Published on August 26th, 2025 by Bob Ciura

Essentialism means focusing on the essential and letting go of the not-so-important. Essentialism is about distilling things down to their essence; removing the superfluous to get to what really matters.

Applying essentialism to investing gets to the core of why we invest.

The reason nearly all of us invest is to replace our income when we are no longer working. And to hopefully replace it by a wide margin.

Income, either through harvesting capital gains, or preferably by getting paid dividends, is essential to investing for financial freedom.

Focusing on income in investing cuts through a lot of unneeded market noise. When your dividend income exceeds your expenses, your portfolio covers your lifestyle.

Dividend investing lines up with the reason we invest: income. As long as those dividends keep rolling in, no selling is needed.

For this reason, we recommend income investors purchase high dividend stocks.

You can download your free full list of all high dividend stocks (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

However, not all high-yield stocks make equally good investments.

This article will discuss 10 high dividend stocks with yields above 5%, that also have sustainable dividend payouts.

To measure this, we will focus on stocks with Dividend Risk Scores of ‘C’ or better in the Sure Analysis Research Database, with

Table Of Contents

The 10 high dividend stocks are listed by payout ratio, in ascending order.

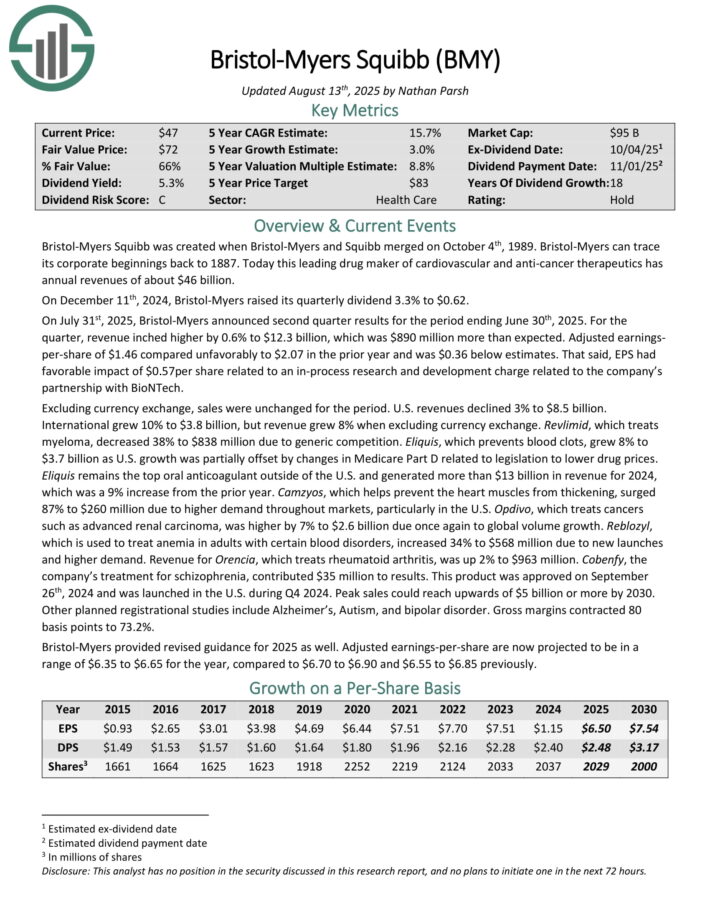

Quality High Dividend Stock: Bristol-Myers Squibb (BMY)

Bristol-Myers Squibb is a leading drug maker of cardiovascular and anti-cancer therapeutics has annual revenues of about $46 billion.

On July 31st, 2025, Bristol-Myers announced second quarter results for the period ending June 30th, 2025. For the quarter, revenue inched higher by 0.6% to $12.3 billion, which was $890 million more than expected. Adjusted earnings-per-share of $1.46 compared unfavorably to $2.07 in the prior year and was $0.36 below estimates.

