Updated on May 22nd, 2025 by Bob Ciura

AGNC Investment Corp (AGNC) has an extremely high dividend yield of above 16%. In terms of current dividend yield, AGNC is near the very top of our list of high-yield dividend stocks.

In addition, AGNC pays its dividend each month rather than quarterly or semi-annually. Monthly dividends allow investors to compound dividends even faster.

There are 76 monthly dividend stocks in our database.

You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter like dividend yields and payout ratios) by clicking on the link below:

That said, investors should also assess the sustainability of such a high dividend yield, as yields in excess of 10% are often a sign of fundamental business challenges.

Double-digit dividend yields often signal that investors do not believe the dividend is sustainable and are pricing the stock in anticipation of a cut to the dividend.

This article will discuss AGNC’s business model and whether the stock appeals to income-oriented investors.

Business Overview

AGNC was founded in 2008 and is an internally managed REIT. Unlike most REITs, which own physical properties that are leased to tenants, AGNC has a different business model. It operates in a niche of the REIT market: mortgage securities.

AGNC invests in agency mortgage-backed securities. It generates income by collecting interest on its invested assets, minus borrowing costs. It also records gains or losses from its investments and hedging practices.

Agency securities have principal and interest payments guaranteed by either a government-sponsored entity or the government itself. They theoretically carry less risk than private mortgages.

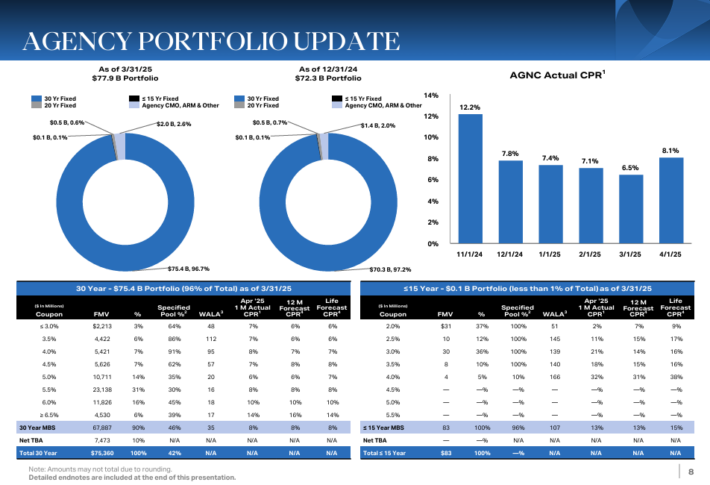

Source: Investor Presentation

The trust employs significant amounts of leverage to invest in these securities, boosting its ability to generate interest income. AGNC borrows primarily on a collateralized basis through securities structured as repurchase agreements.

The trust’s goal is to build value via monthly dividends and net asset value accretion. AGNC has done well with its dividends over time, but net asset value creation has sometimes proven elusive.

Indeed, the trust has paid over $48 of total dividends per share since its IPO; the share price today is just over $8.70. That sort of track record is extraordinary and is why some investors are drawn to the stock.

In other words, the trust has distributed cash per-share to shareholders of more than five times the stock’s current value.

On April 22, 2025, AGNC Investment Corp. reported its financial results for the first quarter of 2025. The company announced a comprehensive income of $0.12 per common share, which included $0.02 in net income and $0.10 in other comprehensive income.

