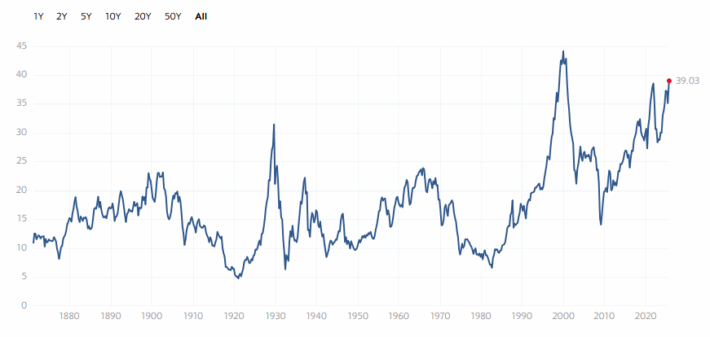

Last year was humbling for economists and investment strategists alike. It began with an “imminent” recession and ended with equity markets near all-time highs.

Historic rate hikes fueled a compelling narrative that, at best, anticipated both a weak economy and disappointing returns. To be sure, legitimate concerns underpinned this narrative. Post-COVID-19, amid resurgent inflation, the world was still emerging from an era of “unprecedented everything.” But the inherent pressure to take a stance on the economic trajectory led many investors to find comfort in collective concern and embrace the prevailing storyline.

For many investors, human nature took the wheel.

So, what can we learn from this scenario?

Investors crave a compelling, rational narrative. Economic data, which is more detailed and accessible than ever, helps us paint those narratives.

But with great amounts of data comes great responsibility. We not only have to keep our convictions, goals, and time horizons in perspective; we must also remember that the economy and financial markets are not the same thing.

That is easy to forget.

In the rational, well-ordered world of economic theory, various pieces of economic data fit together like a puzzle that visualizes the ever-evolving interplay between businesses, consumers, investors, governments, and central banks. Of course, in reality, these pieces of data are often lagged and revised and have varying and evolving impacts on financial markets. Moreover, this data is often cherry picked for clickbait headlines and political talking points.

And with economic projections shifting with the wind, investors struggle to identify clear, actionable insights.

So, what are we to do?

The economy deserves its fair share of attention, but we shouldn’t let it steal the spotlight. The financial markets themselves provide considerable insight.

Here are five questions to ask to better understand the markets without having to speculate about the larger economy:

1. How Has Market Composition Evolved?

What forces are working beneath the surface and churning the financial markets? How concentrated are market-cap-weighted indexes? How have sector weights adjusted over time? Which stocks are newly listed or jumping across the market-cap and style spectrums?

To understand the recipe, we have to understand the ingredients.

2. Which Companies Are Contributing the Earnings?

Are the markets giving credit where it is due? Comparing a stock’s earnings weight with that of its market cap indicates what is moving the stock and whether that movement is temporary or sustainable over the long term.

Closer examination of earnings trends across sectors, sizes, and factors offers critical context that surface-level data simply doesn’t.

3. Which Stocks Are Contributing the Returns?

Stock prices reflect collectively evolving opinions. What are investors rewarding? Fundamentals? Narratives? Narrow or broader segments of the market? Does a 360-degree analysis support these returns into the future?

Last year presented quite the riddle for investors. The “Magnificent Seven” lifted the S&P 500 for most of the year. But should we always count on a handful of players to carry the team? Proactive risk management requires that we understand the source of our returns.

4. What Are the “Fundamental Technicals” Saying?

Just as doctors render their diagnoses after batteries of tests and exams, so too must investors. A cursory examination of market data is not enough context. We need to know what’s going on beneath the surface.

“Fundamental technicals” are critical gauges of the underlying health of financial markets. They measure what’s really going on under the hood.

Market breadth, relative strength, put–call ratios, equal-weighted indexes, and volume, among other metrics, can shed light on risks and opportunities alike.

5. Where Are the Asset Flows Going?

Expressing a view of the market is one thing, but committing actual investment capital to that thesis is quite another. Do we have the courage of our convictions?

Asset flows measure consensus as well as the extremes and outliers. They reflect real choices with real consequences. From a behavioral perspective, the sentiments they uncover can be both entertaining and insightful.

Conclusion

The economy matters, but it matters differently to different investors depending on their distinct objectives, timelines, and asset allocation. And it’s not the only thing that matters.

As humans, we have an innate tendency toward groupthink. The more we follow the headlines, the more our own perceptions will correlate with them and lure us away from our investment process right at the moment when sticking to it matters most.

Ultimately, we must exercise the discipline to convert our analysis into actionable insight. We have to relentlessly ask ourselves, “What does this mean in the context of my strategy?”

If you liked this post, don’t forget to subscribe to Enterprising Investor and the CFA Institute Research and Policy Center.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.\

The opinions expressed are those of John W. Moore, CFA, CAIA, as of the date stated on this article and are subject to change. This material does not constitute investment advice and is not intended as an endorsement of any specific investment or security. Please remember that all investments carry some level of risk, including the potential loss of principal invested. Indexes and/or benchmarks are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance and are not indicative of any specific investment. Diversification and strategic asset allocation do not assure profit or protect against loss.

Image credit: ©Getty Images / Peter Hansen

Professional Learning for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report professional learning (PL) credits earned, including content on Enterprising Investor. Members can record credits easily using their online PL tracker.