That said, EPS had favorable impact of $0.57per share related to an in-process research and development charge related to the company’s partnership with BioNTech.

U.S. revenues declined 3% to $8.5 billion. International grew 10% to $3.8 billion, but revenue grew 8% when excluding currency exchange. Eliquis, which prevents blood clots, grew 8% to $3.7 billion as U.S. growth was partially offset by changes in Medicare Part D related to legislation to lower drug prices.

Eliquis remains the top oral anticoagulant outside of the U.S. and generated more than $13 billion in revenue for 2024, which was a 9% increase from the prior year. Opdivo, which treats cancers such as advanced renal carcinoma, was higher by 7% to $2.6 billion due once again to global volume growth.

Bristol-Myers provided revised guidance for 2025 as well. Adjusted earnings-per-share are now projected to be in a range of $6.35 to $6.65 for the year.

Click here to download our most recent Sure Analysis report on BMY (preview of page 1 of 3 shown below):

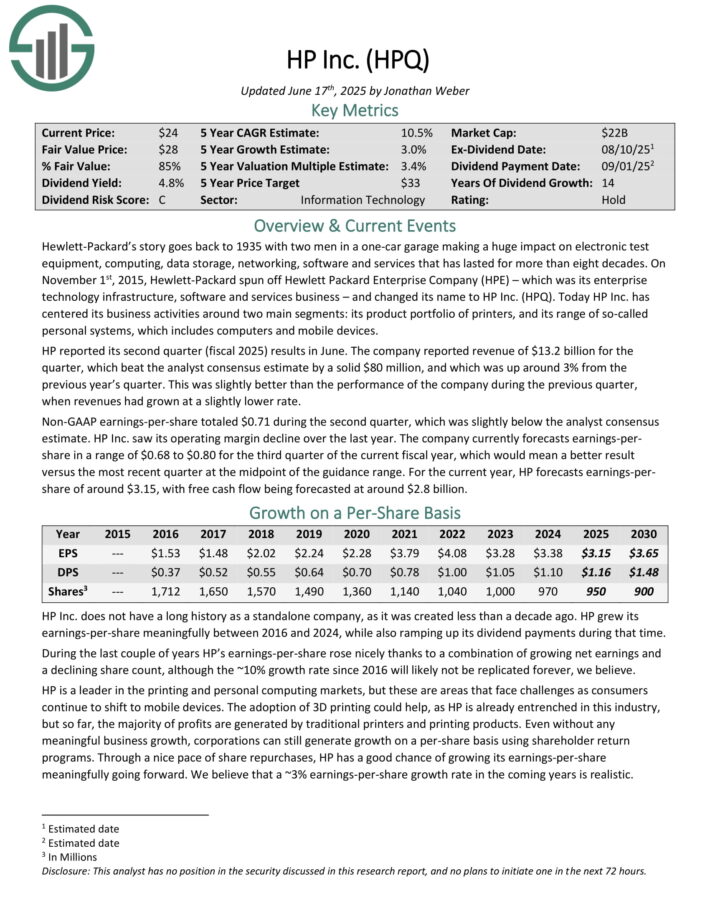

Quality High Dividend Stock: HP Inc. (HPQ)

Hewlett-Packard’s story goes back to 1935 with two men in a one-car garage making a huge impact on electronic test equipment, computing, data storage, networking, software and services that has lasted for more than eight decades.

HP Inc. has centered its business activities around two main segments: its product portfolio of printers, and its range of so-called personal systems, which includes computers and mobile devices.

HP reported its second quarter (fiscal 2025) results in June. The company reported revenue of $13.2 billion for the quarter, which beat the analyst consensus estimate by a solid $80 million, and which was up around 3% from the previous year’s quarter.

This was slightly better than the performance of the company during the previous quarter, when revenues had grown at a slightly lower rate.

Non-GAAP earnings-per-share totaled $0.71 during the second quarter, which was slightly below the analyst consensus estimate. HP Inc. saw its operating margin decline over the last year.

