Published on November 4th, 2025 by Felix Martinez

High-yield stocks pay out dividends that are significantly higher than the market average. For example, the S&P 500’s current yield is only ~1.2%.

High-yield stocks can be particularly beneficial in supplementing income after retirement. A $120,000 investment in stocks with an average dividend yield of 5% creates an average of $500 a month in dividends.

Hess Midstream LP (HESM) is part of our ‘High Dividend 50’ series, which covers the 50 highest-yielding stocks in the Sure Analysis Research Database.

We have created a spreadsheet of stocks (and closely related REITs, MLPs, etc.) with dividend yields of 5% or more.

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

Next on our list of high-dividend stocks to review is Hess Midstream LP (HESM).

Business Overview

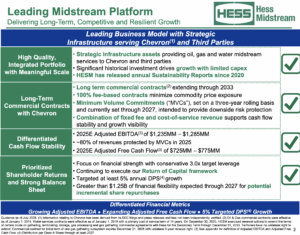

Hess Midstream LP is a growth-oriented midstream energy company that owns, operates, and develops infrastructure for crude oil, natural gas, and produced water in the Williston Basin, including the Bakken and Three Forks shale plays.

The company provides services to Hess Corporation and third-party customers through three main segments: gathering pipelines, processing and storage facilities, and terminaling and export logistics. Its operations are primarily fee-based, providing relatively stable revenue streams while supporting production in a key U.S. oil region.

Strategically, Hess Midstream leverages its integrated infrastructure footprint to capture steady cash flows and pursue growth opportunities, including acquisitions and expansions. The company also focuses on returning capital to shareholders through unit repurchases and distributions.

However, it remains exposed to commodity price fluctuations, regulatory pressures, and the capital-intensive nature of midstream projects, which require careful management to maintain profitability and long-term growth.

Source: Investor Relations

The company reported strong third-quarter 2025 results, with net income of $175.5 million and net cash provided by operating activities of $258.9 million. Net income attributable to Hess Midstream LP was $97.7 million, or $0.75 per Class A share, up from $0.63 per share in the same quarter of 2024. Adjusted EBITDA reached $320.7 million, and Adjusted Free Cash Flow totaled $186.8 million.

The company completed accretive repurchases of $70 million in Class A shares and $30 million in Class B units, while increasing the quarterly cash distribution to $0.7548 per Class A share, reflecting higher throughput volumes across gas processing, oil terminaling, and water gathering.

Operationally, Hess Midstream expanded capacity with a new compressor station providing 35 MMcf/d, and throughput volumes grew 10% for gas processing and 7% for both oil terminaling and water gathering compared to the prior-year quarter. Revenue for the quarter rose to $420.9 million from $378.5 million, driven by higher physical volumes and tariff rates.

Operating costs increased modestly to $162.0 million, primarily due to higher employee costs, depreciation, and pass-through expenses. The company’s revolving credit facility had a drawn balance of $356 million, and its senior unsecured debt was upgraded by S&P to BBB-.

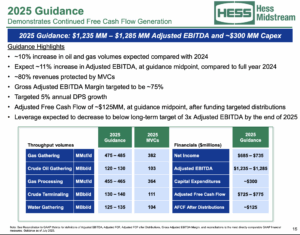

Looking ahead, Hess Midstream expects fourth-quarter 2025 net income of $170–180 million and Adjusted EBITDA of $315–325 million, with full-year net income guidance of $685–695 million and Adjusted EBITDA of $1,245–1,255 million. Capital expenditures for the year are revised to approximately $270 million, reflecting the suspension of the Capa gas plant project.

The company remains focused on fee-based growth, operational efficiency, and returning capital to shareholders while managing the capital-intensive nature of midstream operations and exposure to commodity price fluctuations.

Source: Investor Relations

Growth Prospects

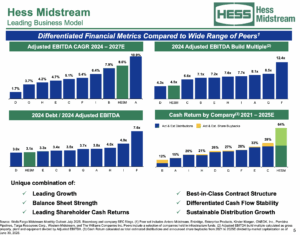

Hess Midstream has strong growth potential driven by secular expansion in natural gas capture and steady production increases from Hess’s upstream operations. The company expects gas and oil volumes to grow about 10% annually through 2026 and over 5% in 2027.

Combined with annual fee hikes linked to inflation, this supports projected EBITDA and free cash flow growth of more than 10% per year, positioning the company for consistent operational expansion.

Financially, Hess Midstream is improving leverage, with Net Debt to EBITDA expected to fall below 2.5x by the end of 2026.

This supports a targeted annual distribution growth of at least 5% through 2027. Analysts project 6% average annual earnings-per-share growth and nearly 5% annual distribution growth over the next five years, highlighting the company’s ability to deliver stable cash returns and long-term shareholder value.

Source: Investor Relations

Competitive Advantages & Recession Performance

The company benefits from several competitive advantages that support its stability and growth. Its integrated infrastructure in the Bakken and Three Forks shale plays provides essential midstream services—gathering, processing, storage, and terminaling—to Hess and third-party producers, creating a fee-based revenue model that is less sensitive to commodity price swings.

Long-term contracts, annual fee escalators tied to inflation, and strategic capacity expansions, such as new compressor stations, further strengthen the company’s market position and operational reliability.

The company has demonstrated resilience during economic downturns and periods of commodity volatility. Its predominantly fee-based structure, coupled with steady throughput growth and diversified service offerings, allows Hess Midstream to maintain cash flow and distributions even during recessions.

Analysts view the company’s consistent earnings growth, conservative leverage profile, and disciplined capital management as key factors that help it sustain performance and shareholder returns under challenging market conditions.

Dividend Analysis

The company’s annual dividend is $3.02 per share. At its recent share price, the stock has a high yield of 8.8%.

Given the company’s 2025 earnings outlook, EPS is expected to be $3.10 per share. As a result, the company is expected to pay out 97% of its EPS to shareholders in dividends.

Final Thoughts

Hess Midstream often goes unnoticed by investors due to its relatively conventional business model, but it is well-suited for income-focused and value-oriented investors.

The stock is projected to deliver an average annual return of 18% over the next five years, supported by an 8.8% distribution yield, 6% earnings-per-share growth, and a 3.3% valuation tailwind. Overall, the stock is assigned a hold rating.

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].