Updated on February 13th, 2026 by Nathan Parsh

When it comes to dividend growth stocks, not many can surpass the Dividend Aristocrats. The Dividend Aristocrats are a group of 69 stocks in the S&P 500 Index that have increased their dividends for 25+ consecutive years. These companies have increased their dividends every year without exception, even during recessions.

The Dividend Aristocrats have a proven ability to raise their dividends even during economic downturns. We have created a full list of all 69 Dividend Aristocrats, along with important metrics such as price-to-earnings ratios and dividend yields.

You can download an Excel spreadsheet with the full list of Dividend Aristocrats by clicking on the link below:

Disclaimer: Sure Dividend is not affiliated with S&P Global in any way. S&P Global owns and maintains The Dividend Aristocrats Index. The information in this article and downloadable spreadsheet is based on Sure Dividend’s own review, summary, and analysis of the S&P 500 Dividend Aristocrats ETF (NOBL) and other sources, and is meant to help individual investors better understand this ETF and the index upon which it is based. None of the information in this article or spreadsheet is official data from S&P Global. Consult S&P Global for official information.

In this article we are going to look more deeply at healthcare distributor Cardinal Health (CAH).

With 38 consecutive years of dividend increases, the company has clearly proven to be a reliable dividend growth stock, which speaks to the resilience of Cardinal Health’s business model.

Business Overview

Cardinal Health, founded in 1971, is one of the “Big 3” drug distribution companies, along with McKesson (MKC) and AmerisourceBergen (ABC). It serves over 100,000 healthcare locations in the U.S. and more than 90% of the country’s hospitals.

The company has two operating segments: Pharmaceutical and Specialty Solutions and Global Medical Products and Distribution. The Pharmaceutical and Specialty Solutions segment is by far the largest, representing more than 90% of total revenue.

The Pharmaceutical and Specialty Solutions segment distributes branded and generic drugs and consumer products to hospitals and other healthcare providers.

Meanwhile, the Global Medical Products and Distribution segment distributes medical, surgical, and laboratory products to hospitals, surgery centers, clinical laboratories, and other service centers.

On February 5th, 2026, Cardinal Health released results for the second quarter of fiscal year 2026, which ended December 31st, 2025. Revenue surged 18.6% to $65.6 billion, which beat estimates by $360 million.

Adjusted earnings-per-share of $2.63 compared favorably to $1.93 in the prior year and was $0.26 better than expected.

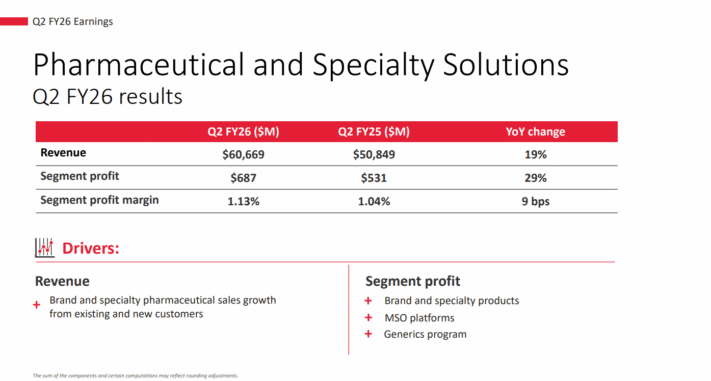

Source: Investor Presentation

Acquisitions greatly aided results during the quarter. For the period, Pharmaceutical and Specialty Solutions sales grew 19% to $60.7 billion, while segment profit increased 29% to $687 million. Growth continues to be driven by gains in brand and specialty pharmaceutical products from existing and new customers.

Revenue for the Global Medical Products and Distribution segment of $3.3 billion was a 3% improvement year-over-year while segment profit of $37 million compared favorably to $18 million last year. Higher demand from existing customers was offset by the impact of tariffs.

“Other” had revenue growth of 34% to $1.7 billion while segment profit was higher by 52% to $179 million.

Growth Prospects

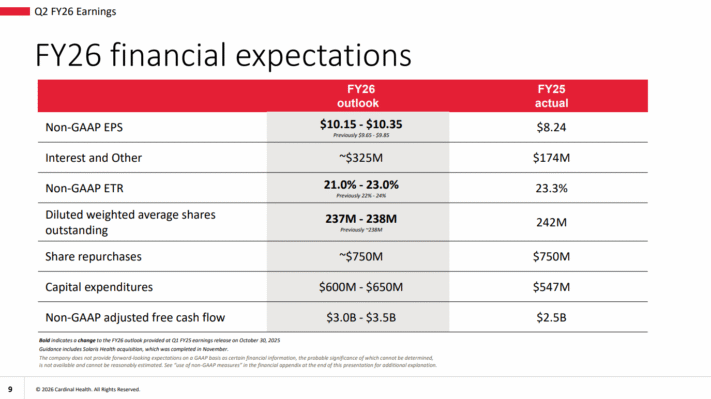

Cardinal Health provided updated guidance for fiscal year 2026 as well.