The company currently forecasts earnings-per-share in a range of $0.68 to $0.80 for the third quarter of the current fiscal year.

Click here to download our most recent Sure Analysis report on HPQ (preview of page 1 of 3 shown below):

Quality High Dividend Stock: Sonoco Products (SON)

Sonoco Products provides packaging, industrial products and supply chain services to its customers. The markets that use the company’s products include those in the appliances, electronics, beverage, construction and food industries.

The company generates over $5 billion in annual sales. Sonoco Products is now composed of 2 major segments, Consumer Packaging, and Industrial Packaging, with all other businesses listed as “All Other”.

On April 16th, 2025, Sonoco Products raised its quarterly dividend 1.9% to $0.53, extending the company’s dividend growth streak to 49 consecutive years.

On July 23rd, 2025, Sonoco Products announced second quarter results for the period ending June 29th, 2025. For the quarter, revenue grew 17.9% to $1.91 billion, which was in-line with estimates. Adjusted earnings-per-share of $1.37 compared to $1.28 in the prior year, but was $0.08 less than expected.

Revenues and earnings benefited from the addition of Eviosys. For the quarter, Consumer Packaging revenues surged 110% to $1.23 billion, mostly due to contributions from Eviosys.

Volume growth was strong and favorable currency exchange rates also aided results. Industrial Paper Packing sales fell 2% to $588 million due to the impact of foreign currency exchange rates and lower volume following two plant divestitures in China last year.

Click here to download our most recent Sure Analysis report on Sonoco (SON) (preview of page 1 of 3 shown below):

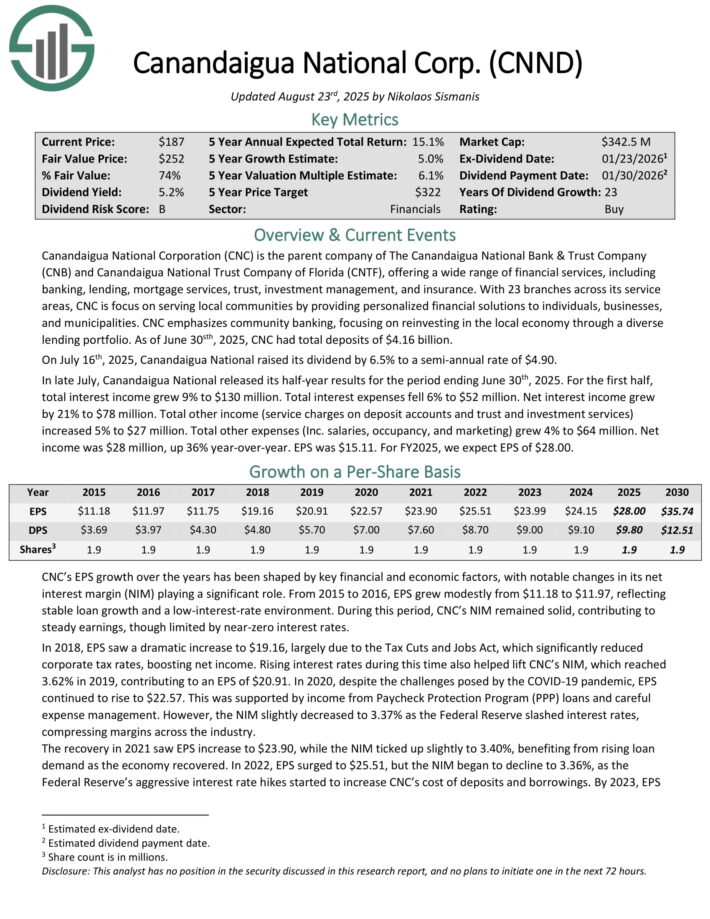

Quality High Dividend Stock: Canandaigua National Corporation (CNND)

Canandaigua National Corporation (CNC) is the parent company of The Canandaigua National Bank & Trust Company (CNB) and Canandaigua National Trust Company of Florida (CNTF), offering a wide range of financial services, including banking, lending, mortgage services, trust, investment management, and insurance.

