Published on October 22nd, 2025 by Felix Martinez

High-yield stocks pay out dividends that are significantly higher than the market average. For example, the S&P 500’s current yield is only ~1.2%.

High-yield stocks can be particularly beneficial in supplementing retirement income. A $120,000 investment in stocks with an average dividend yield of 5% creates an average of $500 a month in dividends.

Blue Owl Capital Corporation (OBDC) is part of our ‘High Dividend 50’ series, which covers the 50 highest-yielding stocks in the Sure Analysis Research Database.

We have created a spreadsheet of stocks (and closely related REITs, MLPs, etc.) with dividend yields of 5% or more.

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

Next on our list of high-dividend stocks to review is Blue Owl Capital Corporation (OBDC).

Business Overview

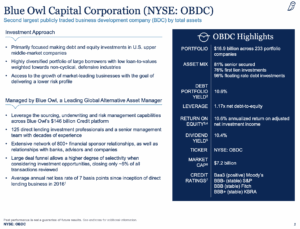

Blue Owl Capital Corporation is a publicly traded business development company (BDC) headquartered in New York, New York. Founded in October 2015, the firm completed its initial public offering in July 2019. Blue Owl primarily invests in and provides financing to U.S. middle-market companies, targeting those with annual EBITDA between $10 million and $250 million or revenues ranging from $50 million to $2.5 billion at the time of investment.

The company generates approximately $1.6 billion in annual gross investment income and holds a market capitalization of $6.6 billion, making it the third-largest publicly traded BDC. Blue Owl focuses on supporting growth-oriented companies through strategic investments and lending solutions.

On July 6, 2023, the firm rebranded from Owl Rock Capital Corporation to Blue Owl Capital Corporation, updating its Nasdaq ticker from ORCC to OBDC to reflect its new identity.

