Updated on April 7th, 2025 by Nathan Parsh

It is not hard to see why Business Development Companies—or BDCs—are popular investments among income investors. Considering that the S&P 500 Index currently has an average dividend yield of just 1.5%, these high-yield stocks are very appealing by comparison.

BDCs typically offer very high dividend yields. Gladstone Investment Corporation (GAIN) is a BDC with a current dividend yield of 7.8%, with occasional supplemental dividend payouts pushing the yield even higher.

GAIN is one of 76 monthly dividend stocks and one of a select few that pays its dividend each month rather than each quarter.

We have compiled a full list of all monthly dividend stocks. You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter like dividend yield and payout ratio) by clicking on the link below:

GAIN stock combines a high yield with monthly payouts, which on the surface is very attractive for income investors. But of course, investors should assess the quality of GAIN’s business, its future growth potential, and the sustainability of the dividend before buying shares.

This article will discuss GAIN’s business model and whether the high dividend yield is too good to be true.

Business Overview

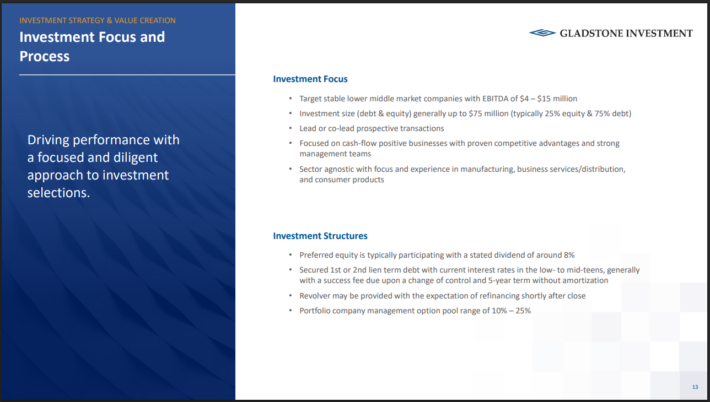

GAIN is a Business Development Company that invests in small and medium privately held companies at an early stage of development. These companies usually have annual EBITDA in the range of $4 million to $15 million.

A rundown of GAIN’s investment process can be seen in the image below:

Source: Investor Presentation

The trust’s debt investments primarily consist of senior term loans, senior subordinated loans, and junior subordinated loans.

On the equity side, investments primarily consist of preferred or common stock or options to acquire stock. Equity investments are usually made in anticipation of a buyout or some form of recapitalization. They are made in the lower-middle market segment, meaning medium-sized companies. GAIN intends to split its portfolio between debt and equity investments by 75%- 25%.

GAIN makes money in two ways. First, when its investments are successful, it will realize capital gains. In addition, it receives interest and dividend income from securities held.

The company aims to invest in businesses that provide stable earnings and cash flow, which GAIN can use to pay operating expenses, meet its debt obligations, and distribute to shareholders with residual cash flow. Gladstone Investment released its Q3 2024 earnings on February 13th, 2025, reporting a total investment income of $21.4 million, a 7.4% drop from the previous year and 5.3% less than Q3 2024.

The company’s adjusted net investment income per share of $0.23 fell from $0.26 year over year and was down slightly from $0.24 on a sequential basis. However, its net asset value per share of $13.30 was up from $13.01 in the prior year and up $12.49 quarter over quarter. Gladstone’s net investment income per share is expected to see a modest decline this year compared to 2023.

Growth Prospects

GAIN’s investment strategy has been successful over the past several years. Over the last five years, its profits have grown at a mid-single-digit CAGR, which is not bad at all for such a high-yielding investment.

Gladstone Investment makes its money via spreads between the interest rates the company pays on cash that it borrows, and the interest rates the company receives on cash that it lends – the same principle as with banks. Despite declining interest rates in the last couple years, Gladstone Investment’s weighted average investment interest yield has held up very well; the company generated a yield of around 14% in the most recent quarter.

Higher loan losses caused by worsening economic conditions will cause a short-term headwind, but we do not see this impacting profitability in the long run.

In addition, the bulk of GAIN’s debt portfolio is variable rate, with a floor or minimum. This will help protect interest income in a high-rate environment. Given the company’s history of proven results, continued growth going forward will rely on the successful implementation of the investment strategy, which appears likely.