With 23 branches across its service areas, CNC is focus on serving local communities by providing personalized financial solutions to individuals, businesses, and municipalities. CNC emphasizes community banking, focusing on reinvesting in the local economy through a diverse lending portfolio.

As of June 30sth, 2025, CNC had total deposits of $4.16 billion. On July 16th, 2025, Canandaigua National raised its dividend by 6.5% to a semi-annual rate of $4.90.

In late July, Canandaigua National released its half-year results for the period ending June 30th, 2025. For the first half, total interest income grew 9% to $130 million. Total interest expenses fell 6% to $52 million. Net interest income grew by 21% to $78 million.

Total other income (service charges on deposit accounts and trust and investment services) increased 5% to $27 million. Total other expenses (Inc. salaries, occupancy, and marketing) grew 4% to $64 million. Net income was $28 million, up 36% year-over-year. EPS was $15.11.

Click here to download our most recent Sure Analysis report on CNND (preview of page 1 of 3 shown below):

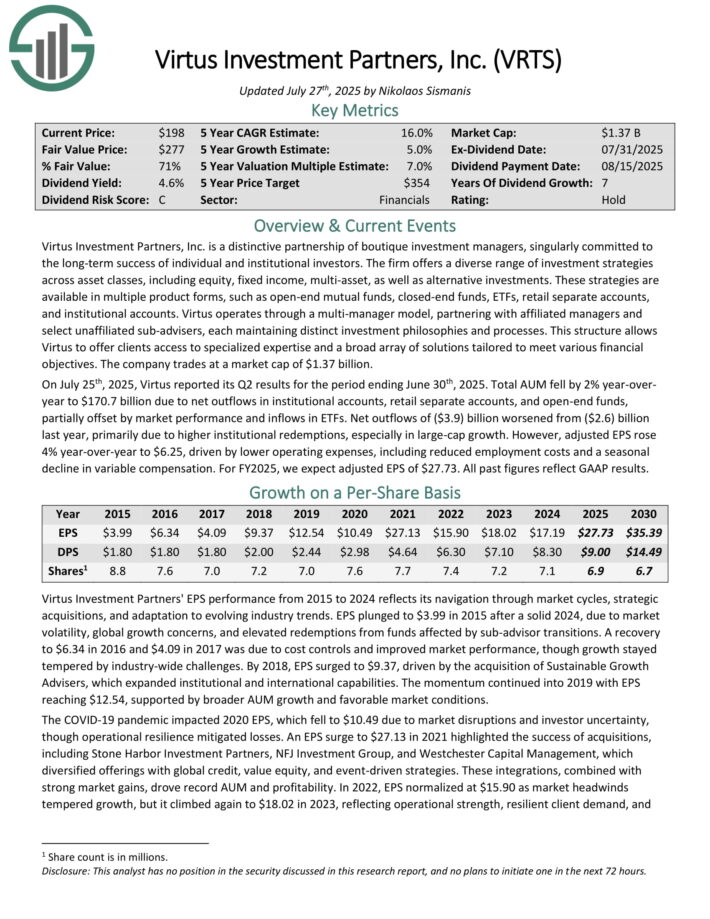

Quality High Dividend Stock: Virtus Investment Partners (VRTS)

Virtus Investment Partners is a partnership of boutique investment managers. The firm offers a diverse range of investment strategies across asset classes, including equity, fixed income, multi-asset, as well as alternative investments.

Virtus operates through a multi-manager model, partnering with affiliated managers and select unaffiliated sub advisers, each maintaining distinct investment philosophies and processes. This structure allows Virtus to offer clients access to specialized expertise and a broad array of solutions tailored to meet various financial objectives.

