Updated on April 17th, 2025 by Nathan Parsh

Investors seeking high yields may consider purchasing shares of Business Development Companies, also known as BDCs. These stocks frequently have a higher dividend yield than the broader stock market average.

Some BDCs even pay monthly dividends.

You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter, like dividend yield and payout ratio) by clicking on the link below:

Oxford Square Capital Corporation (OXSQ) is a Business Development Company (BDC) that pays a monthly dividend. Oxford Square is also a highly yielding stock, with a yield of nearly 17% based on expected dividends for fiscal 2025. This is 12 times the average yield of the S&P 500.

However, investors should always keep in mind that the sustainability of a dividend is just as important, if not more so, than the yield itself.

BDCs often provide high levels of income, but many (including Oxford Square) have trouble maintaining their dividends, particularly during recessions. This article will examine the company’s business, growth prospects, and evaluate the safety of the dividend.

Business Overview

Oxford Square Capital Corp. is a Business Development Company (BDC) specializing in financing early- and middle-stage businesses through loans and Collateralized Loan Obligations (CLOs). You can see our full BDC list here.

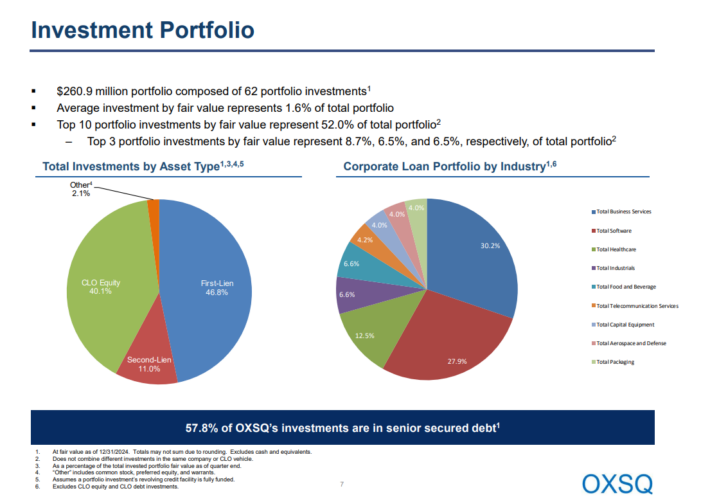

The company holds a well-diversified portfolio of First–Lien, Second–Lien, and CLO equity assets spread across seven industries, with the highest exposure in business services and software, at 30.2% and 27.9%, respectively.

Source: Investor presentation

On February 28, 2025, Oxford Square announced its Q4 and 2024 results for the period ended December 31, 2024.

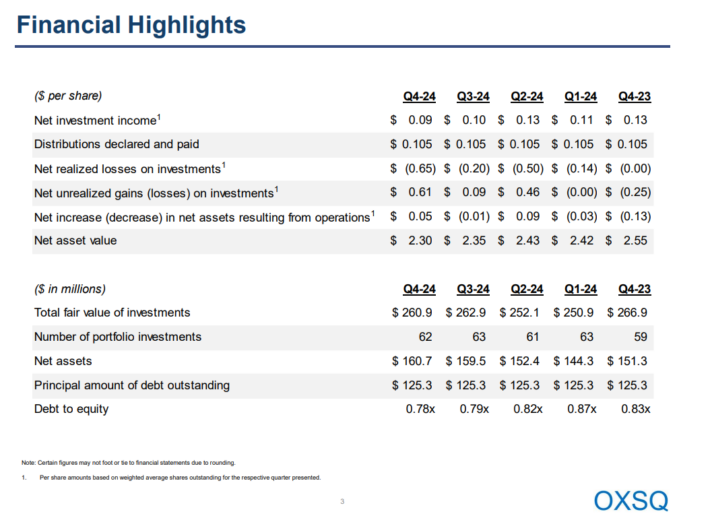

Source: Investor presentation

The company reported total investment income of $42.7 million for the year, a decrease of $9.1 million from the previous year. This decline was primarily due to a reduction in interest income from debt investments.

