Updated on April 22nd, 2025 by Nathan Parsh

H&R Real Estate Investment Trust (HRUFF) has three appealing investment characteristics:

#1: It is a REIT, so it has a favorable tax structure and pays out the majority of its earnings as dividends.Related: List of publicly traded REITs

#2: It offers an above-average dividend yield of 6.2%, nearly eight times the 0.8% yield of the S&P 500.

#3: It pays dividends monthly instead of quarterly.Related: List of monthly dividend stocks

You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter, like dividend yield and payout ratio) by clicking on the link below:

H&R Real Estate Investment Trust’s trifecta of favorable tax status as a REIT, an above-average dividend yield, and a monthly dividend makes it appealing to individual investors.

But there’s more to the company than just these factors. Keep reading this article to learn more about H&R Real Estate Investment Trust.

Business Overview

H&R REIT is one of the largest real estate investment trusts in Canada, with total assets of approximately $7.4 billion. It owns a portfolio of high-quality office, retail, industrial, and residential properties in North America, with a total leasable area of more than 26 million square feet.

H&R REIT is undergoing a major transformation. It is divesting its grocery-anchored and essential service retail properties and office properties to focus exclusively on residential and industrial properties.

Source: Investor Presentation

The REIT aims to become a high-growth platform for residential and industrial properties. Management expects the asset portfolio to consist of approximately 80% residential and 20% industrial properties by the end of 2026.

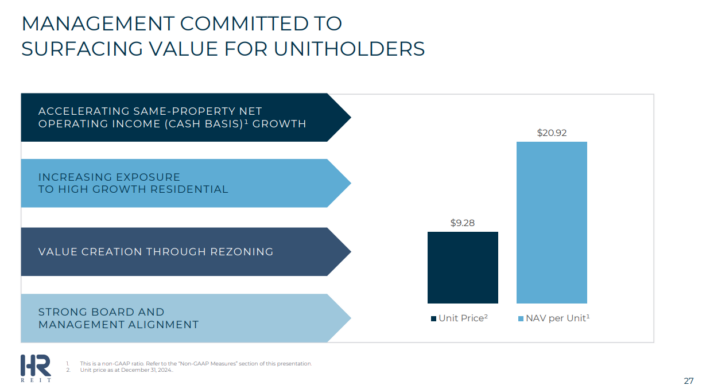

H&R REIT has some attractive characteristics for prospective investors. Its management owns a significant stake in the company, and hence, its interests are aligned with those of the unitholders.

Source: Investor Presentation

In addition, the REIT is increasing its exposure to residential properties, which have promising growth prospects. Management also expects to enhance unitholder value through meaningful unit repurchases, as the stock price of approximately $7 is significantly below the REIT’s net asset value of $20.92.

Due to the sensitivity of its industrial and office properties to the underlying economic conditions, H&R REIT proved vulnerable to the coronavirus crisis, in contrast to other REITs, which have more defensive types of properties, such as healthcare, residential, and self-storage properties. In 2020, H&R REIT posted negative funds from operations (FFO) per unit of -$1.7,1, and thus it reported its first loss in a decade.

On the bright side, the pandemic has subsided, and hence, the REIT has recovered from this crisis. Thanks to the strong demand for its properties, it posted FFO per unit of $1.64 in 2021 and a 10-year high of $2.29 in 2022.

The company reported its Q4 2024 results on February 12, 2025, showing an overall portfolio occupancy of 95.5%.

Net operating income dropped by 2.8% year-over-year due to property sales in 2023 and 2024. However, same-property net operating income on a cash basis increased by 1.3%, led by stronger performance in industrial and retail sectors. The REIT’s Funds From Operations (FFO) per unit was $0.66 for the year, down from $0.84 in 2023. Unitholders’ equity per unit stood at nearly $21 as of December 31st, 2024.

H&R’s debt-to-total assets ratio remained stable at 43.7%, while liquidity stood at $944 million. The REIT’s strategic plan, focused on repositioning towards residential and industrial properties, has resulted in significant sales, including the completion of property transactions totaling $700 million since the end of 2023. Significant disposals include the sale of 25 Dockside Drive in Toronto, as well as several industrial and residential land parcels. H&R continues to advance its rezoning efforts, aiming to convert office properties into residential developments.

Additionally, H&R has initiated new developments, including the creation of Lantower Residential Real Estate Development Trust (No. 1), which has raised U.S. $52 million in equity for residential projects in Florida. The REIT also continues to focus on leasing activity, completing lease renewals on several industrial properties across Canada. H&R remains committed to executing its long-term growth strategy, despite facing economic challenges and market volatility.

Growth Prospects

H&R REIT has exhibited a volatile performance record, partly due to fluctuations in the exchange rate between the Canadian dollar and the USD. In USD, FFO had declined 5.3% annually over the last decade.

That said, the REIT has a promising pipeline of growth projects in Austin, Dallas, Miami, and Tampa. These areas are characterized by superior population and economic growth when compared to the rest of the country. Given the ample room for new properties in these markets, H&R REIT is likely to continue growing its FFO per unit significantly for many years to come.

On the other hand, just like most REITs, H&R REIT is currently facing a headwind due to the adverse environment of high interest rates, which are likely to increase the burden of the interest expense on the trust.

Nevertheless, it is hard to estimate the impact of high interest rates on H&R REIT, as the trust’s interest expense has decreased sharply in recent quarters thanks to the extensive divestment of properties. In addition, investors should exercise caution in their growth expectations, given the extensive divestment of properties during the REIT’s ongoing transformation. Overall, we expect the FFO growth to remain flat over the next five years.

Dividend & Valuation Analysis

H&R REIT is currently offering a 6.2% dividend yield. It is thus an interesting candidate for income-oriented investors. Still, the latter should be aware that the dividend may fluctuate significantly over time due to the fluctuations in exchange rates between the Canadian dollar and the USD.

Notably, the REIT has a payout ratio of only 52% for the current year, which is one of the lowest payout ratios in the REIT universe. Given its solid business model and healthy interest coverage of approximately 4, the REIT can easily cover its dividend. To cut a long story short, investors can secure a dividend yield of 6% or more and rest assured that the dividend has a wide margin of safety.

Taking into account the stable FFO-per-unit growth, the 6.2% dividend, and a 5.5% annualized compression in the valuation level, H&R REIT could offer just 1.6% average annual total return over the next five years. This is not an attractive expected return, especially for investors who prioritize total returns. We note that the stock is suitable only for patient investors who are comfortable with the risks associated with the ongoing transformation of the trust.

Final Thoughts

H&R REIT has a solid business model in place, primarily thanks to the strong demand for its properties in the markets it serves. The stock offers an attractive dividend yield accompanied by a very low payout ratio, making it a suitable candidate for the portfolios of income-oriented investors.

On the other hand, investors should be aware of the risk associated with the REIT’s somewhat weak balance sheet and its ongoing transformation, which may lead to some volatility in the REIT’s results going forward. Moreover, H&R REIT is characterized by exceptionally low trading volume. Therefore, we rate shares of H&R REIT as a sell.

Don’t miss the resources below for more monthly dividend stock investing research.

And see the resources below for more compelling investment ideas for dividend growth stocks and/or high-yield investment securities.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].