On July 25th, 2025, Virtus reported its Q2 results for the period ending June 30th, 2025. Total AUM fell by 2% year-over-year to $170.7 billion due to net outflows in institutional accounts, retail separate accounts, and open-end funds, partially offset by market performance and inflows in ETFs.

Net outflows of ($3.9) billion worsened from ($2.6) billion last year, primarily due to higher institutional redemptions, especially in large-cap growth. However, adjusted EPS rose 4% year-over-year to $6.25, driven by lower operating expenses, including reduced employment costs and a seasonal decline in variable compensation.

Click here to download our most recent Sure Analysis report on VRTS (preview of page 1 of 3 shown below):

Quality High Dividend Stock: JBT Bancorp (JBTC)

JBT Bancorp is a long-standing, independent community bank holding company based in Jonestown, Pennsylvania, with a history spanning over 150 years.

Through its wholly owned subsidiary, Jonestown Bank & Trust Co., JBT operates 11 full-service offices and 2 limited-service offices across Lebanon, northern Lancaster, and eastern Berks counties.

The bank offers a full suite of financial products and services, including personal and business checking and savings accounts, term certificates, residential mortgages, commercial loans, consumer loans, and specialized services such as treasury management and cannabis banking. The company generated $32.3 million in net interest income last year.

On July 15th, 2025, JBT Bancorp reported its Q2 results for the period ending June 30th, 2025. The company generated quarterly earnings of $2.17 million, or $0.89 per share, compared to $1.97 million, or $0.81 per share, in Q2 2024. Six-month reported earnings rose 11% year-over-year to $3.86 million, or $1.58 per share.

Results benefited from continued focus on smart growth and maintaining margin, according to management. The company declared a second quarter dividend of $0.27 per share.

Click here to download our most recent Sure Analysis report on JBTC (preview of page 1 of 3 shown below):

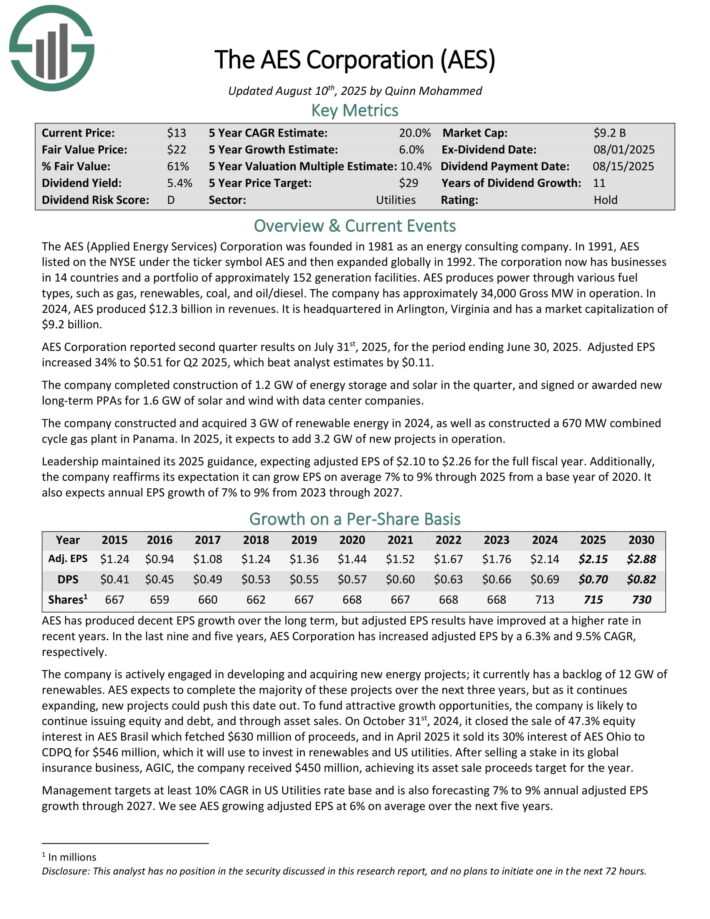

Quality High Dividend Stock: AES Corp. (AES)

The AES (Applied Energy Services) Corporation was founded in 1981 as an energy consulting company. The corporation now has businesses in 14 countries and a portfolio of approximately 152 generation facilities.

