Broadcom’s robust earnings outlook, driven by AI and software growth, makes it a standout buy this week.

Lululemon’s expected weak results and consumer spending concerns signal a sell.

Looking for more actionable trade ideas? Subscribe now and save 45% off InvestingPro!

Stocks on Wall Street ended lower on Friday, but the major indices notched a weekly gain and the biggest monthly increase since late 2023 as investors shook off trade war fears.

The benchmark jumped 1.9% for the week and 6.2% in May. The tech-heavy advanced 2% on the week and 9.6% for all of May, its biggest monthly gain since November 2023. Meanwhile, the rose 1.6% during the week and 3.9% for the month.

Source: Investing.com

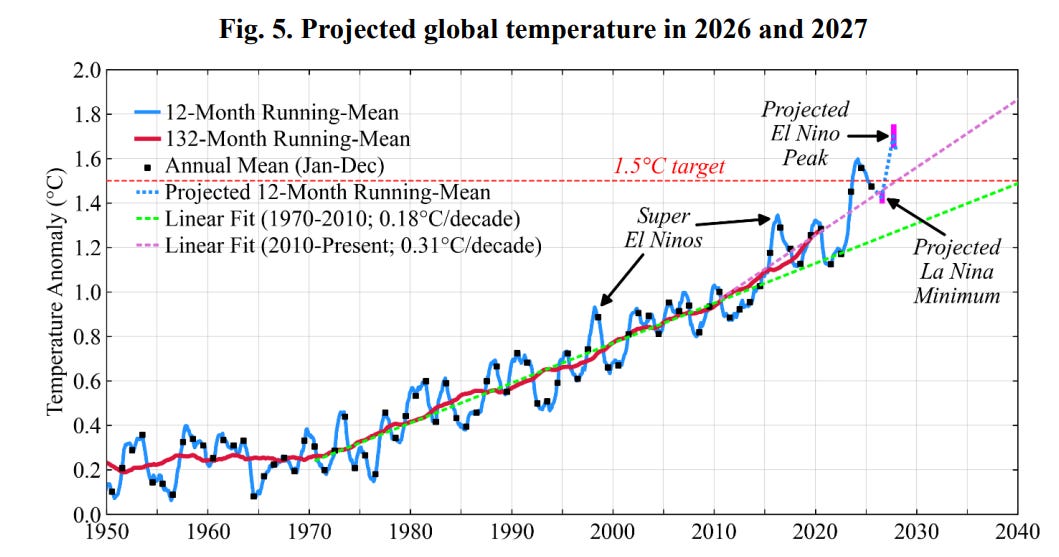

More volatility could be in store this week as investors continue to assess the outlook for the economy, inflation, interest rates and corporate earnings amid President Donald Trump’s trade war.

Most important on the calendar will be Friday’s U.S. employment report for May, which is forecast to show the economy added 130,000 positions. The unemployment rate is seen holding steady at 4.2%. Ahead of the jobs report, the ISM manufacturing and services PMIs will also be closely watched.

That will be accompanied by a heavy slate of Fed speakers, including Chairman Jerome Powell. Traders maintained bets that the U.S. central bank would cut interest rates by 25 basis points in September, as per the Investing.com .

Source: Investing.com

Elsewhere, on the earnings docket, there are just a handful of corporate results due as the Q1 reporting season draws to a close, including Broadcom (NASDAQ:), CrowdStrike (NASDAQ:), Lululemon (NASDAQ:), Dollar Tree (NASDAQ:), Dollar General (NYSE:), Five Below (NASDAQ:), and Nio (NYSE:).

Regardless of which direction the market goes, below I highlight one stock likely to be in demand and another which could see fresh downside. Remember though, my timeframe is just for the week ahead, Monday, June 2 – Friday, June 6.

