Published on October 17, 2025, by Nathan Parsh

High-yield stocks pay out dividends that are significantly higher than the market average. For example, the S&P 500’s current yield is only ~1.2%, a product of record highs for the market.

High-yield stocks can be particularly helpful in shoring up income after retirement. A $120,000 investment in stocks with an average dividend yield of 5% creates an average of $500 a month in dividends.

We have created a spreadsheet of stocks (and closely related REITs and MLPs, etc.) with dividend yields of 5% or more…

You can download your free full list of all high dividend stocks with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

You can download your free full list of all high dividend stocks with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

The next article in this series will review Stellus Capital Investment Corp. (SCM).

Business Overview

Stellus is a Business Development Company, or BDC, that views itself as a flexible source of capital for the middle market. The company invests in small, predominantly private companies that are usually at an early stage in their growth cycles.

Stellus is a middle-market investment firm that makes equity and debt investments in private middle-market companies. The company provides capital solutions to companies with $5 million to $50 million of EBITDA and does so with various instruments, the majority of which are debt.Stellus provides first lien, second lien, mezzanine, convertible debt, and equity investments to a diverse group of customers, generally at high yields, in the US and Canada.

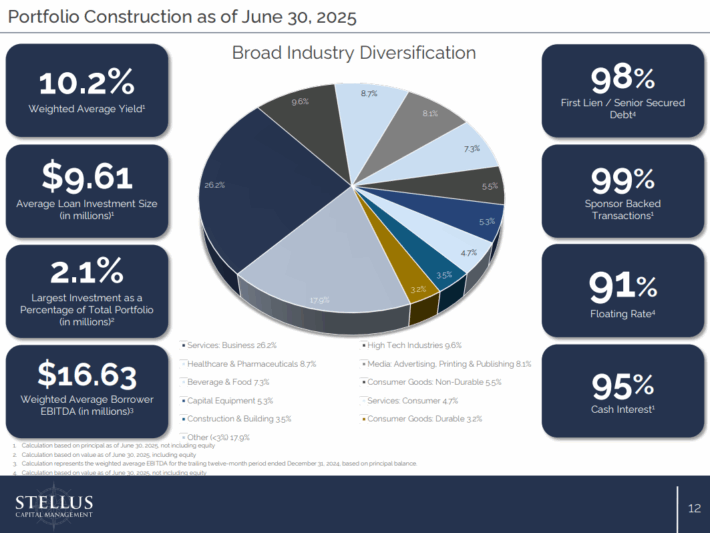

Source: Investor Presentation

Stellus has a highly diversified investment portfolio, both in terms of industry and geography concentration. The company offers a variety of debt investments, including first lien, second lien, uni-tranche, and mezzanine financing.

Invested capital is used for a wide range of purposes, including acquisitions, growth investments, and more. The investments are placed in various industries, including business services, industrial, healthcare, technology, energy, consumer products, and finance. Stellus is externally managed by Stellus Capital Management LLC, a registered investment advisor.

The company follows a disciplined investment strategy. For example, it closed only about 2% of deals reviewed over the past few years. Its relative selectiveness allows the company to focus on the highest-quality investments.

It also means the company has far more investment opportunities than it needs, enhancing its ability to select only the best investments. Stellus generates particularly high yields from its first lien, second lien, and unsecured debt investments. The weighted average yield as of the most recent quarterly report was 10.3%.

Growth Prospects

A strong catalyst for Stellus is its growing investment portfolio. Over the past five years, Stellus has seen its portfolio rise rapidly, allowing the company to earn higher investment income.

However, this all stopped in 2020 as the coronavirus pandemic sent the U.S. economy into a deep recession, negatively impacting many of Stellus’ investments.

Stellus reported second-quarter results on August 7th, 2025, with results close to the market’s expectations. Net investment income was $0.34, while core net investment income of was $0.35. This was down compared to the prior year, however. Total investment income of $25.7 million decreased from $26.6 million last year.

Gross expenses climbed $600K, or 3.6%, from last year, while fees and expenses related to borrowings increased from $3.9 million to $4.3 million.

The company funded $15 million of new investments, ending the quarter with a total portfolio fair value of $986 million.

We expect that net investment income will decline 20.7% to $1.30 in 2025.

Competitive Advantages & Recession Performance

Like many BDCs, Stellus does not benefit from significant competitive advantages. The company offers the same types of products that other BDCs do to a similar set of customers. We feel that makes it hard for BDCs to distinguish themselves too much from the industry. Additionally, BDCs often suffer during recessions because borrowers have a more difficult time meeting repayment timelines.

Stellus was not around during the 2007 to 2009 period, as it was not formed until 2012. That said, net investment income dipped from $1.23 to $1.13 in 2020, before making a new high in 2022. This was a decent result compared to many BDCs during that period.

One area of concern is that Stellus continues to dilute its share count. The share count more than doubled between 2015 and 2024. We project that the share count will more than triple from 2015 to 2030, which will likely act as a headwind to net investment income and could put the dividend at risk.

Dividend Analysis

Stellus, like most BDCs, offers a very high yield, which is 13.4% currently.

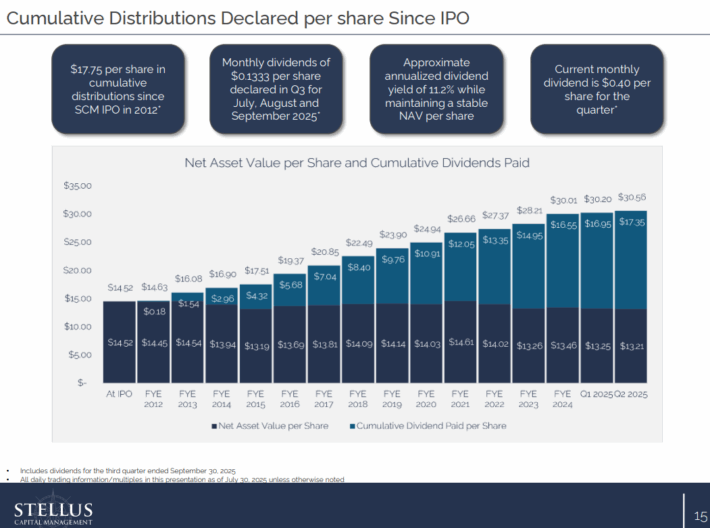

Source: Investor Presentation

Source: Investor Presentation

Stellus currently pays a monthly dividend of $0.1333 per share, equating to an annualized payout of $1.5996. The company cut its dividend in mid-2020 due to the pandemic, which was likely a prudent move during that period.

Stellus has paid out special distributions in the past to supplement its attractive monthly dividend further, but this last occurred in 2022.

The main reason investors are attracted to BDCs is that they often provide high rates of income, and Stellus is no different. Those high yields often come with risks. Stellus is expected to see a sizeable decline in NII in 2025, with the projected payout ratio at 123% for this year. The payout ratio has typically been elevated with Stellus, but this would be the highest rate in more than a decade and the first time since 2019 that it exceeded the 100% threshold.

Therefore, it is quite possible that Stellus would be forced to cut its dividend if net investment income does not return to growth.

Final Thoughts

Stellus has a fairly diversified business model and survived the worst of the Covid-19 pandemic much better than many of its fellow BDCs.

The 13%+ yield could be enticing for income investors, but the yield might not be safe from a potential cut given that Stellus is projected to payout more in dividends than it generates in net investment income.

We suggest that only the most risk-tolerant investors consider owning shares of Stellus.

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].