on automobile and auto parts imports looming, Ford is likely to slash its full-year profit and sales guidance. The company’s generous dividend, currently yielding around 7.3%, may also be at risk if financial pressures persist.

Source: InvestingPro

Wall Street projects earnings per share of $0.02, a significant decline from a profit of $0.49 per share in the same quarter last year. Revenue is forecast to fall by 16.3% year-over-year to $35.79 billion.

The primary concern looming over Ford is the potential impact of impending tariffs on cars and auto parts imports. These tariffs could increase manufacturing costs as well as vehicle prices, potentially eroding Ford’s profit margins and affecting demand.

Ford’s challenges extend beyond just policy uncertainties. The company continues to navigate the complex transition toward electric vehicles while managing legacy product lines and dealing with intense competition from both traditional rivals and new market entrants. Recent quality issues and recalls have further complicated the company’s path forward.

Source: Investing.com

According to the options market, traders are pricing in a swing of about 7% in either direction for F stock following the print. Shares –which fell below $8.50 for the first time since January 2021 last month– ended Friday’s session at $10.28.

As per InvestingPro, Ford has a Financial Health Overall Score of 2.58, which translates to a “GOOD” rating on the scale. However, the automaker’s exposure to import-dependent supply chains makes it particularly vulnerable and could weigh heavily on its stock.

Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and instantly unlock access to several market-beating features, including:

• ProPicks AI: AI-selected stock winners with proven track record.

• InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

• Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

• Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the via the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Invesco Top QQQ ETF (QBIG), and Invesco S&P 500 Equal Weight ETF (RSP).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.