We expect 3% annual NII-per-share growth over the next five years, which we believe is a reasonable estimate of future growth given all of the above factors. GAIN shareholders benefit from the company’s strong investment performance, although whether this performance would hold up in a severe recession is a different question.

Competitive Advantages & Recession Performance

GAIN also has a durable competitive advantage due to its unique expertise in the lower middle market private debt and equity segment. Lower middle market companies are broadly defined as those with annual revenue between $5 million and $50 million.

This segment is generally too small for commercial banks to lend to, but too large for the small business representatives of retail banks to lend to. GAIN fills this gap. By putting money to work in this unloved group of private companies, GAIN can realize outsized returns compared to its larger commercial bank counterparts.

Listed below is GAIN’s net-investment-income-per-share and distribution per share both before, during and after the last recession:

Net-investment-income-per-share 2007 – $0.67

Net-investment-income-per-share 2008 – $0.79 (18% increase)

Net-investment-income-per-share 2009 – $0.62 (22% decrease)

Net-investment-income-per-share 2010 – $0.48 (23% decrease)

The company’s historical distributable net income during the Great Recession is shown below:

Distributable-net-investment-income 2007 – $0.85

Distributable-net-investment-income 2008 – $0.93 (9% increase)

Distributable-net-investment-income 2009 – $0.96 (3% increase)

Distributable-net-investment-income 2010 – $0.48 (50% decrease)

GAIN saw severe net investment income per share declines during the last recession, though the company returned to growth by 2011. Since then, results for this metric have varied from year to year.

In 2020, as the coronavirus pandemic sent the U.S. economy into recession, GAIN’s NII-per-share declined 23%, but the company could maintain its monthly dividend payments. The company then increased its dividend by 6.7% in October 2022.

Dividend Analysis

BDCs like GAIN can pay high dividends because of their favorable tax structure. GAIN qualifies as a regulated investment company. As such, it is generally not subject to income taxes, so long as it distributes taxable income to shareholders.

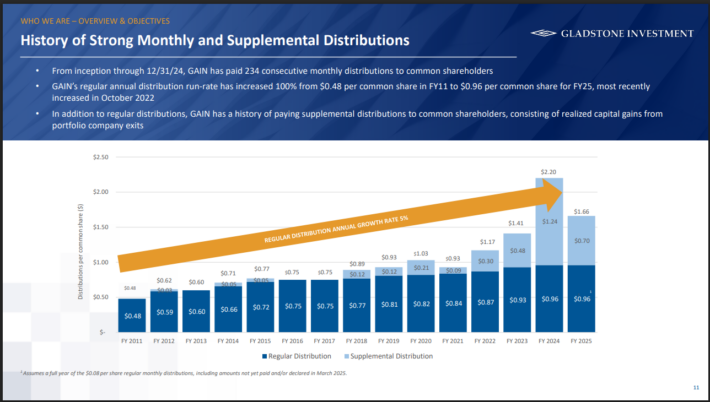

GAIN is an attractive stock for dividend investors. It currently pays a monthly dividend of $0.08 per share. On an annualized basis, the $0.96 per-share dividend represents a 7.8% current dividend yield.

The company has a long history of generating consistent dividend payments to shareholders.

Source: Investor Presentation

Not only that, but GAIN also provides supplemental dividends from undistributed capital gains and investment income. For example, on September 17th, 2024, the company declared a supplemental dividend payout of $0.70 per share. This is, of course, in addition to the regular monthly dividends paid.

GAIN has a pretty conservative capital structure, which helps secure the dividend. Gladstone Investment’s dividend payout ratio, relative to its net investment income, has been close to or above 100% for several years over the last decade.

The company is usually more profitable than the net investment income metric suggests. Gladstone Investment can also generate gains from its equity investments, which are not reflected in the net investment income metric.

Final Thoughts

GAIN’s strongest competitive advantage is its investment strategy, which is to make long-term investments in high-quality businesses, with strong management teams. This has produced strong results for GAIN since inception.

Plus, shareholders can expect GAIN to make supplemental dividend payments when its investment strategy performs well. Therefore, GAIN is a high dividend stock that has appeal for investors primarily concerned with income.

Don’t miss the resources below for more monthly dividend stock investing research.

And see the resources below for more compelling investment ideas for dividend growth stocks and/or high-yield investment securities.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].