AES produces power through various fuel types, such as gas, renewables, coal, and oil/diesel. The company has approximately 34,000 Gross MW in operation. In 2024, AES produced $12.3 billion in revenues.

AES Corporation reported second quarter results on July 31st, 2025, for the period ending June 30, 2025. Adjusted EPS increased 34% to $0.51 for Q2 2025, which beat analyst estimates by $0.11.

The company completed construction of 1.2 GW of energy storage and solar in the quarter, and signed or awarded new long-term PPAs for 1.6 GW of solar and wind with data center companies.

The company constructed and acquired 3 GW of renewable energy in 2024, as well as constructed a 670 MW combined cycle gas plant in Panama. In 2025, it expects to add 3.2 GW of new projects in operation. Leadership maintained its 2025 guidance, expecting adjusted EPS of $2.10 to $2.26 for the full fiscal year.

Additionally, the company reaffirms its expectation it can grow EPS on average 7% to 9% through 2025 from a base year of 2020. It also expects annual EPS growth of 7% to 9% from 2023 through 2027.

Click here to download our most recent Sure Analysis report on AES (preview of page 1 of 3 shown below):

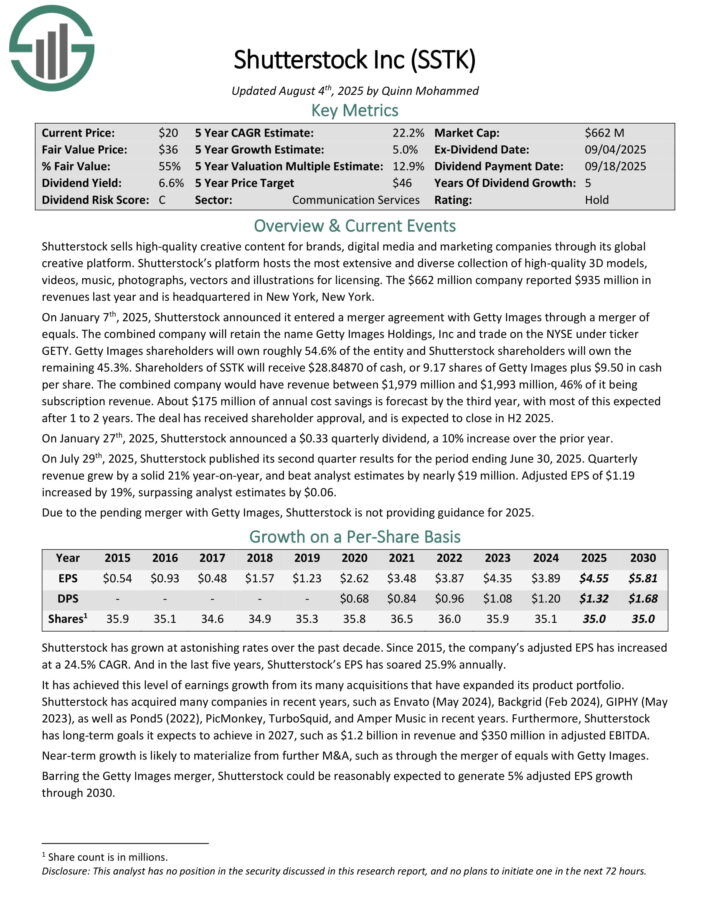

Quality High Dividend Stock: Shutterstock, Inc. (SSTK)

Shutterstock sells high-quality creative content for brands, digital media and marketing companies through its global creative platform.

Its platform hosts the most extensive and diverse collection of high-quality 3D models, videos, music, photographs, vectors and illustrations for licensing. The company reported $935 million in revenues last year.