Source: Investor Presentation

The company now expects adjusted earnings-per-share in a range of $10.15 to $10.35 for the fiscal year, up from $9.65 to $9.85 and $9.30 to $9.50 previously. At the midpoint, this would be a 24.4% improvement from the prior year.

Cardinal Health has grown earnings-per-share by an average compound rate of 5.2% and 13.0% over the last ten and five years, respectively. Since fiscal 2016, the dividend has grown at 2.6% annually, but this has slowed to 1.0% for the last five years. Moving forward, we anticipate dividend growth of 1% annually.

We are forecasting 5% intermediate-term earnings growth based on management’s guidance. Our subdued growth rate view could turn out to be conservative, especially given the company’s penchant for share repurchases. Cardinal Health has reduced its share count by more than 3% annually over the last decade. The company does expect to repurchase at least $750 million per year.

Competitive Advantages & Recession Performance

Cardinal Health’s biggest competitive advantage is its distribution capability, which makes it very difficult for competitors to enter the market successfully.

Cardinal Health distributes its products to roughly 90% of U.S. hospitals and serves more than 100,000 healthcare locations in the U.S. It also manufactures and distributes more than 50,000 types of Cardinal Health medical products and procedure kits. The company’s home healthcare business serves over 3.4 million patients, with over 46,000 products.

In addition, Cardinal Health operates in a stable industry with high demand. The company should remain steadily profitable, as pharmaceutical products will always be needed to be distributed.

Here’s a look at Cardinal Health’s earnings-per-share during the Great Recession:

2007 earnings-per-share of $3.41

2008 earnings-per-share of $3.80 (11.4% increase)

2009 earnings-per-share of $2.26 (40.5% decline)

2010 earnings-per-share of $2.22 (1.8% decline)

While part of this is recession-related, keep in mind that Cardinal Health’s financial results were materially impacted by its 2009 spinoff of CareFusion Corporation. Despite this spinoff, the company’s segment revenues, segment earnings, and dividends continued to grow.

Since people will always need their medications and healthcare products, regardless of the economic climate, Cardinal Health could be considered more recession-resistant than the average company.

Valuation & Expected Returns

Based on anticipated adjusted earnings-per-share of $10.25 for fiscal 2026, and a share price of ~$221, Cardinal Health is currently trading at a P/E ratio of 21.6.

The stock has traded hands with an average P/E ratio of 13.3 times earnings since 2016. In recognition of our anticipated growth rate and the historical valuation average, we have used a multiple of 13 times earnings as a starting place for fair value.

A declining P/E multiple could reduce annual returns by 9.6% per year over the next five years.

In addition to changes in the valuation multiple, future returns will be generated from earnings growth and dividends. We expect Cardinal Health to grow earnings-per-share by 5% per year, primarily from revenue growth and share repurchases.

Finally, the stock has a current dividend yield of 0.9%. We note that the pace of dividend growth has slowed and the current yield is below the average yield of the S&P 500. However, company’s has a long track record of dividend growth, with almost four decades of annual raises.

As a Dividend Aristocrat, Cardinal Health will likely continue raising its dividend each year. Moreover, the dividend appears secure, with a projected dividend payout ratio of approximately 20% for fiscal 2026.

Putting all the pieces together – average growth and dividend yield offset by a meaningful valuation headwind – our expected total return for Cardinal Health is -4.0% per year over the next five years. Our projection stems from 5% earnings growth and the starting yield that are more than offset by multiple contraction. Due to the company’s outstanding track record of growth, we rate shares of Cardinal Health stock as a hold right now.

Final Thoughts

Cardinal Health is a Dividend Aristocrat that has increased its dividend for nearly 40 years. The company continues to grow revenue and segment profit improved in all businesses last quarter. Combined with share repurchases, the company should continue to see positive earnings-per-share growth going forward.

High-quality companies like Cardinal Health have withstood difficult periods and will do so again. The company’s history, its dividend history, and its current yield of 0.9% make the stock an interesting choice for income investors. However, total expected returns remain very low, making the stock a hold at the moment.

Additionally, the following Sure Dividend databases contain the most reliable dividend growers in our investment universe:

If you’re looking for stocks with unique dividend characteristics, consider the following Sure Dividend databases:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].