Updated on July 15th, 2025 by Nathan Parsh

PPG Industries (PPG) is one of the most time-tested stocks in the basic materials sector. PPG has increased its dividend for 53 consecutive years, earning it the distinction of a Dividend King.

The Dividend Kings have raised their dividend payouts for at least 50 consecutive years. You can see all 55 Dividend Kings here.

You can download the full list of Dividend Kings, plus important financial metrics such as dividend yields and price-to-earnings ratios, by clicking on the link below:

PPG Industries has maintained its long history of dividend increases thanks to its superior position in its industry. Its competitive advantages have fueled the company’s long-term growth. The company should continue to raise its dividend each year.

We also view the stock as relatively undervalued right now. This article will discuss PPG’s business model, growth potential, and valuation.

Business Overview

PPG Industries is the world’s most extensive paints and coatings company. Its only competitors of similar size are Sherwin–Williams and the Dutch paint company Akzo Nobel.

PPG Industries was founded in 1883 as a manufacturer and distributor of glass (its name stands for Pittsburgh Plate Glass) and today has approximately 50,000 employees located in more than 70 countries at 100 locations. The company generates roughly $15.8 billion in annual revenue.

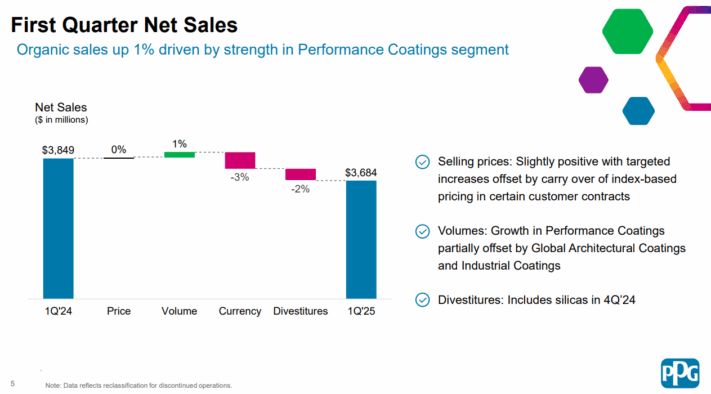

PPG Industries reported first-quarter results on April 29th, 2025.

Source: Investor Presentation

Revenue declined 4.4% to $3.68 billion, while adjusted earnings per share of $1.72 compared unfavorably to $1.86 in the prior year. Pricing increased slightly for the period, while volume improved by 1%. Offsetting this growth was a 3% headwind from currency exchange and a 2% negative impact from divestitures.

Global Architectural Coatings, formerly part of Performance Coatings, fell 11% to $857 million, primarily due to weaker volume and unfavorable currency exchange rates. Performance Coating increased 7% to $1.27 billion, driven by strong volume growth in aerospace, protective, and marine coatings. Industrials Coatings declined 8% to $1.56 billion as automotive OEMs remain weak due to lower industry build rates in the U.S. and Europe. The company’s segment margin decreased 340 basis points to 13.8%. Additionally, PPG continued its shareholder returns, repurchasing $ 400 million in shares this quarter.

Despite weaker quarterly results, PPG reaffirmed its guidance for the year, with adjusted earnings per share projected to be in a range of $7.75 to $8.05. At the midpoint, this would represent a slight improvement from the prior year. With a strong balance sheet and continued cost controls, PPG remains committed to enhancing shareholder value and sustaining growth momentum in targeted markets. The company concluded the quarter with $1.9 billion in cash and short-term investments, positioning it well for ongoing operational investments and future shareholder returns.

Growth Prospects

PPG Industries’ earnings per share have grown at a rate of 4.8% over the last decade. We expect earnings per share to grow at a rate of 7% through 2030. In 2020, PPG Industries’ demand dropped significantly due to the impact of COVID-19. However, we expect the company’s recovery from the pandemic to lead to higher growth in the long run.

The company expects several businesses, including those in the aerospace sector, to deliver stronger growth due to significant supply deficits and low inventories in these end-use markets.

These trends are supported by expected sequential automotive OEM production, further aerospace recovery, and the continuation of recent trends in auto refinish sales, as PPG works to fulfill strong backorders.

That said, PPG management believes that the recovery will span a few years, with U.S. dealer inventories and fleet replenishment remaining at low levels.

Acquisitions are another component of the company’s future growth plan. PPG has historically used smaller, bolt-on acquisitions to complement its organic growth.

The company has made five recent acquisitions that cumulatively added $1.7 billion in annual sales and achieved ~$30 million in savings. Going forward, similar deals should provide at least a couple of percentage points in annual revenue growth. PPG has also divested non-core assets, such as its architectural coatings business, in late 2024.

Finally, we expect the company’s period share repurchases to aid earnings growth on a per-share basis. For context, the company has reduced its share count by 1.8% over the last decade and by 0.7% over the previous five years. Since 1995, PPG has reduced its share count by ~45%.

Competitive Advantages & Recession Performance

PPG enjoys several competitive advantages. It operates in the paints and coatings industry, which is economically attractive for several reasons.

First, these products have high-profit margins for manufacturers. They also require minimal capital investment, resulting in significant cash flow.

The paint and coatings industry is not recession-resistant because it depends on healthy housing and construction markets. This impact can be seen in PPG’s performance during the 2007-2009 financial crisis:

2007 adjusted earnings-per-share: $2.52

2008 adjusted earnings-per-share: $1.63 (35% decline)

2009 adjusted earnings-per-share: $1.02 (37% decline)

2010 adjusted earnings-per-share: $2.32 (127% increase)

PPG’s adjusted earnings-per-share fell by more than 50% during the last major recession and took two years to recover. The silver lining during a downturn is that homeowners may be more likely to paint their houses than to move or take on more costly home renovations.

A decline in new construction is PPG’s dominant factor during a recession. However, the company has consistently demonstrated its ability to navigate recessions successfully throughout its history.

The company’s margins are currently under threat due to the highly inflationary and ongoing macroeconomic turmoil. However, the company has historically managed to increase prices by equal to or above inflation rates. We remain confident in its profitability during recessions and its ability to recover.

Valuation & Expected Returns

We expect PPG to generate earnings per share of $7.90 this year. As a result, the stock is currently trading at a price-to-earnings ratio of 14.7. We expect the stock’s valuation multiple to converge toward its historical average over time, at around 19.

As a result, we view PPG stock as relatively undervalued right now.

If the P/E multiple expands from 14.7 to 19 over the next five years, shareholder returns will be increased by 5.3% per year.

Dividends and earnings-per-share growth will boost shareholder returns. PPG shares currently yield 2.3%. Further, we expect 7% annual EPS growth over the next five years.

Combined, PPG stock is expected to generate annual returns of 14.4% over the next five years.

Final Thoughts

PPG Industries is one of the newest additions to the Dividend Kings list, having raised its dividend for the 53rd consecutive year in 2024. The company has maintained a long history of annual dividend increases, even during recessions, despite operating in a cyclical industry that relies on the health of the U.S. economy.

Due to inflation, PPG is experiencing a significant increase in raw material costs. Still, the company’s brand strength enables it to raise prices to offset the increasing costs.

We believe the stock is relatively undervalued, which could extend future returns. With expected returns of more than 14% annually for the next five years, we rate this Dividend King as a buy.

The following articles contain stocks with very long dividend histories, ripe for selection for dividend growth investors:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].