In This Article

Real estate investors are always looking for ways to gain more control over their investments, reduce administrative delays, and maximize tax advantages. One strategy that enables all three goals is using a checkbook IRA LLC—a structure that allows investors to purchase real estate directly through their retirement accounts. By forming a single-member or multi-member LLC within a self-directed IRA (SDIRA), investors can streamline transactions, manage properties more efficiently, and pool capital for larger deals.

Before you start, it’s important to understand the main differences between single-member and multi-member LLCs, how they work within an IRA, and how to set up your own checkbook IRA LLC.

Why Investors Open an LLC Within an IRA

A checkbook IRA LLC is a legal entity owned by an IRA that allows investors to write checks directly for real estate purchases. Instead of waiting for a custodian to approve transactions, an IRA-owned LLC gives investors immediate control over funds, making it easier to seize time-sensitive investment opportunities.

Potential benefits of using an LLC in an IRA include:

Faster transactions: No need for custodian approval on each investment decision.

Greater control: Investors manage their own transactions while maintaining compliance with IRS regulations.

Ability to pool funds: Multi-member LLCs allow multiple investors to combine capital for larger investments.

Liability protection: Separates IRA assets from personal assets, which can reduce risk exposure.

Single-Member vs. Multi-Member LLCs: What’s the Difference?

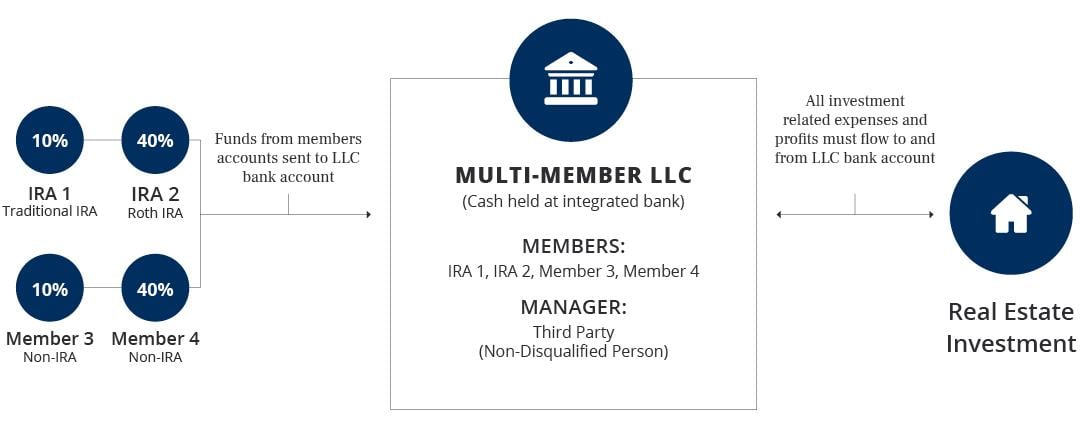

Investors can structure their checkbook IRA LLC as either a single-member LLC (owned by one SDIRA) or a multi-member LLC (owned by multiple SDIRAs or other investors). Understanding the differences between the two structures is crucial for choosing the right option for your investment strategy.

Here are visuals of how single-member and multi-member LLCs are set up through self-directed IRA custodian Equity Trust Company, which offers the Real Estate Checkbook IRA LLC in either configuration.

Percentage of ownership is proportionate to the capital contributed. Rules apply, including disqualified persons and prohibited transactions: See IRC 4975 for more information.

How to Set Up an Account With an LLC

Creating an IRA LLC involves several key steps to ensure compliance with IRS rules. Here’s how to get started:

Step 1: Open and fund a self-directed IRA

Before forming an LLC, you must establish a self-directed IRA with a custodian that allows alternative investments, such as real estate. You can fund the SDIRA by rolling over funds from an existing retirement account or making a new contribution.

Step 2: Form a new LLC

Select a name for your LLC and register it with the appropriate state agency. The SDIRA itself—not you personally—will be the owner of the LLC. (At Equity Trust, our affiliate Equity Doc Prep handles this for you.)

Step 3: Open a business checking account

Once the LLC is formed, you’ll need to set up a business bank account in the LLC’s name. (Equity Trust uses an integrated bank that specializes in this type of bank account.) All transactions related to investments must go through this account to maintain compliance.

Step 4: Transfer funds to your checking account

Direct your IRA custodian to transfer your IRA funds to your business checking account.

Step 5: Start investing

With the LLC fully established, you now have checkbook control over your IRA funds and can begin purchasing real estate, tax liens, private loans, and other investments. Revenue (rents) and expenses from your IRA-owned property must flow directly through your business checking account.

You might also like

Common Mistakes to Avoid

While an IRA LLC offers many potential advantages, it’s important to avoid common pitfalls that could jeopardize your investment and tax-advantaged status, including:

Prohibited transactions: The IRS strictly prohibits certain transactions, such as using the LLC to buy property for personal use or conducting business with disqualified persons (e.g., family members). Violating these rules could result in severe tax penalties.

Mixing personal and IRA funds: All investment-related expenses must be paid from the LLC’s bank account. Using personal funds for any aspect of an IRA-owned property can lead to compliance issues.

Failing to file necessary tax documents: While a single-member LLC is typically a disregarded entity for tax purposes, a multi-member LLC may need to file a partnership tax return (Form 1065). Investors should consult a tax professional to ensure proper reporting.

Not keeping records of transactions: Investors should maintain detailed records of all LLC activities, including expenses, rental income, and asset management decisions, to remain in compliance with IRS regulations.

Learn More and Get Started

Setting up an IRA LLC can be a powerful way to take control of your retirement investments while maximizing flexibility and efficiency. Certain custodians, such as Equity Trust Company, provide full real estate checkbook IRA LLC establishment services, all in one place. If you’re ready to explore this type of account setup, connect with an Equity Trust IRA Counselor.

Equity Trust Company is a directed custodian and does not provide tax, legal, or investment advice. Any information communicated by Equity Trust is for educational purposes only, and should not be construed as tax, legal, or investment advice. Whenever making an investment decision, please consult with your tax attorney or financial professional.

Equity Doc Prep, LLC (formerly Midland Forms, LLC) is a document preparation company and is not authorized to advise you as to which documents you should use or may need; such advice would be considered the “practice of law.” Please consult your legal or financial advisor before making any financial decisions. Under the guidelines for legal document preparation services, you must make all legal decisions yourself — including decisions about the type of documents you need.

BiggerPockets/PassivePockets is not affiliated in any way with Equity Trust Company or any of Equity’s family of companies. Opinions or ideas expressed by BiggerPockets/PassivePockets are not necessarily those of Equity Trust Company, nor do they reflect their views or endorsement. The information provided by Equity Trust Company is for educational purposes only. Equity Trust Company, and their affiliates, representatives, and officers do not provide legal or tax advice. Investing involves risk, including possible loss of principal. Please consult your tax and legal advisors before making investment decisions. Equity Trust and BiggerPockets/PassivePockets may receive referral fees for any services performed as a result of being referred opportunities.