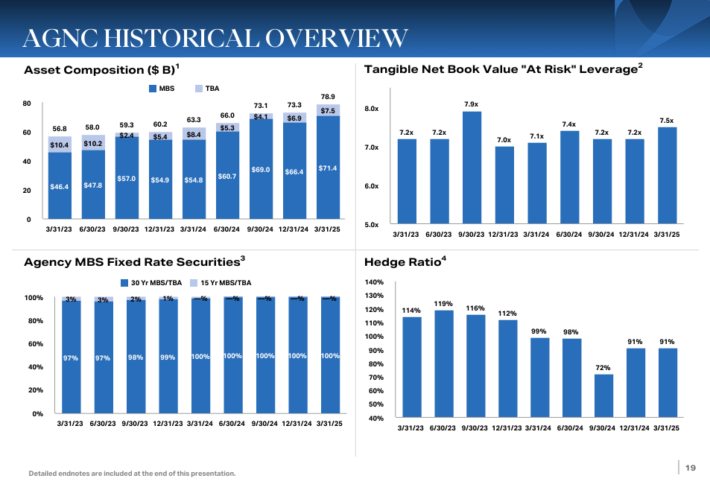

The tangible net book value per common share decreased by 1.9% from the previous quarter, ending at $8.25 as of March 31, 2025. AGNC achieved a 2.4% economic return on tangible common equity for the quarter, comprising $0.36 in dividends declared and a $0.16 decline in tangible book value.

The company’s net spread and dollar roll income was $0.44 per share, an increase from $0.37 in the prior quarter, reflecting improved earnings from its investment portfolio.

The average asset yield stood at 4.78%, while the net interest spread was 2.12%. AGNC maintained a leverage ratio of 7.5x tangible net book value and held $6.0 billion in unencumbered cash and Agency MBS.

Growth Prospects

The major drawback to mortgage REITs is that rising interest rates negatively impact the business model. AGNC makes money by borrowing at short-term rates, lending at long-term rates, and pocketing the difference. Mortgage REITs are also highly leveraged to amplify returns.

It is common for mortgage REITs to have leverage rates of 5x or more because spreads on these securities tend to be quite tight. AGNC currently has a leverage ratio of 7.5x.

In a rising interest-rate environment, mortgage REITs typically see the value of their investments reduced. Higher rates usually cause their interest margins to contract, as the payment received is fixed in most cases, whereas borrowing costs are variable.

Interest rates surged to 23-year highs last year as central banks around the world hiked rates aggressively to reduce inflation. The trust’s book value contracted in recent quarters as a result of these moves.

Overall, the high payout ratio and the volatile nature of the business model will harm earnings-per-share growth. We also believe that dividend growth will be anemic for the foreseeable future.

On the bright side, inflation has finally moderated in most developed countries, including the U.S. As a result, the Fed just began reducing interest rates and expects to reduce further, from 4.75%-5.0% to 2.75%-3.0% by 2026. If inflation does not rebound, the Fed will likely execute as per its guidance.

In that case, AGNC will enjoy a strong tailwind in its business, as its borrowing costs will decrease and its interest margins will expand.

Dividend Analysis

AGNC has declared monthly dividends of $0.12 per share since April 2020. This means that AGNC has an annualized payout of $1.44 per share, which equals an extremely high current yield of 16.3% based on the current share price.

Source: Investor Presentation

High yields can be a sign of elevated risk. AGNC’s dividend does carry significant risk. AGNC has reduced its dividend several times over the past decade.

We do not see a dividend cut as an imminent risk at this point, given that the payout was fairly recently cut to account for unfavorable interest rate movements and that AGNC’s net asset value appears to have stabilized.

Management has taken the necessary steps to protect its interest income, so we don’t see another dividend cut in the near term, particularly given that the Fed’s expected interest rate reductions over the next three years will provide a tailwind to AGNC.

The payout ratio is expected to be below 90% of earnings for 2025. If this proves correct, there will be no reason to cut the payout.

However, with any mortgage REIT, there is always a significant risk to the payout, and investors should keep that in mind, particularly given the volatile behavior of interest rates in recent years.

Final Thoughts

High-yield monthly dividend-paying stocks are extremely attractive for income investors, at least on the surface. This is particularly true in an environment of low interest rates, as alternative sources of income generally have much lower yields.

AGNC pays a hefty yield of 16.3% right now, which is very high by any standard.

We believe the REIT’s high yield is safe for the foreseeable future, but given the company’s business model and interest-rate sensitivity, this is hardly a low-risk situation.

While AGNC should continue to pay a dividend yield many times higher than the S&P 500 Index average, it is not an attractive option for risk-averse income investors.

Don’t miss the resources below for more monthly dividend stock investing research.

And see the resources below for more compelling investment ideas for dividend growth stocks and/or high-yield investment securities.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].