Published on October 28th, 2025 by Felix Martinez

High-yield stocks pay out dividends that are significantly higher than the market average. For example, the S&P 500’s current yield is only ~1.2%.

High-yield stocks can be particularly helpful in shoring up income after retirement. A $120,000 investment in stocks with an average dividend yield of 5% creates an average of $500 a month in dividends.

Delek Logistics Partners (DKL) is part of our ‘High Dividend 50’ series, which covers the 50 highest-yielding stocks in the Sure Analysis Research Database.

We have created a spreadsheet of stocks (and closely related REITs, MLPs, etc.) with dividend yields of 5% or more.

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

Next on our list of high-dividend stocks to review is Delek Logistics Partners (DKL).

Business Overview

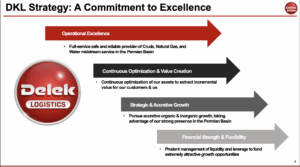

In addition to transporting and storing crude oil, Delek Logistics also markets, distributes, and stores refined petroleum products for Delek US and third-party customers. The partnership benefits from stable, fee-based revenue under long-term agreements, which helps reduce exposure to commodity price volatility. Through steady expansion projects and strategic acquisitions, Delek Logistics continues to strengthen its position in the midstream sector, providing essential infrastructure that connects crude oil production areas with key refining and distribution markets.

Source: Investor Relations

Growth Prospects

The company has a strong growth outlook, with analysts expecting distributable cash flow (DCF) per unit to rise at a 3.7% annual rate over the next five years. Growth will be driven by expanding sour natural gas treating and acid gas injection operations, integrating the Gravity Water Midstream acquisition, and pursuing additional strategic deals. These initiatives aim to increase efficiency, scale, and profitability across key U.S. basins while supporting steady cash flow generation.

The company also launched a $150 million unit repurchase program to enhance unitholder value and maintain financial discipline. While DKL’s payout ratio is currently high, management expects distribution growth to trail DCF growth to preserve flexibility for reinvestment. Backed by a fee-based business model and a strong track record of execution, Delek Logistics is positioned for stable and sustainable growth through 2030.

Source: Investor Relations

Competitive Advantages & Recession Performance

Delek Logistics Partners has key competitive advantages, including a large midstream network connecting major production areas to refineries and long-term, fee-based contracts that reduce exposure to commodity price swings. Recent expansions and acquisitions, such as Libby 2 and Gravity Water Midstream, further increase scale, efficiency, and service capabilities.

The company has proven resilient in economic downturns, with diversified operations generating stable cash flow even when commodity prices fall. Disciplined capital management and contracted revenue streams help maintain distributions and financial stability, making DKL well-positioned to perform across market cycles.

Dividend Analysis

Delek Logistics Partners’ annual dividend is $4.46 per share. At its recent share price, the stock has a high yield of 9.8%.

Given the company’s 2025 earnings outlook, EPS is expected to be $5.95 per share. As a result, the company is expected to pay out 75% of its EPS to shareholders in dividends.

Final Thoughts

Delek Logistics Partners combines a high distribution yield, steady growth, and potential valuation expansion, with distributable cash flow per unit projected to grow 3.7% annually through 2030. Strategic acquisitions and infrastructure projects, including Gravity Water Midstream and sour gas treating, support its growth and distribution track record.

However, with an elevated payout ratio and a dividend risk score of F, distribution growth may be limited. While total returns could reach 15.3% annually, the company is rated a Hold due to this moderate dividend risk.

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].