The weighted average yield on debt investments improved to 15.8% from 13.3% in the previous year. The cash distribution yield on cash income-producing CLO equity investments rose slightly to 16.2% from 15.3% on a sequential basis. The effective yield on CLO equity investments was 8.8%, down marginally from 9.6% in Q3 2024.

Total expenses were $16.2 million for the year, down significantly from $24.5 million in the prior year due to the absence of incentive fees.

As a result, net investment income (NII) totaled $26.4 million, or $0.42 per share, compared to $27.4 million, or $0.48 per share, in the previous year. The company’s net asset value (NAV) per share of $2.30 was down from $2.55 a year ago. Based on its current portfolio, Oxford Square projects to have a full-year 2025 investment income per share (IIS) of $0.42.

Growth Prospects

The company’s investment income per share had been declining at an alarming rate, as financing became cheaper, preventing Oxford Square from refinancing at its previously higher rates. Additionally, the company has historically over-distributed dividends to shareholders, thereby eroding its NAV and future income generation due to reduced asset holdings.

Considering that the Fed has not cut interest rates due to the current economic uncertainty, we expect Oxford Square to generate stable investment income per share in the near term.

The 2020 dividend cut should enable Oxford Square to retain some cash, hopefully allowing it to start regrowing its NAV. With rates unlikely to continue moving any lower for the moment, income generation should stabilize.

With investment across a wide breadth of different industries, Oxford Square has a reasonably balanced portfolio. The company’s top three industries do make up most of the portfolio, but they are in different areas of the economy. This provides some protection in the event of a downturn in one industry.

However, if rates decline over time, the company’s receivables could be further pressured, worsening its financial performance annually. Overall, we believe that the company’s future investment income generation carries substantial risks, while a potential recession and an adverse economic environment could severely damage its interest income.

Dividend Analysis

Oxford Square only recently began paying a monthly dividend, with the first being distributed in April 2019. Total dividends paid over the past few years are listed below:

2015 dividends: $1.14

2016 dividends: $1.16 (1.8% increase)

2017 dividends: $0.80 (31% decline)

2018 dividends: $0.80 (no increase)

2019 dividends: $0.80 (no increase)

2020 dividends: $0.6120 (23.5% decline)

2021 dividends: $0.42 (31.4% decline)

2022 dividends: $0.42 (Flat)

2023 dividends: $0.54(28.5% increase)

2024 dividends: $0.42 (22% decline)

Shareholders received a small increase in 2016, followed by three large dividend reductions since 2017. This inconsistency in dividend payout is due to the company’s volatile financial performance. Last year’s dividend total was negatively impacted by the absence of a $0.12 per share special dividend that occurred in 2023. The monthly payment has remained the same since the 2020 cut.

Oxford Square currently pays a monthly dividend of $0.035 per share, equaling an annualized payout of $0.42 per share.

Based on a full-year payout of $0.42 per share, Oxford Square stock yields 16.9%. Although the dividend cuts in recent years have been substantial, the dividend yield remains remarkably high. That said, investors should not focus solely on yield; dividend safety is a crucial consideration for income investors, and in this regard, Oxford Square leaves a lot to be desired.

Based on our expectation of a full-year investment income per share of $0.42 for 2025, the company is projected to maintain a 100% dividend payout ratio for 2025. However, if investment income declines from current levels, another dividend cut could result.

Final Thoughts

Oxford Square boasts a robust business model, characterized by diversification across various investment assets and industries. The company has also taken steps to build up its less risky asset position while decreasing its reliance on riskier CLOs.

That said, Sure Dividend recommends that risk-averse investors avoid Oxford Square. We believe that the dividend does not offer enough safety. The company distributes essentially all of its investment income, leaving little room for maneuver. Any decline in investment income could lead to further dividend cuts, making Oxford Square a less attractive investment option for investors seeking stable and secure sources of income.

Don’t miss the resources below for more monthly dividend stock investing research.

And see the resources below for more compelling investment ideas for dividend growth stocks and/or high-yield investment securities.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].