On January 7th, 2025, Shutterstock announced it entered a merger agreement with Getty Images through a merger of equals. The combined company will retain the name Getty Images Holdings, Inc and trade on the NYSE under ticker GETY.

Getty Images shareholders will own roughly 54.6% of the entity and Shutterstock shareholders will own the remaining 45.3%. Shareholders of SSTK will receive $28.84870 of cash, or 9.17 shares of Getty Images plus $9.50 in cash per share.

The combined company would have revenue between $1,979 million and $1,993 million, 46% of it being subscription revenue. About $175 million of annual cost savings is forecast by the third year, with most of this expected after 1 to 2 years.

On July 29th, 2025, Shutterstock published its second quarter results for the period ending June 30, 2025. Quarterly revenue grew by a solid 21% year-on-year, and beat analyst estimates by nearly $19 million. Adjusted EPS of $1.19 increased by 19%, surpassing analyst estimates by $0.06.

Click here to download our most recent Sure Analysis report on SSTK (preview of page 1 of 3 shown below):

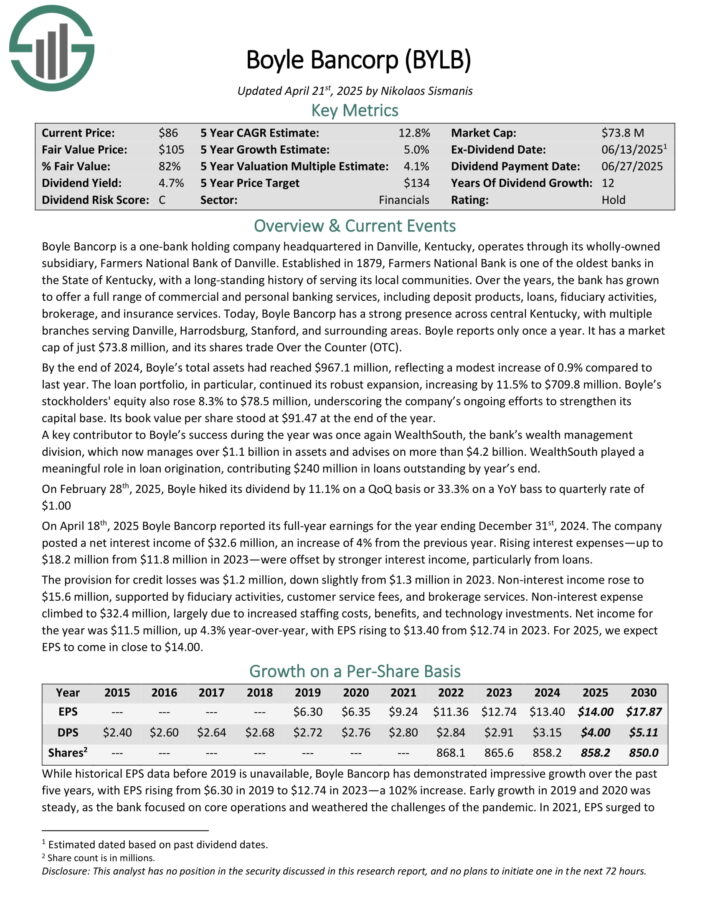

Quality High Dividend Stock: Boyle Bancorp (BYLB)

Boyle Bancorp is a one-bank holding company headquartered in Danville, Kentucky, operates through its wholly-owned subsidiary, Farmers National Bank of Danville. Established in 1879, Farmers National Bank is one of the oldest banks in the State of Kentucky, with a long-standing history of serving its local communities.

Today, Boyle Bancorp has a strong presence across central Kentucky, with multiple branches serving Danville, Harrodsburg, Stanford, and surrounding areas. Boyle reports only once a year.

