Published on October 22nd, 2025 by Felix Martinez

High-yield stocks pay out dividends that are significantly higher than the market average. For example, the S&P 500’s current yield is only ~1.2%.

High-yield stocks can be particularly beneficial in supplementing retirement income. A $120,000 investment in stocks with an average dividend yield of 5% creates an average of $500 a month in dividends.

Ellington Financial Inc. (EFC) is part of our ‘High Dividend 50’ series, which covers the 50 highest-yielding stocks in the Sure Analysis Research Database.

We have created a spreadsheet of stocks (and closely related REITs, MLPs, etc.) with dividend yields of 5% or more.

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

Next on our list of high-dividend stocks to review is Ellington Financial Inc. (EFC).

Business Overview

Ellington Financial only transitioned into a REIT at the beginning of 2019. Before this, the trust was taxed as a partnership. It is now classified as a mortgage REIT.

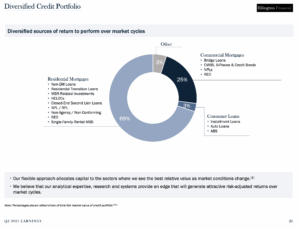

Ellington Financial is a hybrid REIT, meaning that the trust combines the characteristics of an equity REIT, which owns properties, and a mortgage REIT, which invests in mortgage loans and mortgage-backed securities.

The company manages mortgage-backed securities backed by prime jumbo loans, Alt-A loans, manufactured housing loans, and subprime residential mortgage loans.

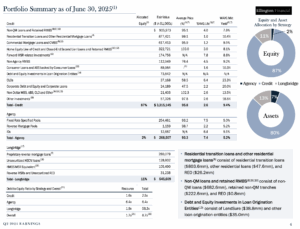

Ellington Financial has a market capitalization of about $1.4 billion. You can see a snapshot of Ellington’s investment portfolio in the image below:

Source: Investor Relations

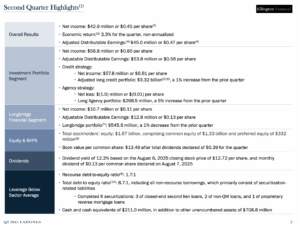

Ellington Financial Inc. (EFC) posted strong Q2 2025 results, with net income of $42.9 million, or $0.45 per share, and adjusted distributable earnings of $45.0 million, or $0.47 per share, above its $0.39 quarterly dividend. Revenue rose 14.9% year-over-year to $115.47 million, driven by broad contributions from its investment portfolio, credit strategy, and Longbridge segment. Book value per share increased to $13.49, and the dividend yield was 12.3%.

The company completed six securitizations and maintained a stable portfolio, with the credit portfolio growing slightly to $3.32 billion. Net interest margins improved to 3.11% due to lower funding costs. Agency RMBS results were impacted by hedge losses, while Longbridge’s portfolio declined 1% sequentially but benefited from higher reverse mortgage originations and servicing gains.

Looking forward, Ellington plans to expand its portfolio, accelerate securitizations, and leverage Longbridge’s new HELOC for Seniors program. Total assets reached $17.1 billion, with $211 million in cash, and debt-to-equity ratios of 1.7:1 (recourse) and 8.7:1 overall, reflecting disciplined leverage and financial flexibility.

Source: Investor Relations

Growth Prospects

Ellington Financial’s earnings per share have been uneven over the past decade, largely due to a declining interest rate environment. Consequently, its per-share dividend has mostly decreased since 2015.

To mitigate volatility, the company has focused on diversifying its portfolio across multiple investment strategies and sectors. This approach helps reduce performance swings and smooths overall returns.

Its residential mortgage investments are spread across various security types, including Non-QM loans, reverse mortgages, and REOs. By avoiding concentrated risk, Ellington improves the stability of its economic returns and enhances portfolio resilience.

Source: Investor Presentation

Ellington has structured its portfolio to minimize the impact of interest rate fluctuations on overall performance. This defensive positioning helps stabilize returns, even in changing market conditions.

The Federal Reserve has indicated potential future rate cuts if inflation reaches its target, which would likely benefit Ellington. Under the current portfolio, a 50-basis-point decline in the rate could generate $2.2 million in equity gains, while a 50-basis-point increase could result in $9.7 million in losses.

Looking ahead, the company is expected to achieve modest growth, with projected annual EPS increases of approximately 1% over the next five years. Its portfolio design and risk management support steady, resilient performance.

Competitive Advantages & Recession Performance

Ellington Financial does not have a major competitive advantage, though it maintains a high-quality balance sheet. Its recourse debt-to-equity ratio was 1.8x in Q4, down from 2x at the end of 2023, reflecting lower borrowings in the Agency RMBS and proprietary reverse mortgage portfolios.

Although the company was not publicly traded during the Great Recession, its stock price fell sharply at the onset of the COVID-19 pandemic. This highlights some sensitivity to market stress despite conservative leverage.

Since the pandemic, EFC’s earnings and dividends have recovered, yet both remain below 2014 levels. The company remains committed to maintaining financial stability amid economic uncertainty.

Dividend Analysis

Ellington Financial has a volatile dividend history, with cuts and subsequent increases. The company reduced its monthly dividend from $0.15 to $0.08 in Q1 2020 due to the pandemic, later raising it multiple times. In Q4 2023, the monthly dividend was lowered from $0.15 to $0.13 to support equity growth and has remained at that level.

The annual dividend is currently $1.56 per share, translating to a yield of 11.5%. While this is attractive for income investors, dividend safety is uncertain given past cuts and high expected payout ratios, which are projected at 96% for 2025. The five-year average payout ratio has been 85%, though it has exceeded 100% in earlier periods.

Despite volatility, Ellington has delivered strong cumulative dividends since its IPO, totaling over $34 per share—nearly three times the current stock price—demonstrating a historically solid income stream for shareholders.

Final Thoughts

High-yield dividend stocks warrant caution, as elevated yields often signal underlying risks. Ellington Financial exemplifies this, showing significant volatility in its dividend payments over time.

The company maintains a diversified loan portfolio and has improved profitability, supporting the current dividend. However, a slowdown in business could trigger another cut, highlighting potential risk.

EFC offers an attractive yield of 11.5%, but investors should be aware of the elevated risk associated with its stock.

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].