Stock To Buy: Broadcom

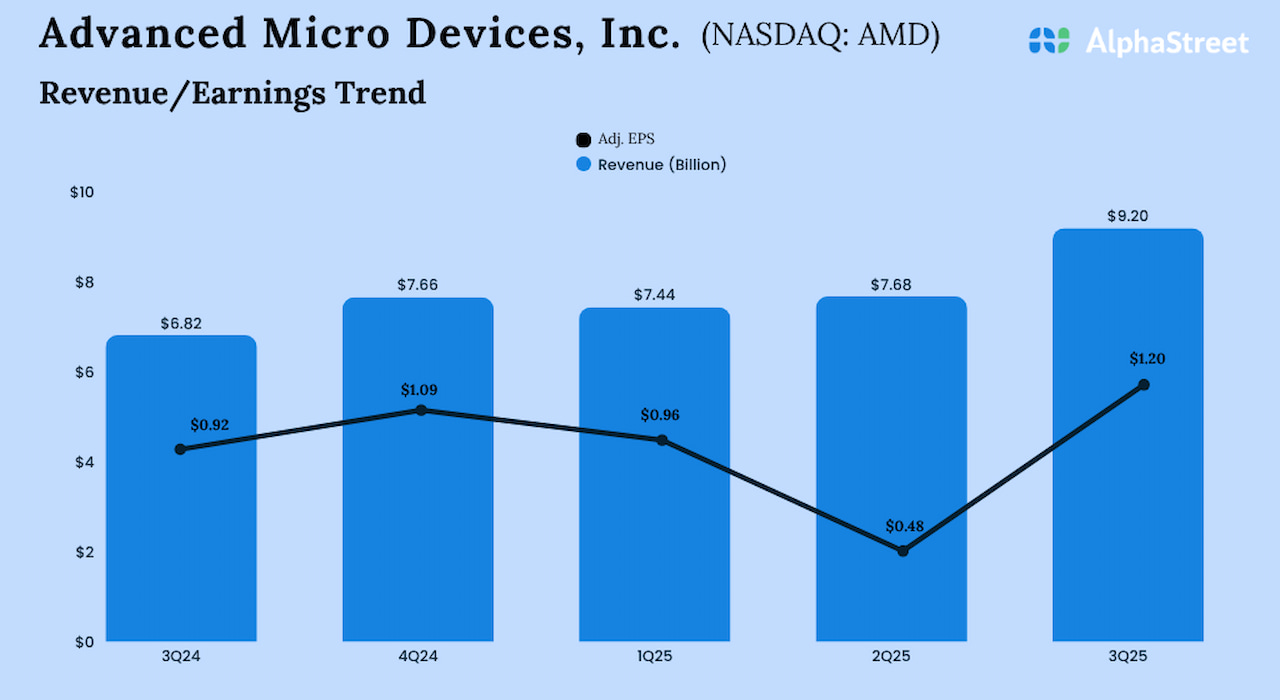

Broadcom, a leading semiconductor and software company with a market cap exceeding $1 trillion, is poised for a breakout week. The primary catalyst is its upcoming earnings report, expected to showcase robust financial performance.

The company’s fiscal Q2 report is scheduled to come out on Thursday at 4:15PM ET. Market participants expect a sizable swing in AVGO shares following the print, with options markets pricing in a potential $7 move, or roughly 8%, in either direction post-earnings.

Source: InvestingPro

Analysts expect Broadcom to deliver $1.57 per share, a robust 43% year-over-year increase, on revenue of $14.95 billion, up 20%. With data center investments continuing to accelerate globally and enterprise software spending showing resilience despite economic uncertainties, Broadcom appears well-positioned to deliver another strong quarter that could drive further appreciation in its shares.

Analyst sentiment has been notably positive heading into the print. According to InvestingPro data, all 22 of the latest analyst revisions have been to the upside, highlighting confidence in Broadcom’s continued expansion. The company’s momentum mirrors that of AI leader Nvidia (NASDAQ:), fueled by its dominance in data center infrastructure.

With a history of beating earnings estimates and a forward P/E ratio that remains attractive compared to peers, Broadcom is well-positioned for upside. Positive guidance and potential dividend increases could further boost investor confidence.

Source: Investing.com

AVGO stock ended Friday’s session at $242.07, near its 52-week high of $251.88. Shares are up just 4% year-to-date in 2025 after delivering a robust 110% total return in 2024.

InvestingPro’s AI-powered quantitative model rates Broadcom with a ‘GREAT’ Financial Health Score of 3.05, reflecting strong profit and sales growth, high gross margins (over 76%), and a long-standing record of rising dividends.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Subscribe now for 45% off and position your portfolio one step ahead of everyone else!

Stock to Sell: Lululemon

Conversely, Lululemon, a premium athleisure brand, faces a challenging week as it prepares to release earnings that are expected to disappoint. With intensifying competition in the activewear space and a lofty valuation that leaves little margin for error, LULU is vulnerable to a post-earnings sell-off.

The yoga wear retailer is scheduled to release its first quarter update after the U.S. market closes on Thursday at 4:05PM ET. According to the options market, traders are pricing in a massive swing of 8.6% in either direction for LULU stock following the print.

Source: InvestingPro

The market is bracing for weak financials, driven by a slowdown in U.S. consumer spending on discretionary items like yoga gear and sportswear. Analyst sentiment is overwhelmingly bearish with 19 downward revisions and no upward adjustments in the weeks preceding the report.

Lululemon is expected to post an annual gain of 1.6% in adjusted earnings per share to $2.58, with revenue projected to increase by 6.8% from the year-ago period to $2.36 billion. Commentary from executives on the health of the U.S. consumer will be closely watched, as any signs of prolonged weakness could rattle investor confidence.

Lululemon’s forward guidance already disappointed last quarter, and there’s a palpable risk that another underwhelming report could prompt further downgrades. The premium athletic apparel retailer, known for its $128 leggings and $68 workout tanks, faces increasing competition from both established athletic brands and fast-fashion retailers offering similar styles at lower price points.

Source: Investing.com

The technical picture for Lululemon stock has deteriorated as well, with shares underperforming the broader market and key retail indices year-to-date. LULU stock closed at $316.47 on Friday, well below its 52-week high of $423.32.

As per InvestingPro research, recent analyst commentary paints a picture of declining momentum. Morgan Stanley cut its price target, and BNP Paribas (OTC:) downgraded to Underperform, warning of shrinking margins and pricing pressures.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now for 45% off and instantly unlock access to several market-beating features, including:

ProPicks AI: AI-selected stock winners with proven track record.

InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the via the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Invesco Top QQQ ETF (QBIG), and Invesco S&P 500 Equal Weight ETF (RSP).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.