By the end of 2024, Boyle’s total assets had reached $967.1 million, reflecting a modest increase of 0.9% compared to last year. The loan portfolio, in particular, continued its robust expansion, increasing by 11.5% to $709.8 million. Boyle’s stockholders’ equity also rose 8.3% to $78.5 million, underscoring the company’s ongoing efforts to strengthen its capital base. Its book value per share stood at $91.47 at the end of the year.

On April 18th, 2025 Boyle Bancorp reported its full-year earnings. The company posted a net interest income of $32.6 million, an increase of 4% from the previous year. Rising interest expenses—up to $18.2 million from $11.8 million in 2023—were offset by stronger interest income, particularly from loans.

Click here to download our most recent Sure Analysis report on BYLB (preview of page 1 of 3 shown below):

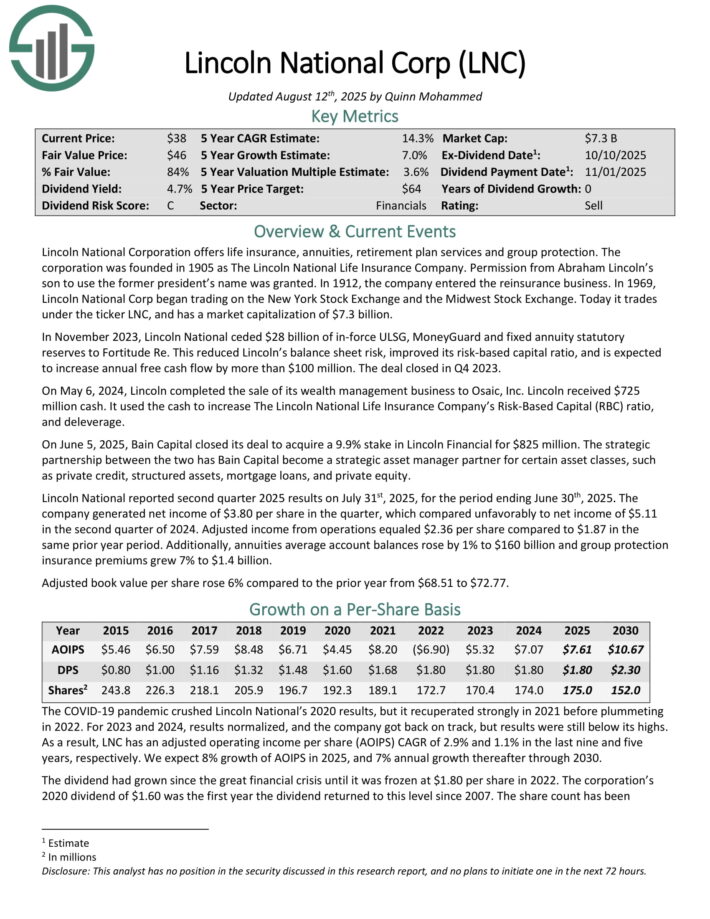

Quality High Dividend Stock: Lincoln National Corp. (LNC)

Lincoln National Corporation offers life insurance, annuities, retirement plan services and group protection.

On June 5, 2025, Bain Capital closed its deal to acquire a 9.9% stake in Lincoln Financial for $825 million. The strategic partnership between the two has Bain Capital become a strategic asset manager partner for certain asset classes, such as private credit, structured assets, mortgage loans, and private equity.

Lincoln National reported second quarter 2025 results on July 31st, 2025. The company generated net income of $3.80 per share in the quarter, which compared unfavorably to net income of $5.11 in the second quarter of 2024. Adjusted income from operations equaled $2.36 per share compared to $1.87 in the same prior year period.

Additionally, annuities average account balances rose by 1% to $160 billion and group protection insurance premiums grew 7% to $1.4 billion. Adjusted book value per share rose 6% compared to the prior year from $68.51 to $72.77.

Click here to download our most recent Sure Analysis report on LNC (preview of page 1 of 3 shown below):

Additional Reading

If you are interested in finding other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].