Published on April 11th, 2025 by Nathan Parsh

Companies that pay monthly dividends can help investors secure consistent cash flows, providing income more regularly than those that pay quarterly or annual payments.

That said, just 76 companies currently offer monthly dividend payments, which can severely limit an investor’s options. You can see all 76 monthly dividend-paying names here.

You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter, like dividend yield and payout ratio) by clicking on the link below:

One name that we have not yet reviewed is Savaria Corporation (SISXF), a Canadian-based company that operates in the accessibility industry. Shares currently yield more than 3.6%, which is more than twice the average yield of the S&P 500 Index.

This article will evaluate the company, its business model, and its dividend to determine whether Savaria Corporation is a good candidate for purchase.

Business Overview

Savaria Corporation is a specialty industrial machinery company that provides accessibility solutions for the elderly and disabled. Though the company has a market capitalization of just $789 million, Savaria Corporation has a solid global footprint.

The company operates in Canada, the U.S., the U.K., Germany, China, and Italy. Savaria Corporation has more than 1 million square feet of production space, 30 direct sales offices, and 17 product and distribution centers.

Savaria Corporation comprises several business segments, including Accessibility, Patient Care, and Adapted Vehicles.

Accessibility manufactures products such as stairlifts for straight and curved staircases and wheelchair platform lifts. This segment contributes ~70% of revenue. Patient Care, which accounts for 21% of revenue, manufactures and markets therapeutic support surfaces for medical beds and other medical equipment. Adapted Vehicles produces vehicles for use by patients with mobility difficulties. This segment is the smallest within the company, making up less than 10% of total revenue. The company was founded in 1979 and is based in Laval, Quebec, Canada.

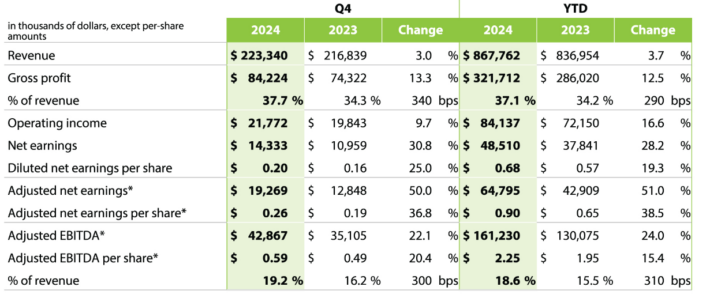

The company reported solid financial results for the fourth quarter of 2024.

Source: Fourth Quarter Earnings Results

Revenue reached $223.3 million, an increase of 3.0% compared to Q4 2023. This growth was driven by 0.9% organic growth and a 2.1% positive foreign exchange impact. The company’s Accessibility segment had 3.4% organic growth during the quarter, while the Patient Care segment improved 4.5%. Gross profit rose by 12.5%, and operating income improved by 16.6%, reflecting higher margins and increased efficiency.

Savaria’s adjusted EBITDA for the quarter was $42.87 million, up 22.1% from the previous year, with an adjusted EBITDA margin of 19.2%. The Accessibility segment had a particularly strong performance, with an adjusted EBITDA margin of 19.8%. Patient Care maintained a healthy 19.1% margin. Additionally, Savaria reduced its net debt ratio to 1.63, signaling improved financial health and liquidity, with available funds of $242.8 million for future investments and growth.

Growth Prospects

Savaria Corporation has a number of tailwinds that should help the company continue to grow. First, the company’s main markets are seeing elderly people make up a higher percentage of the total population. In the U.S. alone, those over 65 are projected to make up more than 20% of the population by 2030. People in this age group tend to require more assistance with mobility.

Next, the vast majority of older people wish to remain in their homes. According to AARP, nearly 80% of people over 50 want to stay in their homes as they age. More than two-thirds say that their properties have accessibility issues inside and outside the home. Savaria should be able to capitalize on this trend as it buys up smaller players in the industry.

Source: Investor Presentation

Savaria Corporation estimates that the global long-term market will grow at 6% annually through 2030, a solid, if not spectacular, growth rate. By the end of this decade, the U.S. is forecasted to have more than 20 million people requiring long-term care.

Given that people live longer, want to remain in their homes, and have accessibility challenges, a company like Savaria Corporation is poised to benefit from product demand.

The company offers a variety of products, from chair lifts to vehicles to beds, that can greatly improve the quality of life for customers. This can also help people remain in their homes instead of entering an adult care center, which can be much more expensive than the products that Savaria Corporation markets. People wishing to remain in their home could very well be willing to purchase a product if it means that they can continue to live as they have.

Dividend Analysis

Savaria Corporation began paying an annual dividend before switching to a quarterly dividend in 2013. By late 2017, the company converted to its current monthly payment schedule.

Payments have fluctuated for U.S. investors due to currency exchange, but the size of the dividend has gradually increased over the years. U.S. investors received $0.37 in annual dividends in 2024 and are expected to receive $0.39 in 2025. For the most part, dividend growth has been very low over the last five years. We do not anticipate that this will change.

The dividend hasn’t increased materially in the past and is not forecasted to do so in the near future due to the high payout ratio. Last year, Savaria Corporation’s payout ratio was 79%. It should be noted that the company has raised its dividend for 12 consecutive years in local currency.

With results showing signs of growth, the dividend is likely safe. A downturn in the business could call that into question, especially considering the debt on the company’s balance sheet.

The annualized rate of $0.39 for U.S. investors results in a 3.6% yield.

Final Thoughts

Savaria Corporation is a small, monthly dividend-paying company that is well-positioned to take advantage of people who are living longer. With most people wanting to remain in their homes, tackling accessibility and mobility challenges will likely be a significant industry in the coming decade.

This positions the company in an advantageous spot. A growing business should help defend its dividends and provide the capital needed to pay down debt to a much more manageable level. Lower debt would also help to protect the dividend. Investors looking for monthly income and access to a growing population might find Savaria Corporation an attractive investment option.

Don’t miss the resources below for more monthly dividend stock investing research.

And see the resources below for more compelling investment ideas for dividend growth stocks and/or high-yield investment securities.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].