Published on October 30th, 2025 by Felix Martinez

High-yield stocks pay out dividends that are significantly higher than the market average. For example, the S&P 500’s current yield is only ~1.2%.

High-yield stocks can be particularly beneficial in supplementing income after retirement. A $120,000 investment in stocks with an average dividend yield of 5% creates an average of $500 a month in dividends.

Plains All American Pipeline, L.P. (PAA) is part of our ‘High Dividend 50’ series, which covers the 50 highest-yielding stocks in the Sure Analysis Research Database.

We have created a spreadsheet of stocks (and closely related REITs, MLPs, etc.) with dividend yields of 5% or more.

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

Next on our list of high-dividend stocks to review is Plains All American Pipeline, L.P. (PAA).

Business Overview

Source: Investor Relations

Growth Prospects

Source: Investor Relations

Competitive Advantages & Recession Performance

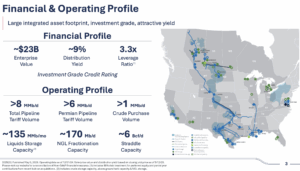

Plains All American Pipeline, L.P. (PAA) benefits from a highly integrated and extensive midstream infrastructure network, including over 18,000 miles of pipelines, storage, and gathering assets across key U.S. and Canadian energy hubs. This scale provides operational efficiency, strong market access, and stable fee-based cash flows, giving the company a competitive edge in crude oil and NGL transportation. Strategic investments, such as expanding its Permian Basin footprint through the BridgeTex Pipeline and optimizing core assets, further strengthen its market position.

PAA has also demonstrated resilience during economic downturns and energy market volatility. Historical performance shows that even after sharp declines in distributable cash flow during the 2016–2017 oil slump and the COVID-19 pandemic, the company’s disciplined cost management, asset optimization, and strong balance sheet enabled a swift recovery. This track record highlights PAA’s ability to maintain stability, generate cash flow, and continue distributions to unitholders during recessions or market stress.

2008 earnings-per-share: $1.48

2009 earnings-per-share: $1.57

2010 earnings-per-share: $1.52

Dividend Analysis

The company’s annual dividend is $1.52 per share. At its recent share price, the stock has a high yield of 8.9%.

Given the company’s 2025 earnings outlook, EPS is expected to be $2.65 per share. As a result, the company is expected to pay out roughly 57% of its EPS to shareholders in dividends.

Source: Investor Relations

Final Thoughts

In recent years, Plains All American has delivered strong returns, reflecting its disciplined operations and strategic asset management. Looking ahead, the company shows potential for continued gains, with an 8.9% yield and possible valuation improvements driving an estimated annual return of 16.2% over the medium term. While these prospects are attractive, we maintain a hold rating due to the relatively short track record of consistent dividend growth.

That said, Plains’ solid infrastructure, resilient cash flow, and focus on capital discipline position it well to capitalize on growth opportunities and navigate market volatility. Investors seeking income combined with moderate growth may find it a compelling option, particularly if the company continues its strategic initiatives and strengthens its dividend consistency over time.

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].