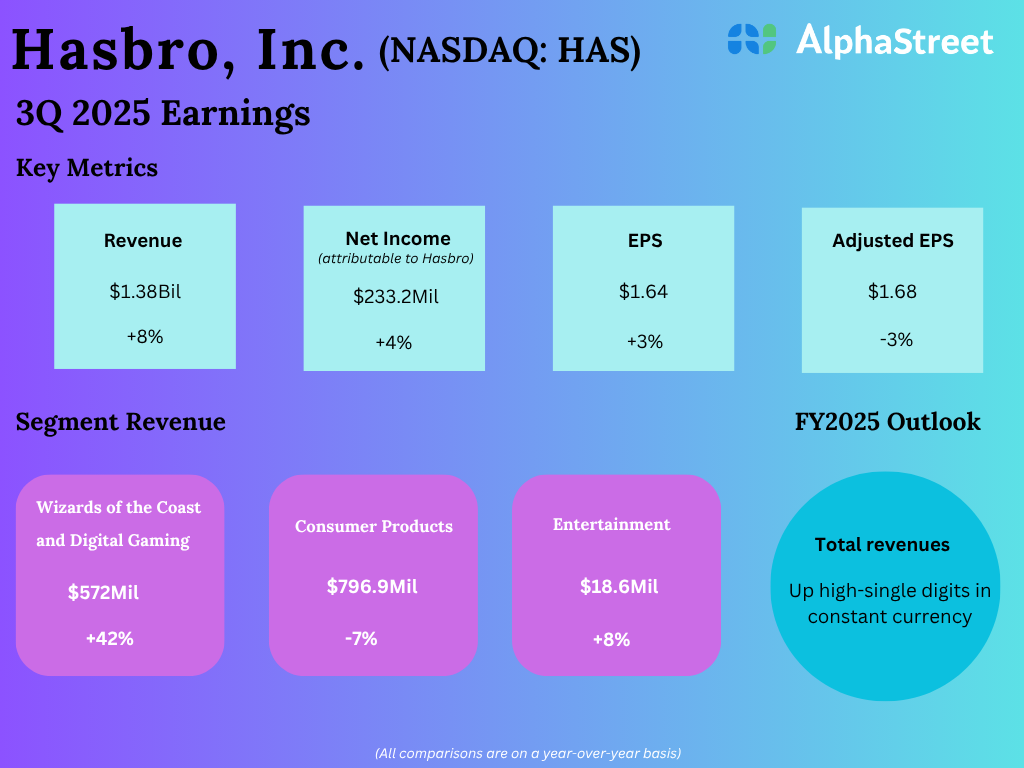

Blue Owl Capital Corporation (OBDC) reported strong financial results for the second quarter ended June 30, 2025. GAAP net investment income (NII) per share was $0.42, exceeding expectations by $0.03, while revenue increased 22.5% year-over-year to $485.8 million. Adjusted NII per share rose slightly to $0.40 from $0.39 in Q1 2025. The Board of Directors declared a total dividend of $0.39 per share for the quarter, including a $0.02 supplemental dividend, reflecting an annualized yield of 10.4%. Net asset value per share was $15.03, modestly down from $15.14 in the prior quarter due to select write-downs, partially offset by earnings exceeding dividends.

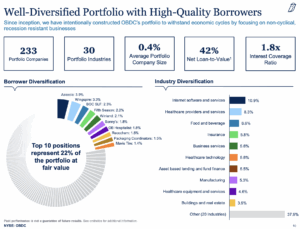

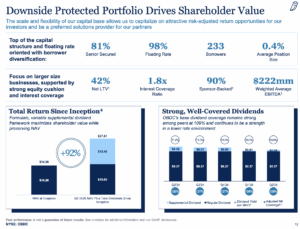

During the quarter, Blue Owl committed $1.1 billion to new investments while receiving $1.9 billion in repayments and sales, resulting in a net reduction of invested capital. The company’s portfolio consisted of 233 companies across 30 industries, with total investments valued at $16.9 billion. First-lien senior secured debt represented 75.8% of the portfolio, and only 0.7% of the investments were on non-accrual status, demonstrating strong credit quality and portfolio stability. Weighted average yields on debt investments remained attractive at approximately 10.6% at fair value.

OBDC ended the quarter with $360 million in cash, $9.3 billion in total debt, and $3.7 billion in undrawn credit capacity, maintaining compliance with all financial covenants. Operating expenses increased slightly to $266.8 million, primarily from interest, management, and incentive fees related to the recent merger. CEO Craig Packer emphasized that the portfolio’s performance supports consistent earnings and attractive risk-adjusted returns, positioning Blue Owl to capitalize on opportunities in the middle-market lending sector while maintaining strong liquidity and capital flexibility.

Source: Investor Relations

Growth Prospects

The company’s net investment income (NII) per share is highly dependent on the spread between the yields on its investments and its own funding costs. At the end of Q2 2025, the weighted average total yield on debt and income-producing securities was 10.6%, down 130 basis points year-over-year, while the average spread declined 50 basis points to 5.8%.

High interest rates can benefit Blue Owl, but only if the company maintains control over its funding costs. Given the already elevated FY2025 NII per share, further growth is unlikely in the near term as market dynamics evolve.

Regarding distributions, Blue Owl currently pays a quarterly base dividend of $0.37 per share. Special dividends have been frequent in recent periods due to excess gains, but the base dividend is expected to grow modestly at around 2% annually, a pace considered sustainable given the company’s earnings profile.

Source: Investor Relations

Competitive Advantages & Recession Performance

Blue Owl Capital has strong advantages because it focuses on lending to U.S. middle-market companies with stable cash flows. The company’s experience in structuring loans and investments, combined with its solid relationships with its portfolio companies, enables it to identify attractive opportunities and make informed investment decisions. Most of its loans are floating-rate, which can help earn more when interest rates rise.

The company also performs well in downturns. Its portfolio is mostly senior secured debt, which is safer, and very few investments are on non-accrual. This conservative approach and focus on cash-generating businesses help Blue Owl maintain stable income and dividends, even during recessions, while continuing to provide steady returns to investors.

Source: Investor Relations

Dividend Analysis

Blue Owl Capital’s annual dividend is $1.48 per share. At its recent share price, the stock has a high yield of 11.4%.

Given the company’s earnings outlook for 2025, NII/share is expected to be $1.65. As a result, the company is expected to pay out 90% of its net income per share to shareholders. This does not include some small special dividends that are sometimes declared.

Final Thoughts

Blue Owl Capital is one of the largest BDCs, with a diversified portfolio across different companies and industries. Although it has a relatively short history as a publicly traded company, it has shown strong fundamentals.

We expect annualized returns of about 9.9% over the medium term, mostly driven by its dividend, and rate the stock as a hold.

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].