Updated on October 24th, 2025 by Bob Ciura

Business Development Companies — or BDCs, for short — allow investors to generate income with the potential for robust total returns while minimizing the tax paid at the corporate level.

Despite these advantages, investors generally avoid business development companies. This may be due to the tax implications of their distributions for their shareholders. But even with the added headache come tax time, BDCs can still be worthwhile for income investors.

Prospect Capital Corporation (PSEC) is one of the more attractive business development companies in the market today.

Prospect stands out from the crowd in that it pays monthly dividends, giving its shareholders a steady and predictable passive income stream, which is highly appealing to income investors.

There are currently just 78 monthly dividend stocks. You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter, like dividend yield and payout ratio) by clicking on the link below:

Prospect Capital’s dividend yield is over 19%, more than ten times that of the average S&P 500 Index. Our full list of stocks with 5%+ dividend yields is here.

Prospect’s high dividend yield and monthly dividend payments are two of the reasons why the company merits further research. This article will discuss the investment prospects of Prospect Capital Corporation in detail.

Business Overview

Prospect Capital Corporation is a Business Development Company founded in 2004. It is one of the largest, with a market cap of almost $1.3 billion.

Prospect Capital is a leading provider of private equity and private debt financing for middle-market companies, broadly defined as a company with between 100 and 2,000 employees.

Prospect Capital benefits from operating in the middle market because it lacks competition from larger, more established lenders.

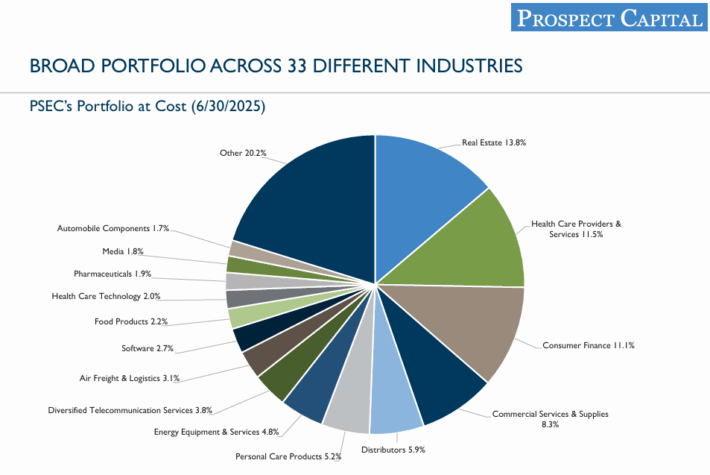

Source: Investor Presentation

Middle-market companies are generally too small to be customers of commercial banks but too large to be served by the small business representatives of retail banks. Prospect Capital does business in the “sweet spot” between these two services. This lack of competition in this sector has allowed Prospect Capital to finance some truly attractive deals.

Investors should note that Prospect Capital is highly exposed to volatile interest rates. This is because the company’s liabilities are nearly all at fixed rates, while its investments are nearly all floating-rate instruments. That means interest expense is largely fixed, while interest income rises and falls commensurately with prevailing interest rates.

As interest rates rise, the revenues from Prospects floating-rate interest-bearing assets will increase. At the same time, Prospect’s interest expense will remain constant since most of its debt is fixed. Of course, the opposite is true, as falling rates generally mean declining interest income.

This makes Prospect Capital a great portfolio hedge against interest-sensitive securities like REITs and utilities, but it underperforms when rates are very low and when rates are declining.

Prospect Capital’s flexible origination mix is also a meaningful positive from an investor’s perspective, given that the wide variety of instruments it uses to produce income helps it find the best opportunities.

The company has many different ways to invest with target companies, including different types of debt and equity. They all have different risk levels and rates of return.

Prospect Capital’s willingness to seek out the best instruments — and having the scale to do so — is a major advantage over other middle-market BDCs. The company’s investment strategy is central to its long-term growth.

Growth Prospects

Prospect Capital’s growth prospects stem largely from the company’s ability to:

Raise new capital via debt or equity offerings

Invest this new capital in deal originations with an internal rate of return higher than the cost of capital raised in Step 1

Prospect’s ability to source new deals that offer appropriate risk-adjusted returns is the most important part of this process.

Fortunately for the company (and its investors), there is no shortage of new deals for Prospect’s consideration. The company has thousands of deal opportunities each year, allowing it to be very selective in its investment decision-making.

Prospect posted fourth quarter and full-year results on August 26th, 2025, and results were weak once again as the company continues to struggle. Net interest income for the quarter was 17 cents per share. NII was down from 25 cents from the same period a year ago. Total revenue plummeted 21% year-over-year to $167 million.

Total originations were $271 million, up from $196 million in the prior quarter. Total repayments and sales were $445 million, up from just $192 million in Q3. Net originations, then, fell from $4 million in Q3 to -$175 million in the final quarter of the year, shrinking the company’s portfolio to $6.67 billion. That’s down from $7.72 billion a year ago.

Annualized current yield for all investments rose to 9.6% from 9.2% in Q3, but lower from 9.8% a year ago. Nonaccrual loans were 0.3% of total assets from 0.6% in Q3. NAV was $6.56 per share, down from $7.25 in Q3 and $8.74 in last year’s Q4.

Dividend Analysis

Prospect Capital’s dividend is the obvious reason investors would choose to own the stock, so it is critical that the dividend is as safe as possible. As a BDC, Prospect Capital has no choice but to distribute essentially all of its taxable income to shareholders. Because of this, its payout ratio will always be very high and sometimes variable.

In other words, the dividend is actually covered by net investment income and has been for some time, meaning the payout should be relatively safe, barring a sizable impact from any potential economic downturn.

The company has declared 4.6 billion in cumulative distributions to shareholders since its IPO.

Clearly, the draw for Prospect Capital is in its ability to generate cash to return to shareholders, and over time, it has done that well.

The dividend appears safe for now, but investors should continuously monitor the company’s net investment income for any signs of trouble that could potentially lead to further cuts down the road.

Related: 3 Reasons Why Companies Cut Their Dividends (With Examples)

Final Thoughts

Prospect Capital’s high dividend yield and monthly distributions are two of the main reasons an investor might take an interest in this stock.

Taking a closer look reveals that this BDC has a high-caliber leadership team and has positioned itself to thrive in most environments.

However, the dividend appears to be on shaky financial ground, meaning Prospect is only worth a look for those investors seeking high levels of current income and monthly payments, plus stomach the inherent risks of owning a BDC.

Don’t miss the resources below for more monthly dividend stock investing research.

And see the resources below for more compelling investment ideas for dividend growth stocks and/or high-yield investment securities.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].